Beauty and Personal Care Market Analysis and Global Forecast 2023-2033

£1,047.96 – £4,161.69Price range: £1,047.96 through £4,161.69

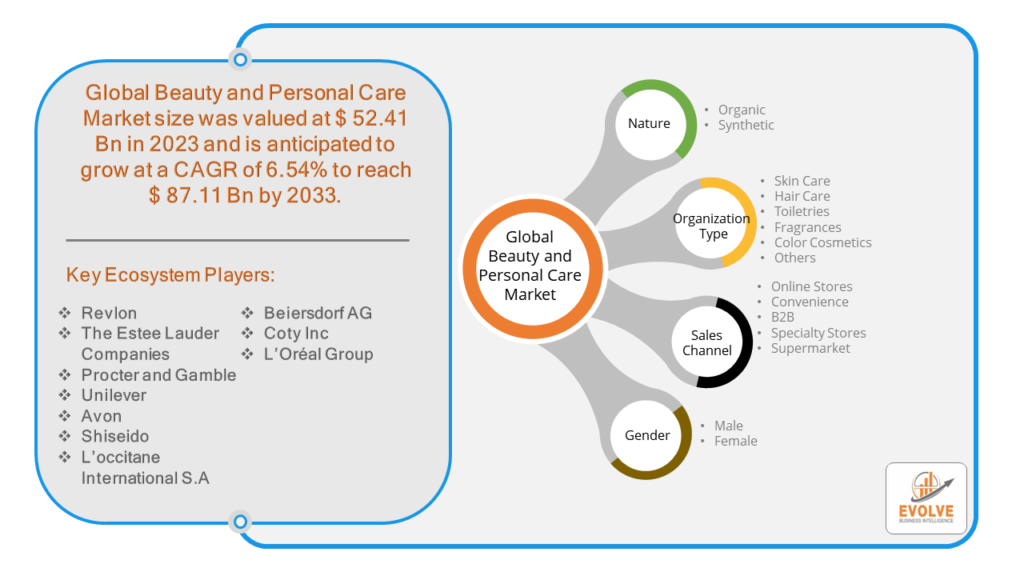

Beauty and Personal Care Market Research Report: Information By Nature (Organic, Synthetic,), By Organization Type (Skin Care, Hair Care, Toiletries, Fragrances, Color Cosmetics, Others), By Sales Channel (Online Stores, Convenience, B2B, Specialty Stores, Supermarket), By Gender (Male, Female), and by Region — Forecast till 2033

Page: 182

Beauty and Personal Care Market Overview

The Beauty and Personal Care Market Size is expected to reach USD 87.11 Billion by 2033. The Beauty and Personal Care Market industry size accounted for USD 52.41 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.54% from 2023 to 2033. The Beauty and Personal Care Market encompasses a wide range of products and services aimed at enhancing physical appearance and personal hygiene. This market is driven by factors such as increasing consumer awareness about personal grooming, the influence of social media and beauty trends, technological advancements in product formulation, and growing disposable incomes.

It is also influenced by the demand for natural and organic products, anti-aging solutions, and products tailored for specific demographics, such as men’s grooming products and beauty products for diverse skin tones.

Global Beauty and Personal Care Market Synopsis

The COVID-19 pandemic had a significant impact on the Beauty and Personal Care Market. With lockdowns and social distancing measures, many consumers reduced their spending on beauty products, particularly makeup, as social events and in-person interactions decreased. Many physical stores were temporarily closed, leading to a drop in in-store sales. This affected brands that relied heavily on brick-and-mortar retail. Consumers prioritized essential items over non-essential beauty products, impacting sales of luxury and discretionary beauty products. With more time spent at home, there was a surge in demand for skincare and self-care products as consumers focused on wellness and at-home treatments. Online sales of beauty products increased significantly as consumers shifted to online shopping. Brands that had strong e-commerce platforms or quickly adapted to digital sales channels saw growth.

Beauty and Personal Care Market Dynamics

The major factors that have impacted the growth of Beauty and Personal Care Market are as follows:

Drivers:

Ø Technological Advancements

Consumers are becoming more knowledgeable about the ingredients and benefits of beauty products, leading to informed purchasing decisions. Increased focus on health and wellness has driven demand for products that promote skin health and overall well-being. Advances in product formulations, such as anti-aging ingredients, long-lasting cosmetics, and multifunctional products, attract consumers. The integration of technology in beauty devices (e.g., facial cleansing brushes, LED therapy masks) enhances the consumer experience. Social media influencers and beauty bloggers play a significant role in shaping consumer preferences and trends. Accessible online content helps consumers learn about and feel confident in using new products. Online shopping offers convenience, a wide range of products, and personalized recommendations, driving consumer engagement and sales.

Restraint:

- Perception of Economic Instability

Economic downturns can lead to reduced consumer spending on non-essential items, including beauty and personal care products. Dependency on specific raw materials can lead to supply chain vulnerabilities and production delays. The presence of numerous brands and products can lead to market saturation, making it difficult for new entrants to establish a foothold. Rapid changes in beauty trends and consumer preferences require constant innovation and adaptation, which can be resource-intensive. Building and maintaining brand loyalty in a highly competitive market can be challenging, especially with the rise of new and niche brands.

Opportunity:

⮚ Growing demand for E-commerce Expansion

Continued growth in online shopping presents opportunities for brands to reach a broader audience through digital platforms. Leveraging DTC models can increase profit margins and foster direct customer relationships. Increasing demand for sustainable and eco-friendly products provides opportunities for brands to innovate with green formulations and packaging. Promoting transparency in ingredient sourcing and ethical practices can attract environmentally conscious consumers. The trend towards holistic health and wellness can be tapped by offering products that promote overall well-being, such as skincare with wellness benefits.

Beauty and Personal Care Market Segment Overview

By Nature

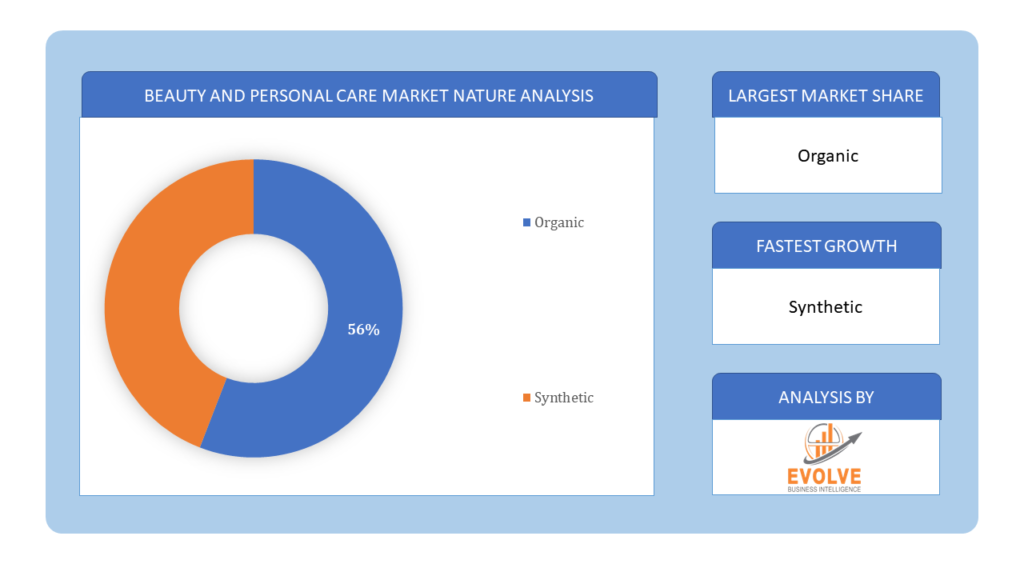

Based on Nature, the market is segmented based on Organic and Synthetic. The Organic segment dominant the market. Organic beauty products are often produced in a way that is more environmentally friendly, promoting sustainable farming practices and reducing the carbon footprint.

Based on Nature, the market is segmented based on Organic and Synthetic. The Organic segment dominant the market. Organic beauty products are often produced in a way that is more environmentally friendly, promoting sustainable farming practices and reducing the carbon footprint.

