Energy Management System Market Analysis and Global Forecast 2021-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

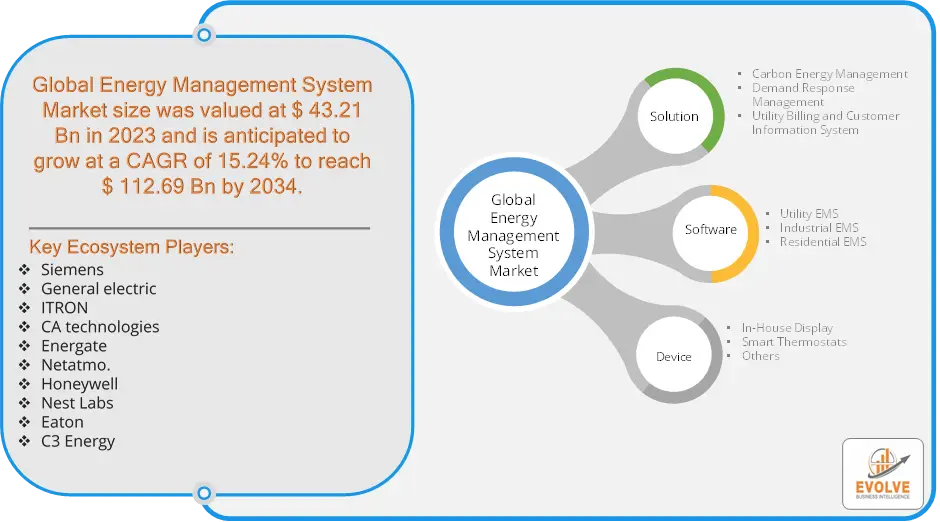

Energy Management System Market Research Report: By Solution (Carbon Energy Management, Demand Response Management, Utility Billing and Customer Information System), By Software (Utility EMS, Industrial EMS, Residential EMS, Others), By Device (In-House Display, Smart Thermostats, Others), and by Region — Forecast till 2034

Page: 173

Energy Management System Market Overview

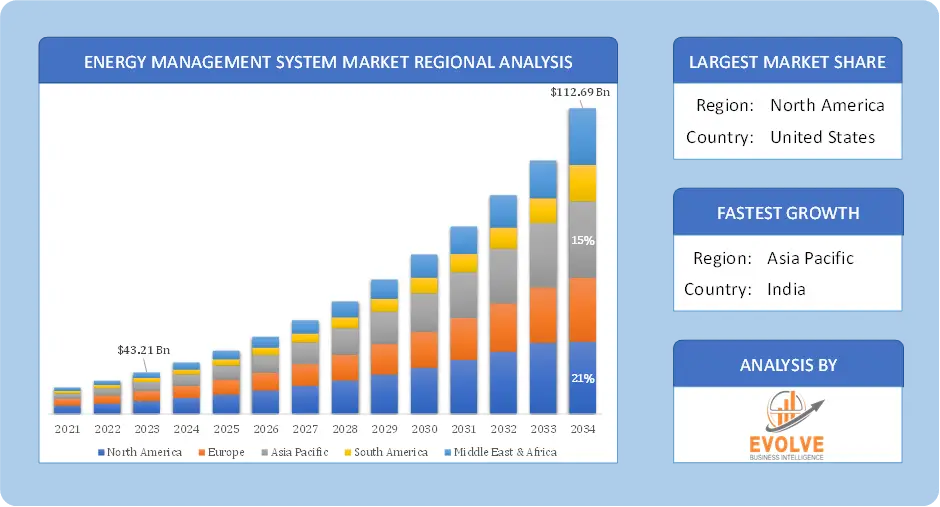

The Energy Management System Market size accounted for USD 3.41 Billion in 2023 and is estimated to account for 3.99 Billion in 2024. The Market is expected to reach USD 112.69 Billion by 2034 growing at a compound annual growth rate (CAGR) of 15.24% from 2024 to 2034. The market for solar inverters that uses Energy Management Systems to change solar panels’ direct current (DC) into alternating current (AC) for grid or local consumption is known as the Energy Management System market. Small to medium-sized solar setups that use several panels connected in series (or strings) to the inverter are the usual applications for Energy Management Systems. Due to their affordability, simplicity of installation, and dependability, these inverters are recommended for use in both residential and commercial solar systems. Growing installations of solar power, the need for renewable energy, and improvements in inverter technology are the main factors propelling the industry. Modern monitoring methods help to prevent issues such as shading sensitivity and lower efficiency in complex installations.

