Automotive Suspension Market Overview

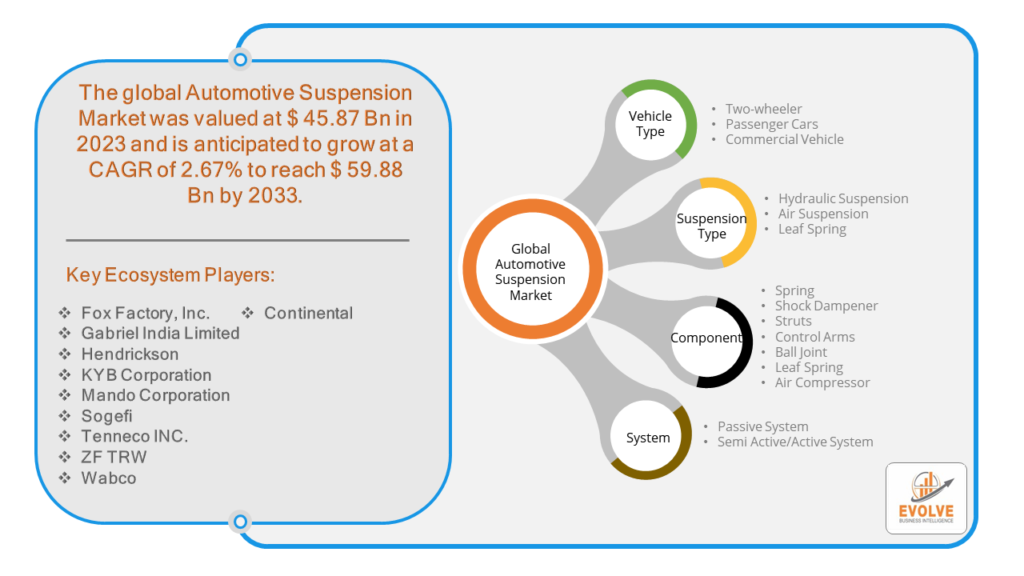

Automotive Suspension Market Size is expected to reach USD 59.88 Billion by 2033. The Automotive Suspension industry size accounted for USD 45.87 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 2.67% from 2023 to 2033. The automotive suspension market encompasses the industry segment dedicated to the design, manufacture, and sale of systems that support vehicle dynamics by absorbing shocks and ensuring stability. It includes various components such as springs, shock absorbers, struts, and control arms. Key factors driving this market include the increasing demand for passenger comfort, vehicle safety, and improved handling performance. Technological advancements like adaptive and semi-active suspensions are also propelling growth. The market caters to a wide range of vehicles, from passenger cars to commercial trucks, across both OEM (original equipment manufacturer) and aftermarket sectors.

Global Automotive Suspension Market Synopsis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the Automotive Suspension market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers adopting various strategies to stabilize the company.

Global Automotive Suspension Market Dynamics

The major factors that have impacted the growth of Automotive Suspension are as follows:

Drivers:

⮚ Technological Advancements

Innovations in suspension technology, such as adaptive and semi-active suspensions, have revolutionized the market. These systems automatically adjust the suspension settings in real-time based on road conditions and driving dynamics, significantly improving vehicle performance and safety.

Restraint:

- High Costs of Advanced Suspension Systems

The development and implementation of advanced suspension technologies, such as adaptive and semi-active systems, involve significant research and development costs. These high costs are often passed on to consumers, making such systems less affordable and limiting their adoption, particularly in cost-sensitive markets.

Opportunity:

⮚ Advancements in Materials and Manufacturing

Innovations in materials science and manufacturing processes provide opportunities to develop lighter, stronger, and more durable suspension components. For example, the use of advanced composites, high-strength steel, and aluminum alloys can enhance the performance and efficiency of suspension systems while reducing weight and improving fuel economy.

