Construction Equipment Rental Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

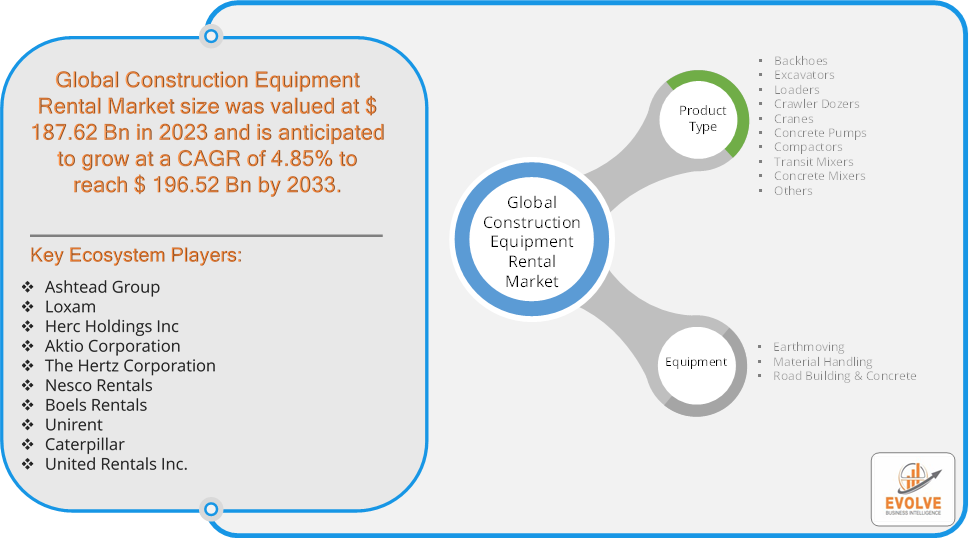

Construction Equipment Rental Market Research Report: Information By Product Type (Backhoes, Excavators, Loaders, Crawler Dozers, Cranes, Concrete Pumps, Compactors, Transit Mixers, Concrete Mixers, Others), By Equipment (Earthmoving, Material Handling, Road Building & Concrete), and by Region — Forecast till 2033

Page: 171

Construction Equipment Rental Market Overview

The Construction Equipment Rental Market Size is expected to reach USD 196.52 Billion by 2033. The Construction Equipment Rental Market industry size accounted for USD 187.62 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.85% from 2023 to 2033. The construction equipment rental market is the sector of the economy involved in leasing construction machinery for temporary use by contractors and other businesses. Companies that operate in this space provide a wide range of equipment, from earthmovers and excavators to cranes and forklifts. Customers can rent these machines for specific projects, eliminating the need to purchase expensive equipment they may only use occasionally.

The construction equipment rental market is expected to continue to grow in the coming years, driven by factors such as increasing infrastructure spending and a growing construction industry in developing countries. The construction equipment rental market is expected to continue growing as companies seek cost-effective and flexible solutions to manage their equipment needs.

Global Construction Equipment Rental Market Synopsis

COVID-19 Impact Analysis

The COVID-19 pandemic had a significant impact on the Construction Equipment Rental Market. Many construction projects were delayed or cancelled due to lockdowns and restrictions, leading to a reduced demand for rental equipment. Supply chain disruptions affected the availability of materials and equipment, causing further delays. Health concerns and social distancing measures led to labor shortages, slowing down construction activities and reducing the need for equipment rentals. The pandemic accelerated the adoption of digital tools and technologies in the construction industry, including the use of IoT and telematics in rental equipment for better fleet management and maintenance. The pandemic highlighted the importance of resilience and flexibility in business operations, encouraging more construction companies to adopt the rental model.

Construction Equipment Rental Market Dynamics

The major factors that have impacted the growth of Construction Equipment Rental Market are as follows:

Drivers:

Ø Technological Advancements

Renting provides access to the latest technology and advanced equipment without the need for continuous upgrades and purchases. Integration of IoT and telematics in rental equipment improves fleet management, usage tracking, and maintenance. Renting equipment eliminates the need for significant upfront capital investment, allowing companies to allocate financial resources more efficiently. Rental companies handle maintenance and repair costs, reducing operational expenses for renters. Renting equipment reduces financial risk associated with equipment obsolescence and market fluctuations. Renting allows companies to manage operational risks better by scaling equipment usage up or down based on project demands.

Restraint:

- Perception of High Operational Costs

While renters benefit from reduced maintenance costs, rental companies bear significant expenses to maintain and repair equipment, affecting their profitability. High insurance premiums for construction equipment add to the operational costs of rental companies. The fast pace of technological advancements can make equipment obsolete quickly, requiring rental companies to continuously invest in newer models to stay competitive. Implementing and integrating new technologies like IoT and telematics can be complex and costly for rental companies.

