Continuous Delivery Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

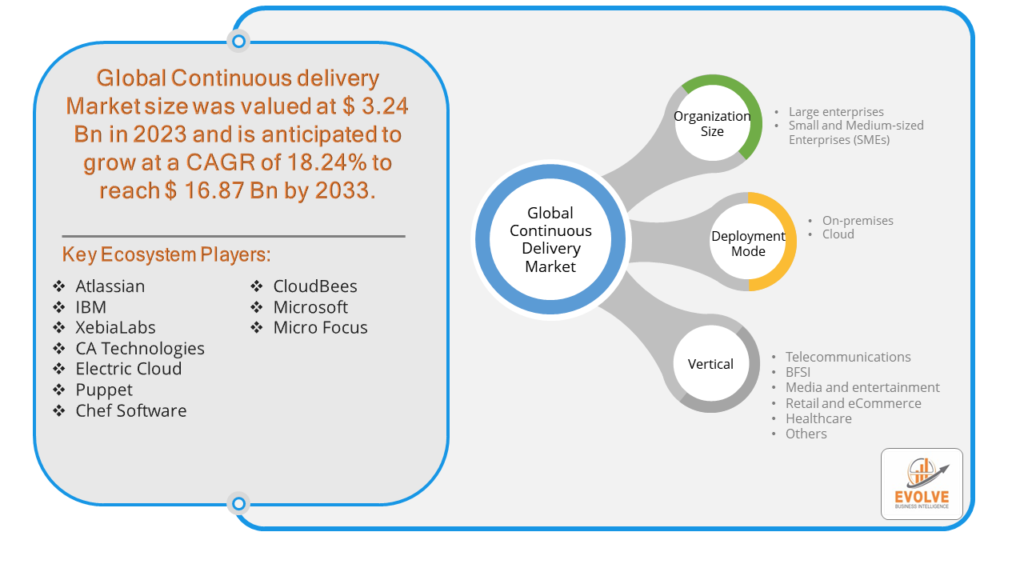

Continuous Delivery Market Research Report: By Organization Size (Large enterprises, Small and Medium-sized Enterprises (SMEs), By Deployment Mode (On-premises, Cloud), By Vertical (Telecommunications, BFSI, Media and entertainment, Retail and eCommerce, Healthcare, Others), and by Region — Forecast till 2033

Page: 115

Continuous Delivery Market Overview

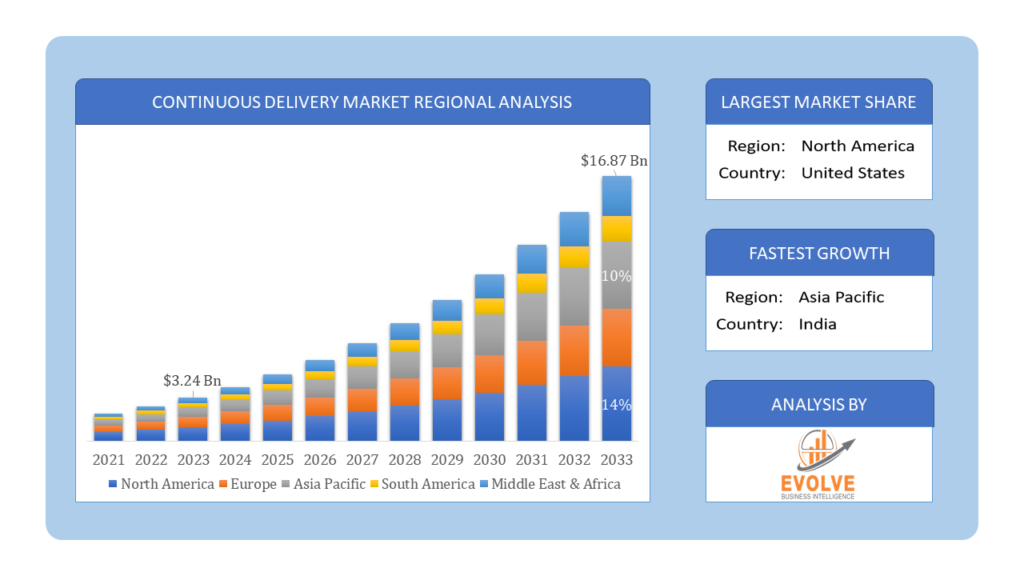

The Continuous Delivery Market Size is expected to reach USD 16.87 Billion by 2033. The Continuous Delivery industry size accounted for USD 3.24 Billion in 2023 and is expected to expand at a CAGR of 18.24% from 2023 to 2033. Continuous Delivery (CD) is a software engineering approach where code changes are automatically built, tested, and prepared for release to production in a streamlined and automated manner. It aims to enable frequent and reliable software releases by automating the software delivery process from code integration to deployment. Continuous Delivery emphasizes the use of automation, rigorous testing, and collaboration between development, testing, and operations teams to ensure that software changes can be deployed to production environments swiftly and with minimal manual intervention. This approach enables organizations to deliver new features, updates, and bug fixes to end-users efficiently and with high quality.

