Container orchestration market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

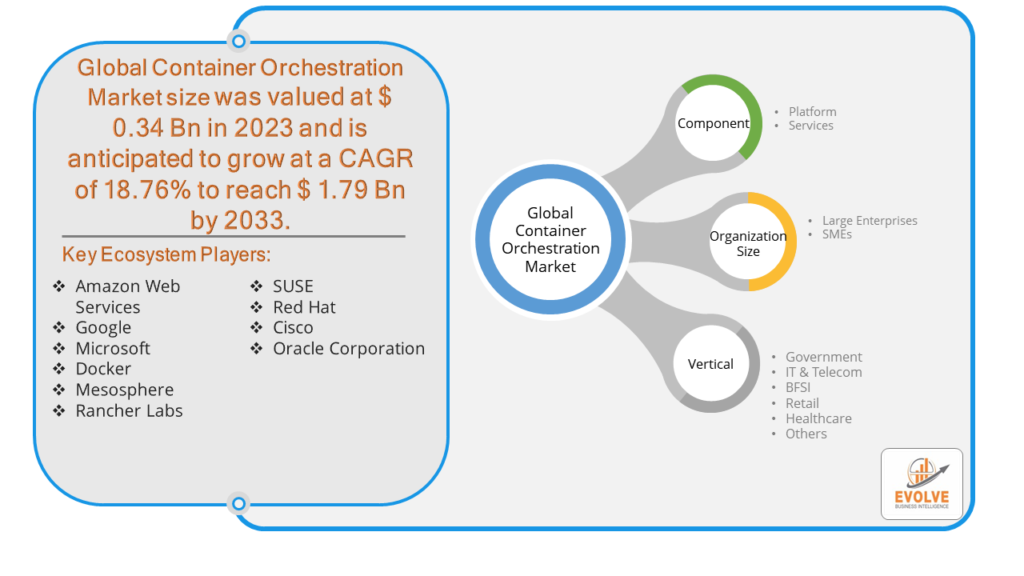

Container orchestration market Research Report: Information By Organization Size (Large Enterprises, SMEs), By Vertical (Government, IT & Telecom, BFSI, Retail, Healthcare, Others), By Component (Platform, Services), and by Region — Forecast till 2033

Page: 112

Container orchestration market Overview

The Container orchestration market Size is expected to reach USD 1.79 Billion by 2033. The Container orchestration market industry size accounted for USD 0.34 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 18.76% from 2023 to 2033. The container orchestration market refers to the industry segment focused on providing tools, platforms, and services for managing, deploying, and scaling containerized Applications. Container orchestration is essential for efficiently managing large-scale deployments of containers across distributed infrastructure. It involves automating tasks such as provisioning, scheduling, scaling, and monitoring containerized Applications to ensure they run reliably and efficiently.

The container orchestration market has experienced rapid growth due to the increasing adoption of container technology for building, deploying, and managing Applications in cloud-native environments. As organizations continue to embrace microservices architectures and DevOps practices, the demand for container orchestration solutions is expected to remain strong. Additionally, advancements in container orchestration technologies, such as support for hybrid and multi-cloud environments, are further driving market growth.

Global Container orchestration market Synopsis

The COVID-19 pandemic had significant impacts on the container orchestration market. With the sudden shift to remote work and the acceleration of digital transformation initiatives, many organizations intensified their adoption of cloud-native technologies, including container orchestration. The need for scalable, flexible, and resilient infrastructure became even more critical during the pandemic, driving increased demand for container orchestration solutions. The pandemic underscored the importance of agility and scalability in IT infrastructure. Containers offer a lightweight and efficient way to package and deploy Applications, making them well-suited for rapidly changing business requirements. Consequently, the adoption of containers and container orchestration platforms like Kubernetes saw a significant uptick during the pandemic as organizations sought to modernize their Applications and infrastructure. The widespread shift to remote work prompted organizations to reassess their IT infrastructure to support distributed teams and remote collaboration. Container orchestration platforms played a crucial role in enabling organizations to deploy and manage Applications across hybrid and multi-cloud environments, facilitating remote access and collaboration.