By Organization Type

Based on Organization Type, the market segment has been divided into the Skin Care, Hair Care, Toiletries, Fragrances, Color Cosmetics and Others. The Skin Care segment has largest global market. Products aimed is to hydrating the skin to prevent dryness and maintain a healthy skin barrier. These can range from lightweight lotions to rich creams. It encompassing a wide array of products designed to maintain and improve the health and appearance of the skin

By Sales Channel

Based on Sales Channel, the market segment has been divided into the Online Stores, Convenience, B2B, Specialty Stores and Supermarket. Supermarkets segment has the largest market share. The convenience and one-stop shopping experience offered by supermarkets and hypermarkets make them a popular retail channel among individuals. Consumers appreciate the ability to browse a wide array of products under one roof, making it easy to compare brands and prices. In addition to this, these retail outlets often provide promotional offers and discounts, incentivizing shoppers to purchase beauty and personal care items while doing their regular grocery shopping.

By Gender

Based on Gender, the market segment has been divided into the Male and Female. female represented the largest segment. The evolving societal norms and increased awareness of self-care are fueling the demand for beauty and personal care products among females. In recent years, there has been a significant shift towards inclusivity and breaking traditional gender stereotypes, encouraging people of all genders to take care of their appearance and well-being. As a result, beauty and personal care brands have started offering more gender-neutral and gender-specific products, catering to a diverse range of consumers.

Global Beauty and Personal Care Market Regional Analysis

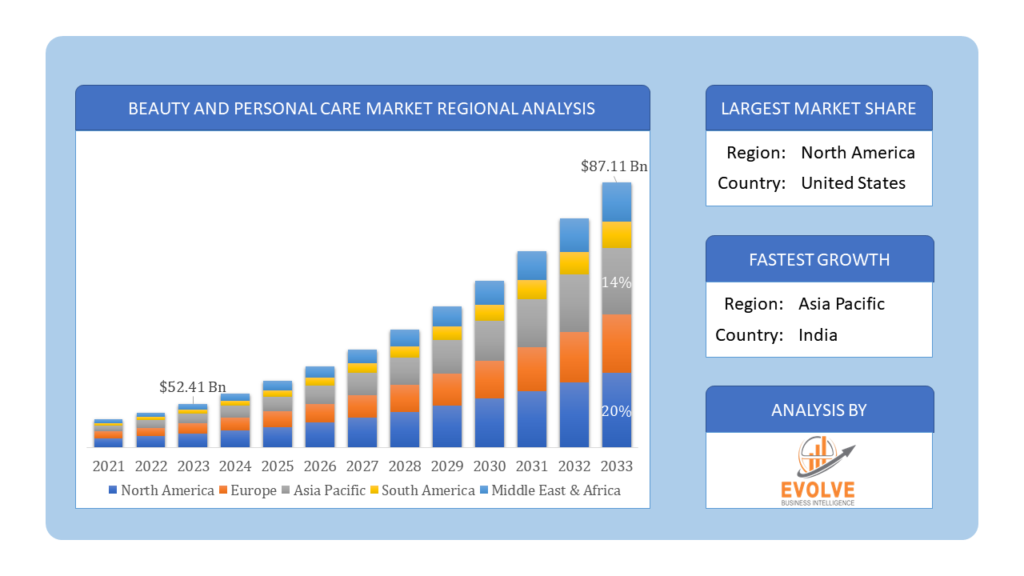

Based on region, the global Beauty and Personal Care Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Beauty and Personal Care Market followed by the Asia-Pacific and Europe regions.

North America Market

North America Market

North America holds a dominant position in the Beauty and Personal Care Market. North America has high demand for premium and innovative beauty products. Social media and influencer marketing play a significant role in consumer purchasing decisions. Wide range of products catering to various skin tones and hair types.

Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Beauty and Personal Care Market industry. Asia-Pacific is Fastest-growing market with increasing urbanization and rising disposable incomes. Strong influence of Korean and Japanese beauty trends. China is the powerhouse in this region, driven by factors like rising disposable income and a growing middle class.

Competitive Landscape

The global Beauty and Personal Care Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Revlon

- The Estee Lauder Companies

- Procter and Gamble

- Unilever

- Avon

- Shiseido

- L’occitane International S.A

- Beiersdorf AG

- Coty Inc

- L’Oréal Group

Key Development

In August 2023, Kao Corporation announced that it had signed an agreement to acquire the Bondi Sands, a renowned Australian sun product company that specializes in self-tanning, suncare, skincare, and body products.

In March 2023, Gillette Venus, a wholly owned subsidiary of Procter & Gamble launched its first-ever dermaplaning skincare regimen, complete with a trio of products for an easy three-step dermaplaning routine.

