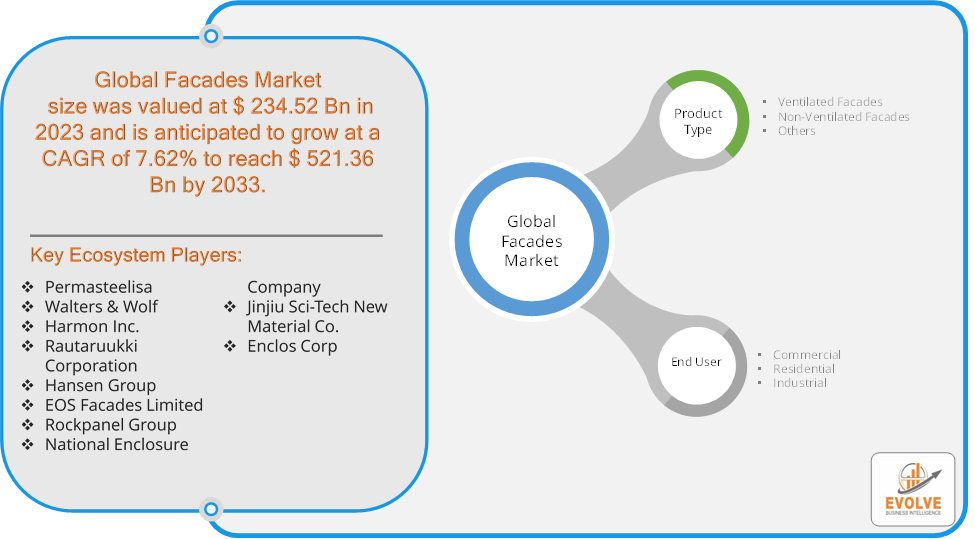

Facades Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

Facades Market Research Report: Information By Product Type (Ventilated Facades, Non-Ventilated Facades, Others), By End-User (Commercial, Residential, Industrial), and by Region — Forecast till 2033

Page: 168

Facades Market Overview

The Facades Market Size is expected to reach USD 521.36 Billion by 2033. The Facades Market industry size accounted for USD 234.52 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.62% from 2023 to 2033. The Facades Market refers to the global market for exterior building facades, which are the outer walls or faces of buildings. This market includes various materials and technologies used in the construction and renovation of building facades. The primary materials used in facades include glass, metal, stone, wood, and composite materials.

The market is influenced by architectural trends, regulatory standards, and advancements in building technologies, aiming to improve both the aesthetic and functional aspects of building facades. The Facades Market is a large and growing industry, driven by increasing construction activity around the world. Demand for more energy-efficient buildings and Development of new facade materials and technologies.

Global Facades Market Synopsis

COVID-19 Impact Analysis

COVID-19 Impact Analysis

The COVID-19 pandemic had a significant impact on the Facades Market. The pandemic caused significant disruptions in global supply chains, affecting the availability and cost of raw materials required for facade construction. This led to delays and increased costs for many projects. Lockdowns and social distancing measures led to the suspension or slowdown of construction activities worldwide. Many ongoing and planned facade projects experienced delays, which impacted market growth. The economic downturn caused by the pandemic led to reduced investments in new construction projects, especially in the commercial and hospitality sectors. This reduction in new projects negatively affected the demand for facades. The pandemic accelerated the demand for sustainable and energy-efficient building solutions, including facades. There was an increased focus on health and wellness, leading to the adoption of facades that improve indoor air quality and natural ventilation. The rise of remote working reduced the demand for office space in urban areas, impacting the commercial building sector. This shift led to a revaluation of construction projects, including those involving facades. As the world began to recover from the pandemic, construction activities resumed, and there was a gradual rebound in the facades market. Companies adapted by implementing digital tools for project management and exploring innovative facade materials and designs to meet new market demands.

Facades Market Dynamics

The major factors that have impacted the growth of Facades Market are as follows:

Drivers:

Ø Technological Advancements

Innovations in materials and construction technologies are enabling the development of advanced facades. These include smart facades with dynamic capabilities, self-cleaning surfaces, and improved durability. Increasing awareness of climate change and environmental sustainability is pushing the construction industry to adopt green building practices. Facades that contribute to reducing the carbon footprint of buildings are gaining popularity. Post-pandemic, there is a heightened focus on indoor environmental quality, health, and comfort. Facades that improve natural ventilation, daylighting, and indoor air quality are becoming more important. Economic growth in emerging markets and increased investments in infrastructure development contribute to the demand for new construction projects, including facades.

