Automotive Ceramics Market Overview

The Automotive Ceramics Market Size is expected to reach USD 6.87 Billion by 2033. The Automotive Ceramics Market industry size accounted for USD 2.64 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.63% from 2023 to 2033. The Automotive Ceramics Market refers to the industry segment that deals with the production and sale of ceramic materials used in automotive applications. These ceramics are known for their high-performance characteristics, including resistance to high temperatures, wear, and corrosion, as well as their electrical insulation properties.

The market is driven by the increasing demand for high-performance and durable materials in the automotive industry, particularly with the growing adoption of electric and hybrid vehicles, which require advanced materials to improve efficiency and performance. The automotive ceramics market also benefits from advancements in ceramic manufacturing technologies and materials science, enabling the production of components with enhanced properties and lower costs.

Global Automotive Ceramics Market Synopsis

The COVID-19 pandemic significantly impacted the Automotive Ceramics Market. The pandemic caused widespread disruptions in global supply chains. Lockdowns, restrictions on manufacturing activities, and transportation challenges led to delays in the production and delivery of ceramic materials and components. Many automotive manufacturers faced shortages of critical parts, impacting their production schedules. The automotive industry experienced a sharp decline in vehicle sales during the early stages of the pandemic due to economic uncertainty, reduced consumer spending, and lockdown measures. This decline in vehicle sales reduced the demand for automotive ceramics used in new vehicle production. The pandemic accelerated certain trends in the automotive industry, such as the shift towards electric vehicles (EVs) and increased focus on sustainability. As the market gradually recovered, there was renewed interest in high-performance materials like ceramics that can enhance the efficiency and durability of EVs and other advanced automotive technologies.

Automotive Ceramics Market Dynamics

The major factors that have impacted the growth of Automotive Ceramics Market are as follows:

Drivers:

Ø Technological Increasing Vehicle Electrification

Automotive ceramics offer superior properties such as high thermal stability, wear resistance, corrosion resistance, and electrical insulation. These characteristics are essential for components that must perform reliably under extreme conditions, such as in engines, braking systems, and electronic devices. The rise of electric vehicles (EVs) and hybrid vehicles is a significant driver for the automotive ceramics market. Ceramics are used in various components of EVs, including battery systems, power electronics, and sensors, due to their ability to withstand high temperatures and improve overall vehicle efficiency and safety. Innovations in ceramic manufacturing processes, such as advanced sintering techniques and additive manufacturing (3D printing), have improved the production efficiency and reduced the costs of automotive ceramics. This has made high-performance ceramic components more accessible for use in a broader range of automotive applications.

Restraint:

- Perception of High Production Costs

The manufacturing processes for automotive ceramics, such as advanced sintering techniques and precision machining, can be expensive. The high cost of raw materials and the energy-intensive nature of ceramic production contribute to the overall expense, making ceramic components more costly compared to conventional materials like metals and plastics. Producing high-quality ceramic components requires specialized equipment and expertise. The complexity of these processes can lead to longer production times and lower yield rates, which can be a barrier for manufacturers aiming for large-scale production.

Opportunity:

⮚ Growing demand for Advanced Driver Assistance Systems (ADAS)

The growing implementation of ADAS in modern vehicles requires reliable and high-performance sensors and electronic components. Ceramics are essential in the production of sensors for ADAS, providing durability and accuracy in harsh automotive environments. The expansion of ADAS technology offers a substantial market for ceramic materials. The automotive industry’s focus on reducing vehicle weight to improve fuel efficiency and reduce emissions opens up opportunities for ceramics. Ceramics are lighter than many traditional materials, making them suitable for use in various automotive components without compromising strength and durability. This trend aligns with global efforts to achieve more sustainable and fuel-efficient transportation. The integration of ceramics with advanced manufacturing technologies, such as additive manufacturing (3D printing), offers new possibilities for customized and complex component designs. This can lead to more efficient production processes, reduced material waste, and the ability to create components with intricate geometries that were previously difficult to manufacture.

