CDMO Market Analysis and Global Forecast 2023-2033

$ 3,470.00 – $ 5,520.00Price range: $ 3,470.00 through $ 5,520.00

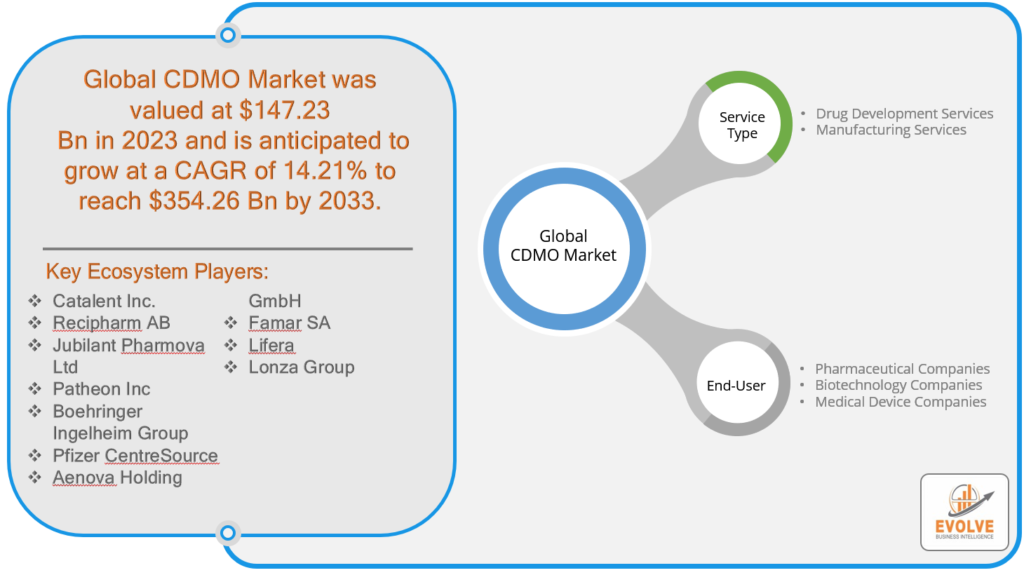

CDMO Market Research Report: Information By Service Type (Drug Development Services, Manufacturing Services), By End-User (Pharmaceutical Companies, Biotechnology Companies, Medical Device Companies), and by Region — Forecast till 2033

CDMO Market Overview

The CDMO Market Size is expected to reach USD 354.26 Billion by 2033. The CDMO industry size accounted for USD 147.23 Billion in 2023 and is expected to expand at a CAGR of 14.21% from 2023 to 2033. A Contract Development and Manufacturing Organization (CDMO) is a specialized entity within the pharmaceutical and biotechnology industries that provides comprehensive services for the research, development, and manufacturing of pharmaceutical products. These organizations offer a range of capabilities, including drug formulation, analytical testing, process development, and manufacturing of active pharmaceutical ingredients (APIs) and finished dosage forms. CDMOs serve as strategic partners for pharmaceutical companies, enabling them to outsource various aspects of drug development and production to improve efficiency, reduce costs, and accelerate time-to-market for new drugs. This outsourcing model allows pharmaceutical firms to focus on core research and marketing activities while leveraging the expertise and infrastructure of CDMOs for various stages of the drug development lifecycle.

Global CDMO Market Synopsis

The Contract Development and Manufacturing Organization (CDMO) market was significantly influenced by the advent of the COVID-19 pandemic. In response to the worldwide urgency to develop and manufacture vaccines and treatments for the virus, CDMOs played a crucial role in providing the requisite expertise and production capabilities. Many CDMOs swiftly reconfigured their facilities and resources to support the manufacturing of COVID-19 vaccines and therapies, resulting in an upsurge in demand for their services. This increased demand not only fortified the CDMO sector but also underscored the critical role these organizations play in addressing public health emergencies and expediting the development and production of vital pharmaceutical products. The pandemic highlighted the resilience and adaptability of CDMOs in the context of global health crises.