Opportunity:

⮚ Green and Sustainable Equipment

Increasing demand for environmentally friendly and energy-efficient construction equipment offers opportunities to expand the rental fleet with sustainable options. Providing equipment that meets stringent environmental and emissions standards can attract customers aiming to comply with regulatory requirements. Offering flexible rental terms, lease options, and customized financial packages can attract a broader range of customers. Implementing subscription-based rental models can provide steady revenue streams and appeal to customers looking for predictable budgeting.

Construction Equipment Rental Market Segment Overview

By Product Type

Based on Product Type, the market is segmented based on Backhoes, Excavators, Loaders, Crawler Dozers, Cranes, Concrete Pumps, Compactors, Transit Mixers, Concrete Mixers and Others. The loaders segment dominant the market. A loader is used for earthmoving operations, which include loading and moving materials such as dirt, demolition, recycled material, raw material, and sand. Different types of loaders are available in the market, some of which include front loaders with attached front buckets and small backhoe loaders. Front loaders are widely used in urban engineering projects and small earthmoving works.

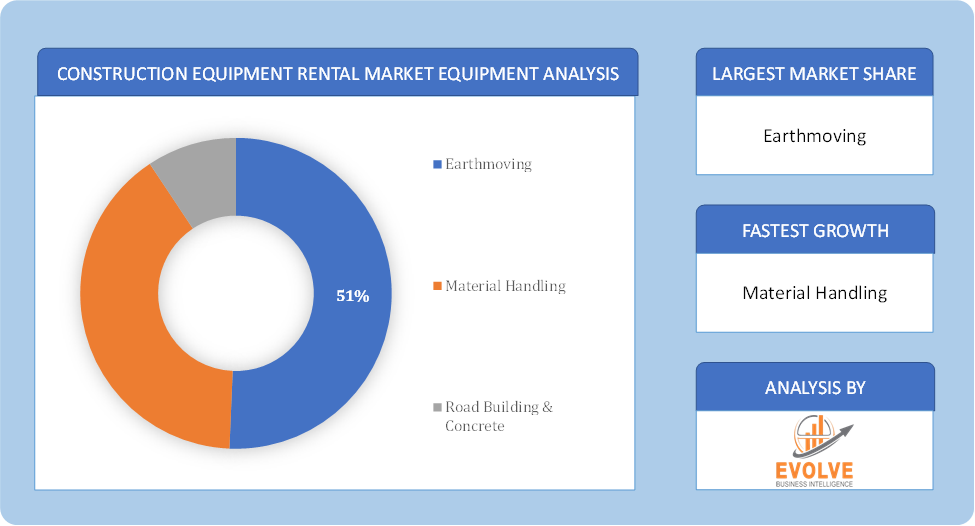

By Equipment

Based on Equipment, the market segment has been divided into the Earthmoving, Material Handling and Road Building & Concrete. Earthmoving segment dominated the Construction Equipment Rental market. Among earthmoving equipment, Excavators are versatile earth-moving machines commonly rented in the construction equipment market. With their hydraulic systems and digging capabilities, they are used for various tasks like digging trenches, excavating foundations, demolishing structures, and moving heavy materials. Excavators offer different attachments such as buckets, breakers, and grapples, making them adaptable to different construction needs.

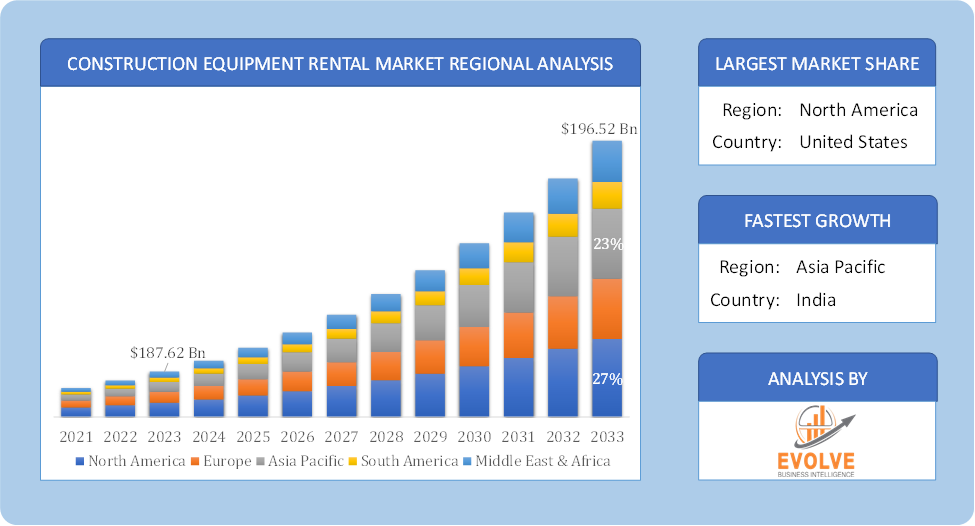

Global Construction Equipment Rental Market Regional Analysis

Based on region, the global Construction Equipment Rental Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Construction Equipment Rental Market followed by the Asia-Pacific and Europe regions.

