Automotive BIW Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

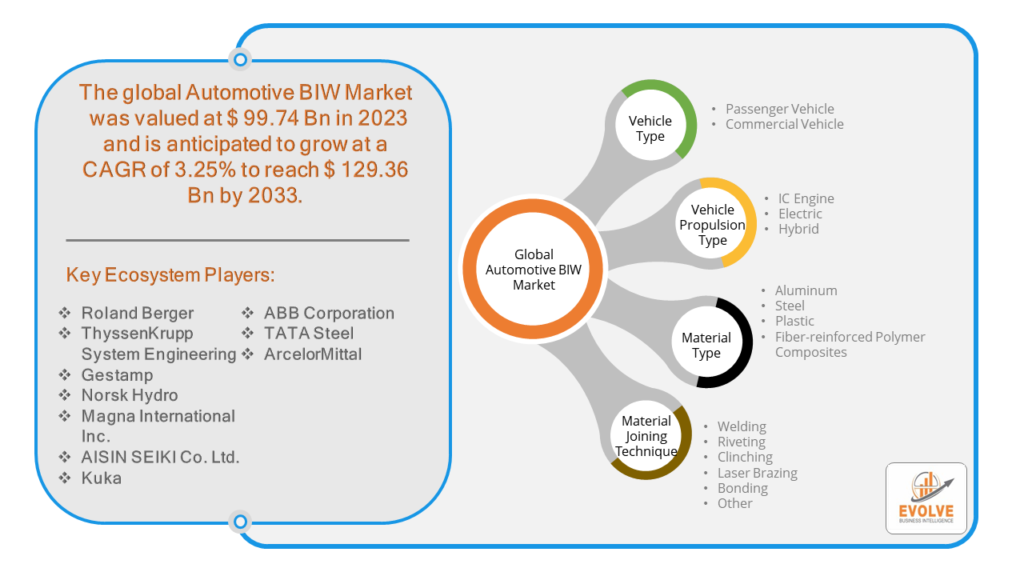

Automotive BIW Market Research Report: Information By Vehicle Type (Passenger Vehicle, Commercial Vehicle), By Vehicle Propulsion Type (IC Engine, Electric, Hybrid), By Material Type (Aluminum, Steel, Plastic, Fiber-reinforced Polymer Composites), By Material Joining Technique (Welding, Riveting, Clinching, Laser Brazing, Bonding, Other), and by Region — Forecast till 2033

Page: 171

Automotive BIW Market Overview

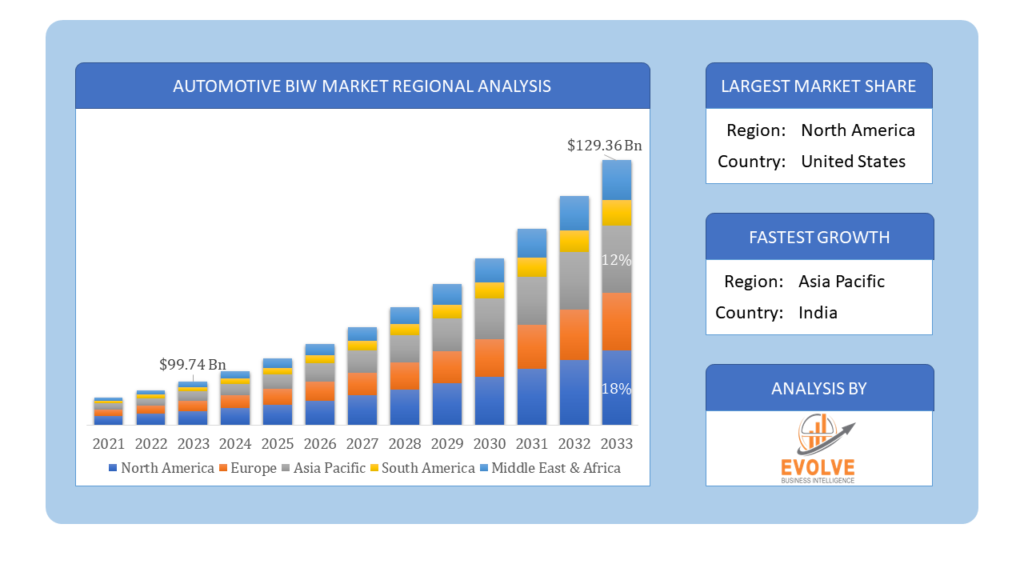

The Automotive BIW Market Size is expected to reach USD 129.36 Billion by 2033. The Automotive BIW Market industry size accounted for USD 99.74 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 3.25% from 2023 to 2033. The Automotive BIW (Body-in-White) Market refers to the segment of the automotive industry that focuses on the production and sale of BIW components. Body-in-White is a stage in automotive manufacturing where the car body’s sheet metal components are assembled, welded together, and before painting or any other finishing processes.

