Engineered Wood Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Engineered Wood Market Research Report: By Type (I-Beams, Plywood, Laminated Veneer Lumber (LVL), Glulam (Glued Laminated Timber), Oriented Strand Boards (OSB), Cross-Laminated Timber (CLT), Others), By Application (Construction, Furniture, Flooring, Packaging, Others), By End-User (Residential, Commercial & Industrial), and by Region — Forecast till 2033

Engineered Wood Market Overview

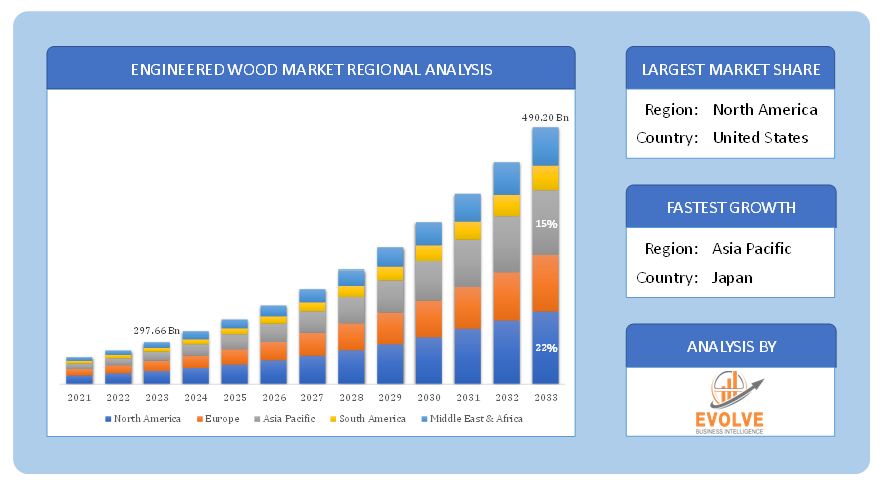

Engineered Wood Market Size is expected to reach USD 490.20 Billion by 2033. The Engineered Wood industry size accounted for USD 297.66 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.98% from 2023 to 2033. Engineered wood, also referred to as composite wood or man made wood, is a composite material fabricated through the combination of wood fibers, strands, veneers, or particles with adhesives and other additives. It is engineered to possess improved structural integrity, dimensional stability, and performance characteristics when compared to solid wood. The manufacturing process involves breaking down wood components into smaller elements or utilizing thin wood veneers, which are then combined with adhesives and subjected to high temperature and pressure to form a cohesive composite structure. The adhesive systems employed typically comprise resins or synthetic binders, which ensure effective bonding between the wood components.

Global Engineered Wood Market Synopsis

The engineered wood market experienced a mixed impact from the COVID-19 pandemic. At the outset, lockdown measures caused disruptions in the supply chain and production, affecting the industry. However, the market rebounded due to heightened demand for engineered wood products driven by increased home improvement projects and the widespread adoption of remote work. This surge in demand was particularly notable in the construction and renovation sectors. Furthermore, the industry benefited from the growing emphasis on sustainable and eco-friendly materials, with engineered wood being favored. Despite temporary challenges, the market showcased resilience and demonstrated growth throughout the pandemic.

Global Engineered Wood Market Dynamics

The major factors that have impacted the growth of Engineered Wood are as follows:

Drivers:

⮚ Growing Construction Industry

The construction industry is a significant driver for the engineered wood market. The demand for engineered wood products is increasing due to the rising construction activities worldwide. Engineered wood offers advantages such as cost-effectiveness, versatility, and sustainability, making it a preferred choice for construction projects.

Restraint:

- Fluctuating Raw Material Costs

The engineered wood market is influenced by the availability and cost of raw materials, such as wood fibers or veneers and adhesives. Fluctuations in the prices of these materials can pose a restraint on the market, impacting the profitability of manufacturers and the overall cost of engineered wood products.

Opportunity:

Sustainable Building Practices

The growing focus on sustainable building practices presents an opportunity for the engineered wood market. Engineered wood is considered an environmentally friendly alternative to traditional solid wood due to its efficient utilization of wood resources, reduced waste, and lower carbon footprint. The increasing adoption of green building certifications and regulations further promotes the use of engineered wood in construction projects.