Automotive Suspension Market Segment Overview

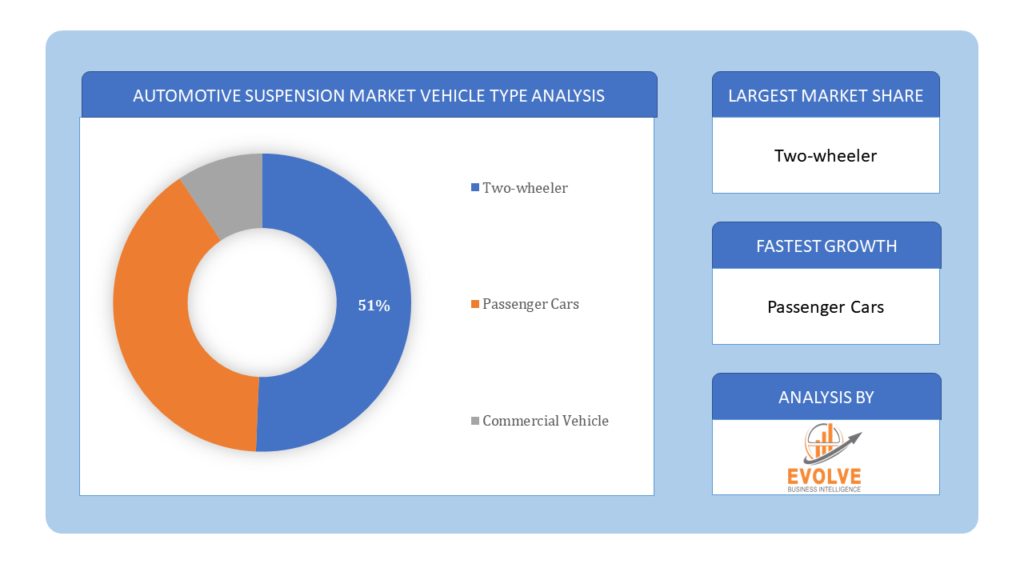

By Vehicle Type

Based on the Vehicle Type, the market is segmented based on Two-wheeler, Passenger Cars, Commercial Vehicle. The passenger car segment is followed by commercial vehicles, which require robust suspension systems to handle heavy loads and varying road conditions

Based on the Vehicle Type, the market is segmented based on Two-wheeler, Passenger Cars, Commercial Vehicle. The passenger car segment is followed by commercial vehicles, which require robust suspension systems to handle heavy loads and varying road conditions

By Suspension Type

Based on Suspension Type, the market has been divided into Hydraulic Suspension, Air Suspension, Leaf Spring. The dominant segment in the global automotive suspension market is the hydraulic suspension segment, which is widely used in various vehicles due to its reliability, durability, and ability to provide precise control over vehicle dynamics and ride quality.

By Component

Based on the Component, the market has been divided into Spring, Shock Dampener, Struts, Control Arms, Ball Joint, Leaf Spring, Air Compressor, Component 8. The global automotive suspension market is dominated by the shock dampener segment, which accounted for the largest market share. Shock dampeners are a critical component of the suspension system, as they help reduce vibrations and improve ride quality across a variety of road conditions.

By System

Based on System, the market has been divided into Passive System, Semi Active/Active System. The global automotive suspension market is dominated by passive suspension systems, which are widely used in various vehicles due to their reliability and cost-effectiveness.

