Fast Fashion Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Fast Fashion Market Research Report: By Gender (Male, Female), By End User (Adult, Teens, Kids), By Distribution Channels (Independent Retailers, Online Stores, Brands Stores), and by Region — Forecast till 2033

Fast Fashion Market Overview

The Fast Fashion Market Size is expected to reach USD 302.11 Billion by 2033. The Fast Fashion industry size accounted for USD 103.24 Billion in 2023 and is expected to expand at a CAGR of 10.47% from 2023 to 2033. Fast fashion refers to the mass production and rapid turnover of inexpensive clothing collections, often inspired by current trends from fashion runways, celebrity culture, and social media. This business model prioritizes quick production cycles and low costs, resulting in frequent releases of new clothing lines to meet consumer demand for trendy and affordable apparel. Fast fashion brands often sacrifice ethical and environmental considerations, relying on cheap labor and unsustainable practices to maintain profit margins. This approach has led to concerns about environmental degradation, labor exploitation, and the disposable nature of fashion, prompting calls for more sustainable and ethical alternatives in the industry.

Global Fast Fashion Market Synopsis

The Fast Fashion market experienced a moderate impact during the COVID-19 pandemic, characterized by disrupted supply chains, store closures, and reduced consumer spending. With lockdown measures and economic uncertainties, consumer demand for trendy clothing declined, leading to inventory backlogs and financial losses for fast fashion retailers. However, online sales surged as consumers turned to e-commerce for their fashion needs, prompting brands to adapt their strategies and prioritize digital channels to mitigate the effects of the crisis.

Global Fast Fashion Market Dynamics

The major factors that have impacted the growth of Fast Fashion are as follows:

Drivers:

⮚ Consumer Demand for Affordable Fashion

The fast fashion market is the widespread consumer demand for affordable and trendy clothing. Fast fashion brands capitalize on this demand by offering inexpensive yet fashionable clothing collections that align with current trends. This constant desire for new styles at affordable prices drives the rapid turnover of inventory and fuels the growth of the fast fashion industry.

Restraint:

- Environmental and Ethical Concerns

A significant restraint facing the fast fashion market is the increasing awareness and concern regarding its environmental and ethical implications. The fast fashion industry is notorious for its high levels of waste, pollution, and exploitation of labor in developing countries. As consumers become more conscious of these issues, there is growing pressure on brands to adopt sustainable and ethical practices, which may pose challenges for traditional fast fashion business models.

Opportunity:

⮚ Digital Transformation and E-commerce

An opportunity for the fast fashion market lies in the digital transformation of the retail landscape and the growth of e-commerce. With the rise of online shopping platforms and social media, fast fashion brands have the opportunity to reach a broader audience and engage directly with consumers. By investing in digital marketing, omnichannel retail strategies, and personalized shopping experiences, fast fashion companies can capitalize on the growing trend of online shopping and enhance their market presence.

