CNG & LPG Vehicle Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

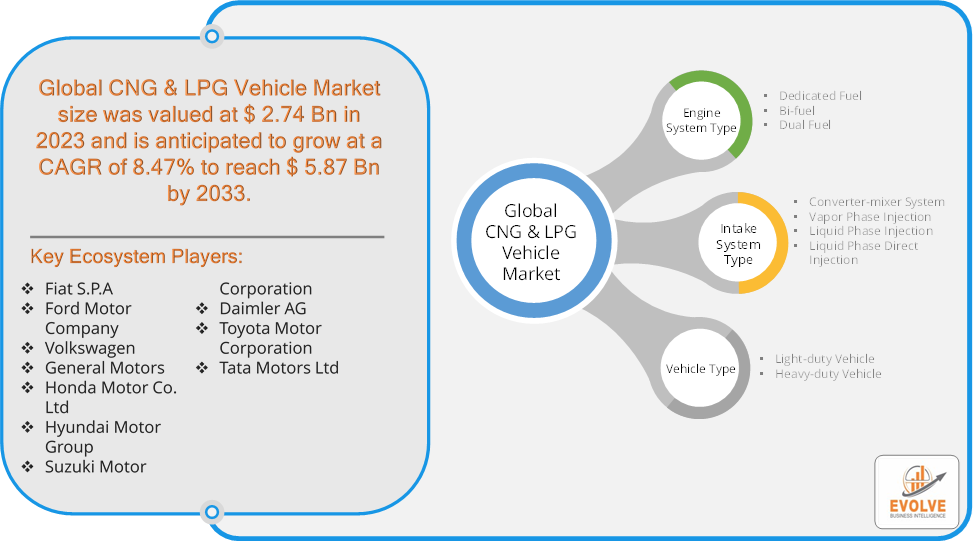

CNG & LPG Vehicle Market Research Report: Information By Engine System Type (Dedicated Fuel, Bi-fuel, Dual Fuel), By Intake System Type (Converter-mixer System, Vapor Phase Injection, Liquid Phase Injection, Liquid Phase Direct Injection), By Vehicle Type (Light-duty Vehicle, Heavy-duty Vehicle), and by Region — Forecast till 2033

Page: 165

CNG & LPG Vehicle Market Overview

The CNG & LPG Vehicle Market Size is expected to reach USD 5.87 Billion by 2033. The CNG & LPG Vehicle Market industry size accounted for USD 2.74 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 8.47% from 2023 to 2033. The CNG (Compressed Natural Gas) and LPG (Liquefied Petroleum Gas) Vehicle Market refers to the segment of the automotive industry focused on vehicles that utilize either CNG or LPG as their primary fuel source. These alternative fuels are considered cleaner burning compared to traditional gasoline or diesel, making them attractive for reducing emissions and enhancing environmental sustainability.

Overall, the CNG and LPG Vehicle Market represents a niche within the broader automotive sector focused on leveraging alternative fuels to reduce environmental impact and promote sustainable transportation solutions.

Global CNG & LPG Vehicle Market Synopsis

COVID-19 Impact Analysis

COVID-19 Impact Analysis

The The COVID-19 pandemic had several impacts on the CNG (Compressed Natural Gas) and LPG (Liquefied Petroleum Gas) Vehicle Market. During lockdowns and periods of restricted movement, overall vehicle sales and usage decreased globally. This decline in vehicle demand affected all types of vehicles, including those running on CNG and LPG. Restrictions on manufacturing and logistics disrupted the supply chain for automotive components, including those specific to CNG and LPG vehicles. This led to delays in production and delivery of vehicles and components. The pandemic caused economic uncertainty and reduced consumer spending capacity. This economic downturn impacted the affordability and adoption of alternative fuel vehicles, including CNG and LPG vehicles, which tend to have different cost dynamics compared to conventional gasoline or diesel vehicles. Operational challenges faced by CNG and LPG refueling stations, including reduced staff availability, safety protocols, and fluctuations in fuel demand, also affected the market. These stations are critical for supporting the infrastructure needed for CNG and LPG vehicles.