Construction Equipment Rental North America Market

North America holds a dominant position in the Construction Equipment Rental Market. The North American market is well-established with a high level of market maturity. High adoption of advanced technologies such as IoT, telematics, and autonomous machinery. Ongoing and planned infrastructure projects, particularly in the U.S., create demand for rental equipment. Continuous demand for upgrading rental fleets to comply with environmental standards and customer expectations.

Construction Equipment Rental Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Construction Equipment Rental Market industry. Fast-paced urbanization and industrialization drive significant construction activity. Large-scale government initiatives and investments in infrastructure development. Opportunities to expand market presence and services in emerging markets. High demand for affordable and flexible rental options to cater to the cost-sensitive market.

Competitive Landscape

The global Construction Equipment Rental Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Ashtead Group

- Loxam

- Herc Holdings Inc

- Aktio Corporation

- The Hertz Corporation

- Nesco Rentals

- Boels Rentals

- Unirent

- Caterpillar

- United Rentals Inc.

Key Development

In April 2024, United Rentals announced the expansion of its equipment rental fleet with the addition of advanced construction machinery to meet the growing demand in key markets.

In March 2024, Herc Holdings unveiled its new digital platform aimed at streamlining equipment rental processes for customers, enhancing user experience, and improving operational efficiency. Scope of the Report

Global Construction Equipment Rental Market, by Product Type

- Backhoes

- Excavators

- Loaders

- Crawler Dozers

- Cranes

- Concrete Pumps

- Compactors

- Transit Mixers

- Concrete Mixers

- Others

Global Construction Equipment Rental Market, by Equipment

- Earthmoving

- Material Handling

- Road Building & Concrete

Global Construction Equipment Rental Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 196.52 Billion |

| CAGR (2023-2033) | 4.85% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Ashtead Group, Loxam, Herc Holdings Inc, Aktio Corporation, The Hertz Corporation, Nesco Rentals, Boels Rentals, Unirent, Caterpillar and United Rentals Inc. |

| Key Market Opportunities | · Green and Sustainable Equipment · Financial Flexibility and Packages |

| Key Market Drivers | · Technological Advancements · Cost Efficiency |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Construction Equipment Rental Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Construction Equipment Rental Market historical market size for the year 2021, and forecast from 2023 to 2033

- Construction Equipment Rental Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Construction Equipment Rental Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Construction Equipment Rental Market is 2021- 2033

What is the growth rate of the global Construction Equipment Rental Market?

The global Construction Equipment Rental Market is growing at a CAGR of 4.85% over the next 10 years

Which region has the highest growth rate in the market of Construction Equipment Rental Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Construction Equipment Rental Market?

North America holds the largest share in 2022

Who are the key players in the global Construction Equipment Rental Market?

Ashtead Group, Loxam, Herc Holdings Inc, Aktio Corporation, The Hertz Corporation, Nesco Rentals, Boels Rentals, Unirent, Caterpillar and United Rentals Inc. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Construction Equipment Rental Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Construction Equipment Rental Market 4.8. Import Analysis of the Construction Equipment Rental Market 4.9. Export Analysis of the Construction Equipment Rental Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Construction Equipment Rental Market, By Product Type 6.1. Introduction 6.2. Backhoes 6.3. Excavators 6.4. Loaders 6.5. Crawler Dozers 6.6. Cranes 6.7. Concrete Pumps 6.8. Compactors 6.9. Transit Mixers 6.10. Concrete Mixers 6.11. Others Chapter 7. Global Construction Equipment Rental Market, By Equipment 7.1. Introduction 7.2. Earthmoving 7.3. Material Handling 7.4. Road Building & Concrete Chapter 8. Global Construction Equipment Rental Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.5. Market Size and Forecast, By End User, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By End User, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By End User, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By End User, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By End User, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By End User, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By End User, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By End User, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By End User, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By End User, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By End User, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By End User, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By End User, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By End User, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By End User, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By End User, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Ashtead Group 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Loxam 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Herc Holdings Inc 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Aktio Corporation 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. The Hertz Corporation 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Nesco Rentals 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Boels Rentals 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Unirent 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Caterpillar 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. United Rentals Inc 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology