Electric Vehicle Motors Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

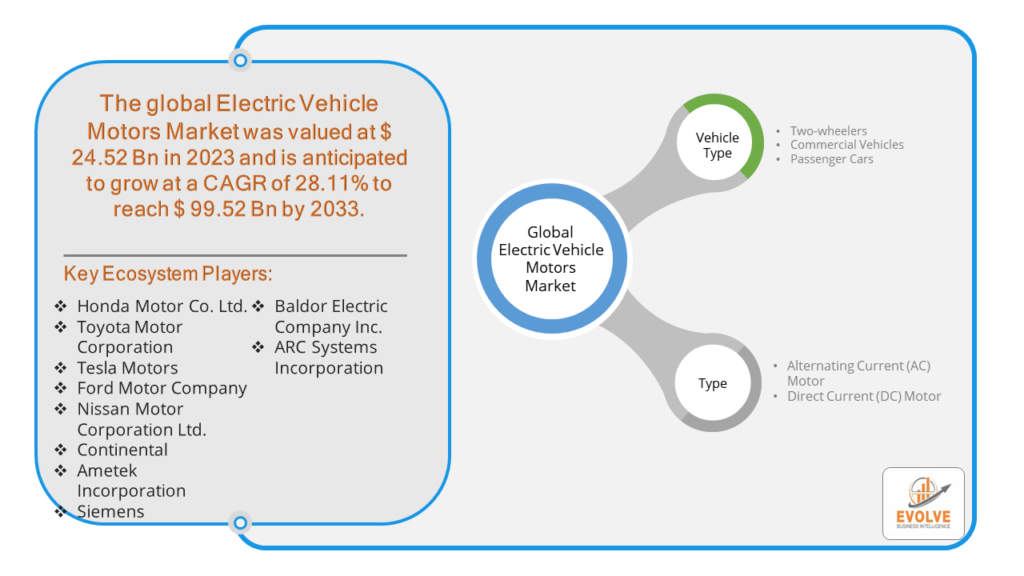

Electric Vehicle Motors Market Research Report: Information By Vehicle Type (Two-wheelers, Commercial Vehicles, Passenger Cars), By Type (Alternating Current (AC) Motor, Direct Current (DC) Motor), and by Region — Forecast till 2033

