Fluid Transfer System Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

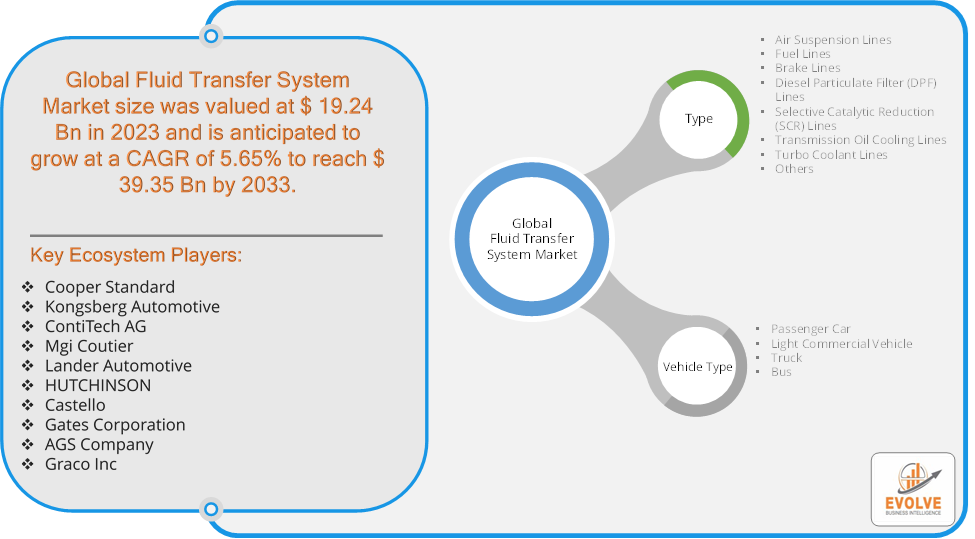

Fluid Transfer System Market Research Report: Information By Type (Air Suspension Lines, Fuel Lines, Brake Lines, Diesel Particulate Filter (DPF) Lines, Selective Catalytic Reduction (SCR) Lines, Transmission Oil Cooling Lines, Turbo Coolant Lines, Others), By Vehicle Type (Passenger Car, Light Commercial Vehicle, Truck, Bus), and by Region — Forecast till 2033

Page: 174

Fluid Transfer System Market Overview

The Fluid Transfer System Market Size is expected to reach USD 39.35 Billion by 2033. The Fluid Transfer System Market industry size accounted for USD 19.24 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.65% from 2023 to 2033. The Fluid Transfer System Market encompasses the global industry involved in the design, manufacture, and sale of systems and components used for the transfer of fluids (liquids and gases) within various applications. These systems are critical in multiple industries, including automotive, aerospace, oil and gas, chemical processing, and water treatment.

The Fluid Transfer System Market is expected to continue growing as industries seek more efficient, reliable, and environmentally friendly fluid handling solutions.

Global Fluid Transfer System Market Synopsis

COVID-19 Impact Analysis

COVID-19 Impact Analysis

The COVID-19 pandemic has significantly impacted the Fluid Transfer System Market. Lockdowns and restrictions led to factory shutdowns and reduced manufacturing capacity, causing delays in production and delivery. Interruptions in the supply of raw materials and components affected the production schedules of fluid transfer systems. The healthcare sector saw increased demand for fluid transfer systems used in medical equipment, such as ventilators and fluid management systems. Post-pandemic, there is a heightened focus on sustainable and efficient fluid transfer solutions, driven by environmental regulations and the need for energy-efficient systems. The pandemic accelerated the adoption of automation and smart technologies to enhance system efficiency and remote monitoring capabilities. The healthcare sector continues to demand advanced fluid transfer systems for medical applications, driven by ongoing health concerns and the need for improved healthcare infrastructure.

Fluid Transfer System Market Dynamics

The major factors that have impacted the growth of Fluid Transfer System Market are as follows:

Drivers:

Ø Technological Advancements

Development of new materials, such as high-performance polymers and composites, enhances the durability and efficiency of fluid transfer systems. Integration of sensors and IoT technologies for real-time monitoring and control improves system performance and reliability. Growth in renewable energy sources like biofuels and biomass requires fluid transfer systems for processing and transport. Fluid transfer systems play a role in cooling and lubrication in solar and wind energy applications. Increased investments in research and development lead to the creation of innovative and advanced fluid transfer systems.

Restraint:

- Perception of High Initial Costs and Complexity of Systems

The high initial investment required for the installation and setup of advanced fluid transfer systems can be a significant barrier for many businesses. Cutting-edge technologies, such as IoT and smart sensors, add to the overall cost of the systems, making them less accessible to small and medium-sized enterprises (SMEs). The complexity involved in designing and integrating fluid transfer systems to meet specific application requirements can be challenging. A high level of technical expertise is required to operate and maintain advanced fluid transfer systems, which may not be readily available.