Automotive Ceramics Market Segment Overview

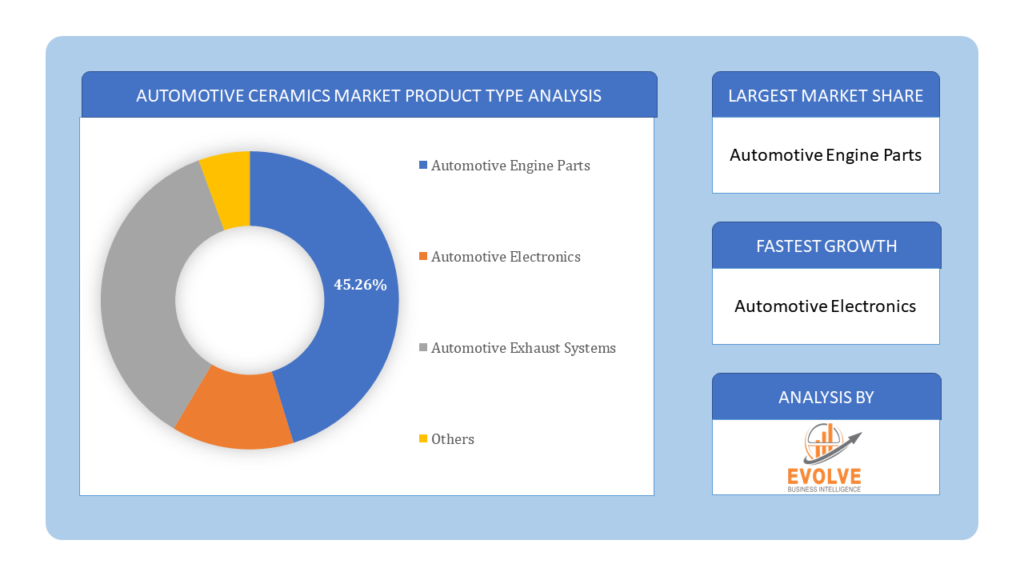

By Product Type

Based on Product Type, the market is segmented based on Automotive Engine Parts, Automotive Electronics, Automotive Exhaust Systems and Others. The Automotive Engine Parts segment dominant the market. High-performance ceramics are used in the insulator sections of spark plugs. These insulators must withstand high temperatures and electrical stresses, ensuring reliable engine ignition. Enhanced durability, improved electrical insulation, and resistance to thermal shock.

Based on Product Type, the market is segmented based on Automotive Engine Parts, Automotive Electronics, Automotive Exhaust Systems and Others. The Automotive Engine Parts segment dominant the market. High-performance ceramics are used in the insulator sections of spark plugs. These insulators must withstand high temperatures and electrical stresses, ensuring reliable engine ignition. Enhanced durability, improved electrical insulation, and resistance to thermal shock.

By Application

Based on Application, the market segment has been divided into the Passenger Vehicle and Commercial Vehicle. The Passenger Vehicle segment dominant the market, due to the adoption of new technologies, including automotive ceramics. Advancements in ceramic materials have led to their increased use in passenger vehicles for various applications, such as engine components, exhaust systems, brakes, and electronic components.