Restraint:

- Perception of High Costs

The cost of advanced facade materials and technologies can be prohibitive. High initial investment and maintenance costs can deter some building owners and developers from adopting cutting-edge facade solutions. The construction industry, including the facades market, often faces shortages of skilled labor. The lack of experienced professionals can delay projects and affect the quality of facade installations.

Opportunity:

⮚ Demand for Sustainable Solutions

There is a growing demand for sustainable building practices and materials. Facades that enhance energy efficiency, reduce environmental impact, and improve indoor air quality are in high demand. Rapid urbanization and infrastructure development in emerging economies present opportunities for new construction projects. High-rise buildings and mixed-use developments require innovative facade solutions. The integration of facades with smart building technologies, such as IoT-enabled systems for monitoring and control, presents opportunities for enhanced building management and occupant comfort.

Facades Market Segment Overview

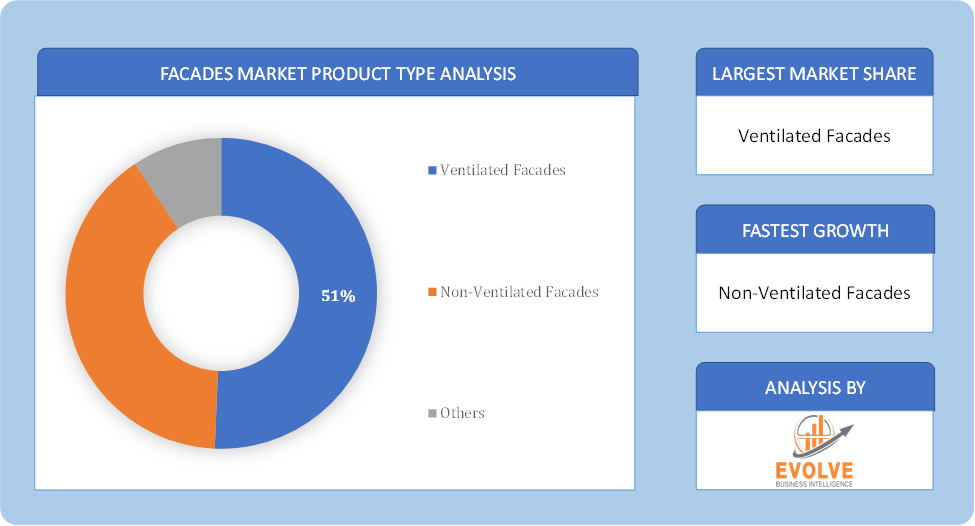

By Product Type

By Product Type

Based on Product Type, the market is segmented based on Ventilated Facades, Non-Ventilated Facades and Others. The ventilated segment dominated the market because they offer excellent thermal insulation properties, which help reduce energy consumption and maintain comfortable indoor temperatures. They also provide effective moisture management, preventing moisture accumulation and reducing the risk of structural damage caused by water infiltration.

By End User

Based on End Users, the market has been divided into the Commercial, Residential and Industrial. The growth of the segment is attributed to the rising use of facades for the protection of the interior and for giving a visually appealing look to the outer surface. The rising commercial and industrial construction across the world, especially in the developing countries, significantly promotes the segment’s growth.