Opportunity:

⮚ Sustainability and Environmental Initiatives

Developing environmentally friendly fluid transfer systems that reduce emissions and energy consumption aligns with global sustainability trends. Meeting stringent environmental regulations with innovative solutions can create a competitive advantage and open new markets. Utilizing data analytics and predictive maintenance technologies can enhance system reliability and reduce downtime. Offering real-time monitoring solutions provides added value to customers and differentiates products in the market. As industries recover from the pandemic, there is expected to be a rebound in demand for fluid transfer systems, particularly in sectors like automotive, aerospace, and manufacturing.

Fluid Transfer System Market Segment Overview

By Type

By Type

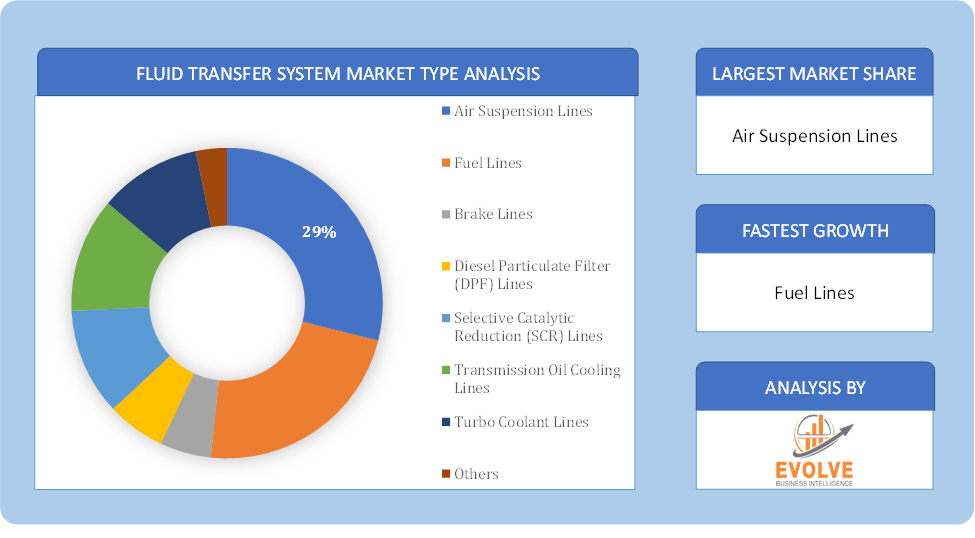

Based on Type, the market is segmented based on Air Suspension Lines, Fuel Lines, Brake Lines, Diesel Particulate Filter (DPF) Lines, Selective Catalytic Reduction (SCR) Lines, Transmission Oil Cooling Lines, Turbo Coolant Lines and Others. The selective catalytic reduction (SCR) segment dominant the market. The increasing number of passenger cars and LCVs are equipping with SCRs as they emit more NOx as compare to small size engines. Additionally, due to ongoing stringent emission norms, lesser CO2 emissions, and lower consumption of fuel, the demand for this segment is significantly elevating.

By Vehicle Type

Based on Vehicle Type, the market segment has been divided into Passenger Car, Light Commercial Vehicle, Truck and Bus. The Passenger Car segment dominant the market. Increasing sales of passenger cars coupled with rising number of automobile production in fueling the segment growth. Moreover, increasing adoption rate of SCRs in passenger car engines is further boosting the segment growth, which in turn driving the demand for fluid transfer system market value.

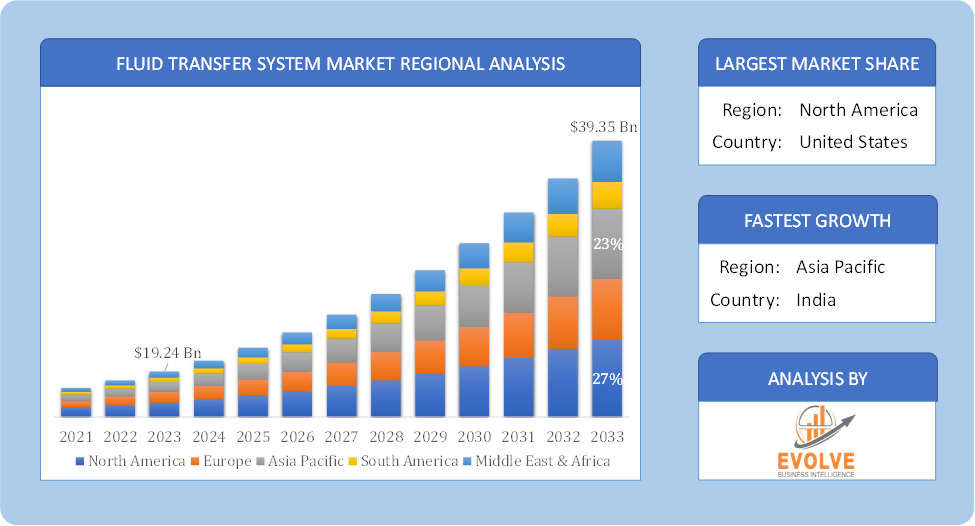

Global Fluid Transfer System Market Regional Analysis

Based on region, the global Fluid Transfer System Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Fluid Transfer System Market followed by the Asia-Pacific and Europe regions.