Scope of the Report

Global Beauty and Personal Care Market, by Nature

- Organic

- Synthetic

Global Beauty and Personal Care Market, by Organization Type

- Skin Care

- Hair Care

- Toiletries

- Fragrances

- Color Cosmetics

- Others

Global Beauty and Personal Care Market, by Sales Channel

- Online Stores

- Convenience

- B2B

- Specialty Stores

- Supermarket

Global Beauty and Personal Care Market, by Gender

- Male

- Female

Global Beauty and Personal Care Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $87.11 Billion |

| CAGR | 6.54% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Nature, Organization Type, Sales Channel, Gender |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Revlon, The Estee Lauder Companies, Procter and Gamble, Unilever, Avon, Shiseido, L’occitane International S.A, Beiersdorf AG, Coty Inc and L’Oréal Group |

| Key Market Opportunities | • Growing demand for E-commerce Expansion • Sustainability and Green Beauty |

| Key Market Drivers | • Technological Advancements • Digital and Social Media Influence |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Beauty and Personal Care Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Beauty and Personal Care Market historical market size for the year 2021, and forecast from 2023 to 2033

- Beauty and Personal Care Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Beauty and Personal Care Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Beauty and Personal Care Market?

The study period for the Beauty and Personal Care Market is from 2023 to 2033.

What is the growth rate of the Beauty and Personal Care Market?

The Beauty and Personal Care Market is expected to grow at a compound annual growth rate (CAGR) of 6.54% from 2023 to 2033.

Which region has the highest growth rate in the Beauty and Personal Care Market?

The Asia-Pacific region has the highest growth rate in the Beauty and Personal Care Market.

Which region has the largest share of the Beauty and Personal Care Market?

North America holds the largest share of the Beauty and Personal Care Market.

Who are the key players in the Beauty and Personal Care Market?

