Ethernet Adapter Market Overview

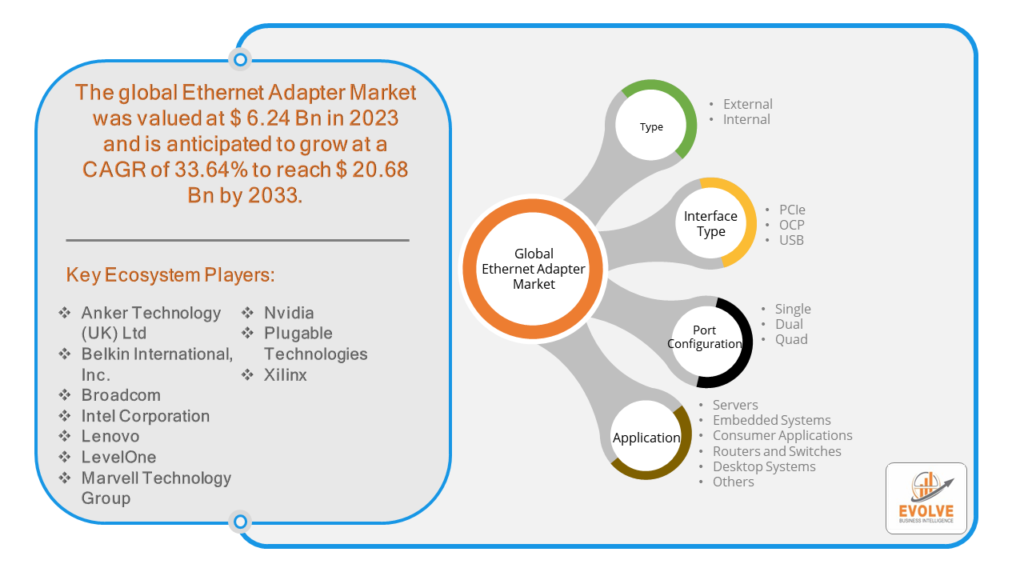

Ethernet Adapter Market Size is expected to reach USD 20.68 Billion by 2033. The Ethernet Adapter industry size accounted for USD 6.24 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 33.64% from 2023 to 2033. The Ethernet adapter market encompasses devices that enable Ethernet connectivity in various devices such as computers, servers, and networking equipment. These adapters facilitate the transmission of data over Ethernet networks, supporting speeds ranging from traditional 10/100 Mbps to Gigabit and beyond. Key players in the market include Intel, Broadcom, Realtek, and Qualcomm, among others, offering a range of adapters catering to different network speeds and interface types (PCIe, USB, etc.). Growth in the market is driven by increasing demand for high-speed and reliable network connections in both consumer and enterprise applications, alongside advancements in Ethernet technology.

Global Ethernet Adapter Market Synopsis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the ethernet adapter market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers adopting various strategies to stabilize the company.

Global Ethernet Adapter Market Dynamics

The major factors that have impacted the growth of Ethernet Adapter are as follows:

Drivers:

⮚ Advancements in Network Technologies

Ethernet adapters are benefiting from ongoing advancements in Ethernet standards, such as the development of 2.5GbE, 5GbE, and 10GbE technologies. These higher-speed standards support faster data transfer rates and lower latency, catering to the increasing bandwidth requirements of modern applications.

Restraint:

- Security Concerns

Ethernet adapters, especially those used in enterprise environments, must adhere to stringent security standards to protect against cyber threats. Ensuring adapter firmware integrity, secure network authentication, and encryption protocols can pose challenges in maintaining robust network security.

Opportunity:

⮚ Transition to Higher Ethernet Speeds

The market shift towards higher Ethernet speeds (e.g., 25GbE, 40GbE, 100GbE) presents opportunities for Ethernet adapter manufacturers. As organizations upgrade their networks to accommodate increasing data volumes and bandwidth-intensive applications, there is a growing demand for adapters that can support these higher speeds effectively.