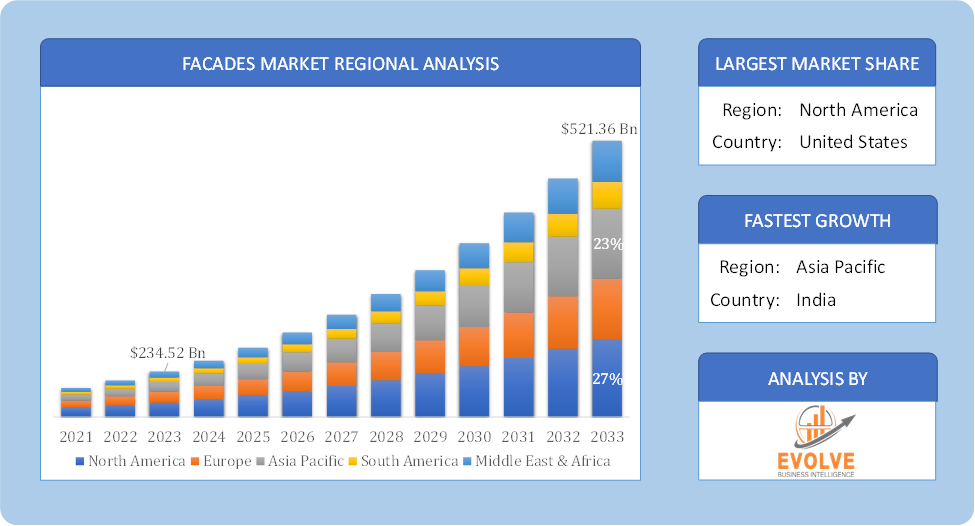

Global Facades Market Regional Analysis

Based on region, the global Facades Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Facades Market followed by the Asia-Pacific and Europe regions.

Facades North America Market

Facades North America Market

North America holds a dominant position in the Facades Market. United States and Canada lead in technological innovation and adoption of sustainable building practices. High demand for energy-efficient facades due to stringent building codes and green building certifications. Growth in renovation and retrofitting projects in urban areas.

Facades Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Facades Market industry. China, Japan, India, and Australia are key markets with rapid urbanization and infrastructure development. Increasing construction of high-rise buildings and commercial complexes drives demand for facades. Adoption of advanced facade technologies, including smart and self-cleaning facades.

Competitive Landscape

The global Facades Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Permasteelisa

- Walters & Wolf

- Harmon Inc.

- Rautaruukki Corporation

- Hansen Group

- EOS Facades Limited

- Rockpanel Group

- National Enclosure Company

- Jinjiu Sci-Tech New Material Co.

- Enclos Corp

Key Development

In Nov 2022, Saint Globen extended its partnership with the PV manufacturer Megasol for increasing its range of facades portfolio. The agreement reveals that the company Saint Globen occupies the minority stake in Megasol’s unit which manufactures and develop BIPV solution in their Deitingen site in Switzerland.

In April 2023, Solar Energy Systems ISE and the Fraunhofer Institute get a partnership with the industry partners for its TABSOLAR III research project for the development of new solar thermal facade panel as a part of it.

Scope of the Report

Global Facades Market, by Product Type

- Ventilated Facades

- Non-Ventilated Facades

- Others

Global Facades Market, by End User

- Commercial

- Residential

- Industrial

Global Facades Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 521.36 Billion |

| CAGR (2023-2033) | 7.62% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Permasteelisa, Walters & Wolf, Harmon Inc., Rautaruukki Corporation, Hansen Group, EOS Facades Limited, Rockpanel Group, National Enclosure Company, Jinjiu Sci-Tech New Material Co. and Enclos Corp. |

| Key Market Opportunities | · Demand for Sustainable Solutions · Integration with Smart Building Technologies |

| Key Market Drivers | · Technological Advancements · Climate Change and Environmental Concerns |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Facades Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Facades Market historical market size for the year 2021, and forecast from 2023 to 2033

- Facades Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Facades Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Facades Market is 2021- 2033

What is the growth rate of the global Facades Market?

The global Facades Market is growing at a CAGR of 7.62% over the next 10 years

Which region has the highest growth rate in the market of Facades Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Facades Market?

North America holds the largest share in 2022

Who are the key players in the global Facades Market?

Permasteelisa, Walters & Wolf, Harmon Inc., Rautaruukki Corporation, Hansen Group, EOS Facades Limited, Rockpanel Group, National Enclosure Company, Jinjiu Sci-Tech New Material Co. and Enclos Corp. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Facades Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Facades Market 4.8. Import Analysis of the Facades Market 4.9. Export Analysis of the Facades Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Facades Market, By Product Type 6.1. Introduction 6.2. Ventilated Facades 6.3. Non-Ventilated Facades 6.4. Others Chapter 7. Global Facades Market, By End User 7.1. Introduction 7.2. Commercial 7.3. Residential 7.4. Industrial Chapter 8. Global Facades Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.5. Market Size and Forecast, By End User, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By End User, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By End User, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By End User, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By End User, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By End User, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By End User, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By End User, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By End User, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By End User, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By End User, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By End User, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By End User, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By End User, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By End User, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By End User, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Permasteelisa 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Walters & Wolf 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Harmon Inc. 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Rautaruukki Corporation 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Hansen Group 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. EOS Facades Limited 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Rockpanel Group 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 National Enclosure Company 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Jinjiu Sci-Tech New Material Co. 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Enclos Corp 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology

Facades North America Market

Facades North America Market