Global Energy Management System Market Synopsis

Global Energy Management System Market Dynamics

Global Energy Management System Market Dynamics

The major factors that have impacted the growth of Energy Management System are as follows:

Drivers:

⮚ Technological Advancements in IoT and AI

Energy management has been completely transformed by the combination of artificial intelligence (AI) and Internet of Things (IoT) devices. Real-time energy usage monitoring is made possible by IoT-enabled sensors, smart meters, and linked devices. AI-based analytics, on the other hand, automate control systems, improve decision-making, and offer predictive insights. With the use of these technologies, businesses can make more educated decisions about how much energy they use, which lowers expenses and emissions

Restraint:

- Cybersecurity and Data Privacy Concerns

Cyberattacks are more likely in EMS because of its heavy reliance on cloud-based platforms, IoT devices, and real-time data collection. Energy systems are vital pieces of infrastructure, and any weakness could cause serious problems. Hackers target smart grids and EMS systems because of their interconnectedness. Businesses may be reluctant to implement EMS technologies due to worries about data security, privacy violations, and unauthorized access to critical information. Although essential, cybersecurity precautions raise the system’s complexity and cost.

Opportunity:

⮚ Expansion of the Internet of Things (IoT) and Artificial Intelligence (AI)

Innovation in EMS is seeing a surge due to the quick development of IoT and AI technologies. Smart thermostats, sensors, and networked appliances are examples of Internet of Things (IoT) technologies that provide real-time energy monitoring and control. Artificial intelligence (AI) can be used to automate energy-saving tasks, improve load control, and forecast patterns in energy consumption. The development of highly effective, automated energy management systems that can save costs and increase energy efficiency is made possible by the marriage of IoT and AI.

Energy Management System Market Segment Overview

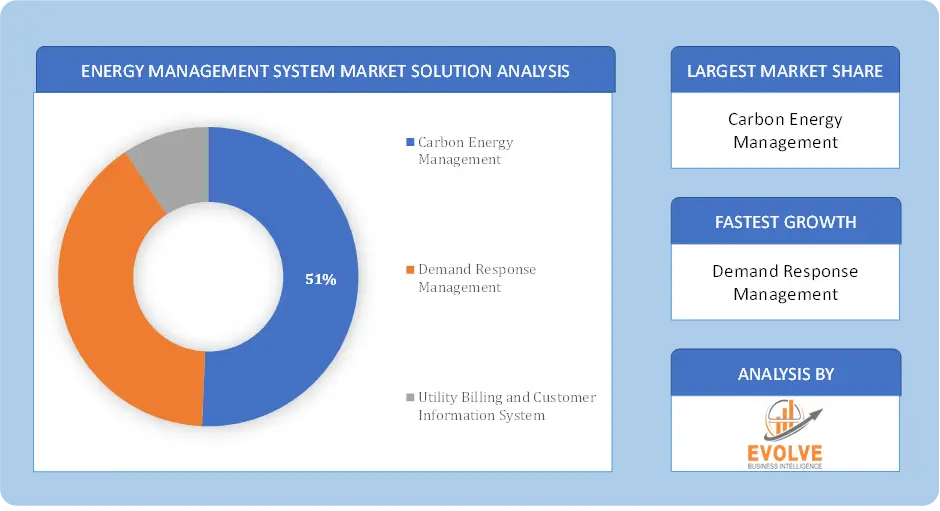

By Solution

Based on the Solution, the market is segmented based on Carbon Energy Management, Demand Response Management, Utility Billing and Customer Information System. Demand Response Management dominates the solution segment, as it plays a crucial role in balancing energy supply and demand, optimizing grid operations, and reducing peak load costs for utilities and consumers.