CNG & LPG Vehicle Market Dynamics

The major factors that have impacted the growth of CNG & LPG Vehicle Market are as follows:

Drivers:

Ø Technological Advancements

Continuous improvements in engine technology and emissions control systems have enhanced the performance and efficiency of CNG and LPG vehicles. These advancements make them more attractive options for consumers concerned about both environmental impact and vehicle performance. CNG and LPG often offer cost advantages over conventional gasoline and diesel fuels in many regions. This can be due to lower fuel prices, tax incentives, and operational efficiencies. Consumers and fleet operators are attracted to these savings, especially in areas where fuel prices are volatile. CNG and LPG vehicles typically produce lower levels of harmful emissions such as particulate matter, nitrogen oxides, and greenhouse gases compared to conventional fuels. This environmental advantage appeals to individuals and organizations aiming to reduce their carbon footprint and comply with stricter emission standards.

Restraint:

- Perception of Fuel Price Volatility and Technological Challenges

While CNG and LPG often offer cost savings, the prices of these fuels can still fluctuate. Dependence on market conditions and geopolitical factors can introduce uncertainty for consumers and fleet operators considering these alternative fuels. Although advancements in technology have improved the efficiency and performance of CNG and LPG vehicles, there are ongoing challenges in developing cost-effective and efficient engine technologies that match the performance of conventional engines.

Opportunity:

⮚ Environmental Sustainability and Energy Security

With increasing global concerns about climate change and air quality, CNG and LPG vehicles offer a cleaner alternative to traditional gasoline and diesel vehicles. Governments and consumers are increasingly supportive of policies and technologies that reduce emissions, presenting a significant opportunity for these cleaner fuels. Utilizing domestically available natural gas and LPG enhances energy security for countries by reducing dependency on imported oil. This strategic advantage is particularly relevant in regions with abundant natural gas resources. Expanding the CNG and LPG refueling infrastructure is crucial for market growth. Investments in infrastructure development, including public and private refueling stations, create opportunities for increased adoption of CNG and LPG vehicles across different regions.

CNG & LPG Vehicle Market Segment Overview

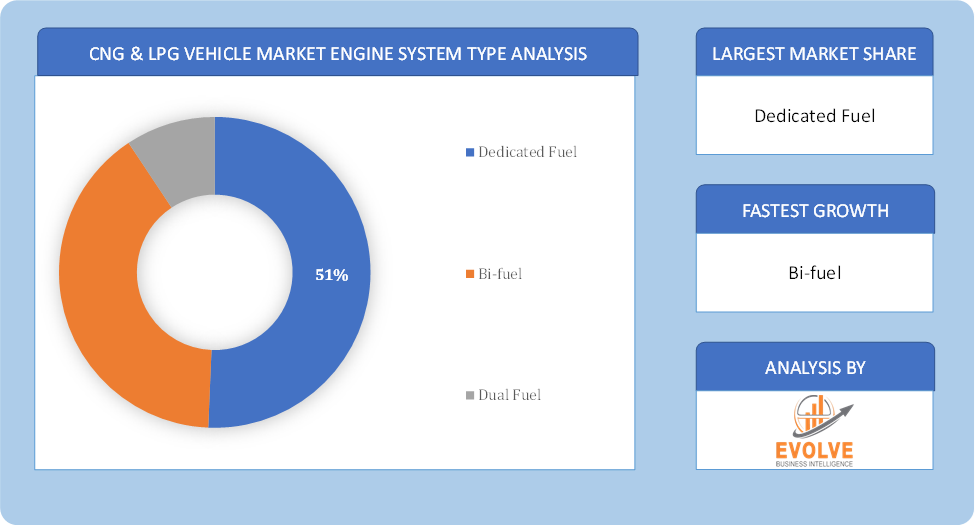

By Engine System Type

By Engine System Type

Based on Engine System Type, the market is segmented based on Dedicated Fuel, Bi-fuel and Dual Fuel. The Dual Fuel segment dominant the market. Dual fuel vehicles can switch between gasoline/diesel and CNG/LPG, offering flexibility and convenience to drivers. Dual fuel systems can extend the driving range of vehicles by allowing the use of two fuel types, reducing the frequency of refueling stops.

By Intake System Type

Based on Intake System Type, the market segment has been divided into the Converter-mixer System, Vapor Phase Injection, Liquid Phase Injection and Liquid Phase Direct Injection. The Vapor Phase Injection segment dominant the market. In VPI systems, CNG or LPG is injected into the intake manifold in vapor form, mixed with air, and then introduced into the combustion chamber. VPI systems can contribute to fuel cost savings, especially in regions where CNG or LPG is significantly cheaper than gasoline or diesel.

By Vehicle Type

Based on Vehicle Type, the market segment has been divided into the Light-duty Vehicle and Heavy-duty Vehicle. The Heavy-duty Vehicle segment dominant the market. The Heavy-Duty Vehicle segment in the CNG and LPG Vehicle Market offers significant opportunities for growth driven by environmental, economic, and regulatory factors. By addressing the challenges and leveraging technological advancements, this segment can contribute to more sustainable and efficient transportation solutions globally.

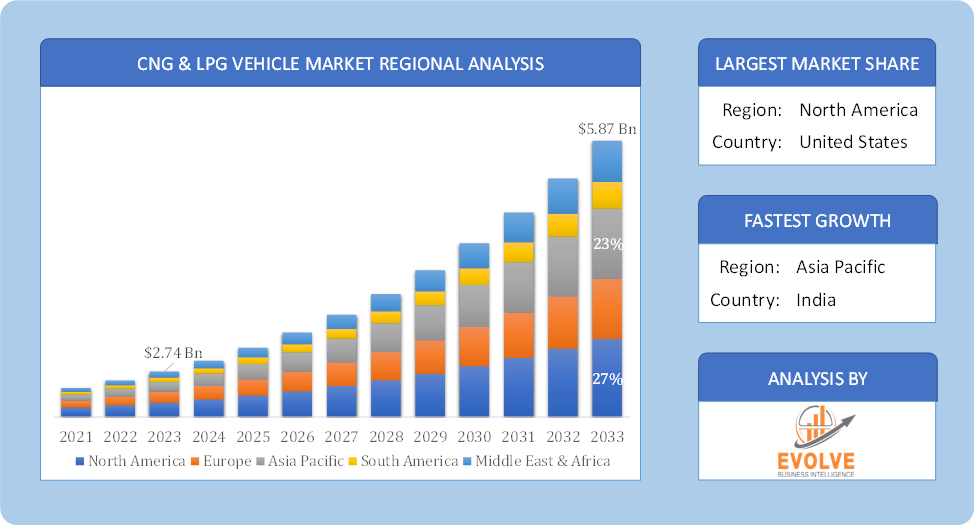

Global CNG & LPG Vehicle Market Regional Analysis

Based on region, the global CNG & LPG Vehicle Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the CNG & LPG Vehicle Market followed by the Asia-Pacific and Europe regions.

CNG & LPG Vehicle North America Market

CNG & LPG Vehicle North America Market

North America holds a dominant position in the CNG & LPG Vehicle Market. The CNG market is well-established, particularly in the United States, where there is significant adoption in public transit, municipal fleets, and commercial vehicles. Abundant domestic natural gas resources make CNG a cost-effective alternative to gasoline and diesel, supporting its adoption.

CNG & LPG Vehicle Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the CNG & LPG Vehicle Market industry. Infrastructure development is accelerating, especially in countries like China and India. Governments are investing in expanding the network of CNG and LPG refueling stations to support the growing number of vehicles. Rapid urbanization, severe air pollution in major cities, and the need for affordable fuel options are driving demand for CNG and LPG vehicles.

Competitive Landscape

The global CNG & LPG Vehicle Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Fiat S.P.A

- Ford Motor Company

- Volkswagen

- General Motors

- Honda Motor Co. Ltd

- Hyundai Motor Group

- Suzuki Motor Corporation

- Daimler AG

- Toyota Motor Corporation

- Tata Motors Ltd

Key Development

In March 2023, HAM Group inaugurated a new liquefied natural gas (LNG) and compressed natural gas (CNG) service station in Benavente, Zamora, located at Caada Berciana 9A. The strategic location near the A-6 (Northwest route), one of Spain’s major radial highways, and the N-630, one of the country’s longest national highways, enhances accessibility and convenience for customers.

In November 2022, Toyota Kirloskar Motor Pvt. Ltd., an India-based joint venture of Toyota Motor Corp., introduced the Compressed Natural Gas (CNG) variant of their high-end hatchback, the Toyota Glanza, to the Indian CNG and LPG Vehicle Market.

Scope of the Report

Global CNG & LPG Vehicle Market, by Engine System Type

- Dedicated Fuel

- Bi-fuel

- Dual Fuel

Global Rolling Stock Market, by Intake System Type

- Converter-mixer System

- Vapor Phase Injection

- Liquid Phase Injection

- Liquid Phase Direct Injection

Global CNG & LPG Vehicle Market, by Vehicle Type

- Light-duty Vehicle

- Heavy-duty Vehicle

Global CNG & LPG Vehicle Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 5.87 Billion |

| CAGR (2023-2033) | 8.47% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Engine System Type, Intake System Type, Vehicle Type |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Fiat S.P.A, Ford Motor Company, Volkswagen, General Motors, Honda Motor Co. Ltd, Hyundai Motor Group, Suzuki Motor Corporation, Daimler AG, Toyota Motor Corporation and Tata Motors Ltd. |

| Key Market Opportunities | · Environmental Sustainability and Energy Security · Infrastructure Development |

| Key Market Drivers | · Technological Advancements · Cost Efficiency |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future CNG & LPG Vehicle Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- CNG & LPG Vehicle Market historical market size for the year 2021, and forecast from 2023 to 2033

- CNG & LPG Vehicle Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global CNG & LPG Vehicle Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global CNG & LPG Vehicle Market is 2021- 2033

What is the growth rate of the global CNG & LPG Vehicle Market?

The global CNG & LPG Vehicle Market is growing at a CAGR of 8.47% over the next 10 years

Which region has the highest growth rate in the market of CNG & LPG Vehicle Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global CNG & LPG Vehicle Market?

North America holds the largest share in 2022

Who are the key players in the global CNG & LPG Vehicle Market?

Fiat S.P.A, Ford Motor Company, Volkswagen, General Motors, Honda Motor Co. Ltd, Hyundai Motor Group, Suzuki Motor Corporation, Daimler AG, Toyota Motor Corporation and Tata Motors Ltd are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Engine System Type Segement – Market Opportunity Score 4.1.2. Intake System Type Segment – Market Opportunity Score 4.1.3. Vehicle Type Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on CNG & LPG Vehicle Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. Market Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. CNG & LPG Vehicle Market, By Engine System Type 7.1. Introduction 7.1.1. Dedicated Fuel 7.1.2. Bi-fuel 7.1.3. Dual Fuel CHAPTER 8 CNG & LPG Vehicle Market, By Intake System Type 8.1. Introduction 8.1.1. Converter-mixer System 8.1.2. Vapor Phase Injection 8.1.3. Liquid Phase Injection 8.1.4. Liquid Phase Direct Injection CHAPTER 9. CNG & LPG Vehicle Market, By Vehicle Type 9.1. Introduction 9.1.1. Light-duty Vehicle 9.1.2 Heavy-duty Vehicle CHAPTER 10. CNG & LPG Vehicle Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Engine System Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Engine System Typess, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Intake System Type, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Fiat S.P.A 13.1.1. Hanon Systems 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Ford Motor Company 13.3. Volkswagen 13.4. General Motors 13.5. Honda Motor Co. Ltd 13.6. Hyundai Motor Group 13.7. Suzuki Motor Corporation 13.8. Daimler AG 13.9 Toyota Motor Corporation 13.10 Tata Motors Ltd.

Connect to Analyst

Research Methodology

CNG & LPG Vehicle North America Market

CNG & LPG Vehicle North America Market