Fixed Satellite Services (FSS) Market Analysis and Global Forecast 2021-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

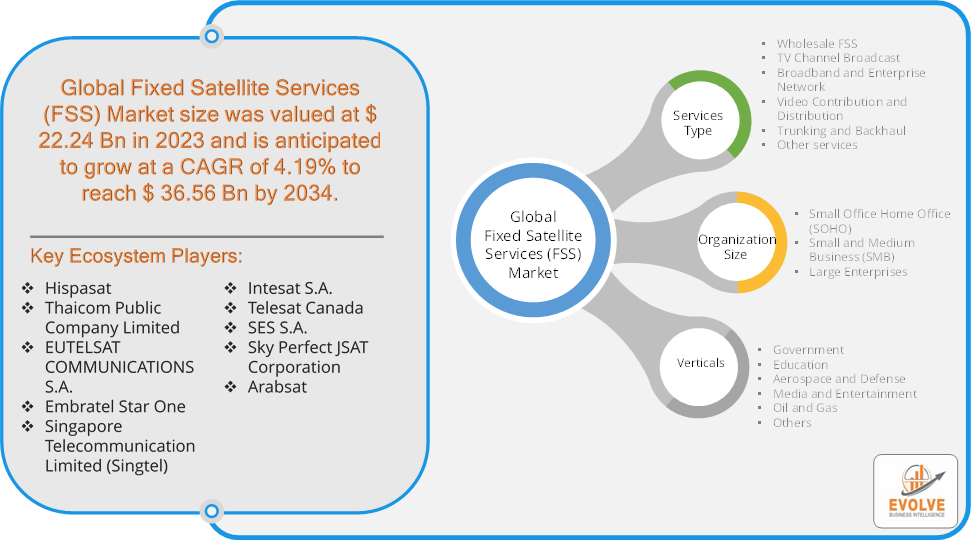

Fixed Satellite Services (FSS) Market Research Report: By Services Type (Wholesale FSS, TV Channel Broadcast, Broadband and Enterprise Network, Video Contribution and Distribution, Trunking and Backhaul, Other services), By Organization Size (Small Office Home Office (SOHO), Small and Medium Business (SMB), Large Enterprises), By Vertical (Government, Education, Aerospace and Defense, Media and Entertainment, Oil and Gas, Others,), and by Region — Forecast till 2034

Page: 115

Fixed Satellite Services (FSS) Market Overview

The Fixed Satellite Services (FSS) Market Size is expected to reach USD 36.56 Billion by 2034. The Fixed Satellite Services (FSS) Market industry size accounted for USD 3.32 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.19% from 2021 to 2034. The Fixed Satellite Services (FSS) market refers to satellite-based communication services that provide reliable, high-capacity connections for broadcasting, data, and voice transmission. FSS satellites operate in specific geostationary orbits and are used for point-to-point or point-to-multipoint communication, serving industries such as television broadcasting, telecommunications, government, and military applications. These services offer long-distance connectivity, especially in areas lacking terrestrial infrastructure. The market is driven by increasing demand for high-quality video content, broadband access in remote areas, and secure communication solutions for businesses and governments. Key trends include technological advancements, growing satellite capacity, and the transition to high-throughput satellites (HTS).

Global Fixed Satellite Services (FSS) Market Synopsis

Global Fixed Satellite Services (FSS) Market Dynamics

Global Fixed Satellite Services (FSS) Market Dynamics

The major factors that have impacted the growth of Fixed Satellite Services (FSS) are as follows:

Drivers:

⮚ Technological Advancements in Satellite Technology

The advent of high-throughput satellites (HTS), which offer significantly higher capacity than traditional satellites, is transforming the FSS market. HTS can deliver more data at lower costs, driving the adoption of satellite services for a wider range of applications, including broadband and enterprise connectivity.

Restraint:

- High Initial Investment and Maintenance Costs

The deployment of satellite infrastructure involves substantial upfront capital expenditure for launching satellites, ground station setup, and network equipment. Additionally, maintaining and operating satellites in orbit can be costly, which may deter smaller service providers or emerging markets from entering the FSS space. The cost to manufacture, launch, and manage satellites significantly impacts the overall profitability of FSS services.

Opportunity:

⮚ Expansion of Satellite-Based IoT Networks

As the Internet of Things (IoT) continues to expand, FSS has the potential to play a crucial role in supporting satellite-based IoT networks. Satellites can provide wide-area coverage for IoT devices deployed in remote or hard-to-reach locations, such as oil rigs, mining operations, agricultural fields, and shipping routes. This enables real-time monitoring, data collection, and asset management, creating new opportunities for FSS providers to cater to industries that require IoT connectivity.

Fixed Satellite Services (FSS) Market Segment Overview

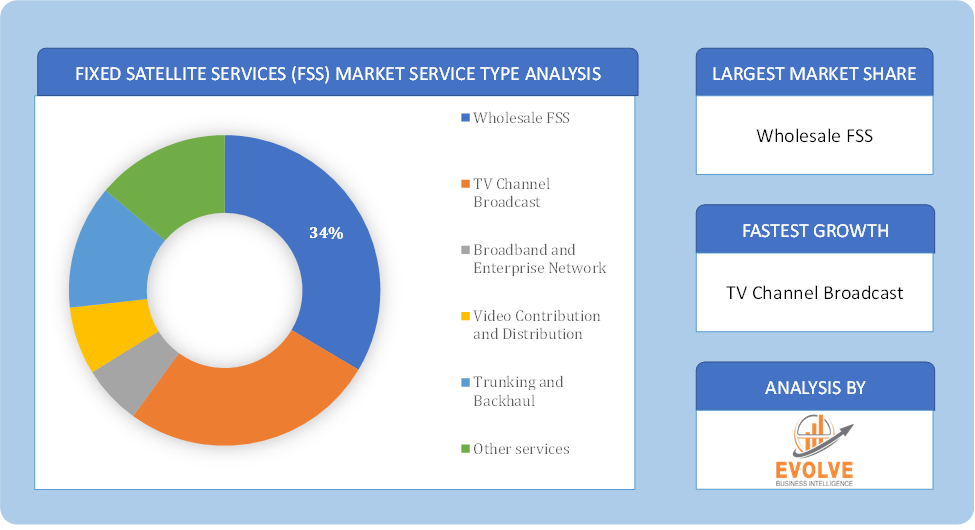

Based on the Services Type, the market is segmented based on Wholesale FSS, TV Channel Broadcast, Broadband and Enterprise Network, Video Contribution and Distribution, Trunking and Backhaul, Other services. TV Channel Broadcast dominates, driven by the extensive use of satellite technology for broadcasting television channels, particularly for HD and UHD content, ensuring reliable, wide-area coverage for global audiences.

By Organization Size

Based on the Organization Size, the market has been divided into Small Office Home Office (SOHO), Small and Medium Business (SMB), Large Enterprises. Large Enterprises dominate due to their extensive need for high-capacity, reliable satellite communication for broadcasting, global connectivity, and secure data transmission across multiple locations and operations.

By Verticals

Based on Verticals, the market has been divided into Government, Education, Aerospace and Defense, Media and Entertainment, Oil and Gas, Others. the Media and Entertainment segment dominates due to its high demand for broadcasting services, including television and radio transmission, especially for HD and UHD content. This sector relies heavily on satellite technology for global content distribution.

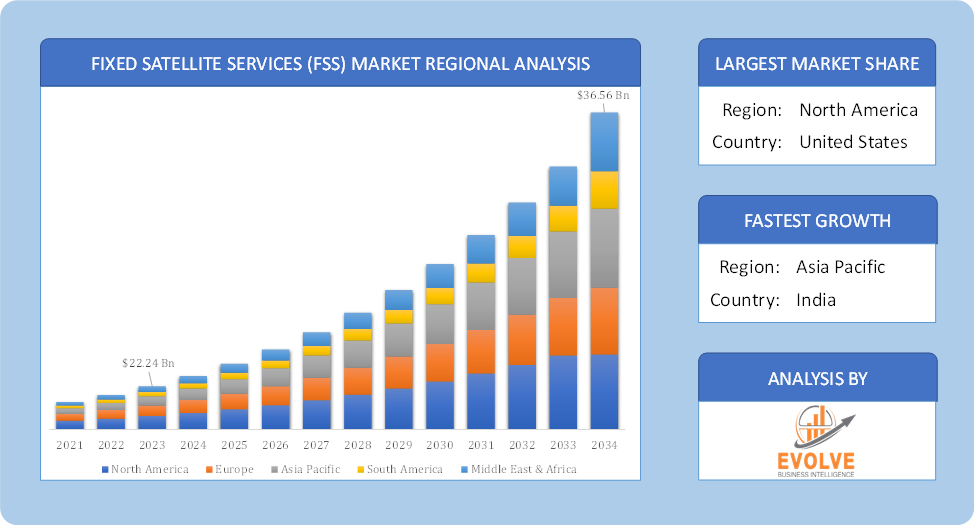

Global Fixed Satellite Services (FSS) Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Fixed Satellite Services (FSS), followed by those in Asia-Pacific and Europe.

Fixed Satellite Services (FSS) North America Market

Fixed Satellite Services (FSS) North America Market

North America dominates the Fixed Satellite Services (FSS) market due to several factors. North America is a leading region in the Fixed Satellite Services (FSS) market, driven by strong demand for satellite communication across industries such as media and entertainment, government, and defense. The region benefits from advanced satellite infrastructure, high adoption of HD and UHD broadcasting, and the growing need for broadband connectivity in remote areas. Additionally, the presence of major satellite service providers and technological advancements in high-throughput satellites (HTS) further bolster market growth in North America.

Fixed Satellite Services (FSS) Asia Pacific Market

The Asia-Pacific region has been witnessing remarkable growth in recent years. The Asia-Pacific region is experiencing significant growth in the Fixed Satellite Services (FSS) market, driven by increasing demand for broadband connectivity in remote and underserved areas, as well as the expansion of media and entertainment services. Rapid urbanization, technological advancements, and government initiatives to improve communication infrastructure are boosting the adoption of FSS in countries like China, India, and Japan

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Hispasat, Thaicom Public Company Limited, EUTELSAT COMMUNICATIONS S.A., Embratel Star One, and Singapore Telecommunication Limited (Singtel) are some of the leading players in the global Fixed Satellite Services (FSS) Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Hispasat

- Thaicom Public Company Limited

- EUTELSAT COMMUNICATIONS S.A.

- Embratel Star One

- Singapore Telecommunication Limited (Singtel)

- Intesat S.A.

- Telesat Canada

- SES S.A.

- Sky Perfect JSAT Corporation

- Arabsat

Key development:

In September 2022, SKY Perfect JSAT Corporation focused on expanding its satellite communication services and partnerships, enhancing its position in the satellite broadband and space infrastructure sectors, particularly through advancements in high-throughput satellite (HTS) technology for enterprise and government applications.

Scope of the Report

Global Fixed Satellite Services (FSS) Market, by Services Type

- Wholesale FSS

- TV Channel Broadcast

- Broadband and Enterprise Network

- Video Contribution and Distribution

- Trunking and Backhaul

- Other services

Global Fixed Satellite Services (FSS) Market, by Organization Size

- Small Office Home Office (SOHO)

- Small and Medium Business (SMB)

- Large Enterprises

Global Fixed Satellite Services (FSS) Market, by Verticals

- Government

- Education

- Aerospace and Defense

- Media and Entertainment

- Oil and Gas

- Others

Global Fixed Satellite Services (FSS) Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 36.56 Billion |

| CAGR (2021-2034) | 4.19% |

| Base year | 2023 |

| Forecast Period | 2021-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Services Type, Organization Size, Verticals |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Hispasat, Thaicom Public Company Limited, EUTELSAT COMMUNICATIONS S.A., Embratel Star One, Singapore Telecommunication Limited (Singtel), Intesat S.A., Telesat Canada, SES S.A., Sky Perfect JSAT Corporation, Arabsat |

| Key Market Opportunities | · Creative Content Generation and Personalization · Expanding Organization Sizes in industries like media & entertainment, gaming, healthcare, design |

| Key Market Drivers | · Advancements in AI research and technology · Growing demand for personalized and creative content |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Fixed Satellite Services (FSS) market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Fixed Satellite Services (FSS) market historical market size for the year 2022, and forecast from 2021 to 2034

- Fixed Satellite Services (FSS) market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Fixed Satellite Services (FSS) market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Fixed Satellite Services (FSS) market is 2021- 2034

What are the 10 Years CAGR (2021 to 2034) of the global Fixed Satellite Services (FSS) market?

The global Fixed Satellite Services (FSS) market is growing at a CAGR of ~4.19% over the next 10 years

Which region has the highest growth rate in the market of Fixed Satellite Services (FSS)?

Asia Pacific is expected to register the highest CAGR during 2021-2034

Which region accounted for the largest share of the market of Fixed Satellite Services (FSS)?

North America holds the largest share in 2023

Major Key Players in the Market of Fixed Satellite Services (FSS)?

Hispasat, Thaicom Public Company Limited, EUTELSAT COMMUNICATIONS S.A., Embratel Star One, Singapore Telecommunication Limited (Singtel), Intesat S.A., Telesat Canada, SES S.A., Sky Perfect JSAT Corporation, Arabsat

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Services Type Segement – Market Opportunity Score 4.1.2. Organization Size Segment – Market Opportunity Score 4.1.3. Verticals Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Fixed Satellite Services (FSS) Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Fixed Satellite Services (FSS) Market, By Services Type 7.1. Introduction 7.1.1. Wholesale FSS 7.1.2. TV Channel Broadcast 7.1.3. Broadband and Enterprise Network 7.1.4. Video Contribution and Distribution 7.1.5. Trunking and Backhaul 7.1.6. Other services CHAPTER 8. Global Fixed Satellite Services (FSS) Market, By Organization Size 8.1. Introduction 8.1.1. Small Office Home Office (SOHO) 8.1.2. Small and Medium Business (SMB) 8.1.3. Large Enterprises CHAPTER 9. Global Fixed Satellite Services (FSS) Market, By Verticals 9.1. Introduction 9.1.1 Government 9.1.2. Education 9.1.3. Aerospace and Defense 9.1.4. Media and Entertainment 9.1.5. Oil and Gas 9.1.6. Others CHAPTER 10. Global Fixed Satellite Services (FSS) Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 10.2.2. North America: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.2.3. North America: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.2.4. North America: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 10.5.2. South America: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.5.3. South America: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.5.4. South America: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Services Type, 2021 – 2034 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Organization Size, 2021 – 2034 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Verticals, 2021 – 2034 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2021 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Hispasat 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Thaicom Public Company Limited 13.3. EUTELSAT COMMUNICATIONS S.A. 13.4. Embratel Star One 13.5. Singapore Telecommunication Limited (Singtel) 13.6. Intesat S.A. 13.7. Telesat Canada 13.8. SES S.A. 13.9. Sky Perfect JSAT Corporation 13.10. Genie AI Ltd

Connect to Analyst

Research Methodology