Global Continuous Delivery Market Synopsis

The Continuous Delivery market underwent a moderate impact amid the COVID-19 pandemic as organizations adapted to remote work arrangements and sought to maintain software development productivity and efficiency. While the transition to remote work initially posed challenges in terms of collaboration and communication, it also underscored the importance of automation and DevOps practices, driving increased adoption of Continuous Delivery solutions. The pandemic prompted a renewed focus on digital transformation initiatives, accelerating the adoption of agile development methodologies and cloud-based Continuous Delivery tools. However, supply chain disruptions and economic uncertainties led to cautious spending on IT investments, particularly among smaller organizations, which somewhat tempered market growth. Overall, the resilience of the software industry and the imperative for businesses to maintain operational continuity fueled continued demand for Continuous Delivery solutions amidst the pandemic’s evolving landscape.

Global Continuous Delivery Market Dynamics

The major factors that have impacted the growth of Continuous Delivery are as follows:

Drivers:

⮚ Increased demand for faster software delivery

The need for organizations to release software updates and features more rapidly to stay competitive in the market is a significant driver for Continuous Delivery adoption. This demand is fueled by customer expectations for frequent updates and improvements, as well as the need to respond quickly to market changes and emerging trends.

Restraint:

- Organizational resistance to change

Resistance to change within organizations can pose a significant restraint to the adoption of Continuous Delivery practices. Cultural barriers, fear of job loss, and reluctance to embrace new technologies and methodologies can hinder the implementation of Continuous Delivery pipelines. Overcoming these barriers requires strong leadership support, effective communication, and a gradual approach to change management.

Opportunity:

⮚ Increasing focus on DevOps and automation

The growing emphasis on DevOps practices and automation presents a significant opportunity for the Continuous Delivery market. Organizations are increasingly recognizing the benefits of integrating development and operations teams, as well as automating manual processes throughout the software delivery pipeline. This trend creates opportunities for Continuous Delivery vendors to provide tools and solutions that streamline and optimize software development and delivery processes.

Continuous Delivery Market Segment Overview

By Organization Size

Based on the Organization Size, the market is segmented based on Large enterprises, Small and Medium-sized Enterprises (SMEs). The Large enterprises segment was anticipated to lead the Continuous Delivery market due to its substantial resources, advanced technological capabilities, and greater propensity for implementing comprehensive Continuous Delivery pipelines. These enterprises prioritize efficiency, agility, and innovation, driving the adoption of Continuous Delivery practices to accelerate software delivery cycles and maintain a competitive edge in rapidly evolving markets.

Based on the Organization Size, the market is segmented based on Large enterprises, Small and Medium-sized Enterprises (SMEs). The Large enterprises segment was anticipated to lead the Continuous Delivery market due to its substantial resources, advanced technological capabilities, and greater propensity for implementing comprehensive Continuous Delivery pipelines. These enterprises prioritize efficiency, agility, and innovation, driving the adoption of Continuous Delivery practices to accelerate software delivery cycles and maintain a competitive edge in rapidly evolving markets.

By Deployment Mode

Based on the Deployment Mode, the market has been divided into On-premises and Cloud. The On-premises segment is expected to dominate the Continuous Delivery market, primarily driven by the stringent data security and compliance requirements of enterprises, particularly in regulated industries such as finance and healthcare. Additionally, some organizations opt for on-premise solutions to retain greater control over their infrastructure and sensitive data, leveraging Continuous Delivery tools to enhance software delivery efficiency while maintaining data sovereignty and privacy.

By Vertical

Based on Vertical, the market has been divided into Telecommunications, BFSI, Media and Entertainment, Retail and eCommerce, Healthcare, and Others. The Telecommunications segment is positioned to capture the largest market share in the Continuous Delivery market due to its increasing reliance on software-driven infrastructure and services, necessitating rapid and continuous software updates to maintain network performance and meet evolving customer demands. Additionally, Continuous Delivery enables telecommunications companies to streamline deployment processes, enhance agility, and accelerate time-to-market for new products and services, driving its adoption as a strategic imperative within the industry.

Global Continuous Delivery Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Continuous Delivery, followed by those in Asia-Pacific and Europe.

Continuous Delivery North America Market

Continuous Delivery North America Market

North America asserts dominance in the Continuous Delivery market due to its advanced technological infrastructure, strong adoption of DevOps practices, and a mature software development ecosystem. The region is home to numerous tech giants and innovative startups driving Continuous Delivery advancements, while also benefiting from a supportive regulatory environment and significant investment in research and development. Additionally, a robust network of enterprises across various industries underscores North America’s leadership in shaping the evolution of Continuous Delivery methodologies and solutions.

Continuous Delivery Asia Pacific Market

The Asia-Pacific region has witnessed remarkable growth in the Continuous Delivery market, fueled by increasing digital transformation initiatives, rapid technological advancements, and a burgeoning startup ecosystem. Organizations in the region are embracing Continuous Delivery practices to accelerate software delivery, enhance agility, and stay competitive in the global market landscape. Additionally, the growing adoption of cloud computing and DevOps methodologies further propels the expansion of Continuous Delivery solutions across diverse industries in the Asia-Pacific region.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Atlassian, IBM, XebiaLabs, CA Technologies, Electric Cloud are some of the leading players in the global Continuous Delivery Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Atlassian

- IBM

- XebiaLabs

- CA Technologies

- Electric Cloud

- Puppet

- Chef Software

- CloudBees

- Microsoft

- Micro Focus

Key Development:

In October 2022, Intel Corp. and Alphabet Inc.’s Google Cloud introduced a jointly developed chip aimed at enhancing security and efficiency in data centers. Google maintains its trajectory of crafting tailored chips for optimizing data center functionalities. Analysts observe that this trend toward customized chip design is fostering the accelerated adoption of bare-metal computing.

Scope of the Report

Global Continuous Delivery Market, by Organization Size

- Large enterprises

- Small and Medium-sized Enterprises (SMEs)

Global Continuous Delivery Market, by Deployment Mode

- On-premises

- Cloud

Global Continuous Delivery Market, by Vertical

- Telecommunications

- BFSI

- Media and entertainment

- Retail and eCommerce

- Healthcare

- Others

Global Continuous Delivery Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $16.87 Billion |

| CAGR | 18.24% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Organization Size, Deployment Mode, Vertical |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Atlassian, IBM, XebiaLabs, CA Technologies, Electric Cloud, Puppet, Chef Software, CloudBees, Microsoft, Micro Focus |

| Key Market Opportunities | • Growing demand for cloud-based Continuous Delivery tools and solutions • Emphasis on automation and efficiency in software development processes |

| Key Market Drivers | • Accelerated digital transformation initiatives due to the COVID-19 pandemic • Increased adoption of agile development methodologies and DevOps practices |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Continuous Delivery Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Continuous Delivery market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Continuous Delivery market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Continuous Delivery Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Continuous Delivery market?

The study period encompasses historical data from 2021 and forecasts for the years 2023 to 2033.

What is the growth rate of the Continuous Delivery market?

The Continuous Delivery market is anticipated to expand at a robust compound annual growth rate (CAGR) of 18.24% from 2023 to 2033.

Which region has the highest growth rate in the Continuous Delivery market?

The Asia-Pacific region is poised to experience the highest growth rate in the Continuous Delivery market, driven by increasing digital transformation initiatives and rapid technological advancements.

Which region has the largest share of the Continuous Delivery market?

North America currently holds the largest share of the Continuous Delivery market, attributed to its advanced technological infrastructure and strong adoption of DevOps practices.

Who are the key players in the Continuous Delivery market?

Key players in the Continuous Delivery market include Atlassian, IBM, XebiaLabs, CA Technologies, Electric Cloud, Puppet, Chef Software, CloudBees, Microsoft, and Micro Focus, among others.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Organization Size Segement – Market Opportunity Score 4.1.2. Deployment Mode Segment – Market Opportunity Score 4.1.3. Vertical Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Continuous Delivery Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Continuous Delivery Market, By Organization Size 7.1. Introduction 7.1.1. Large enterprises 7.1.2. Small and Medium-sized Enterprises (SMEs) CHAPTER 8. Global Continuous Delivery Market, By Deployment Mode 8.1. Introduction 8.1.1. On-premises 8.1.2. Cloud CHAPTER 9. Global Continuous Delivery Market, By Vertical 9.1. Introduction 9.1.1. Telecommunications 9.1.2. BFSI 9.1.3. Media and entertainment 9.1.4. Retail and eCommerce 9.1.5. Healthcare 9.1.6. Others CHAPTER 10. Global Continuous Delivery Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Atlassian 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. IBM 13.3. XebiaLabs 13.4. CA Technologies 13.5. Electric Cloud 13.6. Puppet 13.7. Chef Software 13.8. Micro Focus 13.9. CloudBees 13.10. Microsoft

Connect to Analyst

Research Methodology