The Automotive Body-in-White (BIW) market refers to the industry focused on the manufacturing of the core structure of a car. This unfinished structure, also known as the skeleton, forms the foundation for the rest of the vehicle and is critical for factors like passenger safety, handling, and overall ride comfort. Overall, the Automotive BIW market is an important part of the automotive industry, and with the growing emphasis on fuel efficiency and technological innovation

Global Automotive BIW Market Synopsis

The COVID-19 pandemic had a significant impact on the Automotive BIW (Body-in-White) Market. Lockdowns and restrictions led to temporary closures of manufacturing facilities, causing disruptions in the production of BIW components. Many companies in the BIW market experienced a decline in revenue due to decreased production and sales. Companies had to manage operational costs more efficiently, including workforce reductions, deferral of capital expenditures, and optimizing supply chains. Increased adoption of remote working practices where possible, especially in design and administrative functions. Accelerated digitalization and automation to reduce dependency on human labor and improve efficiency. Companies are focusing on building more resilient supply chains to mitigate future disruptions, including diversifying supplier bases and increasing local sourcing. There is a stronger emphasis on sustainability and innovation in materials and processes to create more robust and environmentally friendly BIW components.

Automotive BIW Market Dynamics

The major factors that have impacted the growth of Automotive BIW Market are as follows:

Drivers:

Ø Technological Advancements

Innovations in materials such as high-strength steel, aluminum, and composites are enabling the production of lighter and stronger BIW components. Adoption of advanced manufacturing processes like laser welding, hydroforming, and additive manufacturing improves the precision and efficiency of BIW production. Rapid industrialization and urbanization in emerging markets, particularly in Asia-Pacific, are driving the demand for new vehicles. The growing popularity of electric vehicles is boosting the demand for specialized BIW components designed for EV platforms. Increasing focus on the recyclability of materials used in BIW components to meet environmental sustainability goals. Efforts to reduce the energy consumption during the manufacturing process of BIW components.

Restraint:

- Perception of High Costs

Advanced materials like high-strength steel, aluminum, and composites are often more expensive than traditional materials, increasing overall production costs. The adoption of new manufacturing technologies and processes can require significant capital investment in new equipment and training, raising the initial costs for manufacturers. Advanced manufacturing processes such as laser welding and hydroforming can be complex and require highly skilled labor and precision engineering. Integrating new materials and technologies into existing production lines can be challenging and time-consuming.

Opportunity:

⮚ Growing demand for Advanced Materials Development

Continued innovation in lightweight materials such as high-strength steel, aluminum alloys, and composites can enhance vehicle performance and fuel efficiency. Research and development of sustainable and recyclable materials for BIW components to meet environmental regulations and consumer preferences. Implementation of circular economy principles, including recycling and reusing materials, to reduce environmental impact and improve sustainability. Development of energy-efficient manufacturing processes to reduce the carbon footprint of BIW production. Increasing demand for enhanced crash safety features and compliance with stringent safety regulations can drive innovation in BIW design and materials. Development of BIW components that enhance the structural integrity of vehicles, supporting advanced driver-assistance systems (ADAS) and autonomous driving technologies.

