Automotive Chassis Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

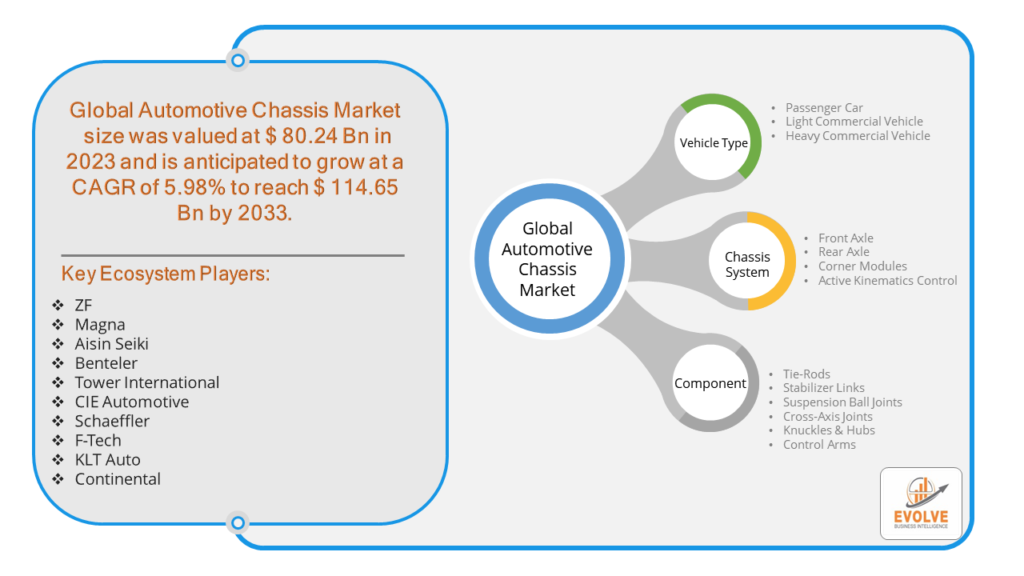

Automotive Chassis Market Research Report: Information By Vehicle Type (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle), By Chassis System (Front Axle, Rear Axle, Corner Modules, Active Kinematics Control), By Component (Tie-Rods, Stabilizer Links, Suspension Ball Joints, Cross-Axis Joints, Knuckles & Hubs, Control Arms), and by Region — Forecast till 2033

Page: 169

Automotive Chassis Market Overview

The Automotive Chassis Market Size is expected to reach USD 114.65 Billion by 2033. The Automotive Chassis Market industry size accounted for USD 80.24 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.98% from 2023 to 2033. The automotive chassis is the structural framework of a vehicle that supports all its components, including the engine, transmission, suspension, wheels, and body. It serves as the backbone of the vehicle, providing the necessary strength, stability, and rigidity to ensure proper alignment and functioning of these components. The chassis plays a crucial role in the vehicle’s performance, safety, and handling characteristics. It is typically constructed from materials such as steel, aluminum, or composites to achieve an optimal balance between durability, weight, and cost. The design and construction of the chassis are fundamental to the overall structural integrity and efficiency of the vehicle.

Global Automotive Chassis Market Synopsis

The COVID-19 pandemic had several impacts on the Automotive Chassis Market. Disruptions in global supply chains and temporary shutdowns of manufacturing plants led to production delays and shortages of essential materials, affecting the availability of automotive chassis components. Additionally, reduced consumer spending and economic uncertainty resulted in decreased vehicle sales, which dampened demand for new chassis production. However, the pandemic also accelerated the industry’s focus on innovation and the adoption of advanced manufacturing technologies to enhance efficiency and resilience. Furthermore, the increasing emphasis on electric and hybrid vehicles opened new opportunities for chassis design and development, driving market recovery and growth in the post-pandemic period.

Automotive Chassis Market Dynamics

The major factors that have impacted the growth of the Automotive Chassis Market are as follows:

Drivers:

Ø Increasing Demand for Lightweight and Fuel-Efficient Vehicles

The push for improved fuel efficiency and reduced emissions is driving the demand for lightweight automotive chassis. Advanced materials like high-strength steel, aluminum, and composites are being increasingly used to reduce vehicle weight while maintaining structural integrity, enhancing fuel efficiency, and meeting stringent environmental regulations.

Restraint:

- High Costs of Advanced Materials and Manufacturing Processes

The use of advanced materials and manufacturing technologies to produce lightweight and high-performance chassis components often results in higher production costs. This can be a significant barrier, especially for manufacturers operating in price-sensitive markets, limiting the widespread adoption of these technologies.

Opportunity:

⮚ Growth of Electric and Hybrid Vehicles

The rising adoption of electric and hybrid vehicles presents significant opportunities for the automotive chassis market. These vehicles require specialized chassis designs to accommodate battery packs and electric drivetrains. The shift towards electrification is driving innovation in chassis design and materials, opening new avenues for market growth and differentiation.

Automotive Chassis Market Segment Overview

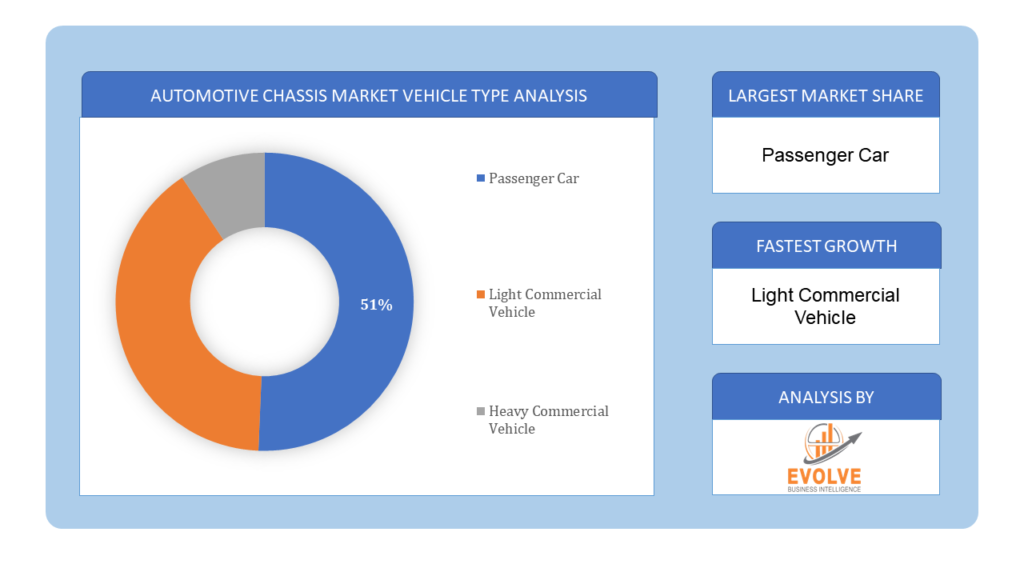

By Vehicle Type

Based on Vehicle Type, the market is segmented based on Passenger Cars, Light Commercial Vehicle, and Heavy Commercial Vehicle. The Passenger Car segment dominated the Automotive Chassis Market due to the high demand for personal vehicles globally, driven by increasing urbanization and rising disposable incomes. Additionally, advancements in chassis technology aimed at enhancing passenger safety, comfort, and fuel efficiency further contribute to the dominance of this segment.

Based on Vehicle Type, the market is segmented based on Passenger Cars, Light Commercial Vehicle, and Heavy Commercial Vehicle. The Passenger Car segment dominated the Automotive Chassis Market due to the high demand for personal vehicles globally, driven by increasing urbanization and rising disposable incomes. Additionally, advancements in chassis technology aimed at enhancing passenger safety, comfort, and fuel efficiency further contribute to the dominance of this segment.

By Chassis System

Based on the Chassis System, the market segment has been divided into the Front Axle, Rear Axle, Corner Modules, and Active Kinematics Control. The Front Axle segment dominated the Automotive Chassis Market due to its critical role in steering and handling, essential for vehicle safety and performance. Additionally, advancements in front axle technologies, such as lightweight materials and improved suspension systems, have enhanced vehicle efficiency and ride quality, further driving the segment’s dominance.

By Component

Based on Components, the market segment has been divided into Tie-Rods, Stabilizer Links, Suspension Ball Joints, Cross-Axis Joints, Knuckles & Hubs, and Control Arms. The Tie-Rods segment dominated the Automotive Chassis Market due to their essential function in steering system stability and alignment, ensuring precise control and safety. The increasing adoption of advanced steering technologies and enhanced durability materials further propelled the demand for high-quality tie-rods, reinforcing this segment’s dominance.