Based on the Solution, the market is segmented based on Carbon Energy Management, Demand Response Management, Utility Billing and Customer Information System. Demand Response Management dominates the solution segment, as it plays a crucial role in balancing energy supply and demand, optimizing grid operations, and reducing peak load costs for utilities and consumers.

By Software

Based on the Software, the market has been divided into Utility EMS, Industrial EMS, Residential EMS, Others. Industrial EMS dominates the software segment, driven by the high energy consumption in industrial sectors and the need for efficiency, cost reduction, and regulatory compliance.

By Device

Based on Device, the market has been divided into In-House Display, Smart Thermostats, Others. smart thermostats dominate the device segment due to their widespread adoption in residential and commercial settings for efficient energy control and cost savings through automated temperature regulation.

Global Energy Management System Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Energy Management System, followed by those in Asia-Pacific and Europe.

Energy Management System North America Market

Energy Management System North America Market

North America dominates the Energy Management System market due to several factors. Over the anticipated period, North America is anticipated to hold a sizable portion of the market for energy management systems It is projected that the region’s increasing focus on grid modernization, expanding use of smart meters, and implementation of home energy management systems to track and regulate electricity usage would all contribute to the need for energy management systems. Strategies adopted by regional governments to reduce energy use center on higher efficiency targets.

Energy Management System Asia Pacific Market

The Asia Pacific region has been witnessing remarkable growth in recent years. The Asia Pacific region is experiencing rapid growth in the Energy Management System (EMS) market, driven by increasing industrialization, urbanization, and the adoption of renewable energy sources. Countries like China, Japan, and India are leading the way with government initiatives supporting energy efficiency and smart grid infrastructure development. The region’s growing energy demand also fuels the adoption of EMS solutions.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Siemens, General electric, ITRON, CA technologies, and Energate are some of the leading players in the global Energy Management System Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Siemens

- General electric

- ITRON

- CA technologies

- Energate

- Honeywell

- Nest Labs

- Eaton

- C3 Energy

Key development:

January 2024: Honeywell declared that, it launched the Advance Control for Buildings, which is a building management system that can use the existing wiring of a building “to provide more efficiency control options to building managers hence improving occupants comfort while advancing energy management goals”.

Scope of the Report

Global Energy Management System Market, by Solution

- Carbon Energy Management

- Demand Response Management

- Utility Billing and Customer Information System

Global Energy Management System Market, by Software

- Utility EMS

- Industrial EMS

- Residential EMS

Global Energy Management System Market, by Device

- In-House Display

- Smart Thermostats

- Others

Global Energy Management System Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $112.69 Billion |

| CAGR | 15.24% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Solution, Software , Device |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Siemens, General electric, ITRON, CA technologies, Energate, Netatmo., Honeywell, Nest Labs, Eaton, C3 Energy. |

| Key Market Opportunities | • Favorable governmental initiatives and updated policies |

| Key Market Drivers | • The rising demand for services in various end-user industry |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Energy Management System market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Energy Management System market historical market size for the year 2022, and forecast from 2021 to 2034

- Energy Management System market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Energy Management System market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Energy Management System market is 2021- 2034

What are the 10 Years CAGR (2021 to 2034) of the global Energy Management System market?

The global Energy Management System market is growing at a CAGR of ~15.24% over the next 10 years

Which region has the highest growth rate in the market of Energy Management System?

Asia Pacific is expected to register the highest CAGR during 2021-2034

Which region accounted for the largest share of the market of Energy Management System?

North America holds the largest share in 2023

Major Key Players in the Market of Energy Management System?

Siemens, General electric, ITRON, CA technologies, Energate, Netatmo., Honeywell, Nest Labs, Eaton, C3 Energy

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Energy Management System Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Energy Management System Market, By Solution 6.1. Introduction 6.2. Carbon Energy Management 6.3. Demand Response Management 6.4. Utility Billing and Customer Information System Chapter 7. Global Energy Management System Market, By Component 7.1. Introduction 7.2. Utility EMS 7.3. Industrial EMS 7.4. Residential EMS 7.5. Others Chapter 8. Global Energy Management System Market, By Device 8.1. Introduction 8.2. In-House Display 8.3. Smart Thermostats 8.4. Others Chapter 9. Global Energy Management System Market, By Region 9.1. Introduction 9.2. North America 9.2.1. Introduction 9.2.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.3. Market Size and Forecast, By Country, 2020 - 2028 9.2.4. Market Size and Forecast, By Solution, 2020 - 2028 9.2.5. Market Size and Forecast, By Component, 2020 – 2028 9.2.6. Market Size and Forecast, By Device, 2020 – 2028 9.2.7. US 9.2.7.1. Introduction 9.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.7.3. Market Size and Forecast, By Solution, 2020 - 2028 9.2.7.4. Market Size and Forecast, By Component, 2020 – 2028 9.2.7.5. Market Size and Forecast, By Device, 2020 - 2028 9.2.8. Canada 9.2.8.1. Introduction 9.2.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.8.4. Market Size and Forecast, By Solution, 2020 - 2028 9.2.8.5. Market Size and Forecast, By Component, 2020 – 2028 9.2.8.6. Market Size and Forecast, By Device, 2020 - 2028 9.3. Europe 9.3.1. Introduction 9.3.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.3. Market Size and Forecast, By Country, 2020 - 2028 9.3.4. Market Size and Forecast, By Solution, 2020 - 2028 9.3.5. Market Size and Forecast, By Component, 2020 – 2028 9.3.6. Market Size and Forecast, By Device, 2020 – 2028 9.3.7. Germany 9.3.7.1. Introduction 9.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.7.3. Market Size and Forecast, By Solution, 2020 - 2028 9.3.7.4. Market Size and Forecast, By Component, 2020 – 2028 9.3.7.5. Market Size and Forecast, By Device, 2020 - 2028 9.3.8. France 9.3.8.1. Introduction 9.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.8.3. Market Size and Forecast, By Solution, 2020 - 2028 9.3.8.4. Market Size and Forecast, By Component, 2020 – 2028 9.3.8.5. Market Size and Forecast, By Device, 2020 - 2028 9.3.9. UK 9.3.9.1. Introduction 9.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.9.3. Market Size and Forecast, By Solution, 2020 - 2028 9.3.9.4. Market Size and Forecast, By Component, 2020 – 2028 9.3.9.5. Market Size and Forecast, By Device, 2020 - 2028 9.3.10. Italy 9.3.10.1. Introduction 9.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.10.3. Market Size and Forecast, By Solution, 2020 - 2028 9.3.10.4. Market Size and Forecast, By Component, 2020 – 2028 9.3.10.5. Market Size and Forecast, By Device, 2020 - 2028 9.3.11. Rest Of Europe 9.3.11.1. Introduction 9.3.11.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.11.3. Market Size and Forecast, By Solution, 2020 - 2028 9.3.11.4. Market Size and Forecast, By Component, 2020 – 2028 9.3.11.5. Market Size and Forecast, By Device, 2020 - 2028 9.4. Asia-Pacific 9.4.1. Introduction 9.4.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.3. Market Size and Forecast, By Country, 2020 - 2028 9.4.4. Market Size and Forecast, By Solution, 2020 - 2028 9.4.5. Market Size and Forecast, By Component, 2020 – 2028 9.4.7. Market Size and Forecast, By Device, 2020 - 2028 9.4.8. China 9.4.8.1. Introduction 9.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.8.3. Market Size and Forecast, By Solution, 2020 - 2028 9.4.8.4. Market Size and Forecast, By Component, 2020 – 2028 9.4.8.5. Market Size and Forecast, By Device, 2020 - 2028 9.4.9. India 9.4.9.1. Introduction 9.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.9.3. Market Size and Forecast, By Solution, 2020 - 2028 9.4.9.4. Market Size and Forecast, By Component, 2020 – 2028 9.4.9.5. Market Size and Forecast, By Device, 2020 - 2028 9.4.10. Japan 9.4.10.1. Introduction 9.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.10.3. Market Size and Forecast, By Solution, 2020 - 2028 9.4.10.4. Market Size and Forecast, By Component, 2020 – 2028 9.4.10.5. Market Size and Forecast, By Device, 2020 - 2028 9.4.11. South Korea 9.4.11.1. Introduction 9.4.11.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.11.3. Market Size and Forecast, By Solution, 2020 - 2028 9.4.11.4. Market Size and Forecast, By Component, 2020 – 2028 9.4.11.5. Market Size and Forecast, By Device, 2020 - 2028 9.4.12. Rest Of Asia-Pacific 9.4.11.1. Introduction 9.4.12.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.12.3. Market Size and Forecast, By Solution, 2020 - 2028 9.4.12.4. Market Size and Forecast, By Component, 2020 – 2028 9.4.12.5. Market Size and Forecast, By Device, 2020 - 2028 9.5. Rest Of The World (RoW) 9.5.1. Introduction 9.5.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.3. Market Size and Forecast, By Solution, 2020 - 2028 9.5.4. Market Size and Forecast, By Component, 2020 – 2028 9.5.5. Market Size and Forecast, By Device, 2020 - 2028 9.5.6. Market Size and Forecast, By Region, 2020 - 2028 9.5.7. South America 9.5.7.1. Introduction 9.5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.7.3. Market Size and Forecast, By Solution, 2020 - 2028 9.5.7.4. Market Size and Forecast, By Component, 2020 – 2028 9.5.7.5. Market Size and Forecast, By Device, 2020 - 2028 9.5.8. Middle East & Africa 9.5.8.1. Introduction 9.5.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.8.3. Market Size and Forecast, By Solution, 2020 - 2028 9.5.8.4. Market Size and Forecast, By Component, 2020 – 2028 9.5.8.5. Market Size and Forecast, By Device, 2020 - 2028 Chapter 10. Competitive Landscape 10.1. Introduction 10.2. Vendor Share Analysis, 2020/Key Players Positioning 2020 Chapter 11. Company Profiles 11.1. Siemens 11.1.1. Business Overview 11.1.2. Financial Analysis 11.1.3. Product Portfolio 11.1.4. Recent Development and Strategies Adopted 11.1.5. SWOT Analysis 11.2. General electric 11.2.1. Business Overview 11.2.2. Financial Analysis 11.2.3. Product Portfolio 11.2.4. Recent Development and Strategies Adopted 11.2.5. SWOT Analysis 11.3. Itron 11.3.1. Business Overview 11.3.2. Financial Analysis 11.3.3. Product Portfolio 11.3.4. Recent Development and Strategies Adopted 11.3.5. SWOT Analysis 11.4. CA technologies 11.4.1. Business Overview 11.4.2. Financial Analysis 11.4.3. Product Portfolio 11.4.4. Recent Development and Strategies Adopted 11.4.5. SWOT Analysis 11.5. Energate 11.5.1. Business Overview 11.5.2. Financial Analysis 11.5.3. Product Portfolio 11.5.4. Recent Development and Strategies Adopted 11.5.5. SWOT Analysis 11.6. Netatmo 11.6.1. Business Overview 11.6.2. Financial Analysis 11.6.3. Product Portfolio 11.6.4. Recent Development and Strategies Adopted 11.6.5. SWOT Analysis 11.7. Honeywell 11.7.1. Business Overview 11.7.2. Financial Analysis 11.7.3. Product Portfolio 11.7.4. Recent Development and Strategies Adopted 11.7.5. SWOT Analysis 11.8. Nest Labs 11.8.1. Business Overview 11.8.2. Financial Analysis 11.8.3. Product Portfolio 11.8.4. Recent Development and Strategies Adopted 11.8.5. SWOT Analysis 11.9. Eaton 11.9.1. Business Overview 11.9.2. Financial Analysis 11.9.3. Product Portfolio 11.9.4. Recent Development and Strategies Adopted 11.9.5. SWOT Analysis 11.10. C3 Energy 11.10.1. Business Overview 11.10.2. Financial Analysis 11.10.3. Product Portfolio 11.9.4. Recent Development and Strategies Adopted 11.9.5. SWOT Analysis Chapter 12. Key Takeaways

Connect to Analyst

Research Methodology