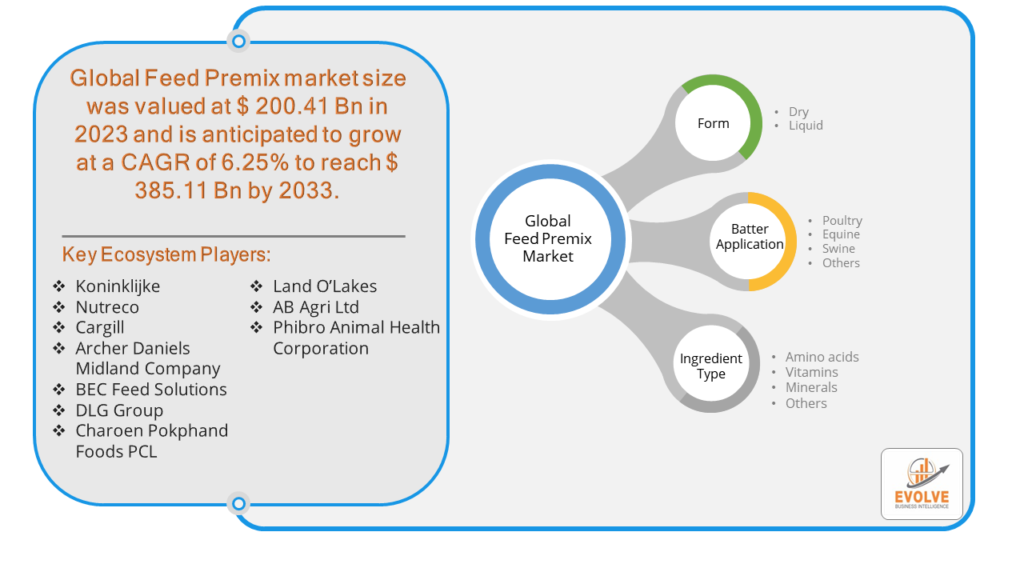

Feed Premix Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Feed Premix Market Research Report: By Form (Dry, Liquid), By Batter Application (Poultry, Equine, Swine, Others), By Ingredient Type (Amino acids, Vitamins, Minerals, Others), and by Region — Forecast till 2033

Page: 144

Feed Premix Market Overview

The Feed Premix Market Size is expected to reach USD 19.74 Billion by 2033. The Feed Premix industry size accounted for USD 8.41 Billion in 2023 and is expected to expand at a CAGR of 5.90% from 2023 to 2033. A feed premix refers to a composite blend of essential nutrients, including but not limited to vitamins, minerals, amino acids, and sometimes therapeutic additives, meticulously formulated to augment animal feed. These premixes are integrated into animal feed formulations in precise proportions to ensure optimal nutrition and health for livestock and poultry. Their composition is tailored to meet the specific dietary requirements of various animal species and production stages, aiming to bolster growth, productivity, and overall well-being. Feed premixes play a pivotal role in fortifying base feed ingredients, addressing nutritional deficiencies, and sustaining the health and performance of livestock populations across diverse agricultural settings.

Global Feed Premix Market Synopsis

The Feed Premix market underwent a moderate impact amid the COVID-19 pandemic. Disruptions to supply chains, primarily in the procurement of raw materials and transportation logistics, initially posed challenges to production and distribution networks. Fluctuations in demand patterns ensued as lockdown measures and economic uncertainties influenced consumer behavior and market dynamics. However, the agricultural sector demonstrated resilience, adapting swiftly to mitigate disruptions and ensure the continuity of feed production. Government support initiatives and the essential nature of livestock farming sustained the market to a significant extent.

Global Feed Premix Market Dynamics

The major factors that have impacted the growth of Feed Premix are as follows:

Drivers:

⮚ Growing demand for high-quality animal products

Increasing consumer awareness about the importance of nutrition in animal diets, coupled with rising disposable incomes, is driving the demand for high-quality meat, dairy, and eggs. This trend is incentivizing livestock producers to invest in premium feed solutions like premixes to ensure optimal nutrition and health for their animals, thereby driving market growth.