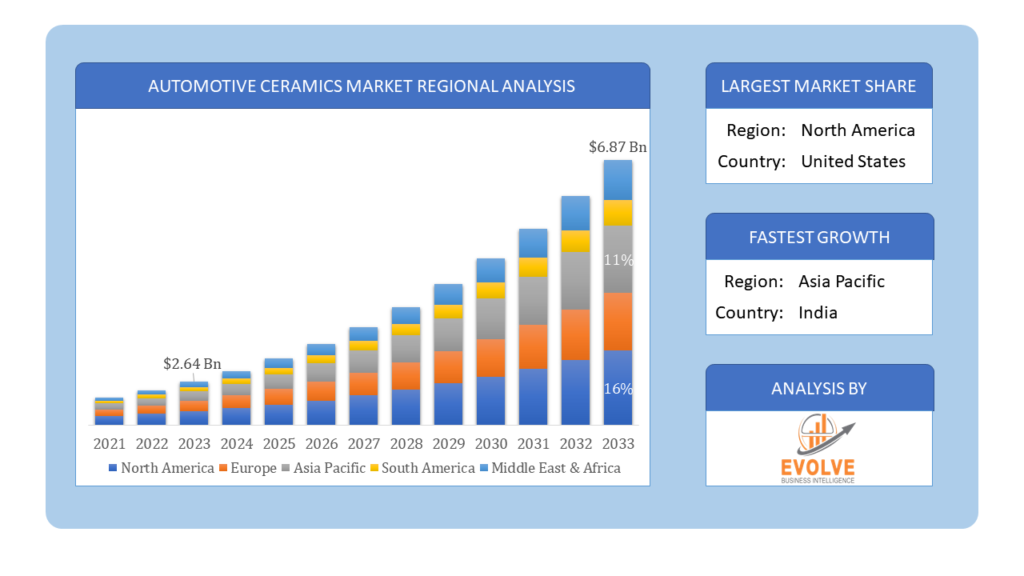

Global Automotive Ceramics Market Regional Analysis

Based on region, the global Automotive Ceramics Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Automotive Ceramics Market followed by the Asia-Pacific and Europe regions.

Automotive Ceramics North America Market

Automotive Ceramics North America Market

North America holds a dominant position in the Automotive Ceramics Market. The North American market for automotive ceramics is expected to grow steadily due to the increasing demand for high-performance vehicles and the focus on fuel efficiency and emission reduction. Stringent emission standards and fuel efficiency regulations foster the use of advanced materials like ceramics in vehicle components.

Automotive Ceramics Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Automotive Ceramics Market industry. Rapid growth of the automotive industry, particularly in China and India. Increasing government regulations on emission control, which drives the demand for components like catalytic converters made from automotive ceramics. Growing demand for lightweight and fuel-efficient vehicles, which is a key advantage of automotive ceramics

Competitive Landscape

The global Automotive Ceramics Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Conagra Brands Inc

- Kellogg Company

- Ajinomoto Co Inc

- Nestle

- Aryzta

- General Mills Inc

- Cargill Incorporated

- Associated British Foods

- The Kraft Heinz Company

- JBS S.A.

Key Development

In August 2022, Kyocera Corporation announced that it will construct a new production facility at its Kokubu Plant Campus in Kagoshima, Japan, to increase its production capacity of multilayer ceramic capacitors (MLCCs), strengthen engineering development capabilities, and ensure ample manufacturing space as Kyocera’s business expands.

Scope of the Report

Global Automotive Ceramics Market, by Product Type

- Automotive Engine Parts

- Automotive Electronics

- Automotive Exhaust Systems

- Others

Global Automotive Ceramics Market, by Application

- Passenger Vehicle

- Commercial Vehicle

Global Automotive Ceramics Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $6.87 Billion |

| CAGR | 5.63% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Almatis GmbH, Compagnie de Saint-Gobain S.A., CoorsTek Inc., Elan Technology, Ferrotec Corporation, Hoganas AB, International Syalons (Newcastle) Limited, Noritake Co. Ltd., Stanford Advanced Materials and Venator Materials Plc. |

| Key Market Opportunities | • The growing demand for Advanced Driver Assistance Systems (ADAS) • Integration with Advanced Manufacturing Technologies |

| Key Market Drivers | • Increasing Vehicle Electrification • Advancements in Manufacturing Technologies |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Automotive Ceramics Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Automotive Ceramics Market historical market size for the year 2021, and forecast from 2023 to 2033

- Automotive Ceramics Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Automotive Ceramics Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.