Automotive BIW Market Segment Overview

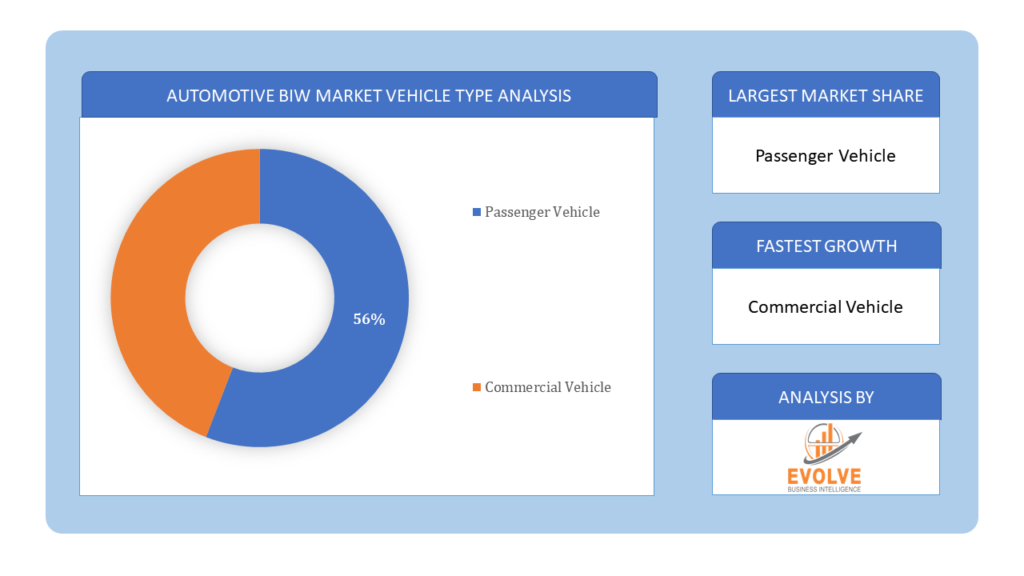

By Vehicle Type

Based on Vehicle Type, the market is segmented based on Passenger Vehicle and Commercial Vehicle. The Passenger Vehicle segment dominant the market. Consumer preferences, economic conditions, and technological advancements heavily influence the demand for passenger vehicles and their BIW components. Development of BIW components to support autonomous driving technologies, including sensor integration and structural modifications.

Based on Vehicle Type, the market is segmented based on Passenger Vehicle and Commercial Vehicle. The Passenger Vehicle segment dominant the market. Consumer preferences, economic conditions, and technological advancements heavily influence the demand for passenger vehicles and their BIW components. Development of BIW components to support autonomous driving technologies, including sensor integration and structural modifications.

By Vehicle Propulsion Type

Based on Vehicle Propulsion Type, the market segment has been divided into the IC Engine, Electric and Hybrid. The IC Engine segment dominant the market. Market demand is influenced by consumer preferences, economic conditions, regulatory requirements, and technological advancements related to IC engines. The segment’s future growth will be influenced by ongoing developments in IC engine efficiency, emissions reduction technologies, and regulatory changes impacting vehicle design and production.

By Material Type

Based on Material Type, the market segment has been divided into the Aluminum, Steel, Plastic and Fiber-reinforced Polymer Composites. The Steel segment dominant the market. Steel remains a crucial material in the BIW of vehicles due to its strength, formability, and cost-effectiveness. Market demand is influenced by factors such as vehicle production volumes, safety standards, and advancements in steel manufacturing technologies.

By Material Joining Technique

Based on Material Joining Technique, the market segment has been divided into the Welding, Riveting, Clinching, Laser Brazing, Bonding and Other. The Welding segment dominant the market. Welding is a critical process in assembling BIW components, joining various materials to form the vehicle structure. Market demand is driven by vehicle production volumes, technological advancements in welding techniques, and regulatory standards. Most commonly used welding process in automotive BIW manufacturing, where two or more sheets of metal are welded together at localized points by the heat obtained from resistance to electric current.

Global Automotive BIW Market Regional Analysis

Based on region, the global Automotive BIW Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Automotive BIW Market followed by the Asia-Pacific and Europe regions.

Automotive BIW North America Market

Automotive BIW North America Market

North America holds a dominant position in the Automotive BIW Market. The North American BIW market is also mature, with major car manufacturers having a strong presence. However, its growth might be slower compared to APAC due to factors like market saturation and increasing competition from foreign carmakers. Strong presence of established automotive manufacturers and a high demand for advanced vehicles, including electric and autonomous vehicles. Stringent safety and emission regulations drive the demand for lightweight and high-performance BIW components.

Automotive BIW Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Automotive BIW Market industry. Rapidly growing automotive market with increasing production and sales, especially in countries like China, India, Japan, and South Korea. Industrialization and urbanization drive the demand for new vehicles, creating a substantial market for BIW components. Focus on cost-effective manufacturing and local production to cater to the regional demand. A mix of global automotive manufacturers and emerging local companies, along with a growing number of technology and material suppliers.

Competitive Landscape

The global Automotive BIW Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Roland Berger

- ThyssenKrupp System Engineering

- Gestamp

- Norsk Hydro

- Magna International Inc.