CDMO Market Dynamics

The major factors that have impacted the growth of CDMOs are as follows:

Drivers:

Ø Rising Pharmaceutical R&D Outsourcing

The pharmaceutical industry’s increasing reliance on external partners for research, development, and manufacturing services is a significant driver for the Contract Development and Manufacturing Organization (CDMO) market. Pharmaceutical companies are increasingly outsourcing these activities to CDMOs to reduce costs, accelerate drug development, and access specialized expertise, which is propelling the CDMO industry’s growth.

Restraint:

- Regulatory Challenges and Quality Control

Stringent regulatory requirements and the need for stringent quality control pose a restraint to the CDMO market. Meeting regulatory compliance and maintaining high-quality standards are critical, and CDMOs must invest significantly in infrastructure and processes to ensure adherence. These challenges can slow down the development and production process and increase costs.

Opportunity:

⮚ Emerging Markets in Asia-Pacific

The Asia-Pacific region offers a substantial growth opportunity for CDMOs. With a skilled workforce, cost-effective manufacturing capabilities, and an increasing focus on healthcare, the region has become a preferred destination for pharmaceutical outsourcing. Expanding pharmaceutical and biotechnology activities in Asia-Pacific nations present CDMOs with a burgeoning market to serve and grow their global presence.

CDMO Segment Overview

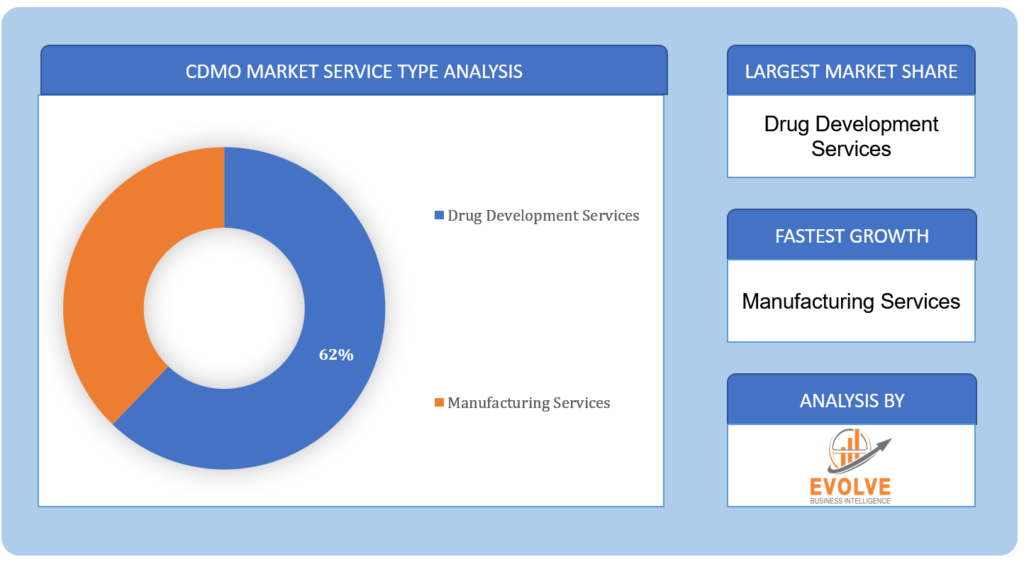

By Service Type

Based on Service Type, the market is segmented based on Drug Development Services, and Manufacturing Services. The Drug Development Services segment is expected to experience significant growth throughout the forecast period in the CDMO market due to a continuous surge in demand for outsourcing various stages of drug research and development to specialized service providers.

Based on Service Type, the market is segmented based on Drug Development Services, and Manufacturing Services. The Drug Development Services segment is expected to experience significant growth throughout the forecast period in the CDMO market due to a continuous surge in demand for outsourcing various stages of drug research and development to specialized service providers.

By End-User

Based on the End-User, the market has been divided into Pharmaceutical Companies, Biotechnology Companies, and Medical Device Companies. The Pharmaceutical Companies segment is poised for substantial growth in the Contract Development and Manufacturing Organization (CDMO) market during the forecast period owing to several factors. Pharmaceutical companies are increasingly relying on CDMOs to streamline their operations, reduce development costs, and expedite time-to-market for new drugs.