Ethernet Adapter Market Segment Overview

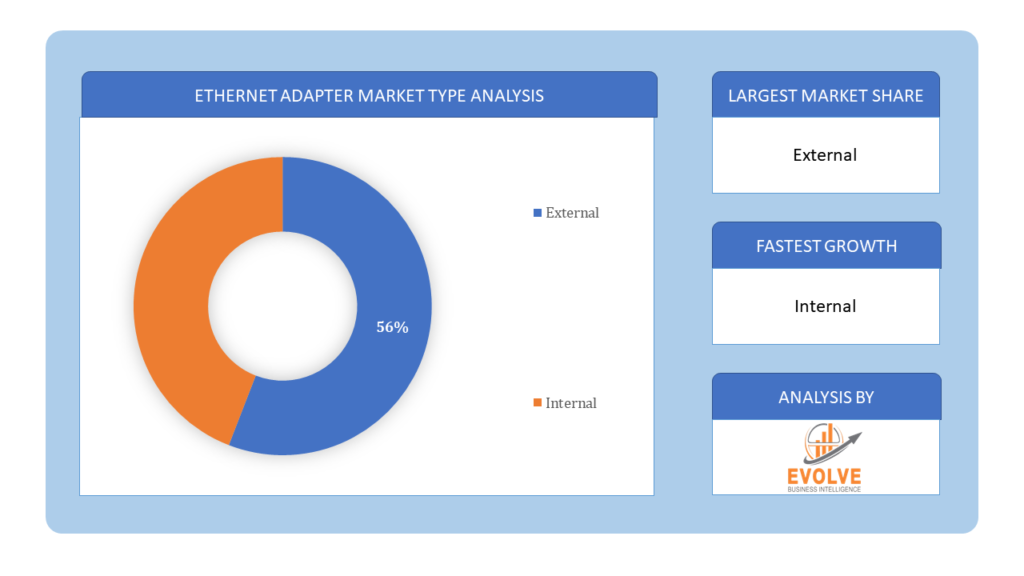

By Type

Based on the Type, the market is segmented based on External, Internal. Internal adapters currently dominate due to their integration within devices like desktop computers and servers, offering streamlined connectivity without external components.

Based on the Type, the market is segmented based on External, Internal. Internal adapters currently dominate due to their integration within devices like desktop computers and servers, offering streamlined connectivity without external components.

By Interface Type

Based on Interface Type, the market has been divided into PCIe, OCP, USB. PCIe (Peripheral Component Interconnect Express) currently dominates due to its high performance and widespread adoption in various computing and networking applications.

By Port Configuration

Based on the Port Configuration, the market has been divided into Single, Dual, Quad. They are widely used in various applications due to their cost-effectiveness, simplicity in deployment, and suitability for most networking needs, ranging from consumer electronics to enterprise networking equipment. Dual and quad-port configurations cater to specific high-density and server applications where multiple simultaneous connections are required, but single-port adapters remain the most prevalent choice across the market.

By Application

Based on Application, the market has been divided into Servers, Embedded Systems, Consumer Applications, Routers and Switches, Desktop Systems, Others. Servers require high-speed Ethernet adapters for data center connectivity, while routers and switches use adapters extensively for network infrastructure management and data transfer between devices. These segments drive significant demand due to their critical roles in enterprise networking and data processing environments.

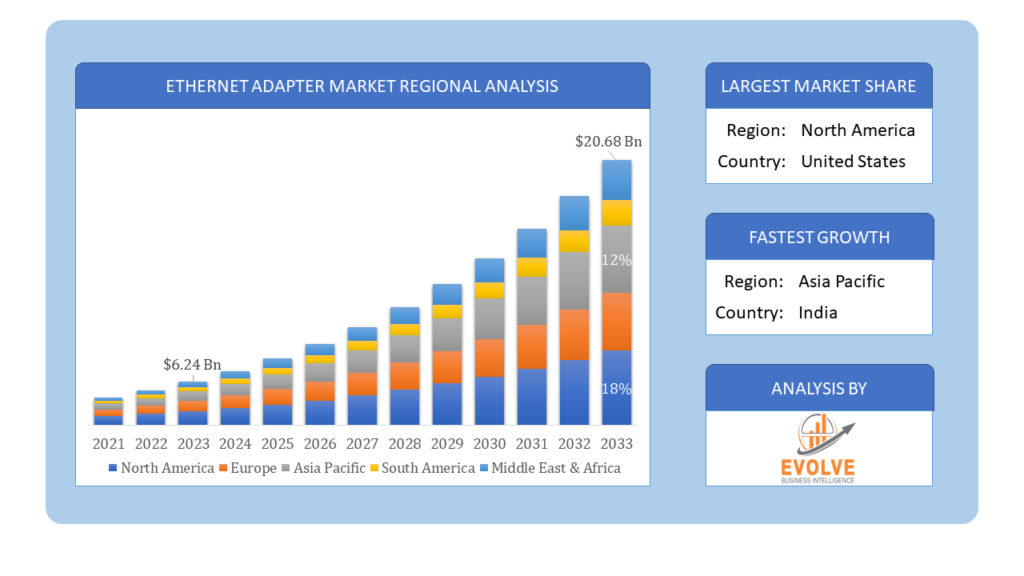

Global Ethernet Adapter Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of Asia-Pacific is anticipated to dominate the market for the usage of Ethernet Adapter, followed by those in North America and Europe.

Ethernet Adapter Asia-Pacific Market

Ethernet Adapter Asia-Pacific Market

The Asia-Pacific region holds a dominant position in the Ethernet Adapter market. The market for Ethernet switches is expanding significantly in the Asia Pacific area. Due to the region’s enormous population and quickly expanding economy, there is an increasing need for Ethernet switches to support the expansion of a number of businesses, including cloud computing, data centers, and telecommunications. The expansion of the Ethernet Switch market in the Asia Pacific region is also being aided by government investments in digital infrastructure and the rising use of technology by consumers and companies.

Ethernet Adapter North America Market

The North America region is witnessing rapid growth and emerging as a significant market for the Ethernet Adapter industry. The Ethernet switch market in North America is anticipated to expand at the quickest rate possible between 2024 and 2032. In terms of market share, North America is regarded as the leader in the Ethernet switch industry and is a significant player. Because of the extensive use of technology and the requirement for high-speed network connectivity, the region is home to several major players in the industry and has a significant demand for Ethernet switches.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Anker Technology (UK) Ltd, Belkin International, Inc., Broadcom, Intel Corporation, and Lenovo are some of the leading players in the global Ethernet Adapter Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Anker Technology (UK) Ltd

- Belkin International, Inc.

- Broadcom

- Intel Corporation

- Lenovo

- LevelOne

- Marvell Technology Group

- Nvidia

- Plugable Technologies

- Xilinx

Key Development:

In September 2022, Intel Corporation introduced advanced Ethernet adapters featuring enhanced performance, reliability, and compatibility with emerging networking standards, reinforcing its leadership in the Ethernet adapter market.

Scope of the Report

Global Ethernet Adapter Market, by Type

- External

- Internal

Global Ethernet Adapter Market, by Interface Type

- PCIe

- OCP

- USB

Global Ethernet Adapter Market, by Port Configuration

- Single

- Dual

- Quad

Global Ethernet Adapter Market, by Application

- Servers

- Embedded Systems

- Consumer Applications

- Routers and Switches

- Desktop Systems

- Others

Global Ethernet Adapter Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $20.68 Billion |

| CAGR | 33.64% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Interface Type, Port Configuration, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Anker Technology (UK) Ltd, Belkin International, Inc., Broadcom, Intel Corporation, Lenovo, LevelOne, Marvell Technology Group, Nvidia, Plugable Technologies, Xilinx |

| Key Market Opportunities | M2M communication technology presents a huge opportunity in front of the integrated ethernet switches market |

| Key Market Drivers | Increasing penetration of the internet presence of high-technology adoption |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Ethernet Adapter Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Ethernet Adapter market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Ethernet Adapter market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Ethernet Adapter Market.