- AISIN SEIKI Co. Ltd.

- Kuka

- ABB Corporation

- TATA Steel

- ArcelorMittal

Scope of the Report

Global Automotive BIW Market, by Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

Global Automotive BIW Market, by Vehicle Propulsion Type

- IC Engine

- Electric

- Hybrid

Global Automotive BIW Market, by Material Type

- Aluminum

- Steel

- Plastic

- Fiber-reinforced Polymer Composites

Global Automotive BIW Market, by Material Joining Technique

- Welding

- Riveting

- Clinching

- Laser Brazing

- Bonding

- Other

Global Automotive BIW Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $129.36 Billion |

| CAGR | 3.25% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Vehicle Type, Vehicle Propulsion Type, Material Type, Material Joining Technique |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Roland Berger, ThyssenKrupp System Engineering, Gestamp, Norsk Hydro, Magna International Inc., AISIN SEIKI Co. Ltd., Kuka, ABB Corporation, TATA Steel and ArcelorMittal |

| Key Market Opportunities | • The growing demand for Advanced Materials Development • Focus on Sustainability and Enhanced Safety Standards |

| Key Market Drivers | • Technological Advancements • Increasing Automotive Production |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Automotive BIW Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Automotive BIW Market historical market size for the year 2021, and forecast from 2023 to 2033

- Automotive BIW Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Automotive BIW Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Automotive BIW Market?

The study period for the Automotive BIW Market is from 2023 to 2033.

What is the growth rate of the Automotive BIW Market?

The Automotive BIW Market is expected to expand at a compound annual growth rate (CAGR) of 3.25% from 2023 to 2033.

Which region has the highest growth rate in the Automotive BIW Market?

The Asia-Pacific region has emerged as the fastest-growing market for the Automotive BIW industry.

Which region has the largest share of the Automotive BIW Market?

North America holds a dominant position in the global Automotive BIW Market.

Who are the key players in the Automotive BIW Market?