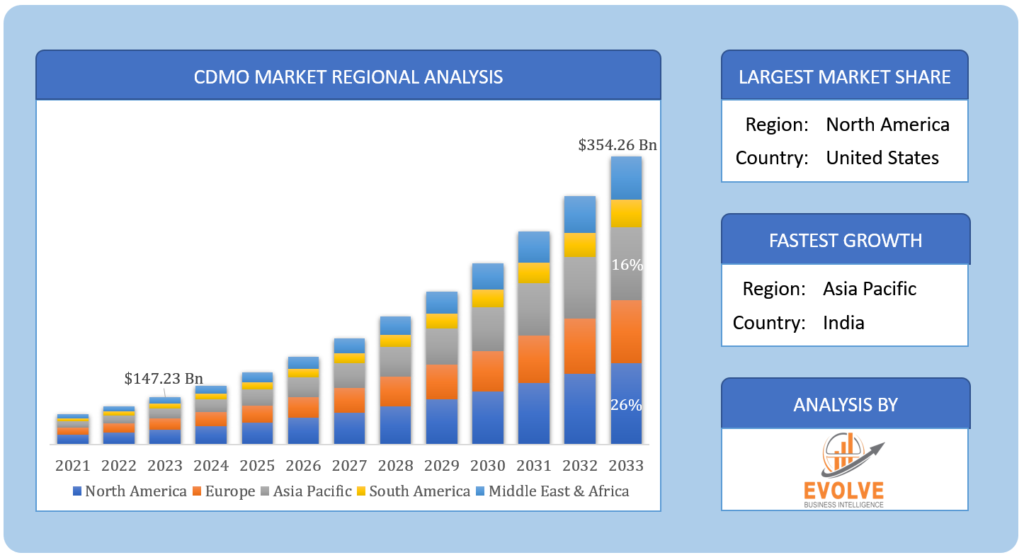

Global CDMO Market Regional Analysis

Based on region, the global CDMO market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the CDMO market followed by the Asia-Pacific and Europe regions.

North America Market

North America Market

North America holds a dominant position in the global Contract Development and Manufacturing Organization (CDMO) market due to several key factors. The region boasts a robust pharmaceutical and biotechnology industry, supported by advanced research and development capabilities, a well-established regulatory framework, and a high demand for outsourcing services. Additionally, the region’s concentration of innovative biopharmaceutical companies and a strong emphasis on research and development activities contribute to its leadership in the CDMO sector. North America’s strategic advantage in terms of intellectual property protection, quality control, and a skilled workforce further solidifies its dominant position in the global CDMO market, making it a preferred hub for pharmaceutical outsourcing and manufacturing services.

Asia-Pacific Market

The Asia-Pacific region has rapidly emerged as a thriving market for the Contract Development and Manufacturing Organization (CDMO) industry. This growth can be attributed to several key factors, including cost-effective manufacturing capabilities, a skilled and adaptable workforce, and a growing emphasis on pharmaceutical and biotechnology research and development. The region’s increasingly favorable regulatory environment and government initiatives to promote life sciences and healthcare innovation have attracted pharmaceutical companies and biotech startups to outsource various aspects of their drug development and manufacturing to Asia-Pacific CDMOs. As a result, the Asia-Pacific region is becoming a major player in the global CDMO landscape, offering strategic advantages and growth opportunities for both regional and international pharmaceutical and biotech firms.

Competitive Landscape

The Global CDMO market is highly competitive, with numerous players offering a wide range of solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Catalent Inc.

- Recipharm AB

- Jubilant Pharmova Ltd

- Patheon Inc

- Boehringer Ingelheim Group

- Pfizer CentreSource

- Aenova Holding GmbH

- Famar SA

- Lifera

- Lonza Group

Key Development:

In June 2023, the Public Investment Fund of the Kingdom of Saudi Arabia unveiled Lifera, a large-scale Contract Development and Manufacturing Organization (CDMO) aimed at advancing the local biopharmaceutical industry in Saudi Arabia. The PIF, which serves as the Kingdom’s sovereign wealth fund, is dedicated to making strategic investments and fostering collaborations that enhance various aspects of the supply chain, workforce capabilities, resource development, pharmaceuticals, employment prospects, and technology transfer from global private sector partners.

In February 2023, Catalent announced the successful completion of a USD 2.2 million expansion project at its clinical supply facility located in Singapore. This expansion added an extra 31,000 square feet to the site’s footprint and facilitated the installation of 35 additional new freezers designed for ultra-low temperature (ULT) storage.

Scope of the Report

Global CDMO Market, by Service Type

- Drug Development Services

- Manufacturing Services

Global CDMO Market, by End-User

- Pharmaceutical Companies

- Biotechnology Companies

- Medical Device Companies

Global CDMO Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $354.26 Billion |

| CAGR | 14.21% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Service Type, End-User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Catalent Inc., Recipharm AB, Jubilant Pharmova Ltd, Patheon Inc., Boehringer Ingelheim Group, Pfizer CentreSource, Aenova Holding GmbH, Famar SA, Lifera, Lonza Group |

| Key Market Opportunities | • Expansion of CDMO services in emerging markets, especially in Asia-Pacific. • Rising interest in biologics and advanced therapies. • Enhanced technological capabilities and innovation in the CDMO sector. |

| Key Market Drivers | • Increased outsourcing of drug development and manufacturing by pharmaceutical companies. • Growing demand for specialized expertise and cost-effective solutions. • Acceleration of drug development processes through CDMO partnerships. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future CDMO market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- CDMO market historical market size for the year 2021, and forecast from 2023 to 2033

- CDMO market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government and defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global CDMO market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government and defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global CDMO market is 2021- 2033

What is the growth rate of the global CDMO market?

The Global CDMO market is growing at a CAGR of 14.21% over the next 10 years

Which region has the highest growth rate in the market of CDMO?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global CDMO market?

North America holds the largest share in 2022

Who are the key players in the global CDMO market?

Catalent Inc., Recipharm AB, Jubilant Pharmova Ltd, Patheon Inc., Boehringer Ingelheim Group, Pfizer CentreSource, Aenova Holding GmbH, Famar SA, Lifera, Lonza Group are the major companies operating in the market.

Do you offer post-sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw Material Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the CDMO Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Distribution Channel Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the CDMO Market 4.8. Import Analysis of the CDMO Market 4.9. Export Analysis of the CDMO Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global CDMO Market, By Service Type 6.1. Introduction 6.2. Drug Development Services 6.3. Manufacturing Services Chapter 7. Global CDMO Market, By End-User 7.1. Introduction 7.2. Pharmaceutical Companies 7.3. Biotechnology Companies 7.4. Medical Device Companies Chapter 8. Global CDMO Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Service Type, 2023-2033 8.2.5. Market Size and Forecast, By End-User, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Service Type, 2023-2033 8.2.6.4. Market Size and Forecast, By End-User, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Service Type, 2023-2033 8.2.7.5. Market Size and Forecast, By End-User, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Service Type, 2023-2033 8.3.5. Market Size and Forecast, By End-User, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Service Type, 2023-2033 8.3.6.4. Market Size and Forecast, By End-User, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Service Type, 2023-2033 8.3.7.4. Market Size and Forecast, By End-User, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Service Type, 2023-2033 8.3.8.4. Market Size and Forecast, By End-User, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Service Type, 2023-2033 8.3.9.4. Market Size and Forecast, By End-User, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Service Type, 2023-2033 8.3.11.4. Market Size and Forecast, By End-User, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Service Type, 2023-2033 8.12.28. Market Size and Forecast, By End-User, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Service Type, 2023-2033 8.4.6.4. Market Size and Forecast, By End-User, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Service Type, 2023-2033 8.4.7.4. Market Size and Forecast, By End-User, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Service Type, 2023-2033 8.4.8.4. Market Size and Forecast, By End-User, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Service Type, 2023-2033 8.4.9.4. Market Size and Forecast, By End-User, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Service Type, 2023-2033 8.4.10.4. Market Size and Forecast, By End-User, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Service Type, 2023-2033 8.5.4. Market Size and Forecast, By End-User, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Catalent Inc. 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Recipharm AB 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Jubilant Pharmova Ltd 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Patheon Inc 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. Boehringer Ingelheim Group 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Pfizer CentreSource 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Aenova Holding GmbH 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Famar SA 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Lifera 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Lonza Group 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology