Bottled Water Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Bottled Water Market Research Report: Information By Type (Still Water, Sparkling Water, and Functional Water), By Distribution Channel (Off-trade, ON-trade), and By Region — Forecast till 2033

Page: 208

What Does This Global Bottled Water Market Report Include?

| Parameters | Values |

|---|---|

| Market Size and Forecast Years | 2021 to 2023 |

| Compounded Average Growth Rate (CAGR) | First 5 Years CAGR (2023–2028) Last 5 Years CAGR (2028–2033) 10 Years CAGR (2023–2033) |

| Year-over-Year Growth Depiction | Included |

| Market Opportunity Score | Included |

| Market Dynamics or Impacting Factors | Included |

| Market Dynamics Impact Analysis | Included |

| PORTER’s Five Forces Analysis (in Brief) | Included (Detailed Analysis Can be included on Demand) |

| Segments Included | By Type Still Water Sparkling Water Functional WaterBy Distribution Channel Off-trade Non-Off-trade |

| Regions Included | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Countries Included | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, BeNeLux, Russia, China, Japan, India, South Korea, Thailand, Indonesia, Malaysia, Australia, Brazil, Argentina, Saudi Arabia, UAE, Egypt, and South Africa |

| Competitor Benchmarking | Included |

| Company/Vendor Market Share Analysis | Included |

| Key Development Analysis for top 5 Companies | Included |

| Market Share Acquisition Key Strategies | Included |

| Key Market Players | Danone SA, The Coca-Cola Company, PepsiCo Inc., Nestle SA, Otsuka Pharmaceutical Co. Ltd, FIJI Water Company LLC, Voss Water, National Beverage Corp., Binzomah Group, and Hana Water-Hana Food Industries Co* This section is completely customizable upto 15 companies; you can share the list of companies you want us to profile and we will include them in the final report for you |

Bottled Water Market Overview

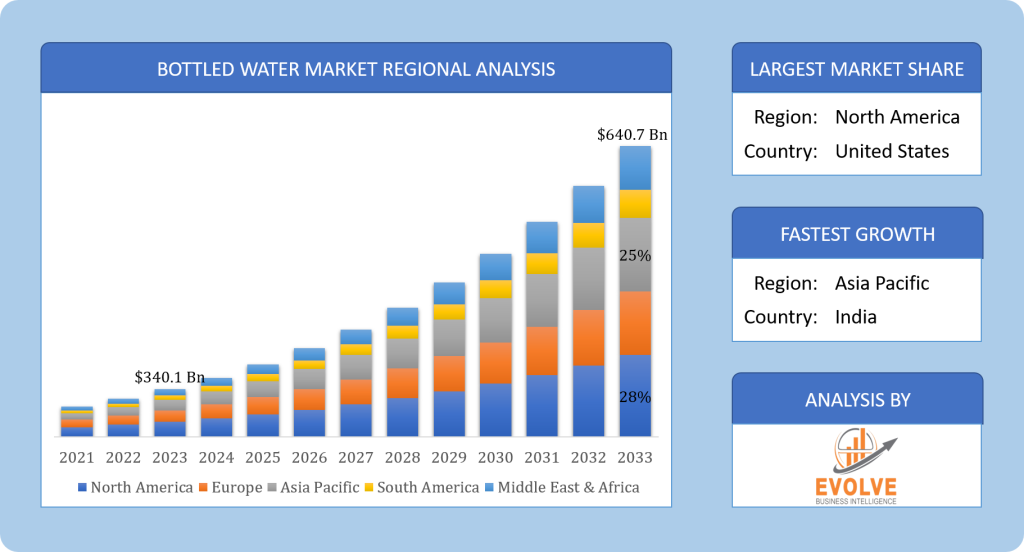

The global Bottled Water Market Size is expected to reach USD 640.7 Billion by 2033. The global Bottled Water industry size accounted for USD 340.1 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.54% from 2023 to 2033. The bottled water market has experienced substantial growth in recent years, becoming an indispensable part of our daily lives. With increasing concerns about water quality and accessibility, bottled water has emerged as a convenient and reliable solution for hydration needs. This market offers a wide range of options, including still water, sparkling water, and functional water, catering to diverse consumer preferences. Bottled water finds its applications in various sectors such as households, offices, restaurants, and retail stores, making it a versatile and essential product.

Global Bottled Water Market Synopsis

COVID-19 Impact Analysis

The COVID-19 pandemic has had a significant impact on the bottled water market. As the virus spread, consumers prioritized hygiene and safety, leading to an upsurge in demand for packaged drinking water. Bottled water offered a trustworthy alternative to tap water, ensuring a reliable source of clean drinking water for individuals and families. Moreover, the closure of public places, including water fountains and water coolers, further fueled the demand for bottled water.