Key players in the Automotive BIW Market include Roland Berger, ThyssenKrupp System Engineering, Gestamp, Norsk Hydro, Magna International Inc., AISIN SEIKI Co. Ltd., Kuka, ABB Corporation, TATA Steel, and ArcelorMittal.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Vehicle Type Segement – Market Opportunity Score 4.1.2. Vehicle Propulsion Type Segment – Market Opportunity Score 4.1.3. Material Type Segment – Market Opportunity Score 4.1.4. Material Joining Technique Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End Users 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Automotive BIW Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Automotive BIW Market, By Vehicle Type 7.1. Introduction 7.1.1. Passenger Vehicle 7.1.2. Commercial Vehicle CHAPTER 8. Automotive BIW Market, By Vehicle Propulsion Type 8.1. Introduction 8.1.1. IC Engine 8.1.2. Electric 8.1.3. Hybrid CHAPTER 9. Automotive BIW Market, By Material Type 9.1. Introduction 9.1.1. Aluminum 9.1.2. Steel 9.1.3 Plastic 9.1.4 Fiber-reinforced Polymer Composites CHAPTER 10. Automotive BIW Market, By Material Joining Technique 10.1.Introduction 10.1.1. Welding 10.1.2. Riveting 10.1.3. Clinching 10.1.4. Laser Brazing 10.1.5. Bonding 10.1.6. Other CHAPTER 11. Automotive BIW Market, By Region 11.1. Introduction 11.2. NORTH AMERICA 11.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.2.2. North America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.2.3. North America: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.2.4. North America: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.2.5. North America: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.2.6. US 11.2.6.1. US: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.2.6.2. US: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.2.6.3. US: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.2.6.4. US: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.2.7. CANADA 11.2.7.1. Canada: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.2.7.2. Canada: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.2.7.3. Canada: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.2.7.4. Canada: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.2.8. MEXICO 11.2.8.1. Mexico: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.2.8.2. Mexico: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.2.8.3. Mexico: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.2.8.4. Mexico: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.3. Europe 11.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.3.2. Europe: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.3. Europe: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.3.4. Europe: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.3.5. Europe: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.3.6. U.K. 11.3.6.1. U.K.: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.6.2. U.K.: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.3.6.3. U.K.: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.3.6.4. U.K.: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.3.7. GERMANY 11.3.7.1. Germany: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.7.2. Germany: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.3.7.3. Germany: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.3.7.4. Germany: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.3.8. FRANCE 11.3.8.1. France: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.8.2. France: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.3.8.3. France: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.3.8.4. France: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.3.9. ITALY 11.3.9.1. Italy: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.9.2. Italy: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.3.9.3. Italy: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.3.9.4. Italy: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.3.10. SPAIN 11.3.10.1. Spain: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.10.2. Spain: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.3.10.3. Spain: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.3.10.4. Spain: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.3.11. BENELUX 11.3.11.1. BeNeLux: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.11.2. BeNeLux: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.3.11.3. BeNeLux: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.3.11.4. BeNeLux: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.3.12. RUSSIA 11.3.12.1. Russia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.12.2. Russia: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.3.12.3. Russia: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.3.12.4. Russia: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.3.13. REST OF EUROPE 11.3.13.1. Rest of Europe: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.13.2. Rest of Europe: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.3.13.3. Rest of Europe: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.3.13.4. Rest of Europe: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.4. Asia Pacific 11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.4.2. Asia Pacific: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.3. Asia Pacific: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.4.4. Asia Pacific: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.4.5. Asia Pacific: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.4.6. CHINA 11.4.6.1. China: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.6.2. China: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.4.6.3. China: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.4.6.4. China: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.4.7. JAPAN 11.4.7.1. Japan: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.7.2. Japan: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.4.7.3. Japan: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.4.7.4. Japan: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.4.8. INDIA 11.4.8.1. India: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.8.2. India: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.4.8.3. India: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.4.8.4. India: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.4.9. SOUTH KOREA 11.4.9.1. South Korea: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.9.2. South Korea: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.4.9.3. South Korea: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.4.9.4. South Korea: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.4.10. THAILAND 11.4.10.1. Thailand: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.10.2. Thailand: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.4.10.3. Thailand: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.4.10.4. Thailand: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.4.11. INDONESIA 11.4.11.1. Indonesia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.11.2. Indonesia: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.4.11.3. Indonesia: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.4.11.4. Indonesia: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.4.12. MALAYSIA 11.4.12.1. Malaysia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.12.2. Malaysia: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.4.12.3. Malaysia: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.4.12.4. Malaysia: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.4.13. AUSTRALIA 11.4.13.1. Australia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.13.2. Australia: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.4.13.3. Australia: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.4.13.4. Australia: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.4.14. REST FO ASIA PACIFIC 11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.5. South America 11.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.5.2. South America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.5.3. South America: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.5.4. South America: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.5.5. South America: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.5.6. BRAZIL 11.5.6.1. Brazil: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.5.6.2. Brazil: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.5.6.3. Brazil: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.5.6.4. Brazil: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.5.7. ARGENTINA 11.5.7.1. Argentina: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.5.7.2. Argentina: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.5.7.3. Argentina: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.5.7.4. Argentina: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.5.8. REST OF SOUTH AMERICA 11.5.8.1. Rest of South America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.5.8.2. Rest of South America: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.5.8.3. Rest of South America: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.5.8.4. Rest of South America: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.6. Middle East & Africa 11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.6.2. Middle East & Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.3. Middle East & Africa: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.6.4. Middle East & Africa: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.6.5. Middle East & Africa: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.6.6. SAUDI ARABIA 11.6.6.1. Saudi Arabia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.6.2. Saudi Arabia: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.6.6.3. Saudi Arabia: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.6.6.4. Saudi Arabia: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.6.7. UAE 11.6.7.1. UAE: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.7.2. UAE: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.6.7.3. UAE: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.6.7.4. UAE: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.6.8. EGYPT 11.6.8.1. Egypt: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.8.2. Egypt: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.6.8.3. Egypt: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.6.8.4. Egypt: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.6.9. SOUTH AFRICA 11.6.9.1. South Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.9.2. South Africa: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.6.9.3. South Africa: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.6.9.4. South Africa: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) 11.6.10. REST OF MIDDLE EAST & AFRICA 11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Vehicle Propulsion Type, 2023 – 2033 ($ Million) 11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By Material Joining Technique, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Roland Berger 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. ThyssenKrupp System Engineering 13.3. Gestamp 13.4. Norsk Hydro 13.5. Magna International Inc. 13.6. AISIN SEIKI Co. Ltd. 13.7. Kuka 13.8. ABB Corporation 13.9. TATA Steel 13.10. ArcelorMittal

Connect to Analyst

Research Methodology