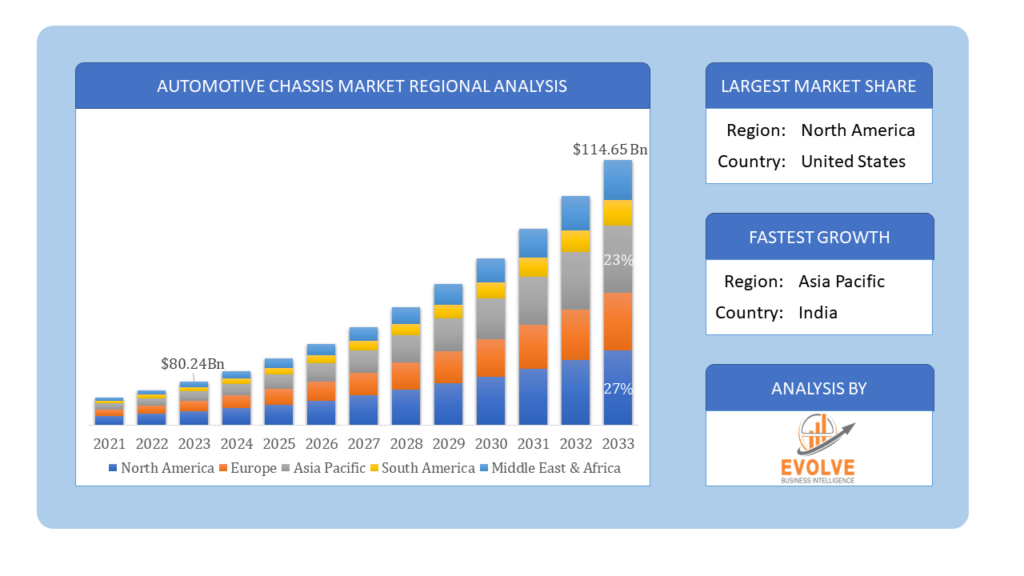

Global Automotive Chassis Market Regional Analysis

Based on region, the global Automotive Chassis Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Automotive Chassis Market followed by the Asia-Pacific and Europe regions.

Automotive Chassis North America Market

Automotive Chassis North America Market

North America holds a dominant position in the Automotive Chassis Market due to its strong automotive industry, advanced manufacturing capabilities, and significant investments in research and development. The presence of major automakers and a well-established supply chain infrastructure further bolster the region’s leadership in chassis innovation and production.

Automotive Chassis Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing for the Automotive Chassis industry, driven by rapid industrialization, increasing vehicle production, and rising consumer demand for automobiles in countries like China and India. Additionally, significant investments in infrastructure and advancements in manufacturing technologies have further accelerated the growth of the automotive chassis market in this region.

Competitive Landscape

The global Automotive Chassis Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as Product launches, and strategic alliances.

Prominent Players:

- ZF

- Magna

- Aisin Seiki

- Benteler

- Tower International

- CIE Automotive

- Schaeffler

- F-Tech

- KLT Auto

- Continental

Scope of the Report

Global Automotive Chassis Market, by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Global Automotive Chassis Market, by Chassis System

- Front Axle

- Rear Axle

- Corner Modules

- Active Kinematics Control

Global Automotive Chassis Market, by Component

- Tie-Rods

- Stabilizer Links

- Suspension Ball Joints

- Cross-Axis Joints

- Knuckles & Hubs

- Control Arms

Global Automotive Chassis Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $114.65 Billion |

| CAGR | 5.98% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Vehicle Type, Chassis System, Component |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | ZF, Magna, Aisin Seiki, Benteler, Tower International, CIE Automotive, Schaeffler, F-Tech, KLT Auto, Continental |

| Key Market Opportunities | • Growth of Electric and Hybrid Vehicles • Technological Advancements in Chassis Design and Materials |

| Key Market Drivers | • Increasing Demand for Lightweight and Fuel-Efficient Vehicles • Growing Automotive Production in Emerging Economies |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Automotive Chassis Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Automotive Chassis Market historical market size for the year 2021, and forecast from 2023 to 2033

- Automotive Chassis Market share analysis at each Product level

- Competitor analysis with detailed insight into its Product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including Product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Automotive Chassis Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, Product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the forecasted market size for the Automotive Chassis Market by 2033?

The Automotive Chassis Market is expected to reach USD 114.65 Billion by 2033

What is the expected CAGR for the Automotive Chassis Market from 2023 to 2033?

The market is anticipated to grow at a compound annual growth rate (CAGR) of 5.98% from 2023 to 2033

How did the COVID-19 pandemic impact the Automotive Chassis Market?

COVID-19 caused production delays and material shortages, but also accelerated innovation and the adoption of advanced manufacturing technologies

Which vehicle type segment dominates the Automotive Chassis Market?

The Passenger Car segment dominates the market due to high global demand and advancements in chassis technology for passenger safety and efficiency

What regions are leading in the Automotive Chassis Market?

North America leads the market due to its strong automotive industry, with the Asia-Pacific region emerging as the fastest-growing due to rapid industrialization and increased vehicle production

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Vehicle Type Segement – Market Opportunity Score 4.1.2. Chassis System Segment – Market Opportunity Score 4.1.3. Component Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Automotive Chassis Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Automotive Chassis Market, By Vehicle Type 7.1. Introduction 7.1.1. Passenger Car 7.1.2. Light Commercial Vehicle 7.1.3 Heavy Commercial Vehicle CHAPTER 8. Automotive Chassis Market, By Chassis System 8.1. Introduction 8.1.1. Front Axle 8.1.2. Rear Axle 8.1.3. Front Axle 8.1.4. Active Kinematics Control CHAPTER 9. Automotive Chassis Market, By Component 9.1. Introduction 9.1.1. Tie-Rods 9.1.2 Stabilizer Links 9.1.3 Suspension Ball Joints 9.1.4 Cross-Axis Joints 9.1.5 Knuckles & Hubs 9.1.6 Control Arms CHAPTER 10. Automotive Chassis Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Chassis System, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. ZF 13.1.1. Introduction 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Magna 13.3. Aisin Seiki 13.4. Benteler 13.5. Tower International 13.6. CIE Automotive 13.7. Schaeffler 13.8. F-Tech 13.9. KLT Auto 13.10. Continental

Connect to Analyst

Research Methodology