Post-COVID, the bottled water market is expected to witness sustained growth. The heightened awareness of health and safety among consumers is likely to persist, driving the demand for packaged water. Additionally, the rising trend of outdoor activities and on-the-go consumption will continue to bolster the market’s growth, as consumers seek portable and convenient hydration solutions.

Bottled Water Market Dynamics

The major factors that have impacted the growth of Bottled Water are as follows:

Drivers:

Growing Health Consciousness and Nourishing the Body, Inspiring Choices

One of the significant driving factors in the bottled water market is the growing health consciousness among consumers. In today’s fast-paced world, people are becoming increasingly aware of the importance of staying hydrated and maintaining good health. Bottled water, with its refreshing taste and perceived purity, has become the go-to choice for health-conscious individuals.

This shift towards a healthier lifestyle has opened up avenues for innovative products in the bottled water market. Manufacturers are now offering functional water variants infused with minerals, vitamins, electrolytes, and other beneficial ingredients. These functional waters not only hydrate but also cater to specific health needs such as enhanced energy, improved digestion, or immune system support.

Restraint:

Environmental Concerns – Balancing Convenience and Sustainability

While the bottled water market continues to flourish, it faces challenges related to environmental sustainability. Plastic waste generated from single-use water bottles has raised concerns about pollution and ecological impact. The catchy header for this restraining factor could be “Balancing Convenience and Sustainability: Addressing Environmental Concerns.”

To counteract these concerns, industry players are increasingly focusing on sustainable packaging solutions. Initiatives such as using recycled materials, developing biodegradable or compostable bottles, and promoting bottle recycling programs are gaining traction. Additionally, the adoption of alternative packaging materials like glass and aluminum cans is on the rise. These efforts aim to minimize the environmental footprint of bottled water and strike a balance between convenience and sustainability.

Opportunity:

Quenching the Thirst for Growth: Emerging Markets Unlocking New Avenues

The bottled water market presents immense opportunities in emerging economies, where the demand for clean drinking water is rapidly increasing. Countries such as India, China, Brazil, and Indonesia are witnessing significant growth in their bottled water sectors, driven by factors such as urbanization, rising disposable incomes, and evolving consumer lifestyles.

In India, for instance, the bottled water market has experienced remarkable expansion in recent years. With a large population and inadequate access to safe drinking water in many areas, the demand for packaged drinking water has soared. Consumers are increasingly turning to bottled water as a reliable source of clean and hygienic drinking water. The rising middle class, along with increased awareness of health and hygiene, has propelled the growth of the market in India. Domestic and international companies are actively investing in production facilities and distribution networks to cater to this expanding market. Similarly, China represents a vast opportunity for the bottled water industry. The country’s growing urbanization and the rise of the middle class have led to a surge in demand for bottled water. Concerns regarding water contamination and quality issues have further boosted the market’s growth. Chinese consumers are willing to pay a premium for trusted and reputable bottled water brands that guarantee safety and purity. This has led to the emergence of local brands as well as the entry of international players, each vying for a share in the market.

Bottled Water Segment Overview

By Type

Based on the Type, the market is segmented based on Still Water, Sparkling Water, and Functional Water. Still water, being the traditional and most widely consumed variant, holds the largest share in the market. It offers a refreshing and pure drinking experience, making it a popular choice among consumers. Still water is often sourced from natural springs or purified through advanced filtration processes to ensure its quality and taste. Sparkling water, on the other hand, has gained significant popularity in recent years, driven by the growing preference for carbonated beverages. Sparkling water provides a bubbly and fizzy sensation, making it an enjoyable alternative to sugary sodas or alcoholic drinks. It is available in various flavors, both natural and artificial, to cater to different consumer preferences.