Fluid Transfer System North America Market

Fluid Transfer System North America Market

North America holds a dominant position in the Fluid Transfer System Market. North America region is mature market with a strong automotive industry. Increasing demand for heavy-duty vehicles in the commercial sector. High adoption of advanced technologies and smart fluid transfer systems. It has significant demand from well-established automotive and aerospace sectors also has strong demand due to extensive oil and gas exploration and production activities.

Fluid Transfer System Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Fluid Transfer System Market industry. Asia-Pacific region dominates the global market due to rapid industrialization and a booming automotive sector. Rapid industrial growth, urbanization, and infrastructure development in countries like China and India. Expanding healthcare sector with increasing investments in medical infrastructure and growing investments in renewable energy projects such as solar, wind, and biofuels.

Competitive Landscape

The global Fluid Transfer System Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Cooper Standard.

- Kongsberg Automotive

- ContiTech AG

- Mgi Coutier

- Lander Automotive

- HUTCHINSON

- Castello

- Gates Corporation

- AGS Company

- Graco Inc

Key Development

In August 2022, Cooper Standard announced a joint development agreement of innovative dynamic fluid control technology for the electric vehicle market.

In November 2021, Gates Corporation and Gogoro formed an exclusive strategic partnership to accelerate sustainable urban transportation through electric mobility.

Scope of the Report

Global Fluid Transfer System Market, by Type

- Air Suspension Lines

- Fuel Lines

- Brake Lines

- Diesel Particulate Filter (DPF) Lines

- Selective Catalytic Reduction (SCR) Lines

- Transmission Oil Cooling Lines

- Turbo Coolant Lines

- Others

Global Fluid Transfer System Market, by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Truck

- Bus

Global Fluid Transfer System Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 39.35 Billion |

| CAGR (2023-2033) | 5.65% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Vehicle Type |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Cooper Standard., Kongsberg Automotive, ContiTech AG, Mgi Coutier, Lander Automotive, HUTCHINSON, Castello, Gates Corporation, AGS Company and Graco Inc. |

| Key Market Opportunities | · Sustainability and Environmental Initiatives · Digitalization and Data Analytics |

| Key Market Drivers | · Technological Advancements · Renewable Energy Sector |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Fluid Transfer System Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Fluid Transfer System Market historical market size for the year 2021, and forecast from 2023 to 2033

- Fluid Transfer System Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Fluid Transfer System Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Fluid Transfer System Market is 2021- 2033

What is the growth rate of the global Fluid Transfer System Market?

The global Fluid Transfer System Market is growing at a CAGR of 5.65% over the next 10 years

Which region has the highest growth rate in the market of Fluid Transfer System Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Fluid Transfer System Market?

North America holds the largest share in 2022

Who are the key players in the global Fluid Transfer System Market?

Cooper Standard., Kongsberg Automotive, ContiTech AG, Mgi Coutier, Lander Automotive, HUTCHINSON, Castello, Gates Corporation, AGS Company and Graco Inc are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Fluid Transfer System Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Fluid Transfer System Market 4.8. Import Analysis of the Fluid Transfer System Market 4.9. Export Analysis of the Fluid Transfer System Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Fluid Transfer System Market, By Type 6.1. Introduction 6.2. Air Suspension Lines 6.3. Fuel Lines 6.4. Brake Lines 6.5. Diesel Particulate Filter (DPF) Lines 6.6. Selective Catalytic Reduction (SCR) Lines 6.7. Transmission Oil Cooling Lines 6.8. Turbo Coolant Lines 6.9. Others Chapter 7. Global Fluid Transfer System Market, By Vehicle Type 7.1. Introduction 7.2. Passenger Car 7.3. Light Commercial Vehicle 7.4. Truck 7.5. Bus Chapter 8. Global Fluid Transfer System Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.5. Market Size and Forecast, By End User, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By End User, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By End User, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By End User, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By End User, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By End User, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By End User, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By End User, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By End User, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By End User, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By End User, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By End User, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By End User, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By End User, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By End User, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By End User, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Cooper Standard. 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Kongsberg Automotive 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. ContiTech AG 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Mgi Coutier 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Lander Automotive 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. HUTCHINSON 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Castello 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Gates Corporation 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 AGS Company 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Graco Inc 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology

Fluid Transfer System North America Market

Fluid Transfer System North America Market