Key players in the Beauty and Personal Care Market include Revlon, The Estee Lauder Companies, Procter and Gamble, Unilever, Avon, Shiseido, L’occitane International S.A, Beiersdorf AG, Coty Inc, and L’Oréal Group.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Nature Segement – Market Opportunity Score 4.1.2. Organization Type Segment – Market Opportunity Score 4.1.3. Sales Channel Segment – Market Opportunity Score 4.1.4. Gender Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End Users 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Beauty and Personal Care Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Beauty and Personal Care Market, By Nature 7.1. Introduction 7.1.1. Organic 7.1.2. Synthetic CHAPTER 8. Beauty and Personal Care Market, By Organization Type 8.1. Introduction 8.1.1. Skin Care 8.1.2. Hair Care 8.1.3. Toiletries 8.1.4. Fragrances 8.1.5 Color Cosmetics 8.1.6 Others CHAPTER 9. Beauty and Personal Care Market, By Sales Channel 9.1. Introduction 9.1.1. Online Stores 9.1.2. Convenience 9.1.3 B2B 9.1.4 Specialty Stores 9.1.5 Supermarket CHAPTER 10. Beauty and Personal Care Market, By Gender 10.1.Introduction 10.1.1. Male 10.1.2. Female CHAPTER 11. Beauty and Personal Care Market, By Region 11.1. Introduction 11.2. NORTH AMERICA 11.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.2.2. North America: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.2.3. North America: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.2.4. North America: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.2.5. North America: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.2.6. US 11.2.6.1. US: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.2.6.2. US: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.2.6.3. US: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.2.6.4. US: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.2.7. CANADA 11.2.7.1. Canada: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.2.7.2. Canada: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.2.7.3. Canada: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.2.7.4. Canada: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.2.8. MEXICO 11.2.8.1. Mexico: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.2.8.2. Mexico: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.2.8.3. Mexico: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.2.8.4. Mexico: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.3. Europe 11.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.3.2. Europe: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.3.3. Europe: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.3.4. Europe: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.3.5. Europe: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.3.6. U.K. 11.3.6.1. U.K.: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.3.6.2. U.K.: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.3.6.3. U.K.: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.3.6.4. U.K.: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.3.7. GERMANY 11.3.7.1. Germany: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.3.7.2. Germany: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.3.7.3. Germany: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.3.7.4. Germany: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.3.8. FRANCE 11.3.8.1. France: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.3.8.2. France: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.3.8.3. France: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.3.8.4. France: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.3.9. ITALY 11.3.9.1. Italy: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.3.9.2. Italy: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.3.9.3. Italy: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.3.9.4. Italy: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.3.10. SPAIN 11.3.10.1. Spain: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.3.10.2. Spain: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.3.10.3. Spain: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.3.10.4. Spain: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.3.11. BENELUX 11.3.11.1. BeNeLux: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.3.11.2. BeNeLux: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.3.11.3. BeNeLux: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.3.11.4. BeNeLux: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.3.12. RUSSIA 11.3.12.1. Russia: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.3.12.2. Russia: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.3.12.3. Russia: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.3.12.4. Russia: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.3.13. REST OF EUROPE 11.3.13.1. Rest of Europe: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.3.13.2. Rest of Europe: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.3.13.3. Rest of Europe: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.3.13.4. Rest of Europe: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.4. Asia Pacific 11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.4.2. Asia Pacific: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.4.3. Asia Pacific: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.4.4. Asia Pacific: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.4.5. Asia Pacific: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.4.6. CHINA 11.4.6.1. China: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.4.6.2. China: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.4.6.3. China: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.4.6.4. China: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.4.7. JAPAN 11.4.7.1. Japan: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.4.7.2. Japan: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.4.7.3. Japan: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.4.7.4. Japan: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.4.8. INDIA 11.4.8.1. India: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.4.8.2. India: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.4.8.3. India: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.4.8.4. India: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.4.9. SOUTH KOREA 11.4.9.1. South Korea: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.4.9.2. South Korea: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.4.9.3. South Korea: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.4.9.4. South Korea: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.4.10. THAILAND 11.4.10.1. Thailand: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.4.10.2. Thailand: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.4.10.3. Thailand: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.4.10.4. Thailand: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.4.11. INDONESIA 11.4.11.1. Indonesia: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.4.11.2. Indonesia: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.4.11.3. Indonesia: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.4.11.4. Indonesia: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.4.12. MALAYSIA 11.4.12.1. Malaysia: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.4.12.2. Malaysia: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.4.12.3. Malaysia: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.4.12.4. Malaysia: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.4.13. AUSTRALIA 11.4.13.1. Australia: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.4.13.2. Australia: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.4.13.3. Australia: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.4.13.4. Australia: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.4.14. REST FO ASIA PACIFIC 11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.5. South America 11.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.5.2. South America: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.5.3. South America: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.5.4. South America: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.5.5. South America: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.5.6. BRAZIL 11.5.6.1. Brazil: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.5.6.2. Brazil: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.5.6.3. Brazil: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.5.6.4. Brazil: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.5.7. ARGENTINA 11.5.7.1. Argentina: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.5.7.2. Argentina: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.5.7.3. Argentina: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.5.7.4. Argentina: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.5.8. REST OF SOUTH AMERICA 11.5.8.1. Rest of South America: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.5.8.2. Rest of South America: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.5.8.3. Rest of South America: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.5.8.4. Rest of South America: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.6. Middle East & Africa 11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.6.2. Middle East & Africa: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.6.3. Middle East & Africa: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.6.4. Middle East & Africa: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.6.5. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.6. SAUDI ARABIA 11.6.6.1. Saudi Arabia: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.6.6.2. Saudi Arabia: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.6.6.3. Saudi Arabia: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.6.6.4. Saudi Arabia: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.6.7. UAE 11.6.7.1. UAE: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.6.7.2. UAE: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.6.7.3. UAE: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.6.7.4. UAE: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.6.8. EGYPT 11.6.8.1. Egypt: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.6.8.2. Egypt: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.6.8.3. Egypt: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.6.8.4. Egypt: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.6.9. SOUTH AFRICA 11.6.9.1. South Africa: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.6.9.2. South Africa: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.6.9.3. South Africa: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.6.9.4. South Africa: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) 11.6.10. REST OF MIDDLE EAST & AFRICA 11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Nature, 2023 – 2033 ($ Million) 11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Organization Type, 2023 – 2033 ($ Million) 11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Sales Channel, 2023 – 2033 ($ Million) 11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By Gender, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Revlon 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. The Estee Lauder Companies 13.3. Procter and Gamble 13.4. Unilever 13.5. Avon 13.6. Shiseido 13.7. L’occitane International S.A 13.8. Beiersdorf AG 13.9. Coty Inc 13.10. L’Oreal Group.

Connect to Analyst

Research Methodology