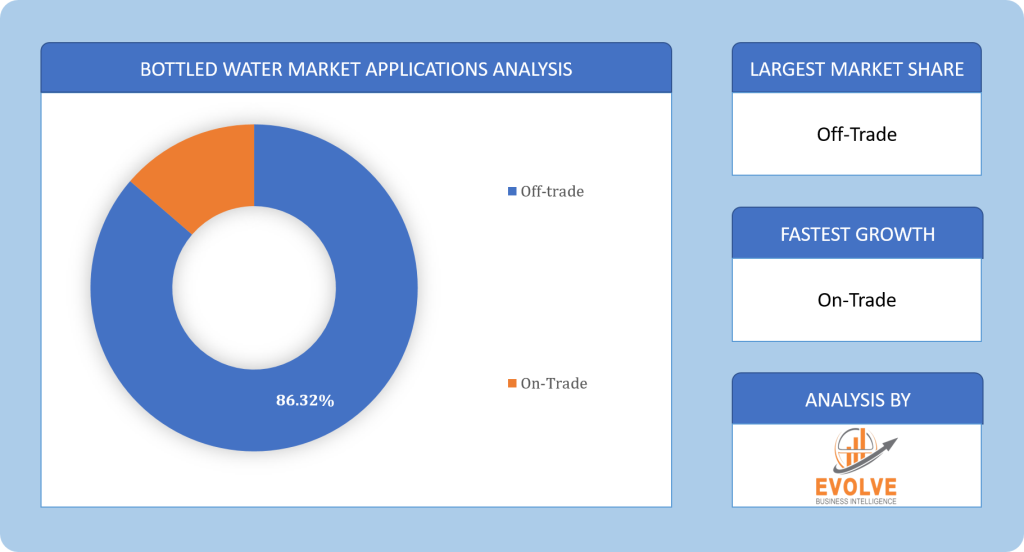

By Distribution Channel

Based on Distribution Channel, the market has been divided into Off-trade, Non-Off-trade. the Off-trade segment holds the largest share in the Bottled Water market. The off-trade channel refers to the retail sales of bottled water through supermarkets, convenience stores, online platforms, and other off-premise locations. This distribution channel caters to consumers who purchase bottled water for home consumption or on-the-go needs. The on-trade channel, on the other hand, includes restaurants, cafes, hotels, and other establishments where bottled water is consumed on-site. This channel serves consumers who prefer to dine out or enjoy bottled water in social settings.

Global Bottled Water Market Regional Analysis

Based on region, the global Bottled Water market has been divided into North America, Europe, Asia-Pacific, South America and Middle East & Africa. North America is projected to dominate the use of the market followed by the Europe and Asia-Pacific regions.

North America Market

North America holds a significant share in the global bottled water market and is characterized by a mature and well-established industry. The region’s market growth is fueled by factors such as increasing health consciousness, changing lifestyles, and the need for convenient and safe hydration options. The United States, in particular, dominates the North American bottled water market. The country’s vast population, urbanization, and concerns over tap water quality have contributed to the steady demand for packaged drinking water. In recent years, the U.S. has witnessed a shift in consumer preferences from sugary beverages to healthier alternatives like bottled water. This trend is further supported by initiatives promoting healthier lifestyles and reducing sugar consumption.

In addition to the United States, Canada also plays a significant role in the North American bottled water market. The country boasts a high standard of living and a well-developed infrastructure, making bottled water easily accessible to consumers. Canada’s natural resources, including abundant freshwater sources, have also fueled the production and consumption of bottled water.

Asia Pacific Market

The Asia Pacific region presents vast growth opportunities for the bottled water market. Rapid urbanization, increasing disposable incomes, and growing health consciousness are driving the demand for safe and convenient drinking water options.

China, as one of the world’s most populous countries, represents a substantial market for bottled water in the Asia Pacific region. The country’s population density, coupled with concerns over tap water quality, has fueled the demand for packaged drinking water. Chinese consumers, particularly those residing in urban areas, prioritize the safety and purity of water, making bottled water an essential part of their daily lives.

India is another key market in the Asia Pacific region, with a significant population and a growing middle class. In India, the bottled water market has witnessed substantial growth due to factors such as inadequate access to clean drinking water, rising health awareness, and changing consumer preferences. The increasing urbanization and the need for convenient and safe hydration solutions have propelled the demand for bottled water in the country.

Competitive Landscape

The global Bottled Water market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as Type launches, and strategic alliances.

Prominent Players:

- Danone SA

- The Coca-Cola Company

- PepsiCo Inc.

- Nestle SA

- Otsuka Pharmaceutical Co. Ltd

- FIJI Water Company LLC

- Voss Water

- National Beverage Corp.

- Binzomah Group

- Hana Water-Hana Food Industries Co.

Key Development:

February 2020: Agthia Group PJSC announced the launch of Al Ain Plant Bottle, the region’s first plant-based water bottle. An MoU was also signed between Agthiaand Veolia, a global leader in optimized resource management, to launch a PET water bottle collection initiative in the United Arab Emirates.

Scope of the Report

Global Bottled Water Market, by Type

- Still Water

- Sparkling Water

- Functional Water

Global Bottled Water Market, by Distribution Channel

- Off-trade

- Non-Off-trade

Global Bottled Water Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Australia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Values |

|---|---|

| Market Size | 2033: USD 640.7 Billion |

| Compounded Average Growth Rate (CAGR) 2023 to 2033 | 6.54% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Distribution Channel |

| Key Market Opportunities | Emerging Markets Unlocking New Avenues |

| Key Market Drivers | Embracing a Healthier Lifestyle with Bottled Water |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Danone SA, The Coca-Cola Company, PepsiCo Inc., Nestle SA, Otsuka Pharmaceutical Co. Ltd, FIJI Water Company LLC, Voss Water, National Beverage Corp., Binzomah Group, and Hana Water-Hana Food Industries Co |

Report Content Brief:

- High-level analysis of the current and future Bottled Water market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Bottled Water market historical market size for the year 2021, and forecast from 2023 to 2033

- Bottled Water market share analysis at each Type level

- Competitor analysis with a detailed insight into its Type segment, Store strength, and strategies adopted.

- Identifies key strategies adopted including Type launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Bottled Water market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Store health of the company’s past 2-3 years with segmental and regional revenue breakup, Type offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Hydrogen Fuel Cell Market Analysis and Global Forecast 2023-2035

Hydrogen Fuel Cell Market Research Report: Information by Type (Proton Exchange Membrane Fuel cells, Phosphoric Acid Fuel Cells, Solid Oxide Fuel Cells, Molten Carbonate Fuel Cells, Others), By Application (Stationary, Transportation, Portable), By End-Use (Fuel Cell Vehicles, Utilities, Defense), and by Region — Forecast till 2033

Page: 116

HoReCa Market Analysis and Global Forecast 2023-2035

HoReCa Market Research Report: Information By Service Type (Hotels, Restaurants, Cafés, Pubs), By Category (Single Outlet, HoReCa Chain), and by Region — Forecast till 2035

Page: 116

Medical Nitrile Gloves Market Analysis and Global Forecast 2023-2033

Medical Nitrile Gloves Market Research Report: Information By Type (Powdered gloves, Non-powdered gloves), By Usage (Disposable, Reusable), By Application (Medical & Healthcare, Food Industry, Cleaning Industry, Others), By End Use (Ambulatory Surgery Centers, Diagnostic Centers, Rehabilitation Centers), and by Region — Forecast till 2033

Page: 116

Bidets Market Analysis and US Forecast 2023-2033

US Bidets Market By Type (Ceramic Bidets, Over the Rim Bidets, Handheld Bidets, Others), By Category (Electronics, Manual), By Distribution Channel (Store-Based, Non-Store-Based), By End Use (Residential, Commercial) and By Geography – COVID-19 Impact Analysis, Post COVID Analysis, Opportunities, Trends and Forecast from 2021 to 2028

Report Code: EB_LS_1279 | Page: 59 | Published Date: April 2022

Semiconductor Rectifiers Market Analysis and Global Forecast 2023-2033

Semiconductor Rectifiers Market Research Report: Information By Type (Half Wave, Full Wave), By Industry Vertical (Communication, Consumer Electronics, Automotive, Manufacturing), and by Region — Forecast till 2033

Page: 165

What is the study period of this market?

The study period of the global Bottled Water market is 2021- 2033

What is the growth rate of the global Bottled Water market?

The global Bottled Water market is growing at a CAGR of 6.5% over the next 10 years

Which region has the highest growth rate in the market of Bottled Water?

North America is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Bottled Water market?

Asia Pacific holds the largest share in 2022

Who are the key players in the global Bottled Water market?

Danone SA, The Coca-Cola Company, PepsiCo Inc., Nestle SA, Otsuka Pharmaceutical Co. Ltd, FIJI Water Company LLC, Voss Water, National Beverage Corp., Binzomah Group, and Hana Water-Hana Food Industries Co the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Bottled Water Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 4.5. Macro factor 4.6. Micro Factor 4.7.Demand Supply Gap Analysis of the Bottled Water Market 4.8.Import Analysis of the Bottled Water Market 4.9.Export Analysis of the Bottled Water Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Bottled Water Market, By Type 6.1. Introduction 6.2. Still Water 6.3. Sparkling Water Chapter 7. Global Bottled Water Market, By Distribution Channel 7.1. Introduction 7.2. Off-trade 7.3. Non-Off-trade Chapter 8. Global Bottled Water Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Type, 2023-2033 8.2.5. Market Size and Forecast, By Distribution Channel, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Type, 2023-2033 8.2.6.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Type, 2023-2033 8.2.7.5. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Type, 2023-2033 8.3.5. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Type, 2023-2033 8.3.6.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Type, 2023-2033 8.3.7.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Type, 2023-2033 8.3.6.5. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Type, 2023-2033 8.3.9.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Type, 2023-2033 8.3.11.4. Market Size and Forecast, By Distribution Channel, 2023-2033 6.5. Asia-Pacific 6.5.1. Introduction 6.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 6.5.3. Market Size and Forecast, By Country, 2023-2033 6.5.4. Market Size and Forecast, By Type, 2023-2033 6.5.5. Market Size and Forecast, By Distribution Channel, 2023-2033 6.5.6. China 6.5.6.1. Introduction 6.5.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 6.5.6.3. Market Size and Forecast, By Type, 2023-2033 6.5.6.4. Market Size and Forecast, By Distribution Channel, 2023-2033 6.5.7. India 6.5.7.1. Introduction 6.5.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 6.5.7.3. Market Size and Forecast, By Type, 2023-2033 6.5.7.4. Market Size and Forecast, By Distribution Channel, 2023-2033 6.5.8. Japan 6.5.8.1. Introduction 6.5.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 6.5.8.3. Market Size and Forecast, By Type, 2023-2033 6.5.6.5. Market Size and Forecast, By Distribution Channel, 2023-2033 6.5.9. South Korea 6.5.9.1. Introduction 6.5.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 6.5.9.3. Market Size and Forecast, By Type, 2023-2033 6.5.9.4. Market Size and Forecast, By Distribution Channel, 2023-2033 6.5.10. Rest Of Asia-Pacific 6.5.10.1. Introduction 6.5.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 6.5.10.3. Market Size and Forecast, By Type, 2023-2033 6.5.10.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Type, 2023-2033 8.5.4. Market Size and Forecast, By Distribution Channel, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Danone SA. 10.1.1. Business Overview 10.1.2. Non-Off-trade Analysis 10.1.2.1. Non-Off-trade – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. The Coca-Cola Company 10.2.1. Business Overview 10.2.2. Non-Off-trade Analysis 10.2.2.1. Non-Off-trade – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. PepsiCo Inc. 10.3.1. Business Overview 10.3.2. Non-Off-trade Analysis 10.3.2.1. Non-Off-trade – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Nestle SA 10.4.1. Business Overview 10.4.2. Non-Off-trade Analysis 10.4.2.1. Non-Off-trade – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. Otsuka Pharmaceutical Co. Ltd 10.5.1. Business Overview 10.5.2. Distribution Analysis 10.5.2.1. Non-Off-trade – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. FIJI Water Company LLC 10.6.1. Business Overview 10.6.2. Non-Off-trade Analysis 10.6.2.1. Non-Off-trade – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Voss Water 10.7.1. Business Overview 10.7.2. Non-Off-trade Analysis 10.7.2.1. Non-Off-trade – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8. National Beverage Corp. 10.8.1. Business Overview 10.8.2. Non-Off-trade Analysis 10.8.2.1. Non-Off-trade – Existing/Funding 10.8.3. Product Portfolio 10.6.5. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9. Binzomah Group 10.9.1. Business Overview 10.9.2. Non-Off-trade Analysis 10.9.2.1. Non-Off-trade – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Hana Water-Hana Food Industries Co. 10.10.1. Business Overview 10.10.2. Non-Off-trade Analysis 10.10.2.1. Non-Off-trade – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Pricing

| Report Type | Description | Price | How to Purchase |

|---|---|---|---|

| Full Report (200+ Pages PDF Report) | This report gives a detailed analysis of the industry which includes Market Dynamics, Industry Trends, Segmental, Regional and Country level market estimation & forecast to 2033, competitive landscape, and company profiles. (Customization Possible as per your need) | $3,475 | Click on Buy Now |

| Market Overview Report (10-15 Page PDF Summary Report) | This report gives a brief idea about the industry, without being too heavy on your budget. It gives you an understanding of current and future market scenarios (long-term and short-term), major dynamics and their impact analysis, top-level regional analysis, and competitive benchmarking of 10 key competitors in the market. (Customization Possible as per your need) | $250 | Connect with our Sales Representative by Email or Filling Form on the side |

| Competitive Intelligence Report (35-45 Pages PDF Report) | This report gives you a detailed understanding of key competitors in the market. This report includes competitive benchmarking of 15 key competitors, market share of the top 5 competitors, key strategies adopted by the top 5 players, and key market share acquisition strategies adopted in the market. (Customization Possible as per your need) | $750 | Connect with our Sales Representative by Email or Filling Form on the side |

| Excel Data Pack (Excel Report) | This report includes market Segmental, Regional, and Country level market estimation & forecast to 2033 in Excel format. (Customization Possible as per your need) | $2,499 | Connect with our Sales Representative by Email or Filling Form on the side |

Research Methodology