Distributed Energy Resource Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

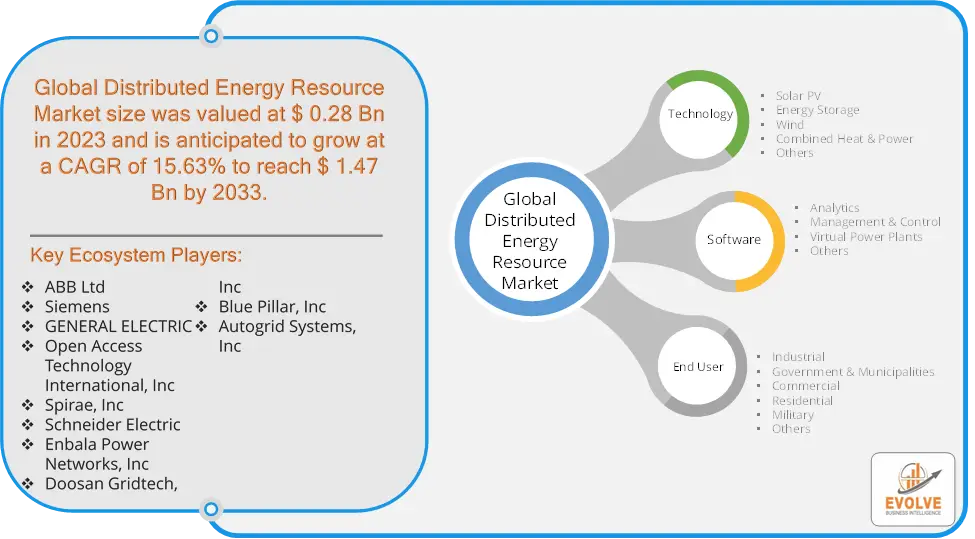

Distributed Energy Resource Market Research Report: By Technology (Solar PV, Energy Storage, Wind, Combined Heat & Power, Others), By Software (Analytics, Management & Control, Virtual Power Plants, Others), By End-User (Industrial, Government & Municipalities, Commercial, Residential, Military, Others), and by Region — Forecast till 2033

Page: 169

Distributed Energy Resource Market Overview

The Distributed Energy Resource Market Size is expected to reach USD 1.47 Billion by 2033. The Distributed Energy Resource industry size accounted for USD 0.28 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 15.63% from 2023 to 2033. The Distributed Energy Resource (DER) market refers to a decentralized approach to energy generation, storage, and consumption. It encompasses a diverse range of technologies such as solar PV, wind turbines, battery storage systems, and demand response mechanisms. DERs are typically located close to where energy is used, reducing transmission losses and enhancing grid resilience. They empower consumers to generate their own electricity, participate in energy markets, and optimize energy usage. Key drivers include advancements in technology, policy support for renewable energy integration, and the need for more reliable and sustainable energy solutions in both developed and developing economies.

Global Distributed Energy Resource Market Synopsis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the Distributed Energy Resource market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers adopting various strategies to stabilize the company.

Global Distributed Energy Resource Market Dynamics

The major factors that have impacted the growth of Distributed Energy Resource are as follows:

Drivers:

⮚ Technological Advancements

Innovations in renewable energy technologies, such as solar photovoltaics (PV), wind turbines, and energy storage systems (ESS), have significantly lowered costs and improved efficiency. These advancements make DERs more economically viable and attractive to consumers and businesses alike.

Restraint:

- Limited Scalability

DERs often operate at smaller scales compared to traditional centralized power plants. This decentralized nature can pose challenges for scaling up to meet large-scale energy demands or for providing grid services such as frequency regulation and voltage support.

Opportunity:

⮚ Technological Innovation

Ongoing advancements in DER technologies, such as improvements in solar PV efficiency, energy storage systems (ESS) capabilities, and smart grid technologies, enhance DER performance and cost-effectiveness. Innovations in digitalization, blockchain, and artificial intelligence further optimize DER operations and grid integration.

Distributed Energy Resource Market Segment Overview

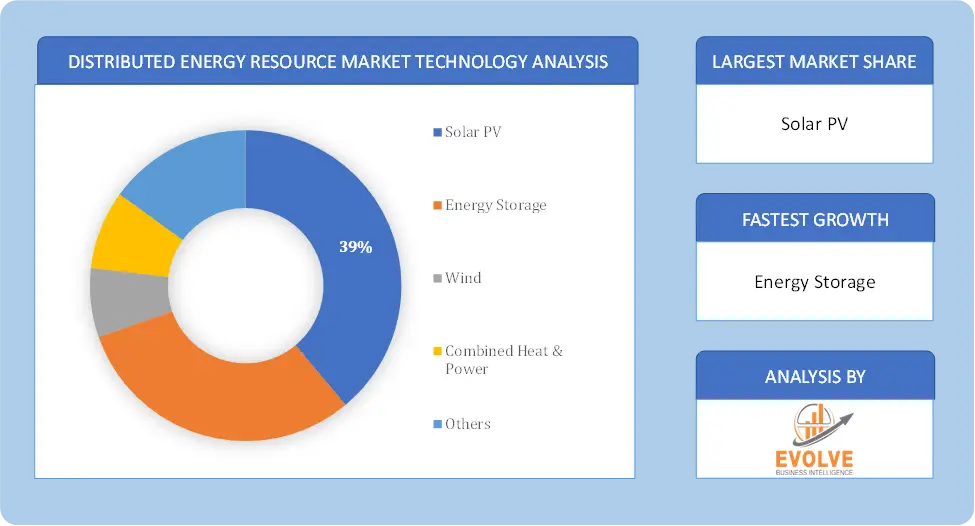

By Technology

Based on the Technology, the market is segmented based on Solar PV, Energy Storage, Wind, Combined Heat & Power, Others. Energy Storage” solutions typically dominate. Energy storage systems, including batteries and other storage technologies, play a crucial role in enhancing grid stability, integrating intermittent renewable energy sources like solar and wind, and providing flexibility for demand-side management and grid services.

Based on the Technology, the market is segmented based on Solar PV, Energy Storage, Wind, Combined Heat & Power, Others. Energy Storage” solutions typically dominate. Energy storage systems, including batteries and other storage technologies, play a crucial role in enhancing grid stability, integrating intermittent renewable energy sources like solar and wind, and providing flexibility for demand-side management and grid services.

By Software

Based on the Software, the market has been divided into Analytics, Management & Control, Virtual Power Plants, Others. Management & Control” software solutions typically dominate. These platforms enable centralized monitoring, optimization, and coordination of diverse DER assets, ensuring efficient operation, grid integration, and participation in energy markets like virtual power plants (VPPs).

By End-User

Based on End-User, the market has been divided into Industrial, Government & Municipalities, Commercial, Residential, Military, Others. the commercial sector typically dominates. Commercial entities, including businesses, office buildings, retail centers, and hotels, often lead in adopting DER technologies due to cost-saving opportunities, sustainability goals, and the ability to hedge against electricity price volatility.

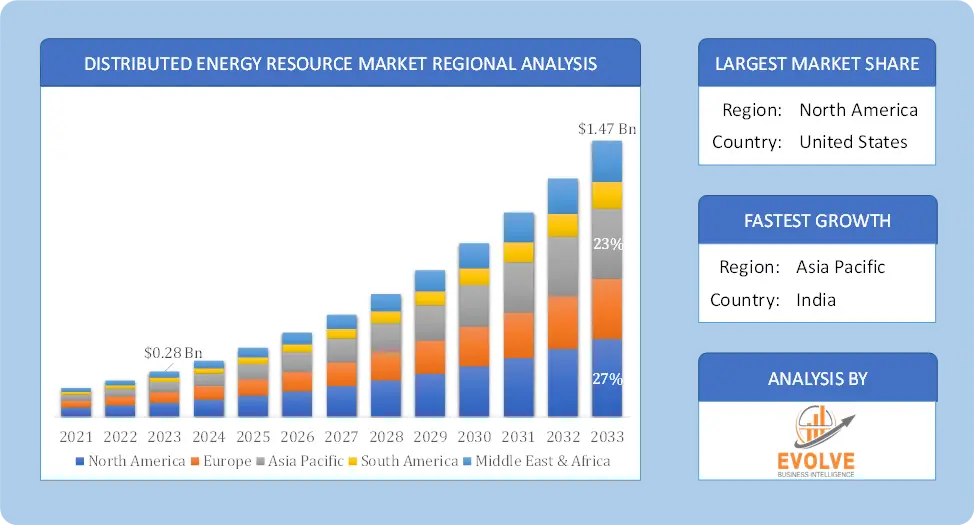

Global Distributed Energy Resource Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of Asia-Pacific is anticipated to dominate the market for the usage of Distributed Energy Resource, followed by those in North America and Europe.