Engineered Wood Market Segment Overview

By Type

Based on the Type, the market is segmented based on I-Beams, Plywood, Laminated Veneer Lumber (LVL), Glulam (Glued Laminated Timber), Oriented Strand Boards (OSB), Cross-Laminated Timber (CLT), and Others. The largest market share is anticipated to go to the I-Beams segment. As the need for longer spans, flexibility in design, and cost-effectiveness compared to alternative materials. Their versatility and ability to optimize material usage make them an attractive choice in various construction projects.

By Application

Based on Application, the market has been divided into Construction, Furniture, Flooring, Packaging, and Others. The Furniture segment is expected to hold the largest market share in the Market, due to increased demand for stylish, durable, and eco-friendly furniture products. Engineered wood offers several advantages for furniture manufacturing, such as dimensional stability, consistent quality, and the ability to achieve intricate designs. Additionally, engineered wood provides an environmentally friendly alternative to solid wood furniture, aligning with the growing trend of sustainable and eco-conscious consumer preferences.

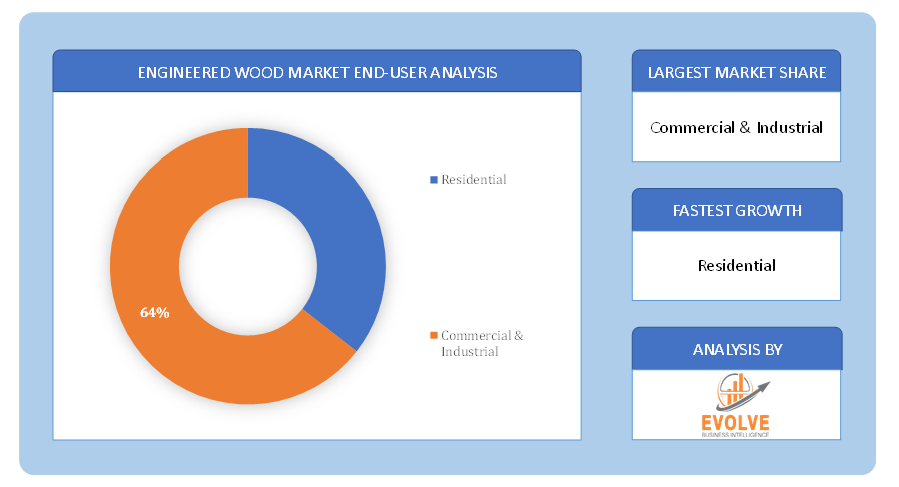

By End Users

Based on End Users, the market has been divided into Residential, Commercial & Industrial. The market is projected to see significant growth in the Commercial & Industrial segment. The growth of commercial and industrial construction projects worldwide is a major driver. Engineered wood products, such as plywood, laminated veneer lumber (LVL), and oriented strand board (OSB), are commonly used for structural elements, flooring, roofing, and interior finishes in these buildings. The versatility, strength, and cost-effectiveness of engineered wood make it a preferred choice for such projects.

Global Engineered Wood Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Engineered Wood, followed by those in Asia-Pacific and Europe.

North America Market

North America was indeed one of the leading regions in terms of market share for the Engineered Wood Market. The region has a well-established construction sector and a high demand for sustainable building materials. Engineered wood products, such as plywood, oriented strand board (OSB), laminated veneer lumber (LVL), and glued laminated timber (glulam), have gained popularity in North America due to their versatility, durability, and eco-friendly characteristics. The use of engineered wood in residential and commercial construction projects has been on the rise in North America. Engineered wood offers several advantages over traditional lumber, including enhanced structural properties, increased resistance to warping and shrinking, and improved sustainability. These factors have driven the demand for engineered wood products in the region.

Asia Pacific Market

the Asia-Pacific region has indeed been experiencing rapid growth in the Engineered Wood industry. The region’s increasing urbanization, booming construction sector, and growing awareness of sustainable building materials have contributed to the expansion of the Engineered Wood Market in Asia-Pacific. Several factors have fueled the demand for engineered wood products in the region. Firstly, the rising population and urbanization have led to a surge in construction activities, particularly in countries like China, India, and Southeast Asian nations. Engineered wood, with its versatility and cost-effectiveness, has become a popular choice for residential, commercial, and infrastructure projects. Moreover, the growing focus on environmentally friendly and sustainable construction practices has further boosted the demand for engineered wood in the Asia-Pacific region. Engineered wood products are known for their resource efficiency, as they utilize smaller logs and timber pieces and can be produced from fast-growing plantation trees. This aligns with the region’s sustainability goals and drives the adoption of engineered wood solutions.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Boise Cascade Company, Georgia-Pacific, Norbord Inc, Masonite International Corporation, and EGGER Group are some of the leading players in the global Engineered Wood Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Louisiana-Pacific Corporation

- Weyerhaeuser Company

- Boise Cascade Company

- Georgia-Pacific

- Norbord Inc

- Masonite International Corporation

- EGGER Group

- Kronospan Holdings Limited

- Arauco

- Roseburg Forest Products

Key Development:

December 2022, Boise Cascade expanded its distribution centers in two new markets by acquiring a 45-acre property in Walterboro, SC, and purchasing a 34-acre land parcel in Hondo, Texas.

October 2022, Boise Cascade announced the expansion of its distribution center by acquiring 4.67 acres of adjacent land to its Albuquerque, New Mexico branch.

Scope of the Report

Global Engineered Wood Market, by Type

- I-Beams

- Plywood

- Laminated Veneer Lumber (LVL)

- Glulam (Glued Laminated Timber)

- Oriented Strand Boards (OSB)

- Cross-Laminated Timber (CLT)

- Others

Global Engineered Wood Market, by Application

- Construction

- Furniture

- Flooring

- Packaging

- Others

Global Engineered Wood Market, by End-User

- Residential

- Commercial & Industrial

Global Engineered Wood Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $ 490.20 Billion |

| CAGR | 5.98% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Gender, Product Type, Distribution Channel |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Louisiana-Pacific Corporation, Weyerhaeuser Company, Boise Cascade Company, Georgia-Pacific, Norbord Inc, Masonite International Corporation, EGGER Group, Kronospan Holdings Limited, Arauco, Roseburg Forest Products |

| Key Market Opportunities | Renovation and Remodeling Activities Sustainable Building Practices |

| Key Market Drivers | Growing Construction Industry Urbanization and Population Growth |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Engineered Wood Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Engineered Wood market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Engineered Wood market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Engineered Wood Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Engineered Wood market is 2022- 2033

What are the 10 Years CAGR (2023 to 2033) of the global Engineered Wood market?

The global Engineered Wood market is growing at a CAGR of ~98% over the next 10 years

Which region has the highest growth rate in the market of Engineered Wood?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region accounted for the largest share of the market of Engineered Wood?

North America holds the largest share in 2022

Major Key Players in the Market of Engineered Wood?

Louisiana-Pacific Corporation, Weyerhaeuser Company, Boise Cascade Company, Georgia-Pacific, Norbord Inc, Masonite International Corporation, EGGER Group, Kronospan Holdings Limited, Arauco, Roseburg Forest Products are the major companies operating in the Engineered Wood

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Type Segement – Market Opportunity Score 4.1.2. Application Segment – Market Opportunity Score 4.1.3. End-User Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Engineered Wood Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Engineered Wood Market, By I-Beams 7.1. Introduction 7.1.1. I-Beams 7.1.2. Plywood 7.1.3. Laminated Veneer Lumber (LVL) 7.1.4. Glulam (Glued Laminated Timber) 7.1.5. Oriented Strand Boards (OSB) 7.1.6. Cross-Laminated Timber (CLT) 7.1.7. Others CHAPTER 8. Global Engineered Wood Market, By Application 8.1. Introduction 8.1.1. Construction 8.1.2. Furniture 8.1.3. Flooring 8.1.4. Packaging 8.1.5. Others CHAPTER 9. Global Engineered Wood Market, By End-User 9.1. Introduction 9.1.1. Residential 9.1.2. Commercial & Industrial CHAPTER 10. Global Engineered Wood Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Louisiana-Pacific Corporation 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Weyerhaeuser Company 13.3. Boise Cascade Company 13.4. Georgia-Pacific 13.5. Norbord Inc 13.6. Masonite International Corporation 13.7. EGGER Group 13.8. Kronospan Holdings Limited 13.9. Arauco 13.10. Roseburg Forest Products

Connect to Analyst

Research Methodology