Fat Replacers Market Analysis and Global Forecast 2024-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

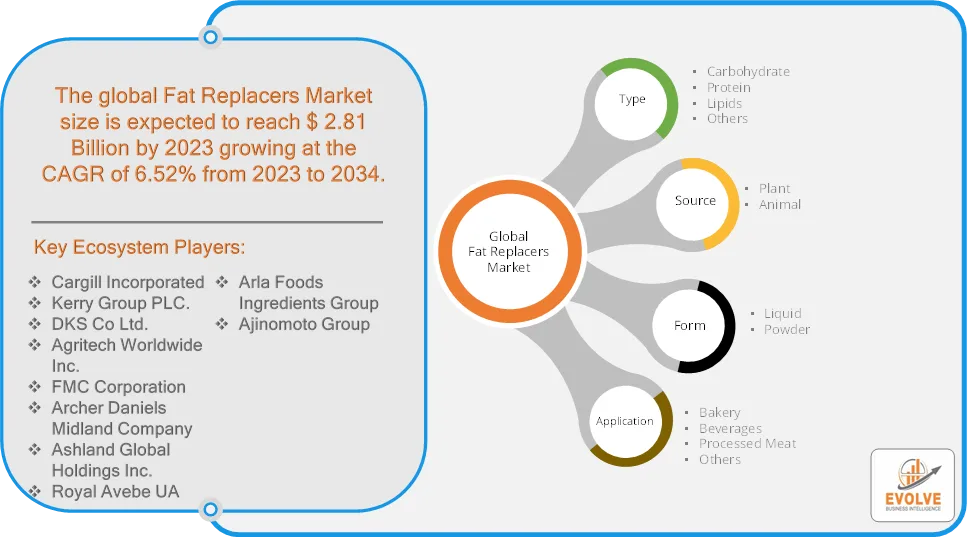

Fat Replacers Market Research Report: Information By Type (Carbohydrate, Protein, Lipids, Others), By Source (Plant, Animal), By Form (Liquid, Powder), By Application (Bakery, Beverages, Processed Meat, Others), and by Region — Forecast till 2034

Page: 165

Fat Replacers Market Overview

The Fat Replacers Market size accounted for USD 2.81 Billion in 2023 and is estimated to account for 4.85 Billion in 2024. The Market is expected to reah USD 9.36 Billion by 2034 growing at a compound annual growth rate (CAGR) of 6.52% from 2024 to 2034. The fat replacers market is experiencing significant growth, driven by increasing consumer health consciousness, rising obesity rates, and the demand for low-calorie and low-fat food products. Fat replacers are ingredients used in food manufacturing to mimic the properties of traditional fats, such as texture, mouthfeel, and flavor, while reducing the overall fat and calorie content.

Increasing awareness of health issues related to high-fat diets, such as obesity, cardiovascular diseases, and high cholesterol, is driving consumers to opt for low-fat and low-calorie food options and the rising preference for weight management and healthier lifestyles is boosting the demand for food products containing fat replacers.

Global Fat Replacers Market Synopsis

Fat Replacers Market Dynamics

Fat Replacers Market Dynamics

The major factors that have impacted the growth of Fat Replacers Market are as follows:

Drivers:

Ø Growing Demand for Low-Fat & Reduced-Calorie Foods

The popularity of functional foods, weight management products, and clean-label foods has boosted the adoption of fat replacers. Food manufacturers are formulating products with reduced fat content to cater to changing consumer preferences. Innovations in microencapsulation, enzyme modification, and nanotechnology have enhanced the performance of fat replacers in food applications and improved fat mimetics now closely replicate the texture, taste, and functionality of natural fats and rising veganism and flexitarian diets are driving demand for plant-based fat replacers such as starches, fibers, and vegetable proteins.

Restraint:

- Consumer Skepticism Toward Artificial Ingredients and High Cost of Development and Production

Some fat replacers, especially synthetic and chemically modified ones like Olestra, have faced consumer backlash due to potential digestive side effects. Preference for clean-label, natural, and minimally processed ingredients limits the adoption of synthetic fat substitutes. The R&D costs for developing effective fat replacers that maintain taste, stability, and functionality are high and production costs of some fat replacers, such as protein-based alternatives (whey or egg-based substitutes), are higher than traditional fats.

Opportunity:

⮚ Rising Popularity of Plant-Based and Vegan Foods

The global shift toward plant-based diets is driving demand for fat substitutes derived from legumes, nuts, and plant proteins. Fat replacers are essential in vegan dairy alternatives, meat substitutes, and functional foods. Fat replacers can be enriched with fiber, protein, and probiotics to provide additional health benefits beyond fat reduction. The rise in sports nutrition, dietary supplements, and functional snacks offers new applications for fat substitutes. Microencapsulation and enzyme modification are improving the texture, stability, and functionality of fat replacers and new techniques allow fat substitutes to be heat-stable, making them suitable for baking, frying, and processed food applications.

Fat Replacers Market Segment Overview

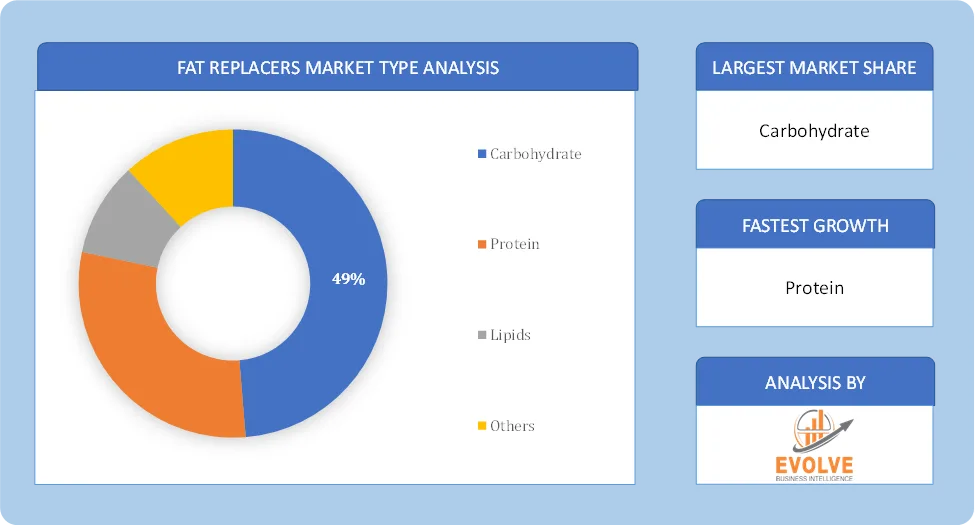

Based on Type, the market is segmented based on Carbohydrate, Protein, Lipids, Others. The carbohydrate-based segment dominant the market. The dominance of the segment can be attributed to the extensive adoption of carbohydrate-based fat replacers in the food industry. These fat replacers mimic conventional flavor, mouthfeel, and texture and have been widely researched in the food market.

By Source

Based on Application, the market segment has been divided Plant and Animal. The plant segment dominant the market. Plant-based fat substitutes encompass a diverse array of options derived from whole foods like fruits, vegetables, nuts, and seeds. These include psyllium husk, oat fiber, potato starch, and oils from sunflower, coconut, avocado, and olive seeds, replicating fat-like characteristics in food products.

By Form

Based on Form, the market segment has been divided into Liquid and Powder. The powder segment dominant the market. Powdered fat substitutes have a large market potential because they are versatile and simple to utilize in a variety of food industries. These powders offer benefits including reduced fat content, improved texture, and extended shelf life, which appeal to consumers looking for healthier solutions. They are used in many different foods, including drinks, dairy products, snacks, and baked goods.

By Application

Based on Application, the market segment has been divided into Bakery, Beverages, Processed Meat, Others. The bakery segment dominant the market. Fat replacers are vital for reducing fat levels in baked goods and confections while maintaining their quality. They enhance shelf life, texture, and mouthfeel, facilitating healthier recipes without sacrificing taste. Common substitutes include emulsifiers, hydrocolloids, and fiber-based ingredients.

Global Fat Replacers Market Regional Analysis

Based on region, the global Fat Replacers Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Fat Replacers Market followed by the Asia-Pacific and Europe regions.

North America Fat Replacers Market

North America Fat Replacers Market

North America holds a dominant position in the Fat Replacers Market. It is largest market due to strong consumer demand for low-fat and functional foods. Presence of major food manufacturers and ingredient suppliers investing in fat substitute innovations and has stringent FDA regulations encouraging reformulation of processed foods with healthier alternatives. High consumer health consciousness, rising obesity rates, and the strong presence of the functional food sector are driving market growth. Millennials and Generation Z are key consumer segments demanding healthier, low-fat options with transparent labeling.

Asia-Pacific Fat Replacers Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Fat Replacers Market industry. Rapid urbanization, changing consumer lifestyles, rising disposable incomes, and a growing inclination towards quality-oriented and healthy food options are driving significant growth. China led the market in 2024 due to the increasing preference for healthy food options. India and other Southeast Asian countries are also witnessing significant growth. Increasing demand for fat-free dairy items and convenient foods. Growing awareness of clean-label products and healthy ingredients.

Competitive Landscape

The global Fat Replacers Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Cargill Incorporated

- Kerry Group PLC.

- DKS Co Ltd.

- Agritech Worldwide Inc.

- FMC Corporation

- Archer Daniels Midland Company

- Ashland Global Holdings Inc.

- Royal Avebe UA

- Arla Foods Ingredients Group

- Ajinomoto Group.

Key Development

In March 2024, Clean Food Group, a U.K.-based food technology company, raised funding of more than USD 3 million to develop sustainable oil and fat alternatives. The company is planning to launch its healthier oil & fat alternative in 2025.

In May 2022, Epogee launched a reduced-calorie alternative fat, EPG (esterified propoxylated glycerol), for plant-based products. The purpose of this launch was to provide a functional alternative to a plant-based meat alternative.

Scope of the Report

Global Fat Replacers Market, by Type

- Carbohydrate

- Protein

- Lipids

- Others

Global Fat Replacers Market, by Source

- Plant

- Animal

Global Fat Replacers Market, by Form

- Liquid

- Powder

Global Fat Replacers Market, by Application

- Bakery

- Beverages

- Processed Meat

- Others

Global Fat Replacers Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 9.36 Billion |

| CAGR (2024-2034) | 6.52% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Source, Form and Application |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Cargill Incorporated, Kerry Group PLC., DKS Co Ltd., Agritech Worldwide Inc., FMC Corporation, Archer Daniels Midland Company, Ashland Global Holdings Inc., Royal Avebe UA, Arla Foods Ingredients Group and Ajinomoto Group. |

| Key Market Opportunities | · Rising Popularity of Plant-Based and Vegan Foods · Expansion of Functional and Fortified Foods |

| Key Market Drivers | · Growing Demand for Low-Fat & Reduced-Calorie Foods · Technological Advancements in Food Processing |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Fat Replacers Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Fat Replacers Market historical market size for the year 2021, and forecast from 2023 to 2033

- Fat Replacers Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Fat Replacers Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Fat Replacers Market is 2021- 2033

What is the growth rate of the global Fat Replacers Market?

The global Fat Replacers Market is growing at a CAGR of 6.52% over the next 10 years

Which region has the highest growth rate in the market of Fat Replacers Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Fat Replacers Market?

North America holds the largest share in 2022

Who are the key players in the global Fat Replacers Market?

Cargill Incorporated, Kerry Group PLC., DKS Co Ltd., Agritech Worldwide Inc., FMC Corporation, Archer Daniels Midland Company, Ashland Global Holdings Inc., Royal Avebe UA, Arla Foods Ingredients Group and Ajinomoto Group. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary

CHAPTER 2. Scope of the Study

2.1. Market Definition

2.2. Market Scope & Segmentation

2.2.1. Objective of Report

CHAPTER 3. Evolve BI Methodology

3.1. Data Collection & Validation Approach

3.2. Market Size Estimation and Forecast

CHAPTER 4. Exclusive Analysis

4.1. Market Opportunity Score

4.1.1. Type Segement – Market Opportunity Score

4.1.2. Source Segment – Market Opportunity Score

4.1.3. Form Segment – Market Opportunity Score

4.1.4. Application Segment – Market Opportunity Score

4.2. Key Market Influencing Indicators

CHAPTER 5. Market Insights and Trends

5.1. Value Chain Analysis

5.1.1. Raw Material

5.1.2. Manufacturing Process

5.1.3. Distribution Channel

5.1.4. End User

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining Power of Buyers

5.2.2. Bargaining Power of Suppliers

5.2.3. Threat of New Entrant

5.2.4. Threat of Substitute

5.2.5. Industry Rivalry

5.3. COVID-19 Impact and Post COVID Scenario on Fat Replacers Market

5.3.1. Impact of COVID-19

5.3.2. Government Support and Industry Revival Policies

5.3.3. Measures Taken by Companies to Mitigate Negative Impact

5.3.4. Post COVID Trend

CHAPTER 6. MArket Dynamics

6.1. Introduction

6.2. Drivers

6.2.1. Driver 1

6.2.2. Driver 2

6.2.3. Driver 3

6.3. Restraints

6.3.1. Restraint 1

6.3.2. Restraint 2

6.4. Opportunity

6.4.1. Opportunity 1

CHAPTER 7. Fat Replacers Market, By Type

7.1. Introduction

7.1.1. Carbohydrate

7.1.2. Protein

7.1.3. Lipids

7.1.4. Others

CHAPTER 8. Fat Replacers Market, By Source

8.1. Introduction

8.1.1. Plant

8.1.2. Animal

CHAPTER 9. Fat Replacers Market, By Form

9.1. Introduction

9.1.1. Liquid

9.1.2. Powder

CHAPTER 10. Fat Replacers Market, By Application

10.1.Introduction

10.1.1 Bakery

10.1.2. Beverages

10.1.3. Processed Meat

10.1.4. Others

CHAPTER 11. Fat Replacers Market, By Region

11.1. Introduction

11.2. NORTH AMERICA

11.2.1. North America: Market Size and Forecast, By Country, 2024 – 2034 ($ Million)

11.2.2. North America: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.2.3. North America: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.2.4. North America: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.2.5. North America: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.2.6. US

11.2.6.1. US: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.2.6.2. US: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.2.6.3. US: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.2.6.4. US: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.2.7. CANADA

11.2.7.1. Canada: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.2.7.2. Canada: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.2.7.3. Canada: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.2.7.4. Canada: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.2.8. MEXICO

11.2.8.1. Mexico: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.2.8.2. Mexico: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.2.8.3. Mexico: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.2.8.4. Mexico: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.3. Europe

11.3.1. Europe: Market Size and Forecast, By Country, 2024 – 2034 ($ Million)

11.3.2. Europe: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.3.3. Europe: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.3.4. Europe: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.3.5. Europe: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.3.6. U.K.

11.3.6.1. U.K.: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.3.6.2. U.K.: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.3.6.3. U.K.: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.3.6.4. U.K.: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.3.7. GERMANY

11.3.7.1. Germany: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.3.7.2. Germany: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.3.7.3. Germany: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.3.7.4. Germany: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.3.8. FRANCE

11.3.8.1. France: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.3.8.2. France: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.3.8.3. France: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.3.8.4. France: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.3.9. ITALY

11.3.9.1. Italy: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.3.9.2. Italy: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.3.9.3. Italy: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.3.9.4. Italy: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.3.10. SPAIN

11.3.10.1. Spain: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.3.10.2. Spain: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.3.10.3. Spain: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.3.10.4. Spain: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.3.11. BENELUX

11.3.11.1. BeNeLux: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.3.11.2. BeNeLux: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.3.11.3. BeNeLux: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.3.11.4. BeNeLux: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.3.12. RUSSIA

11.3.12.1. Russia: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.3.12.2. Russia: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.3.12.3. Russia: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.3.12.4. Russia: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.3.13. REST OF EUROPE

11.3.13.1. Rest of Europe: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.3.13.2. Rest of Europe: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.3.13.3. Rest of Europe: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.3.13.4. Rest of Europe: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.4. Asia Pacific

11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2024 – 2034 ($ Million)

11.4.2. Asia Pacific: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.4.3. Asia Pacific: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.4.4. Asia Pacific: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.4.5. Asia Pacific: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.4.6. CHINA

11.4.6.1. China: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.4.6.2. China: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.4.6.3. China: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.4.6.4. China: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.4.7. JAPAN

11.4.7.1. Japan: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.4.7.2. Japan: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.4.7.3. Japan: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.4.7.4. Japan: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.4.8. INDIA

11.4.8.1. India: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.4.8.2. India: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.4.8.3. India: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.4.8.4. India: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.4.9. SOUTH KOREA

11.4.9.1. South Korea: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.4.9.2. South Korea: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.4.9.3. South Korea: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.4.9.4. South Korea: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.4.10. THAILAND

11.4.10.1. Thailand: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.4.10.2. Thailand: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.4.10.3. Thailand: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.4.10.4. Thailand: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.4.11. INDONESIA

11.4.11.1. Indonesia: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.4.11.2. Indonesia: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.4.11.3. Indonesia: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.4.11.4. Indonesia: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.4.12. MALAYSIA

11.4.12.1. Malaysia: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.4.12.2. Malaysia: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.4.12.3. Malaysia: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.4.12.4. Malaysia: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.4.13. AUSTRALIA

11.4.13.1. Australia: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.4.13.2. Australia: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.4.13.3. Australia: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.4.13.4. Australia: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.4.14. REST FO ASIA PACIFIC

11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.5. South America

11.5.1. South America: Market Size and Forecast, By Country, 2024 – 2034 ($ Million)

11.5.2. South America: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.5.3. South America: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.5.4. South America: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.5.5. South America: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.5.6. BRAZIL

11.5.6.1. Brazil: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.5.6.2. Brazil: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.5.6.3. Brazil: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.5.6.4. Brazil: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.5.7. ARGENTINA

11.5.7.1. Argentina: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.5.7.2. Argentina: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.5.7.3. Argentina: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.5.7.4. Argentina: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.5.8. REST OF SOUTH AMERICA

11.5.8.1. Rest of South America: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.5.8.2. Rest of South America: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.5.8.3. Rest of South America: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.5.8.4. Rest of South America: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.6. Middle East & Africa

11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2024 – 2034 ($ Million)

11.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.6.3. Middle East & Africa: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.6.4. Middle East & Africa: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.6.5. Middle East & Africa: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.6.6. SAUDI ARABIA

11.6.6.1. Saudi Arabia: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.6.6.2. Saudi Arabia: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.6.6.3. Saudi Arabia: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.6.6.4. Saudi Arabia: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.6.7. UAE

11.6.7.1. UAE: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.6.7.2. UAE: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.6.7.3. UAE: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.6.7.4. UAE: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.6.8. EGYPT

11.6.8.1. Egypt: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.6.8.2. Egypt: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.6.8.3. Egypt: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.6.8.4. Egypt: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.6.9. SOUTH AFRICA

11.6.9.1. South Africa: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.6.9.2. South Africa: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.6.9.3. South Africa: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.6.9.4. South Africa: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

11.6.10. REST OF MIDDLE EAST & AFRICA

11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Type, 2024 – 2034 ($ Million)

11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Source, 2024 – 2034 ($ Million)

11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Form, 2024 – 2034 ($ Million)

11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2024 – 2034 ($ Million)

CHAPTER 12. Competitive Landscape

12.1. Competitior Benchmarking 2024

12.2. Market Share Analysis

12.3. Key Developments Analysis By Top 5 Companies

12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players

CHAPTER 13. Company Profiles

13.1. Cargill Incorporated

13.1.1. Business Overview

13.1.2. Financial Analysis

13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million

13.1.2.2. Geographic Revenue Mix, 2020 (% Share)

13.1.3. Product Portfolio

13.1.4. Recent Development and Strategies Adopted

13.1.5. SWOT Analysis

13.2. Kerry Group PLC.

13.3. DKS Co Ltd.

13.4. Agritech Worldwide Inc.

13.5. FMC Corporation

13.6. Archer Daniels Midland Company

13.7. Ashland Global Holdings Inc.

13.8. Royal Avebe UA

13.9. Arla Foods Ingredients Group

13.10. Ajinomoto Group.

Connect to Analyst

Research Methodology