Distributed Energy Resource Asia-Pacific Market

Distributed Energy Resource Asia-Pacific Market

Asia-Pacific dominates the Distributed Energy Resource market due to several factors. With a market share of USD 0.12 billion in 2020, the Asia Pacific region is the largest market for distributed energy resource management systems. The market is driven by the rise in solar and wind power generation as well as the rising need for energy as a result of industrialization throughout Asia Pacific.

Distributed Energy Resource North America Market

The North America region has been witnessing remarkable growth in recent years. The distributed energy resource management market in the United States is one of the largest in North America. By 2050, the US has committed to have net zero emissions. To accomplish this sustainable goal, the federal government invests in renewable energy projects at a quick pace.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as ABB Ltd, Siemens, GENERAL ELECTRIC, Open Access Technology International, Inc, and Spirae, Inc are some of the leading players in the global Distributed Energy Resource Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- ABB Ltd

- Siemens

- GENERAL ELECTRIC

- Open Access Technology International, Inc

- Spirae, Inc

- Schneider Electric

- Enbala Power Networks, Inc

- Doosan Gridtech, Inc

- Blue Pillar, Inc

- Autogrid Systems, Inc

Key development:

In September 2022, Siemens announced advancements in its distributed energy solutions, focusing on integrating digital technologies for enhanced grid management and efficiency, aiming to bolster their position in the evolving DER market.

Scope of the Report

Global Distributed Energy Resource Market, by Technology

- Solar PV

- Energy Storage

- Wind

- Combined Heat & Power

- Others

Global Distributed Energy Resource Market, by Software

- Analytics

- Management & Control

- Virtual Power Plants

- Others

Global Distributed Energy Resource Market, by End-User

- Industrial

- Government & Municipalities

- Commercial

- Residential

- Military

- Others

Global Distributed Energy Resource Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $1.47 Billion |

| CAGR | 15.63% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Technology, Software, End-User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | ABB Ltd, Siemens, GENERAL ELECTRIC, Open Access Technology International, Inc, Spirae, Inc, Schneider Electric, Enbala Power Networks, Inc, Doosan Gridtech, Inc, Blue Pillar, Inc, Autogrid Systems, Inc. |

| Key Market Opportunities | • Increase share of renewable power generation |

| Key Market Drivers | • Shift from centralized to distributed power generation |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Distributed Energy Resource Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Distributed Energy Resource market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Distributed Energy Resource market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Distributed Energy Resource Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Distributed Energy Resource market is 2022- 2033

What are the 10 Years CAGR (2023 to 2033) of the global Distributed Energy Resource market?

The global Distributed Energy Resource market is growing at a CAGR of ~15.63% over the next 10 years

Which region has the highest growth rate in the market of Distributed Energy Resource?

North America is expected to register the highest CAGR during 2023-2033

Which region accounted for the largest share of the market of Distributed Energy Resource?

Asia Pacific holds the largest share in 2022

Major Key Players in the Market of Stem Cell Manufacturers?

ABB Ltd, Siemens, GENERAL ELECTRIC, Open Access Technology International, Inc, Spirae, Inc, Schneider Electric, Enbala Power Networks, Inc, Doosan Gridtech, Inc, Blue Pillar, Inc, Autogrid Systems, Inc

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Technology Segement – Market Opportunity Score 4.1.2. Software Segment – Market Opportunity Score 4.1.3. End-User Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Distributed Energy Resource Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Distributed Energy Resource Market, By Technology 7.1. Introduction 7.1.1. Solar PV 7.1.2. Energy Storage 7.1.3. Wind 7.1.4. Combined Heat & Power 7.1.5. Others CHAPTER 8. Global Distributed Energy Resource Market, By Software 8.1. Introduction 8.1.1. Analytics 8.1.2. Management & Control 8.1.3. Virtual Power Plants 8.1.4. Others CHAPTER 9. Global Distributed Energy Resource Market, By End-User 9.1. Introduction 9.1.1. Industrial 9.1.2. Government & Municipalities 9.1.3. Commercial 9.1.4. Residential 9.1.5. Military 9.1.6. Others CHAPTER 10. Global Distributed Energy Resource Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Software, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By End-User, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. ABB Ltd 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Siemens 13.3. GENERAL ELECTRIC 13.4. Open Access Technology International, Inc 13.5. Spirae, Inc 13.6. Schneider Electric 13.7. Enbala Power Networks, Inc 13.8. Doosan Gridtech, Inc 13.9. Blue Pillar, Inc 13.10. Genie AI Ltd

Connect to Analyst

Research Methodology