Page: 165

Electric Vehicle Motors Market Overview

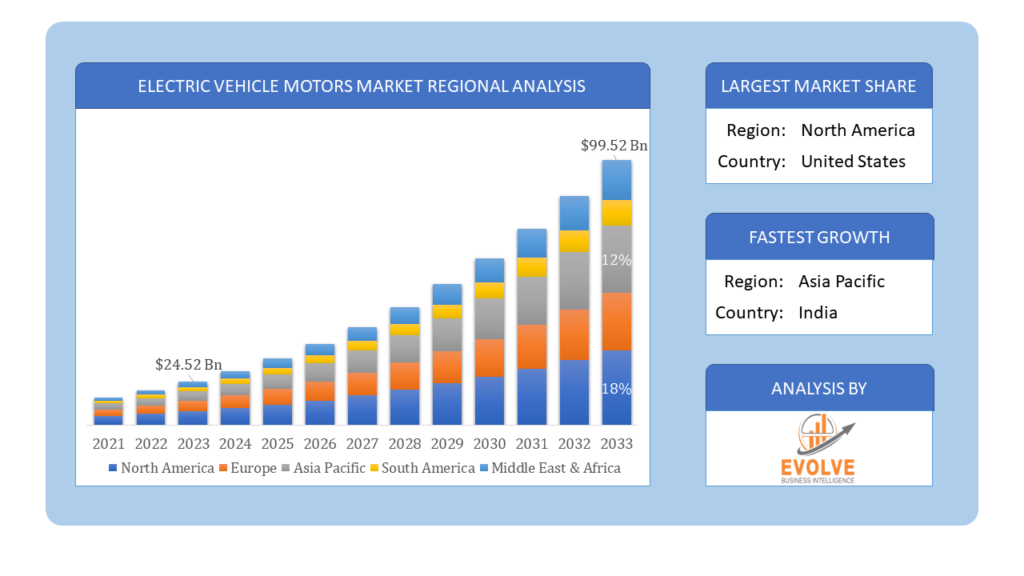

The Electric Vehicle Motors Market Size is expected to reach USD 99.52 Billion by 2033. The Electric Vehicle Motors Market industry size accounted for USD 24.52- Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 28.11% from 2023 to 2033. The electric vehicle motor market is the industry that deals with the development, production, and sale of electric motors specifically designed for electric vehicles (EVs). These motors convert electrical energy stored in the EV’s battery into mechanical energy that drives the wheels. The market is driven by factors like stricter emission regulations, rising fuel prices, and government incentives for EV adoption.

Overall, the Electric Vehicle Motors Market is a crucial segment of the broader electric vehicle industry, driving advancements in vehicle performance, efficiency, and sustainability.

Global Electric Vehicle Motors Market Synopsis

The COVID-19 pandemic had a significant impact on the Electric Vehicle (EV) Motors Market. Lockdowns and restrictions led to temporary closures of manufacturing facilities, causing delays in the production of EV motors and components. Restrictions on transportation and logistics affected the timely delivery of raw materials and finished products. Social distancing and health measures impacted the efficiency of manufacturing operations. Post-pandemic recovery plans in many countries included increased incentives for electric vehicle adoption as part of green recovery strategies. The pandemic highlighted the importance of sustainable practices, accelerating the shift towards electric vehicles and, consequently, the demand for EV motors. The need to adapt to new challenges led to innovations in supply chain management and manufacturing processes. The pandemic led to a greater emphasis on personal mobility and sustainability, boosting long-term interest in electric vehicles.

Electric Vehicle Motors Market Dynamics

The major factors that have impacted the growth of Electric Vehicle Motors Market are as follows:

Drivers:

Ø Technological Advancements

Ongoing innovations in motor design and materials have led to more efficient and powerful electric motors. Advances in battery technology, including higher energy densities and faster charging capabilities, enhance the performance and appeal of EVs, driving demand for efficient motors. Enhanced integration of electric motors with electronic control units (ECUs) and other vehicle systems improves overall vehicle performance and efficiency. The shift towards renewable energy sources, such as wind and solar, aligns with the use of electric vehicles, which can be powered by clean electricity, further driving the market. Companies are increasingly electrifying their vehicle fleets to meet sustainability goals and reduce operating costs. The rise of shared mobility services, such as electric ride-hailing and car-sharing, is contributing to the demand for EVs and their motors.

Restraint:

- Perception of High Initial Costs

The production of high-efficiency electric motors involves advanced materials and precision manufacturing, which can be costly. Despite decreasing costs, electric vehicles (and their motors) can still be more expensive upfront compared to traditional internal combustion engine (ICE) vehicles. Current battery technology limitations affect the range and performance of electric vehicles, influencing consumer preferences. Although battery prices are falling, they still represent a significant portion of the total cost of an electric vehicle.

Opportunity:

⮚ Battery Technology Evolution

Advancements in battery technology will extend the driving range of electric vehicles, making them more appealing to consumers. Economies of scale and technological innovations will continue to drive down the cost of battery packs, making EVs more affordable. Deployment of fast-charging stations will reduce charging times and improve the convenience of owning an electric vehicle. Increasing urbanization and congestion in cities will encourage the adoption of electric vehicles due to their lower emissions and quieter operation. Growth of electric ride-sharing and car-sharing services will increase the demand for electric vehicles and their motors. Electrification of commercial vehicle fleets will create a significant market opportunity for electric vehicle motors.

Electric Vehicle Motors Market Segment Overview

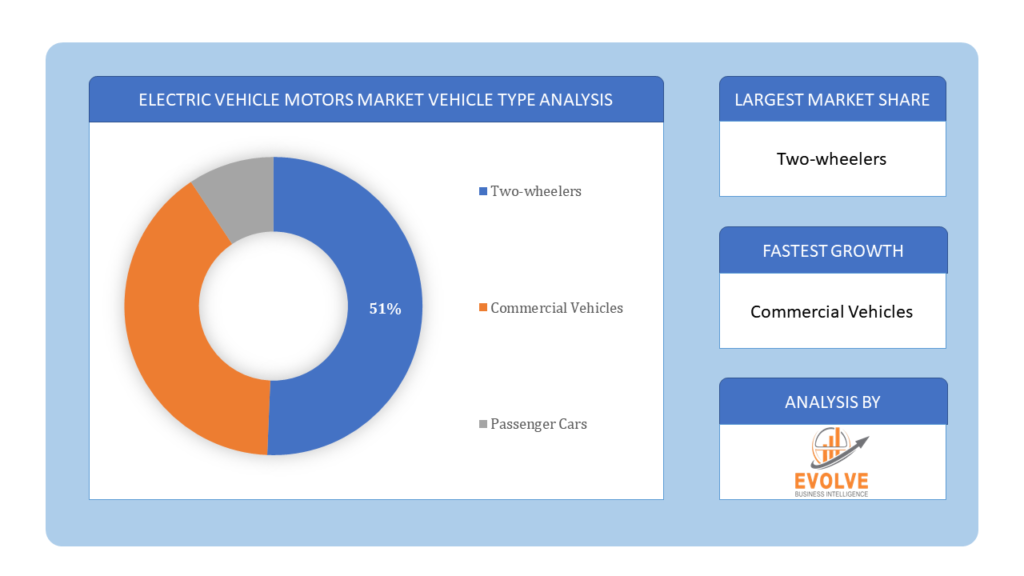

By Vehicle Type

Based on Vehicle Type, the market is segmented based on Two-wheelers, Commercial Vehicles and Passenger Cars. The Passenger Cars segment dominant the market. The Passenger Cars segment in the Electric Vehicle (EV) Motors Market is a crucial and rapidly growing area, driven by technological advancements, changing consumer preferences, and supportive government policies

Based on Vehicle Type, the market is segmented based on Two-wheelers, Commercial Vehicles and Passenger Cars. The Passenger Cars segment dominant the market. The Passenger Cars segment in the Electric Vehicle (EV) Motors Market is a crucial and rapidly growing area, driven by technological advancements, changing consumer preferences, and supportive government policies

By Type

Based on Type, the market segment has been divided into the Alternating Current (AC) Motor and Direct Current (DC) Motor. The Alternating Current (AC) Motor segment dominant the market. The Alternating Current (AC) Motor segment in the Electric Vehicle (EV) Motors Market is a critical area, driven by technological advancements, regulatory requirements, and the increasing adoption of electric vehicles. Alternating Current (AC) Motors are widely used in electric vehicles due to their efficiency, reliability, and performance.

Global Electric Vehicle Motors Market Regional Analysis

Based on region, the global Electric Vehicle Motors Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Electric Vehicle Motors Market followed by the Asia-Pacific and Europe regions.

Electric Vehicle Motors North America Market

Electric Vehicle Motors North America Market

North America holds a dominant position in the Electric Vehicle Motors Market. United States and Canada both countries offer federal and state/provincial incentives to promote electric vehicle adoption, driving demand for EV motors. Leading automakers and tech companies are investing heavily in electric vehicle technology, including motors and batteries. The region has a well-developed network of fast-charging stations, supporting EV adoption.

Electric Vehicle Motors Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Electric Vehicle Motors Market industry. China is the world’s largest market for electric vehicles, driving significant demand for EV motors. Generous subsidies and incentives have been instrumental in promoting electric vehicle adoption. Chinese companies are leading innovations in EV motors and battery technologies. Diverse market with rapid growth, led by China and supported by technological advancements

Competitive Landscape

The global Electric Vehicle Motors Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Honda Motor Co. Ltd.

- Toyota Motor Corporation

- Tesla Motors

- Ford Motor Company

- Nissan Motor Corporation Ltd.

- Continental

- Ametek Incorporation

- Siemens

- Baldor Electric Company Inc.

- ARC Systems Incorporation

Key Development

In November 2022– Hero Electric announced a partnership with Nidec electric motor manufacturers from Japan to use their E-motors in bikes, and E-scooters of the Hero brand from February 2023. this partnership is intended to resolve supply chain issues and allow the production of mobility solutions progressively.

In August 2022– ABB announced the acquisition of the low-voltage NEMA motor business of Siemens. The company has expanded manufacturing plants in Mexico to support future growth. This is expected to be margin accretive to ABB within two years

Scope of the Report

Global Electric Vehicle Motors Market, by Vehicle Type

- Two-wheelers

- Commercial Vehicles

- Passenger Cars

Global Electric Vehicle Motors Market, by Type

- Alternating Current (AC) Motor

- Direct Current (DC) Motor

Global Electric Vehicle Motors Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $99.52 Billion |

| CAGR | 28.11% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Vehicle Type, Type |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Honda Motor Co. Ltd., Toyota Motor Corporation, Tesla Motors, Ford Motor Company, Nissan Motor Corporation Ltd., Continental, Ametek Incorporation, Siemens, Baldor Electric Company Inc. and ARC Systems Incorporation |

| Key Market Opportunities | • Battery Technology Evolution |

| Key Market Drivers | • Technological Advancements • Corporate Fleets and Shared Mobility |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Electric Vehicle Motors Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Electric Vehicle Motors Market historical market size for the year 2021, and forecast from 2023 to 2033

- Electric Vehicle Motors Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Electric Vehicle Motors Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Electric Vehicle Motors Market?

The study period for the Electric Vehicle Motors Market spans from 2023 to 2033.

What is the growth rate of the Electric Vehicle Motors Market?

The Electric Vehicle Motors Market is expected to grow at a compound annual growth rate (CAGR) of 28.11% from 2023 to 2033.

Which region has the highest growth rate in the Electric Vehicle Motors Market?

The Asia-Pacific region has the highest growth rate in the Electric Vehicle Motors Market, driven by strong demand and technological advancements.

Which region has the largest share of the Electric Vehicle Motors Market?

North America holds the largest share of the Electric Vehicle Motors Market, supported by significant investments and high consumer adoption.

Who are the key players in the Electric Vehicle Motors Market?

Key players in the Electric Vehicle Motors Market include Honda Motor Co. Ltd., Toyota Motor Corporation, Tesla Motors, Ford Motor Company, Nissan Motor Corporation Ltd., Continental, Ametek Incorporation, Siemens, Baldor Electric Company Inc., and ARC Systems Incorporation.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Electric Vehicle Motors Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Electric Vehicle Motors Market 4.8. Import Analysis of the Electric Vehicle Motors Market 4.9. Export Analysis of the Electric Vehicle Motors Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Electric Vehicle Motors Market, By Vehicle Type 6.1. Introduction 6.2. Two-wheelers 6.3. Commercial Vehicles 6.4. Passenger Cars Chapter 7. Global Electric Vehicle Motors Market, By Type 7.1. Introduction 7.2. Alternating Current (AC) Motor 7.3. Direct Current (DC) Motor Chapter 8. Global Electric Vehicle Motors Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.5. Market Size and Forecast, By End User, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By End User, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By End User, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By End User, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By End User, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By End User, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By End User, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By End User, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By End User, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By End User, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By End User, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By End User, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By End User, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By End User, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By End User, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By End User, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Honda Motor Co. Ltd. 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Toyota Motor Corporation 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Tesla Motors 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Ford Motor Company 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Nissan Motor Corporation Ltd. 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Continental 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Ametek Incorporation 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Siemens 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Baldor Electric Company Inc. 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. ARC Systems Incorporation 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology