Automotive Fabric Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

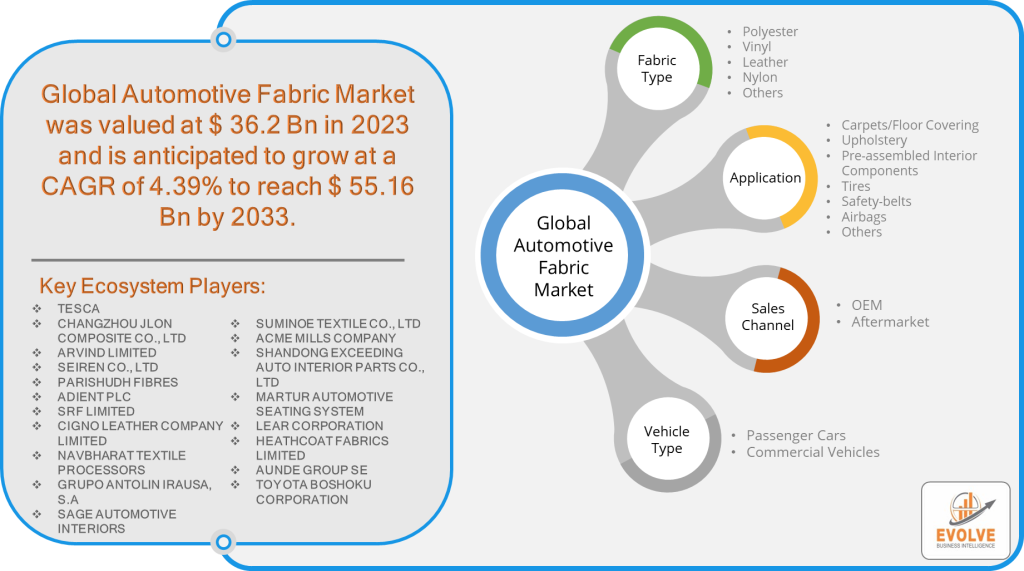

Automotive Fabric Market By Fabric Type (Polyester, Vinyl, Leather, Nylon, and Others), By Application (Carpets/Floor Covering, Upholstery, Pre-assembled Interior Components, Tires, Safety-belts, Airbags, and Others), By Sales Channel (OEM and Aftermarket), By Vehicle Type (Passenger Cars and Commercial Vehicles) and By Geography – COVID-19 Impact Analysis, Post COVID Analysis, Opportunities, Trends and Forecast from 2023 to 2033

Report Code: EB_LS_3007 | Page: 208 | Report Status: May 2023

Automotive Fabric Market Overview

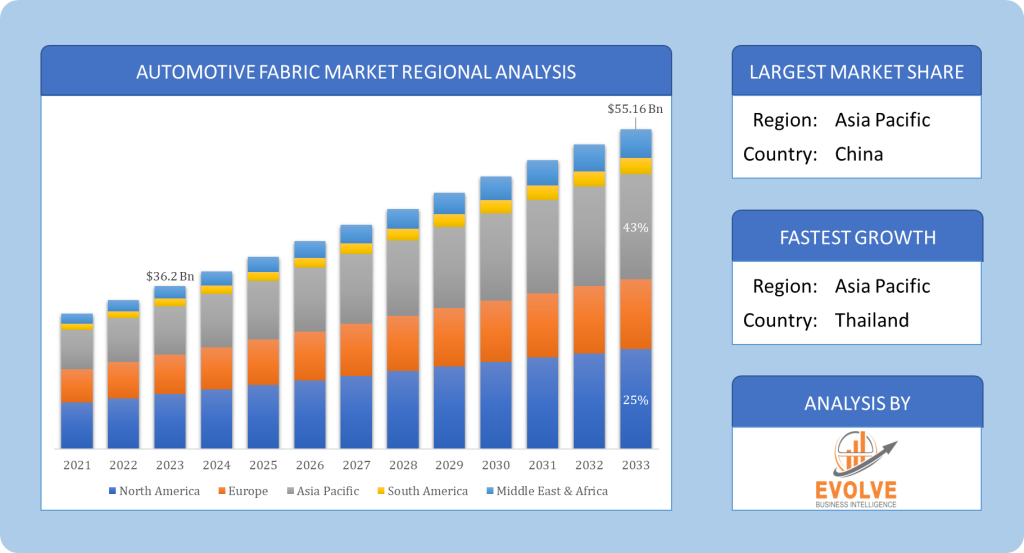

Automotive Fabric Market Size is expected to reach USD 55.16 Billion by 2033. The Automotive Fabric industry size accounted for USD 34.17 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.39% from 2023 to 2033. Automotive fabric is a type of fabric that is specifically designed for use in vehicles. It is typically made from synthetic fibers, such as polyester or nylon, and is often coated with a protective finish to make it resistant to wear, tear, and staining. Automotive fabrics are used in a variety of applications in vehicles, including: Upholstery, Airbags, and Safety belts, among other applications.

The automotive fabric market is growing due to a number of influencing factors such as, the increasing demand for lightweight and fuel-efficient vehicles, growing popularity of premium and luxury vehicles, increasing demand for safety features in vehicles, and increasing focus on sustainability in the automotive industry. In addition, the development of new synthetic fibers and coating technologies is also driving the growth of the automotive fabric market. These new materials offer improved performance properties, such as flame retardancy, stain resistance, and UV resistance. This is making them increasingly attractive to automakers, who are looking for ways to improve the safety, comfort, and durability of their vehicles.

Global Automotive Fabric Market Synopsis

COVID-19 Impact Analysis

The COVID-19 pandemic had a significant impact on the automotive fabric market, as it led to a decline in vehicle production and sales. However, the market is expected to recover in the post-COVID-19 period, as automakers resume production and sales. The pandemic had a number of specific impacts on the automotive fabric market, including:

A decline in vehicle production and sales: The COVID-19 pandemic led to a decline in vehicle production and sales, as automakers were forced to shut down plants and dealerships. This led to a decrease in demand for automotive fabrics.

Increased focus on safety: The COVID-19 pandemic also led to an increased focus on safety in vehicles. This led to an increased demand for automotive fabrics that are flame retardant, stain resistant, and UV resistant.

Shift in consumer preferences: The COVID-19 pandemic also led to a shift in consumer preferences. Consumers are now more interested in vehicles that are comfortable, durable, and easy to clean. This is leading to an increased demand for automotive fabrics that meet these needs.

The post-COVID-19 scenario for the automotive fabric market is expected to be positive. This is because the market is expected to recover as automakers resume production and sales. In addition, the market is expected to benefit from the increasing focus on safety and the shift in consumer preferences. As a result, the automotive fabric market is expected to grow in the coming years.

Global Automotive Fabric Market Dynamics

The major factors that have impacted the growth of Automotive Fabric are as follows:

Drivers:

- Increasing demand for lightweight and fuel-efficient vehicles

The increasing demand for lightweight and fuel-efficient vehicles is a major driving factor for the growth of the automotive fabric market. Automakers are using lightweight automotive fabrics to make their vehicles lighter, improve fuel efficiency, and improve the comfort and appearance of their vehicles. For instance, Ford recently announced that it will be using lightweight automotive fabrics in its new Mustang Mach-E electric vehicle. This will help to make the vehicle lighter and more fuel-efficient, while also improving the comfort and appearance of the interior. As the demand for these vehicles continues to grow, the demand for lightweight automotive fabrics is expected to continue to grow as well.

Restraint:

- Government regulations

The automotive fabric market is facing increasing competition from substitute materials, such as leather and synthetic leather. These materials offer a number of advantages over automotive fabrics, including a more luxurious and premium look, durability, and the ability to be made to look like a variety of different materials. As the demand for these substitute materials continues to grow, the demand for automotive fabrics is expected to decline. For instance, BMW recently announced that it will be using synthetic leather in its new 7 Series sedan. This is because synthetic leather offers a number of advantages over traditional automotive fabrics, including durability, appearance, and luxury. The increasing competition from substitute materials is a major restraint for the growth of the automotive fabric market.

Opportunity:

- Increasing demand for sustainable fabrics

Consumers are increasingly demanding products that are made from sustainable materials, and this is driving demand for sustainable automotive fabrics. Automakers are responding to this demand by developing new automotive fabrics that are made from sustainable materials, such as recycled plastics and natural fibers. For instance, Ford recently announced that it will be using recycled plastic in the seats of its new Mustang Mach-E electric vehicle. This is a major step forward for the automotive industry, as it shows that automakers are committed to using sustainable materials in their vehicles. As the demand for sustainable fabrics continues to grow, the automotive fabric market is expected to see significant growth in the coming years. Automakers that are able to develop innovative and sustainable automotive fabrics will be well-positioned to succeed in this growing market.

Automotive Fabric Market Segment Overview

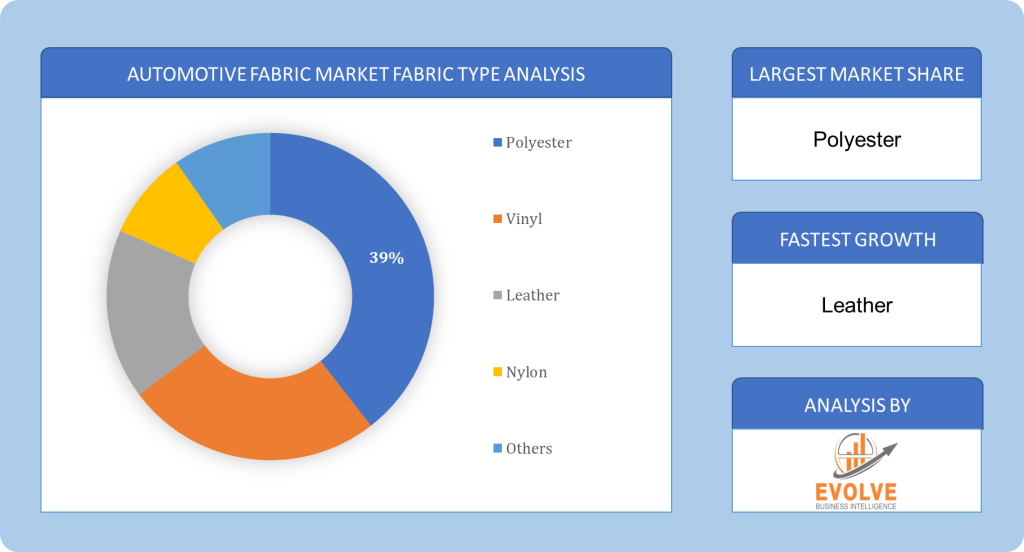

By Fabric Type

Based on the Fabric Type, the market is segmented based on Polyester, Vinyl, Leather, and Nylon, among others. The Polyester segment holds the largest market share in the global Automotive Fabric market. This is due to its many advantages, such as its durability, strength, and resistance to wear and tear. Vinyl is also a popular choice for automotive fabrics, as it is water-resistant, durable, and easy to clean. Leather is a more luxurious option, but it is also more expensive. Nylon is often used in safety-critical applications, such as safety belts and airbags.

By Application

Based on Application, the market has been divided into carpets/floor covering, upholstery, pre-assembled interior components, tires, safety-belts, and airbags, among others. The upholstery segment is expected to hold the largest market share in the Automotive Fabric market as it is used in a variety of areas in a vehicle, such as seats, door panels, and dashboards. Carpets/Floor Covering is the second most popular application, as it is used to cover the floors of vehicles.

By Sales Channel

Based on Sales Channel, the market has been divided into OEM, and Aftermarket. The Automotive Fabric market is projected to see significant share in the OEM segment. The market share of the OEM segment is expected to decline in the future as more and more consumers opt for aftermarket automotive fabrics. This is because aftermarket automotive fabrics are often more affordable and offer a wider range of options than OEM automotive fabrics.

By Vehicle Type

Based on the Vehicle Type, the market is segmented into Passenger Cars, and Commercial Vehicles. This is because passenger cars are more numerous than commercial vehicles, and they also tend to use more automotive fabrics in their interiors. Commercial vehicles, on the other hand, often use more durable and heavy-duty automotive fabrics, such as vinyl and nylon.

Global Automotive Fabric Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of Asia-Pacific is anticipated to dominate the market for the usage of Automotive Fabric, followed by those in North America and Europe.

Asia Pacific Market

Asia Pacific is the fastest growing segment in Automotive Fabric market. The growth of the automotive fabrics market in Asia-Pacific is being driven by the increasing demand for automotive vehicles, premium and luxury vehicles, and the development of new technologies. The top 5 countries in Asia-Pacific with the largest automotive fabrics market share in 2022 are China, Japan, India, South Korea, and Thailand.

North America Market

North America is the second largest region in Automotive Fabric market in 2022. The growth of the automotive fabrics market in North America is being driven by the increasing demand for automotive vehicles, premium and luxury vehicles, and the development of new technologies.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Lear Corporation, ACME Mills, Toyota Boshoku Corporation, Suminoe Textile Co., Ltd., and Sage Automotive Interiors, Inc. are some of the leading players in the global Automotive Fabric Industry. These players holds around 50% of the global automotive fabric market.