Restraint:

- Fluctuating raw material costs

The feed premix market is susceptible to fluctuations in the prices of raw materials such as vitamins, minerals, and amino acids. Volatility in commodity markets, influenced by factors like weather conditions, geopolitical tensions, and currency fluctuations, can lead to unpredictable costs for feed manufacturers. Managing these cost fluctuations poses a significant challenge for market players, potentially hampering market growth.

Opportunity:

⮚ Technological advancements in feed formulation

The ongoing development of innovative technologies, such as precision nutrition and feed formulation software, presents significant opportunities for the feed premix market. These technologies enable more precise and customized formulations tailored to the specific nutritional requirements of different animal species and production stages. By leveraging such advancements, feed manufacturers can enhance product efficacy, improve animal performance, and capitalize on emerging market trends, driving market growth.

Feed Premix Market Segment Overview

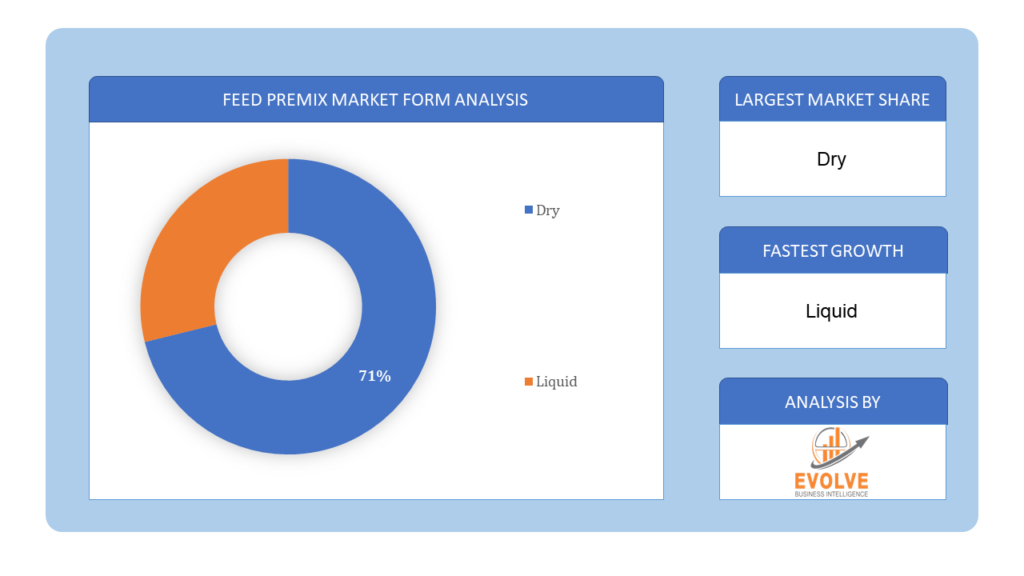

By Form

Based on the Form, the market is segmented based on Dry, Liquid. The Dry segment was anticipated to lead the Feed Premix market due to its ease of handling, longer shelf life, and suitability for incorporation into various types of animal feed formulations, including pellets, powders, and crumbles. Additionally, dry premixes offer convenient storage and transportation advantages, making them preferred by feed manufacturers seeking efficiency and cost-effectiveness in their operations.

Based on the Form, the market is segmented based on Dry, Liquid. The Dry segment was anticipated to lead the Feed Premix market due to its ease of handling, longer shelf life, and suitability for incorporation into various types of animal feed formulations, including pellets, powders, and crumbles. Additionally, dry premixes offer convenient storage and transportation advantages, making them preferred by feed manufacturers seeking efficiency and cost-effectiveness in their operations.

By Batter Application

Based on the Batter Application, the market has been divided into Poultry, Equine, Swine, and Others. The Poultry segment is expected to dominate the Feed Premix market, primarily driven by the burgeoning global demand for poultry products, including meat and eggs, fueled by population growth, rising incomes, and changing dietary preferences toward protein-rich diets. Additionally, increased industrialization and intensification of poultry farming, coupled with a growing focus on optimizing feed efficiency and animal health, further propel the demand for specialized premix solutions tailored to poultry nutrition requirements.

By Ingredient Type

Based on Ingredient Type, the market has been divided into Amino acids, Vitamins, Minerals, and Others. The Amino acids segment is positioned to capture the largest market share in the Feed Premix market due to their crucial role in enhancing animal growth, performance, and overall health. As essential building blocks of protein, amino acids play a pivotal role in supporting muscle development, metabolic functions, and immune system response, driving their widespread adoption in feed formulations across various animal species. Moreover, increasing awareness of the significance of amino acid supplementation in optimizing feed efficiency and reducing environmental impact further amplifies their demand in the livestock industry.

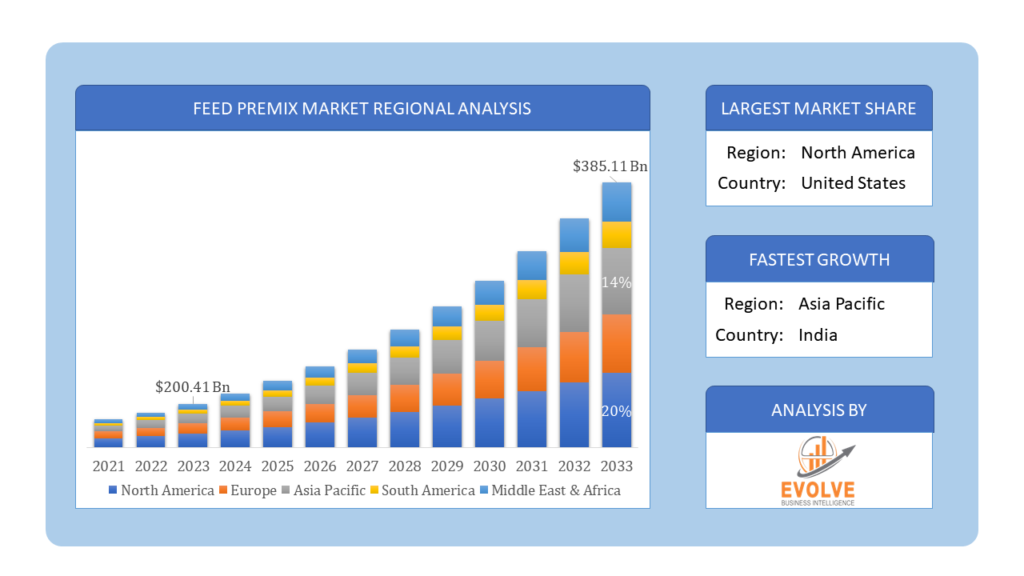

Global Feed Premix Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Feed Premix, followed by those in Asia-Pacific and Europe.

Feed Premix North America Market

Feed Premix North America Market

North America asserts dominance in the Feed Premix market owing to its advanced livestock production systems, stringent regulatory standards ensuring animal welfare and nutrition, and robust infrastructure supporting feed manufacturing and distribution. Additionally, a strong focus on technological innovation and research and development in animal nutrition further propels market growth in the region. Moreover, rising consumer demand for high-quality animal products and increased adoption of specialized feed formulations to optimize animal health and performance contribute to North America’s leading position in the global Feed Premix market.

Feed Premix Asia Pacific Market

The Asia-Pacific region has witnessed remarkable growth in the Feed Premix market, driven by factors such as rapid urbanization, population growth, rising disposable incomes, and shifting dietary preferences towards protein-rich foods. As economies in the region continue to develop, there is a corresponding increase in demand for high-quality meat, dairy, and eggs, stimulating the expansion of the livestock industry. Moreover, advancements in agricultural practices, the adoption of modern farming techniques, and a growing focus on animal health and nutrition contribute to the rising demand for specialized feed premix solutions tailored to the needs of diverse livestock species. Additionally, government initiatives supporting agricultural development and investments in feed production infrastructure further bolster market growth in the Asia-Pacific region.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Nutreco, Cargill, Archer Daniels Midland Company, BEC Feed Solutions, and DLG Group are some of the leading players in the global Feed Premix Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Koninklijke