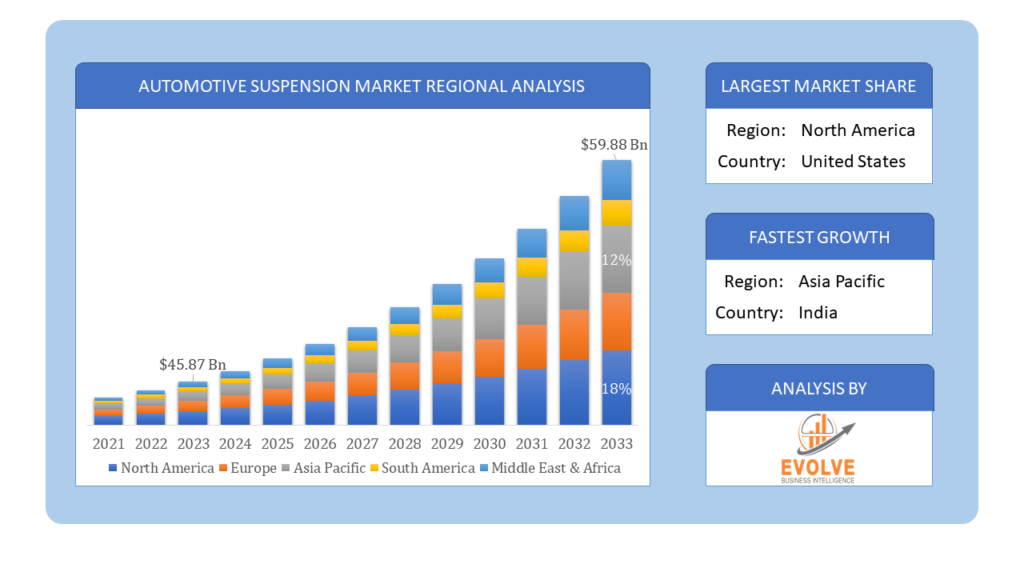

Global Automotive Suspension Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Automotive Suspension, followed by those in Asia-Pacific and Europe.

Automotive Suspension North America Market

Automotive Suspension North America Market

The North American region holds a dominant position in the Automotive Suspension market. The market for automotive suspension systems will be dominated by North America; expanding demand for passenger and commercial vehicles, stricter safety laws, and the introduction of cutting-edge suspension systems will all contribute to this region’s rapid market expansion.

Automotive Suspension Asia Pacific Market

The Asia-Pacific region is witnessing rapid growth and emerging as a significant market for the Automotive Suspension industry. From 2023 to 2032, the Automotive Suspension System Market in Asia-Pacific is anticipated to develop at the quickest compound annual growth rate (CAGR). This is a result of the region’s growing automobile manufacturing industry. In addition, the automotive suspension system market in China had the most market share, while the market in India had the quickest rate of growth in the Asia-Pacific area.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Fox Factory, Inc., Gabriel India Limited, Hendrickson, KYB Corporation, and Mando Corporation are some of the leading players in the global Automotive Suspension Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Fox Factory, Inc.

- Gabriel India Limited

- Hendrickson

- KYB Corporation

- Mando Corporation

- Sogefi

- Tenneco INC.

- ZF TRW

- Wabco

- Continental

Key Development:

In September 2022, KYB Corporation announced that it will conduct development of new electric power steering (EPS) systems and establish electric oil pump specifications to support its automotive components business

Scope of the Report

Global Automotive Suspension Market, by Vehicle Type

- Two-wheeler

- Passenger Cars

- Commercial Vehicle

Global Automotive Suspension Market, by Suspension Type

- Hydraulic Suspension

- Air Suspension

- Leaf Spring

Global Automotive Suspension Market, by Component

- Spring

- Shock Dampener

- Struts

- Control Arms

- Ball Joint

- Leaf Spring

- Air Compressor

Global Automotive Suspension Market, by System

- Passive System

- Semi Active/Active System

Global Automotive Suspension Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $59.88 Billion/strong> |

| CAGR | 2.67% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Vehicle Type, Suspension Type, Component, System |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Fox Factory, Inc., Gabriel India Limited, Hendrickson, KYB Corporation, Mando Corporation, Sogefi, Tenneco INC., ZF TRW, Wabco, Continental |

| Key Market Opportunities | Demand for a regenerative suspension system for electric and hybrid vehicles Advancements in lightweight components |

| Key Market Drivers | Increased safety regulations Introduction of innovative suspension systems Rising demand for commercial and passenger vehicles |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Automotive Suspension Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Automotive Suspension market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Automotive Suspension market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Automotive Suspension Market.