Fast Fashion Market Segment Overview

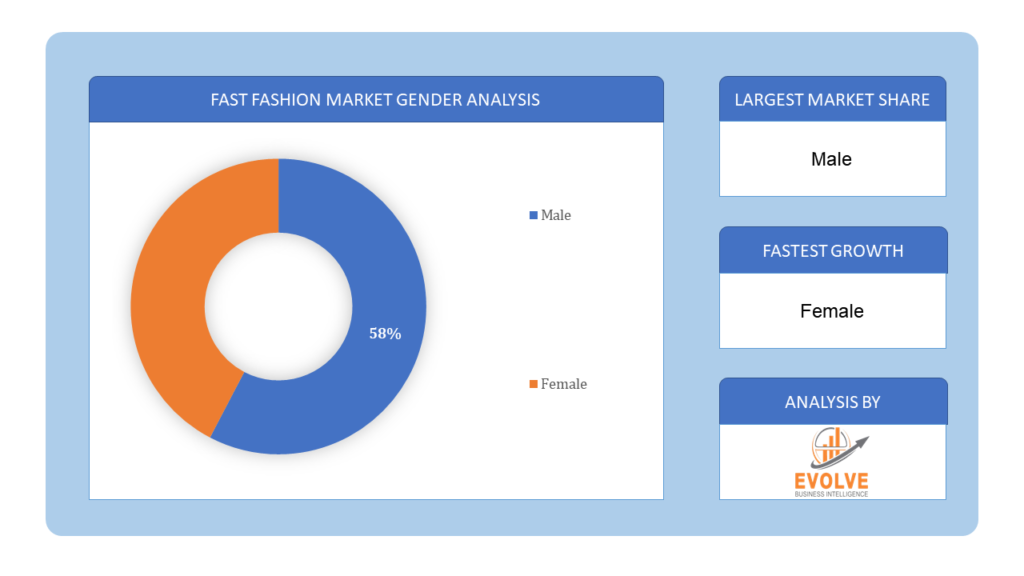

By Gender

Based on Gender, the market is segmented based on males and females. The Male segment was anticipated to lead the Fast Fashion market due to its widespread adoption, compatibility with mainstream software applications, and advancements in processing power, making it a preferred choice for high-performance computing solutions across various industries. Additionally, the availability of x86-based Fast Fashion from leading vendors offers scalability, cost-effectiveness, and ease of integration, further driving the segment’s dominance in the market.

Based on Gender, the market is segmented based on males and females. The Male segment was anticipated to lead the Fast Fashion market due to its widespread adoption, compatibility with mainstream software applications, and advancements in processing power, making it a preferred choice for high-performance computing solutions across various industries. Additionally, the availability of x86-based Fast Fashion from leading vendors offers scalability, cost-effectiveness, and ease of integration, further driving the segment’s dominance in the market.

By End User

Based on the End Users, the market has been divided into Adults, Teens, and Kids. The adult segment is expected to dominate the fast fashion market, primarily driven by the larger consumer base of adults, their higher purchasing power, and their diverse fashion preferences. Additionally, the increasing trend of adults seeking affordable yet trendy clothing options, coupled with the rapid turnover of fashion trends, further propels the dominance of the adult segment in the fast fashion market.

By Distribution Channels

Based on Distribution Channels, the market has been divided into Independent Retailers, Online Stores, and Brands Stores. The Independent Retailers segment is positioned to capture the largest market share in the fast fashion market due to their agility in responding to local fashion trends and their ability to offer unique and curated selections that resonate with niche consumer preferences. Additionally, independent retailers often foster a sense of community and exclusivity, attracting loyal customers seeking a more personalized shopping experience amidst the homogenized offerings of larger fast fashion chains.

Global Fast Fashion Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Fast Fashion, followed by those in Asia-Pacific and Europe.

Fast Fashion North America Market

Fast Fashion North America Market

North America asserts dominance in the fast fashion market due to several key factors. The region boasts a robust economy, high levels of disposable income, and a strong consumer culture that values convenience and affordability. Major cities like New York and Los Angeles serve as global fashion hubs, influencing trends and setting the pace for the industry. Additionally, North American consumers have a penchant for the rapid adoption of new fashion styles, driving demand for the frequent turnover of inventory that characterizes the fast fashion model. With a well-established retail infrastructure, extensive e-commerce penetration, and a diverse population with varying fashion preferences, North America remains a pivotal market for fast fashion brands seeking growth and expansion opportunities.

Fast Fashion Asia Pacific Market

The Asia-Pacific region has witnessed remarkable growth in the fast fashion market, propelled by several factors. Rapid urbanization, rising disposable incomes, and a burgeoning middle class have fueled consumer demand for affordable yet trendy clothing options. Countries like China, India, and South Korea have emerged as key manufacturing hubs for fast fashion, benefiting from lower production costs and efficient supply chains. Moreover, the widespread adoption of digital technology and social media platforms has enabled fast fashion brands to reach a vast and tech-savvy consumer base, driving online sales and market expansion.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Primark Limited, Fashion Nova, LLC, The Gap, Inc., Asos Plc, and New Look Retailers Limited are some of the leading players in the global Fast Fashion Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Forever21 Inc.

- Industria de Diseño Textil, S.A.

- UNIQLO Co., Ltd.

- H&M Hennes & Mauritz AB

- Boohoo Group Plc

- Primark Limited

- Fashion Nova, LLC

- The Gap, Inc.

- Asos Plc

- New Look Retailers Limited

Key Development

In September 2023, H&M India disclosed its intentions for expansion in Hyderabad by launching its third store in the city. Presently, the company maintains 55 stores across 28 cities in the country.

In May 2023, German sportswear titan Adidas, collaborating with designer Rich Mnisi, introduced an exclusive apparel line for Pride 2023. The Adidas x Rich Mnisi collection showcases distinctive designs across Adidas Originals, football, cycling, sportswear, and swimwear. Notably, the collection incorporates items made partially from recycled materials and developed in partnership with Better Cotton.

Scope of the Report

Global Fast Fashion Market, by Gender

- Male

- Female

Global Fast Fashion Market, by End User

- Adult

- Teens

- Kids

Global Fast Fashion Market, by Distribution Channels

- Independent Retailers

- Online Stores

- Brands Stores

Global Fast Fashion Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $302.11 Billion |

| CAGR | 10.47% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Gender, End-User, Distribution Channels |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Forever21 Inc., Industria de Diseño Textil, S.A., UNIQLO Co., Ltd., H&M Hennes & Mauritz AB, Boohoo Group Plc, Primark Limited, Fashion Nova, LLC, The Gap, Inc., Asos Plc, New Look Retailers Limited |

| Key Market Opportunities | • The growing popularity of online shopping and e-commerce platforms. • Expansion into emerging markets with rising disposable incomes and urbanization. |

| Key Market Drivers | • Consumer demand for trendy yet affordable clothing. • Quick turnover of inventory to align with rapidly changing fashion trends. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Fast Fashion Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Fast Fashion market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Fast Fashion market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Fast Fashion Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

1.What is the study period of this market?

- The study period of the global Fast Fashion market is 2022- 2033

2.What is the 10-year CAGR (2023 to 2033) of the global Fast Fashion market?

- The global Fast Fashion market is growing at a CAGR of ~47% over the next 10 years

3.Which region has the highest growth rate in the market of Fast Fashion?

- Asia Pacific is expected to register the highest CAGR during 2023-2033

4.Which region accounted for the largest share of the market of Fast Fashion?

- North America holds the largest share in 2022

5.Major Key Players in the Market of Fast Fashion Manufacturers?

- Forever21 Inc., Industria de Diseño Textil, S.A., UNIQLO Co., Ltd., H&M Hennes & Mauritz AB, Boohoo Group Plc, Primark Limited, Fashion Nova, LLC, The Gap, Inc., Asos Plc, New Look Retailers Limited.

6.Do you offer post-sales support?

- Yes, we offer 16 hours of analyst support to solve the queries

7.Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Gender Segement – Market Opportunity Score 4.1.2. End User Areas Segment – Market Opportunity Score 4.1.3. Distribution Channels Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Fast Fashion Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Fast Fashion Market, By Gender 7.1. Introduction 7.1.1. Male 7.1.2. Female CHAPTER 8. Global Fast Fashion Market, By End User 8.1. Introduction 8.1.1. Adult 8.1.2. Teens 8.1.3. Kids CHAPTER 9. Global Fast Fashion Market, By Distribution Channels 9.1. Introduction 9.1.1. Independent Retailers 9.1.2. Online Stores 9.1.3. Brands Stores CHAPTER 10. Global Fast Fashion Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Distribution Channels, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Forever21 Inc 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Industria de Diseño Textil, S.A 13.3. UNIQLO Co., Ltd. 13.4. H&M Hennes & Mauritz AB 13.5. Boohoo Group Plc 13.6. Primark Limited 13.7. Fashion Nova, LLC 13.8. The Gap, Inc. 13.9. Asos Plc 13.10. New Look Retailers Limited

Connect to Analyst

Research Methodology