- Nutreco

- Cargill

- Archer Daniels Midland Company

- BEC Feed Solutions

- DLG Group

- Charoen Pokphand Foods PCL

- Land O’Lakes

- AB Agri Ltd

- Phibro Animal Health Corporation

Key Development

In 2021, Cargill inaugurated one of the globe’s largest premix and animal nutrition facilities in Ohio, USA, marking a $50 million investment by the company. This state-of-the-art facility spans 220,000 square feet and incorporates cutting-edge technologies.

In 2021, ADM completed the acquisition of Golden Farm Production & Commerce Company Limited, a major premix player in Vietnam. This strategic move bolsters ADM’s presence and market reach in Vietnam’s vital feed industry, enhancing its industrial and commercial footprint in the region.

Scope of the Report

Global Feed Premix Market, by Form

- Dry

- Liquid

Global Feed Premix Market, by Batter Application

- Poultry

- Equine

- Swine

- Others

Global Feed Premix Market, by Ingredient Type

- Amino acids

- Vitamins

- Minerals

- Others

Global Feed Premix Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $19.74 Billion |

| CAGR | 5.90% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Form, Batter Application, Ingredient Type |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Koninklijke, Nutreco, Cargill, Archer Daniels Midland Company, BEC Feed Solutions, DLG Group, Charoen Pokphand Foods PCL, Land O’Lakes, AB Agri Ltd, Phibro Animal Health Corporation. |

| Key Market Opportunities | • Technological advancements in feed formulation • Rising focus on precision nutrition and customized feed solutions |

| Key Market Drivers | • Increasing demand for high-quality animal products • Growing awareness about animal nutrition and health |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Feed Premix Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Feed Premix market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Feed Premix market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Feed Premix Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Feed Premix market?

The study period ranges from historical data in 2021 to forecasts for the years 2023 to 2033.

What is the growth rate of the Feed Premix market?

The Feed Premix market is expected to grow at a CAGR of 5.90% from 2023 to 2033.

Which region has the highest growth rate in the Feed Premix market?

Asia-Pacific is anticipated to experience the highest growth rate in the Feed Premix market due to factors such as rapid urbanization, population growth, and rising disposable incomes.

Which region has the largest share of the Feed Premix market?

Currently, North America dominates the Feed Premix market, driven by advanced livestock production systems, stringent regulatory standards, and robust infrastructure supporting feed manufacturing and distribution.

Who are the key players in the Feed Premix market?

Key players in the Feed Premix market include Koninklijke, Nutreco, Cargill, Archer Daniels Midland Company, BEC Feed Solutions, DLG Group, Charoen Pokphand Foods PCL, Land O’Lakes, AB Agri Ltd, and Phibro Animal Health Corporation, among others.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Form Segement – Market Opportunity Score 4.1.2. Batter Application Segment – Market Opportunity Score 4.1.3. Ingredient Type Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Feed Premix Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Feed Premix Market, By Form 7.1. Introduction 7.1.1. Dry 7.1.2. Liquid CHAPTER 8. Global Feed Premix Market, By Batter Application 8.1. Introduction 8.1.1. Poultry 8.1.2. Equine 8.1.3. Swine 8.1.4. Others CHAPTER 9. Global Feed Premix Market, By Ingredient Type 9.1. Introduction 9.1.1. Amino acids 9.1.2. Vitamins 9.1.3. Minerals 9.1.4. Others CHAPTER 10. Global Feed Premix Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Batter Application, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Ingredient Type, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Koninklijke 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Nutreco 13.3. Cargill 13.4. Archer Daniels Midland Company 13.5. BEC Feed Solutions 13.6. DLG Group 13.7. Charoen Pokphand Foods PCL 13.8. Land O’Lakes 13.9. AB Agri Ltd 13.10. Phibro Animal Health Corporation

Connect to Analyst

Research Methodology