Key Market Players:

- TESCA

- CHANGZHOU JLON COMPOSITE CO., LTD

- ARVIND LIMITED

- SEIREN CO., LTD

- PARISHUDH FIBRES

- ADIENT PLC

- SRF LIMITED

- CIGNO LEATHER COMPANY LIMITED

- NAVBHARAT TEXTILE PROCESSORS

- GRUPO ANTOLIN IRAUSA, S.A

- SAGE AUTOMOTIVE INTERIORS (SUBSIDIARY OF ASAHI KASEI CORPORATION)

- SUMINOE TEXTILE CO., LTD

- ACME MILLS COMPANY

- SHANDONG EXCEEDING AUTO INTERIOR PARTS CO., LTD

- MARTUR AUTOMOTIVE SEATING SYSTEM

- LEAR CORPORATION

- HEATHCOAT FABRICS LIMITED

- AUNDE GROUP SE

- TOYOTA BOSHOKU CORPORATION

Key Development:

- In February 2023, Lear Corporation announced a new partnership with BASF to develop sustainable automotive fabrics. The partnership will focus on developing fabrics made from recycled materials, such as PET bottles and nylon waste.

- In March 2023, ACME Mills announced the launch of its new antimicrobial fabric. The fabric is designed to help prevent the growth of bacteria and mold, which can be a problem in automotive interiors.

Scope of the Report

Global Automotive Fabric Market, by Fabric Type

- Polyester

- Vinyl

- Leather

- Nylon

- Others

Global Automotive Fabric Market, by Application

- Carpets/Floor Covering

- Upholstery

- Pre-assembled Interior Components

- Tires

- Safety-belts

- Airbags

- Others

Global Automotive Fabric Market, by Sales Channel

- OEM

- Aftermarket

Global Automotive Fabric Market, by Vehicle Type

- Passenger Cars

- Commercial Vehicles

Global Automotive Fabric Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Values |

|---|---|

| Market Size | 2033: USD 55.16 Billion |

| Compounded Average Growth Rate (CAGR) 2023 to 2033 | 4.39% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Fabric Type, Application, Sales Channel, Vehicle Type |

| Key Market Opportunities | Rise in demand for environment-friendly fabric material Rise in demand for low-weight automotive fabric to reduce vehicle pollution |

| Key Market Drivers | Rise in sale of vehicles Surging demand for Advanced Airbag Fabrics Increase in demand for Non-Woven Fabrics Implementation of stringent government safety standards for usage of airbags, safety-belts, and others |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | TESCA, CHANGZHOU JLON COMPOSITE CO., LTD, ARVIND LIMITED, SEIREN CO., LTD., PARISHUDH FIBRES, ADIENT PLC, SRF LIMITED, CIGNO LEATHER COMPANY LIMITED, NAVBHARAT TEXTILE PROCESSORS, GRUPO ANTOLIN IRAUSA, S.A., SAGE AUTOMOTIVE INTERIORS (SUBSIDIARY OF ASAHI KASEI CORPORATION), SUMINOE TEXTILE CO., LTD., ACME MILLS COMPANY, SHANDONG EXCEEDING AUTO INTERIOR PARTS CO., LTD, MARTUR AUTOMOTIVE SEATING SYSTEM, LEAR CORPORATION, HEATHCOAT FABRICS LIMITED, AUNDE GROUP SE, TOYOTA BOSHOKU CORPORATION |

Report Content Brief:

- High-level analysis of the current and future Automotive Fabric Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Automotive Fabric market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Automotive Fabric market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Automotive Fabric Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Fabric Type Segement – Market Opportunity Score 4.1.2. Application Segement – Market Opportunity Score 4.1.3. Vehicle Type Segment – Market Opportunity Score 4.1.4. Sales Channel Segment – Market Opportunity Score 4.1.5. Regional Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material Providers 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Automotive Fabric Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. Market Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Rise in sale of vehicles 6.2.2. Surging demand for Advanced Airbag Fabrics 6.2.3. Increase in demand for Non-Woven Fabrics 6.2.4. Implementation of stringent government safety standards for usage of airbags, safety-belts, and others 6.3. Restraints 6.3.1. Rise in raw material cost and growing opposition for the use of leather 6.4. Opportunity 6.4.1. Rise in demand for environment-friendly fabric material 6.4.2. Rise in demand for low-weight automotive fabric to reduce vehicle pollution CHAPTER 7. Global Automotive Fabric Market, By Fabric Type 7.1. Introduction 7.1.1. Vinyl 7.1.2. Polyester 7.1.3. Leather 7.1.4. Nylon 7.1.5. Others CHAPTER 8. Global Automotive Fabric Market, By Application 8.1. Introduction 8.1.1. Carpets/Floor Covering 8.1.2. Upholstery 8.1.3. Pre-assembled Interior Components 8.1.4. Tires 8.1.5. Safety-belts 8.1.6. Airbags 8.1.7. Others CHAPTER 9. Global Automotive Fabric Market, By Vehicle Type 9.1. Introduction 9.1.1. Passenger Cars 9.1.2. Commercial vehicle CHAPTER 10. Global Automotive Fabric Market, By Sales Channel 10.1. Introduction 10.1.1. OEM 10.1.2. Aftermarket CHAPTER 11. Global Automotive Fabric Market, By Region 11.1. Introduction 11.2. North America 11.2.1. North America: Market Size and Forecast, By Country, 2021 – 2033 ($ Million) 11.2.2. North America: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.2.3. North America: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.2.4. North America: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.2.5. North America: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.2.6. US 11.2.7. US: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.2.8. US: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.2.9. US: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.2.10. US: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.2.11. Canada 11.2.11.1. Canada: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.2.11.2. Canada: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.2.11.3. Canada: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.2.11.4. Canada: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.2.12. Mexico 11.2.12.1. Mexico: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.2.12.2. Mexico: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.2.12.3. Mexico: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.2.12.4. Mexico: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.3. Europe 11.3.1. Europe: Market Size and Forecast, By Country, 2021 – 2033 ($ Million) 11.3.2. Europe: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.3.3. Europe: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.3.4. Europe: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.3.5. Europe: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.3.6. U.K. 11.3.6.1. U.K.: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.3.6.2. U.K.: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.3.6.3. U.K.: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.3.6.4. U.K.: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.3.7. Germany 11.3.7.1. Germany: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.3.7.2. Germany: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.3.7.3. Germany: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.3.7.4. Germany: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.3.8. France 11.3.8.1. France: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.3.8.2. France: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.3.8.3. France: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.3.8.4. France: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.3.9. Italy 11.3.9.1. Italy: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.3.9.2. Italy: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.3.9.3. Italy: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.3.9.4. Italy: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.3.10. Spain 11.3.10.1. Spain: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.3.10.2. Spain: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.3.10.3. Spain: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.3.10.4. Spain: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.3.11. BeNeLux 11.3.11.1. BeNeLux: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.3.11.2. BeNeLux: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.3.11.3. BeNeLux: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.3.11.4. BeNeLux: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.3.12. Russia 11.3.12.1. Russia: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.3.12.2. Russia: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.3.12.3. Russia: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.3.12.4. Russia: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.3.13. Rest of Europe 11.3.13.1. Rest of Europe: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.3.13.2. Rest of Europe: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.3.13.3. Rest of Europe: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.3.13.4. Rest of Europe: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.4. Asia Pacific 11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2021 – 2033 ($ Million) 11.4.2. Asia Pacific: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.4.3. Asia Pacific: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.4.4. Asia Pacific: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.4.5. Asia Pacific: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.4.6. China 11.4.6.1. China: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.4.6.2. China: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.4.6.3. China: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.4.6.4. China: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.4.7. Japan 11.4.7.1. Japan: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.4.7.2. Japan: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.4.7.3. Japan: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.4.7.4. Japan: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.4.8. India 11.4.8.1. India: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.4.8.2. India: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.4.8.3. India: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.4.8.4. India: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.4.9. South Korea 11.4.9.1. South Korea: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.4.9.2. South Korea: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.4.9.3. South Korea: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.4.9.4. South Korea: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.4.10. Thailand 11.4.10.1. Thailand: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.4.10.2. Thailand: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.4.10.3. Thailand: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.4.10.4. Thailand: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.4.11. Indonesia 11.4.11.1. Indonesia: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.4.11.2. Indonesia: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.4.11.3. Indonesia: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.4.11.4. Indonesia: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.4.12. Malaysia 11.4.12.1. Malaysia: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.4.12.2. Malaysia: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.4.12.3. Malaysia: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.4.12.4. Malaysia: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.4.13. Australia 11.4.13.1. Australia: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.4.13.2. Australia: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.4.13.3. Australia: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.4.13.4. Australia: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.4.14. Rest of Asia Pacific 11.4.14.1. Rest of Asia Pacific: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.4.14.2. Rest of Asia Pacific: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.4.14.3. Rest of Asia Pacific: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.4.14.4. Rest of Asia Pacific: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.5. South America 11.5.1. South America: Market Size and Forecast, By Country, 2021 – 2033 ($ Million) 11.5.2. South America: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.5.3. South America: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.5.4. South America: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.5.5. South America: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.5.6. Brazil 11.5.6.1. Brazil: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.5.6.2. Brazil: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.5.6.3. Brazil: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.5.6.4. Brazil: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.5.7. Argentina 11.5.7.1. Argentina: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.5.7.2. Argentina: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.5.7.3. Argentina: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.5.7.4. Argentina: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.5.8. Rest of South America 11.5.8.1. Rest of South America: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.5.8.2. Rest of South America: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.5.8.3. Rest of South America: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.5.8.4. Rest of South America: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.6. Middle East & Africa 11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2021 – 2033 ($ Million) 11.6.2. Middle East & Africa: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.6.3. Middle East & Africa: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.6.4. Middle East & Africa: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.6.5. Middle East & Africa: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.6.6. Saudi Arabia 11.6.6.1. Saudi Arabia: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.6.6.2. Saudi Arabia: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.6.6.3. Saudi Arabia: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.6.6.4. Saudi Arabia: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.6.7. UAE 11.6.7.1. UAE: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.6.7.2. UAE: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.6.7.3. UAE: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.6.7.4. UAE: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.6.8. Egypt 11.6.8.1. Egypt: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.6.8.2. Egypt: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.6.8.3. Egypt: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.6.8.4. Egypt: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.6.9. South Africa 11.6.9.1. South Africa: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.6.9.2. South Africa: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.6.9.3. South Africa: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.6.9.4. South Africa: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) 11.6.10. Rest of Middle East & Africa 11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Fabric Type, 2021 – 2033 ($ Million) 11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Vehicle Type, 2021 – 2033 ($ Million) 11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By Sales Channel, 2021 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. TESCA 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. CHANGZHOU JLON COMPOSITE CO., LTD 13.3. ARVIND LIMITED 13.4. SEIREN CO., LTD 13.5. PARISHUDH FIBRES 13.6. ADIENT PLC 13.7. SRF LIMITED 13.8. CIGNO LEATHER COMPANY LIMITED 13.9. NAVBHARAT TEXTILE PROCESSORS 13.10. GRUPO ANTOLIN IRAUSA, S.A 13.11. SAGE AUTOMOTIVE INTERIORS (SUBSIDIARY OF ASAHI KASEI CORPORATION) 13.12. SUMINOE TEXTILE CO., LTD 13.13. ACME MILLS COMPANY 13.14. SHANDONG EXCEEDING AUTO INTERIOR PARTS CO., LTD 13.15. MARTUR AUTOMOTIVE SEATING SYSTEM 13.16. LEAR CORPORATION 13.17. HEATHCOAT FABRICS LIMITED 13.18. AUNDE GROUP SE 13.19. TOYOTA BOSHOKU CORPORATION

Connect to Analyst

Pricing

| Report Type | Description | Price | How to Purchase |

|---|---|---|---|

| Full Report (200+ Pages PDF Report) | This report gives a detailed analysis of the industry which includes Market Dynamics, Industry Trends, Segmental, Regional and Country level market estimation & forecast to 2033, competitive landscape, and company profiles. (Customization Possible as per your need) | $3,475 | Click on Buy Now |

| Market Overview Report (10-15 Page PDF Summary Report) | This report gives a brief idea about the industry, without being too heavy on your budget. It gives you an understanding of current and future market scenarios (long-term and short-term), major dynamics and their impact analysis, top-level regional analysis, and competitive benchmarking of 10 key competitors in the market. (Customization Possible as per your need) | $250 | Connect with our Sales Representative by Email or Filling Form on the side |

| Competitive Intelligence Report (35-45 Pages PDF Report) | This report gives you a detailed understanding of key competitors in the market. This report includes competitive benchmarking of 15 key competitors, market share of the top 5 competitors, key strategies adopted by the top 5 players, and key market share acquisition strategies adopted in the market. (Customization Possible as per your need) | $750 | Connect with our Sales Representative by Email or Filling Form on the side |

| Excel Data Pack (Excel Report) | This report includes market Segmental, Regional, and Country level market estimation & forecast to 2033 in Excel format. (Customization Possible as per your need) | $2,499 | Connect with our Sales Representative by Email or Filling Form on the side |

Research Methodology