Container orchestration market Dynamics

The major factors that have impacted the growth of Container orchestration market are as follows:

Drivers:

Ø Increased Adoption of Containers

The adoption of containers has been on the rise due to their lightweight, portable, and consistent runtime environment. Container orchestration platforms like Kubernetes, Docker Swarm, and others facilitate the deployment, management, and scaling of containerized Applications, driving further adoption of containers and container orchestration. Container orchestration platforms automate various tasks associated with deploying and managing containerized Applications, such as provisioning, scheduling, scaling, and monitoring. This automation improves operational efficiency, reduces manual intervention, and enables organizations to deploy Applications faster and with fewer errors. Container orchestration platforms like Kubernetes benefit from large and active ecosystems with a wide range of third-party tools, plugins, and integrations. The strong community support and continuous innovation around container orchestration technologies contribute to their widespread adoption and growth in the market.

Restraint:

- Perception of Complexity and Learning Curve

Container orchestration platforms like Kubernetes can be complex to set up, configure, and operate, requiring specialized skills and expertise. The learning curve associated with these platforms can act as a barrier for organizations looking to adopt container orchestration, especially those with limited resources or expertise in cloud-native technologies. Container orchestration platforms consume computational resources for managing and orchestrating containers, which can impact overall system performance and resource utilization. Organizations need to allocate sufficient resources to support container orchestration workloads, including compute, storage, and networking resources, which may increase infrastructure costs.

Opportunity:

⮚ Increasing Adoption of Cloud-Native Technologies

As organizations continue to modernize their IT infrastructure and embrace cloud-native architectures, the demand for container orchestration solutions is expected to grow. Container orchestration platforms like Kubernetes play a central role in managing and scaling containerized Applications across distributed environments, offering opportunities for vendors to provide value-added services and solutions. As Kubernetes continues to gain momentum as the de facto standard for container orchestration, there is growing demand for managed Kubernetes services. Cloud providers and managed service providers (MSPs) offer managed Kubernetes offerings, providing organizations with a managed and scalable Kubernetes environment without the overhead of infrastructure management. Vendors can capitalize on this opportunity by offering value-added services and enhancements on top of managed Kubernetes offerings.

Container orchestration market Segment Overview

By Organization Size

Based on Organization Size, the market is segmented based on Large Enterprises and SMEs. Large enterprises represented the largest segment. Large enterprises typically manage complex and multifaceted IT infrastructures that require sophisticated solutions to effectively handle the deployment and management of Applications. Container orchestration platforms offer a standardized approach to managing these diverse workloads, ensuring consistency across the organization, and reducing the complexities associated with managing different Vertical stacks.

By Vertical

Based on Vertical, the market segment has been divided into Government, IT & Telecom, BFSI, Retail, Healthcare and Others. IT and telecom represented the largest segment. As these industries embrace microservices architectures and cloud-native practices, container orchestration provides the necessary tools to build, deploy, and scale these modular services while maintaining reliability and flexibility. It allows for rapid experimentation and deployment of new features, promoting agility in responding to customer demands. The IT and telecom industry vertical often deals with a diverse set of Applications, ranging from customer-facing web services to internal communication tools.

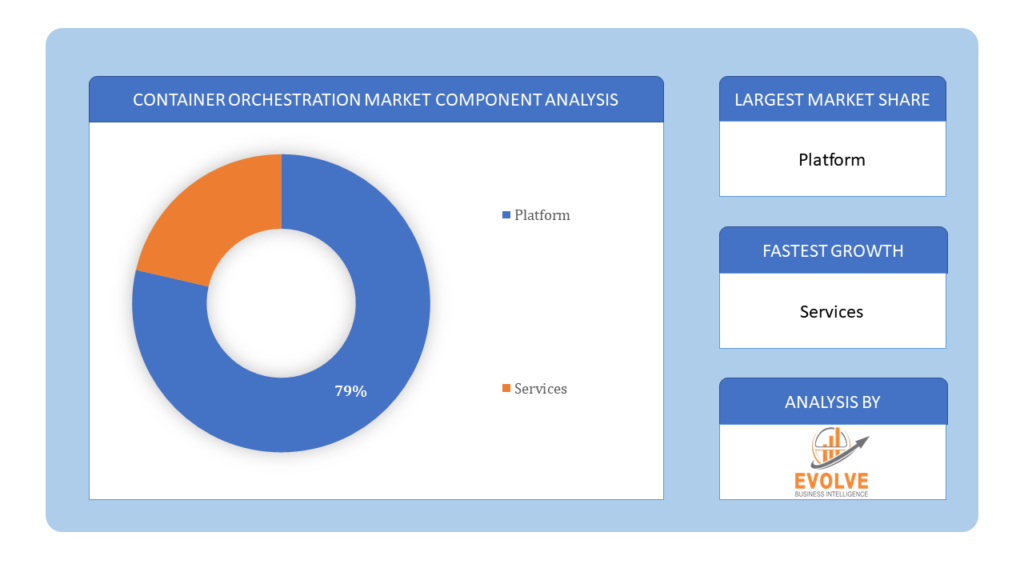

By Component

Based on Component, the market segment has been divided into Platform and Services. The platform segment has the large market. The platform component consists of software platforms for container orchestration including kubernetes, docker swarm, apache mesos, and others. The rising popularity of containers as the preferred way of Vertical deployment and the rising demand for platforms for container orchestration that can control intricate containerized environments are both predicted to contribute to the platform component’s revenue development.

Based on Component, the market segment has been divided into Platform and Services. The platform segment has the large market. The platform component consists of software platforms for container orchestration including kubernetes, docker swarm, apache mesos, and others. The rising popularity of containers as the preferred way of Vertical deployment and the rising demand for platforms for container orchestration that can control intricate containerized environments are both predicted to contribute to the platform component’s revenue development.

Global Container orchestration market Regional Analysis

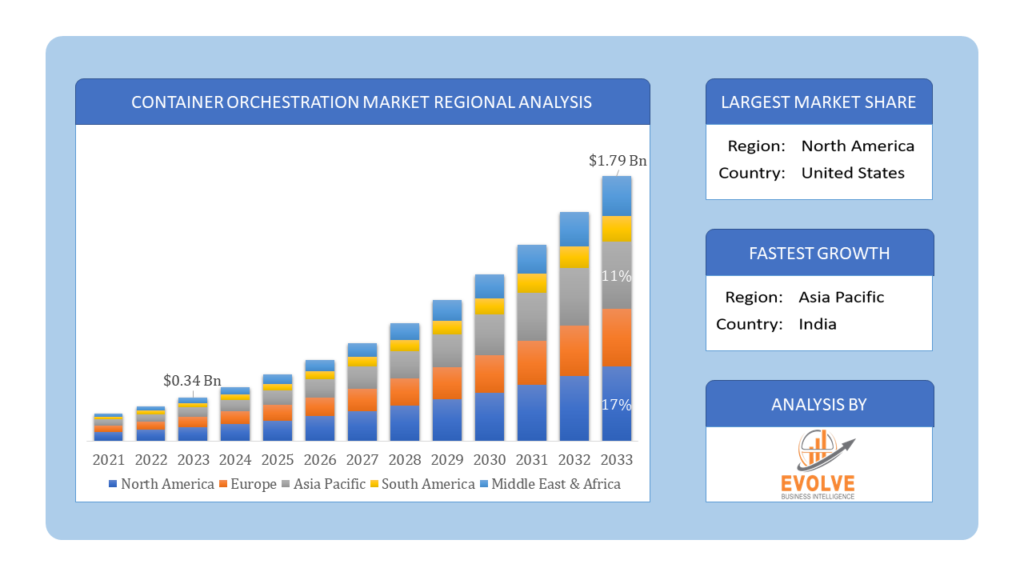

Based on region, the global Container orchestration market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Container orchestration market followed by the Asia-Pacific and Europe regions.

Container orchestration North America Market

Container orchestration North America Market

North America holds a dominant position in the Container orchestration market. North America, particularly the United States, leads the global container orchestration market in terms of adoption and innovation. The region benefits from a robust ecosystem of technology companies, startups, and cloud providers offering container orchestration solutions. Major cloud providers, including Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP), have a strong presence in the region and offer managed Kubernetes services. Enterprises across various industries, including technology, finance, healthcare, and retail, are embracing container orchestration to modernize their Applications and infrastructure.

Container orchestration Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Container orchestration market industry. The APAC region is witnessing rapid growth in container orchestration adoption, fueled by the increasing adoption of cloud computing, digital transformation initiatives, and the emergence of startups and technology hubs. Countries like China, India, Japan, and Australia are key markets for container orchestration, with a growing number of enterprises embracing cloud-native technologies. Cloud providers, both global and regional, are expanding their presence in the region and offering container orchestration services to cater to the growing demand.

Competitive Landscape

The global Container orchestration market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Amazon Web Services

- Microsoft

- Docker

- Mesosphere

- Rancher Labs

- SUSE

- Red Hat

- Cisco

- Oracle Corporation

Key Development

In June 2023, Amazon.com Inc. launched tasks faster alongside tasks with prolonged shutdown. This enables customers to scale their workloads faster and improve infrastructure utilization.

In October 2022, Oracle Corporation Expands App Development Portfolio with New Serverless Container and Messaging Services and Capabilities to Simplify Enterprise Adoption of Cloud Native Technologies.

In May 2021, Red Hat Inc. (International Business Machines Corporation) and IBM Research launched the Konveyor Project. An open source project aimed at helping modernize and migrate Applications for open hybrid cloud by building tools, identifying patterns, and providing advice on how to bring cloud-native transformation across IT.

Scope of the Report

Global Container orchestration Market, by Organization Size

- Large Enterprises

- SMEs

Global Container orchestration market, by Vertical

- Government

- IT & Telecom

- BFSI

- Retail

- Healthcare

- Others

Global Container orchestration market, by Component

- Platform

- Services

Global Container orchestration market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $1.79 Billion |

| CAGR | 18.76% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Organization Size, Vertical, Component |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Amazon Web Services, Google, Microsoft, Docker, Mesosphere, Rancher Labs, SUSE, Red Hat, Cisco and Oracle Corporation. |

| Key Market Opportunities | • Increasing Adoption of Cloud-Native Technologies • Demand for Managed Kubernetes Services |

| Key Market Drivers | • Increased Adoption of Containers • Ecosystem and Community Support |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Container orchestration market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Container orchestration market historical market size for the year 2021, and forecast from 2023 to 2033

- Container orchestration market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Container orchestration market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Container Orchestration Market?

The study period for the Container Orchestration Market spans from 2021 to the projected years of 2023 to 2033.

What is the growth rate of the Container Orchestration Market?

The Container Orchestration Market is expected to experience significant growth, with a compound annual growth rate (CAGR) of 18.76% from 2023 to 2033.

Which region has the highest growth rate in the Container Orchestration Market?

The Asia-Pacific region is anticipated to witness the highest growth rate in the Container Orchestration Market due to increasing adoption of cloud-native technologies and digital transformation initiatives.

Which region has the largest share of the Container Orchestration Market?

Currently, North America holds the largest share in the Container Orchestration Market, driven by the presence of major technology companies and cloud providers.

Who are the key players in the Container Orchestration Market?

Key players in the Container Orchestration Market include Amazon Web Services, Google, Microsoft, Docker, Mesosphere, Rancher Labs, SUSE, Red Hat, Cisco, and Oracle Corporation.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Organization Size Segement – Market Opportunity Score 4.1.2. Vertical Segment – Market Opportunity Score 4.1.3. Component Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Container orchestration market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Container orchestration market, By Organization Size 7.1. Introduction 7.1.1. Large Enterprises 7.1.2. SMEs CHAPTER 8. Global Container orchestration market, By Vertical 8.1. Introduction 8.1.1. Government 8.1.2. IT & Telecom 8.1.3. BFSI 8.1.4. Retail 8.1.5. Healthcare 8.1.6. Others CHAPTER 9. Global Container orchestration market, By Component 9.1. Introduction 9.1.1. Platform 9.1.2. Services CHAPTER 10.Global Container orchestration market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Amazon Web Services 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Google 13.3. Microsoft 13.4. Docker 13.5. Mesosphere 13.6. Rancher Labs 13.7. SUSE 13.8. Red Hat 13.9. Cisco 13.10. Oracle Corporation

Connect to Analyst

Research Methodology