Aspirin Drugs Market Analysis and Global Forecast 2024-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

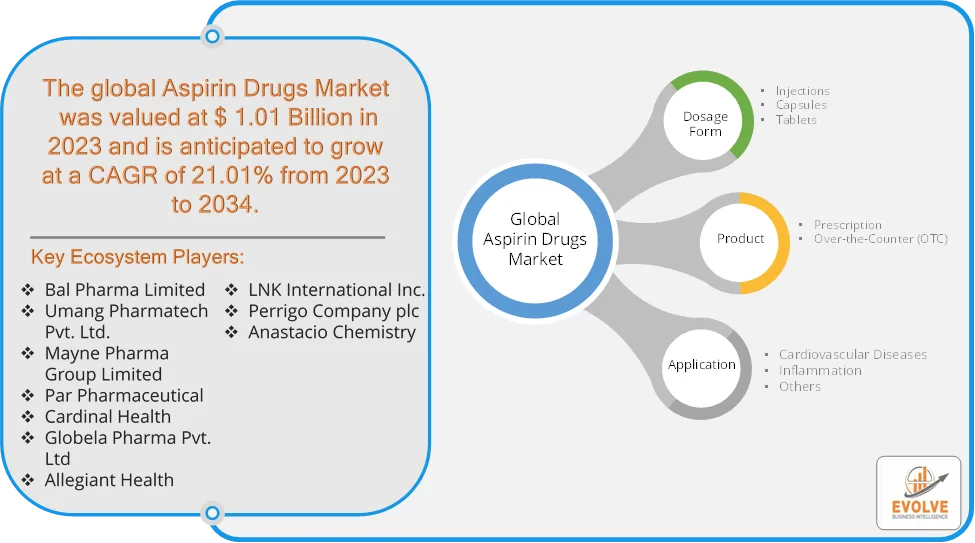

Aspirin Drugs Market Research Report: Information By Dosage Form (Injections, Capsules, and Tablets), By Product (Prescription and Over-the-Counter (OTC)), By Application (Cardiovascular Diseases, Inflammation, and Others), and by Region — Forecast till 2034

Page: 165

Aspirin Drugs Market Overview

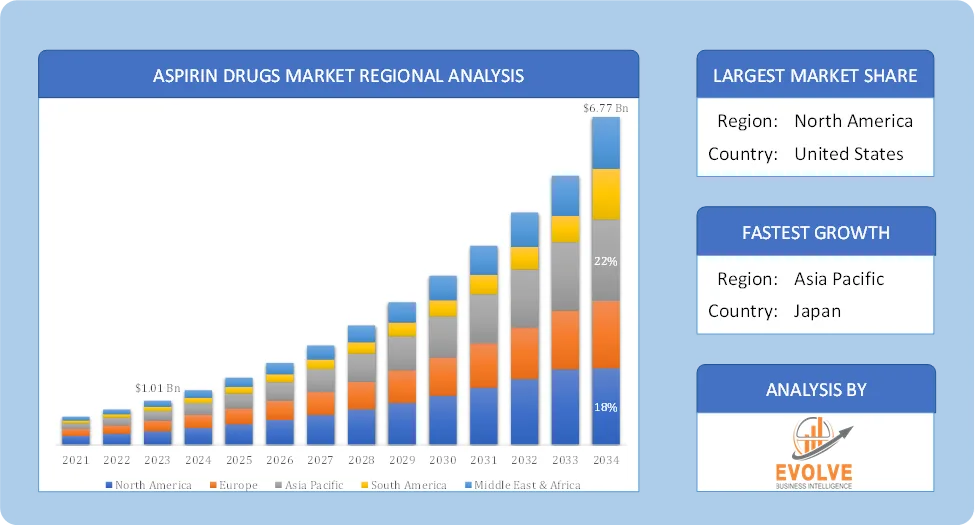

The Aspirin Drugs Market size accounted for USD 1.01 Billion in 2023 and is estimated to account for 1.25 Billion in 2024. The Market is expected to reach USD 6.77 Billion by 2034 growing at a compound annual growth rate (CAGR) of 21.01% from 2024 to 2034. The global Aspirin Drugs Market is currently experiencing steady growth, driven by a confluence of factors including the rising prevalence of cardiovascular diseases, the expanding applications of aspirin in pain management and fever reduction, and increasing government and healthcare initiatives promoting preventive medicine.

The aspirin drugs market is expected to continue its growth trajectory, driven by its established therapeutic uses and expanding applications, particularly in regions with increasing healthcare access and awareness.

Global Aspirin Drugs Market Synopsis

Aspirin Drugs Market Dynamics

Aspirin Drugs Market Dynamics

The major factors that have impacted the growth of Aspirin Drugs Market are as follows:

Drivers:

Ø Increasing Prevalence of Cardiovascular Diseases (CVDs)

Aspirin is widely used as a blood thinner to prevent heart attacks and strokes. The rising incidence of hypertension, heart disease, and stroke is boosting aspirin demand. According to the WHO, CVDs are the leading cause of death globally. Aspirin is used to relieve pain from conditions like arthritis, migraines, and musculoskeletal disorders. The increasing aging population contributes to the demand for nonsteroidal anti-inflammatory drugs (NSAIDs) like aspirin. Aspirin is a low-cost medication compared to other pain relievers and anticoagulants and the presence of multiple generic manufacturers ensures widespread affordability.

Restraint:

- Adverse Drug Reactions (ADR) and Contraindications

Aspirin is contraindicated in patients with conditions like asthma, kidney disease, and bleeding disorders. The risk of Reye’s syndrome in children restricts its use in pediatric patients. Aspirin has been available for decades, and patents have long expired, leading to intense competition from generic manufacturers and the lack of major innovations in aspirin-based drugs limits profit margins for pharmaceutical companies. The rising trend of herbal and natural pain relief solutions reduces aspirin consumption and ingredients like turmeric, willow bark, and CBD-based treatments are gaining popularity as alternatives.

Opportunity:

⮚ Expansion in Cancer Prevention and Treatment

Growing evidence suggests aspirin may help reduce the risk of colorectal, breast, and prostate cancers. Ongoing clinical trials could lead to new approvals for aspirin-based cancer prevention therapies, opening new revenue streams. Innovations such as enteric-coated and extended-release aspirin formulations reduce gastrointestinal side effects, improving patient compliance. Combining aspirin with statins or proton pump inhibitors (PPIs) may enhance its effectiveness while reducing risks, creating new pharmaceutical product lines and with rising awareness of cardiovascular health, more individuals are opting for low-dose aspirin therapy as a preventive measure. Telemedicine and digital health platforms can help promote aspirin’s benefits and increase sales.

Aspirin Drugs Market Segment Overview

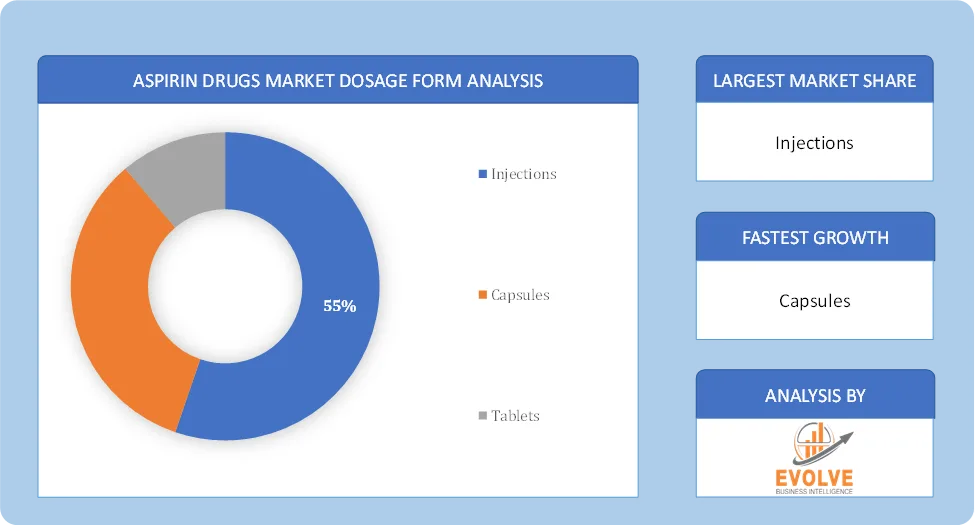

Based on Dosage Form, the market is segmented based on Injections, Capsules, and Tablets. The tablets segment dominant the market. The segmental expansion is attributed to the greater efficacy of tablets than capsules, rapid onset of action, ease of administration, greater stability, prolonged shelf-life, enhanced bioavailability, cost-effectiveness, and availability in the targeted drug delivery system such as controlled release tablets, and tablets are suitable to the pediatric and geriatric population as it undergoes the sugar coating and film coating it prevents from the unpleasant taste.

By Product

Based on Product, the market segment has been divided into Prescription and Over-the-Counter (OTC). The over-the-counter (OTC) segment dominant the market. The segment’s growth is owing to the rise in the occurrence of common allergies, colds, flu, and fever, the growing trend of online pharmacies, available in retail locations, cost-effectiveness, and the increasing prevalence of lifestyle diseases.

By Application

Based on Application, the market segment has been divided into Cardiovascular Diseases, Inflammation, and Others. The inflammation segment dominant the market. This segment growth is ascribed to the increasing prevalence of inflammatory diseases such as arthritis, and psoriasis, aspirin is more effective in relieving inflammation as a low dose of aspirin is required, and inhibits the action of inflammatory mediators.

Global Aspirin Drugs Market Regional Analysis

Based on region, the global Aspirin Drugs Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Aspirin Drugs Market followed by the Asia-Pacific and Europe regions.

North America Aspirin Drugs Market

North America Aspirin Drugs Market

North America holds a dominant position in the Aspirin Drugs Market. Aspirin is widely used for its antiplatelet properties to prevent heart attacks and strokes. The region’s aging population contributes to increased aspirin consumption for conditions like arthritis. It has Strong healthcare infrastructure and significant healthcare expenditure and increasing geriatric population and a high adoption rate of OTC drugs. It has high prevalence of cardiovascular diseases.

Asia-Pacific Aspirin Drugs Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Aspirin Drugs Market industry. Rising prevalence of cardiovascular diseases and increasing healthcare awareness and growing geriatric population and rapid urbanization and Improving healthcare infrastructure and expanding pharmaceutical manufacturing capabilities, particularly in China and India, which are major producers of Active Pharmaceutical Ingredients (APIs) and Increasing adoption of OTC drugs and rising disposable incomes.

Competitive Landscape

The global Aspirin Drugs Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Bal Pharma Limited

- Umang Pharmatech Pvt. Ltd.

- Mayne Pharma Group Limited

- Par Pharmaceutical

- Cardinal Health

- Globela Pharma Pvt. Ltd

- Allegiant Health

- LNK International Inc.

- Perrigo Company plc

- Anastacio Chemistry.

Scope of the Report

Global Aspirin Drugs Market, by Dosage Form

- Injections

- Capsules

- Tablets

Global Aspirin Drugs Market, by Product

- Prescription

- Over-the-Counter (OTC)

Global Aspirin Drugs Market, by Application

- Cardiovascular Diseases

- Inflammation

- Others

Global Aspirin Drugs Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 6.77 Billion |

| CAGR (2024-2034) | 21.01% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Dosage Form, Product, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Bal Pharma Limited, Umang Pharmatech Pvt. Ltd., Mayne Pharma Group Limited, Par Pharmaceutical, Cardinal Health, Globela Pharma Pvt. Ltd, Allegiant Health, LNK International Inc., Perrigo Company plc and Anastacio Chemistry. |

| Key Market Opportunities | · Expansion in Cancer Prevention and Treatment · Development of Gastro-Resistant and Combination Therapies |

| Key Market Drivers | · Increasing Prevalence of Cardiovascular Diseases (CVDs) · Growing Cases of Chronic Pain and Inflammation |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Aspirin Drugs Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Aspirin Drugs Market historical market size for the year 2021, and forecast from 2023 to 2033

- Aspirin Drugs Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Aspirin Drugs Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Aspirin Drugs Market is 2021- 2033

What is the growth rate of the global Aspirin Drugs Market?

The global Aspirin Drugs Market is growing at a CAGR of 21.01% over the next 10 years

Which region has the highest growth rate in the market of Aspirin Drugs Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Aspirin Drugs Market?

North America holds the largest share in 2022

Who are the key players in the global Aspirin Drugs Market?

Bal Pharma Limited, Umang Pharmatech Pvt. Ltd., Mayne Pharma Group Limited, Par Pharmaceutical, Cardinal Health, Globela Pharma Pvt. Ltd, Allegiant Health, LNK International Inc., Perrigo Company plc and Anastacio Chemistry. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary

CHAPTER 2. Scope of the Study

2.1. Market Definition

2.2. Market Scope & Segmentation

2.2.1. Objective of Report

CHAPTER 3. Evolve BI Methodology

3.1. Data Collection & Validation Approach

3.2. Market Size Estimation and Forecast

CHAPTER 4. Exclusive Analysis

4.1. Market Opportunity Score

4.1.1. Dosage Form Segement – Market Opportunity Score

4.1.2. Product Segment – Market Opportunity Score

4.1.3. Application Segment – Market Opportunity Score

4.2. Key Market Influencing Indicators

CHAPTER 5. Market Insights and Trends

5.1. Value Chain Analysis

5.1.1. Raw Material

5.1.2. Manufacturing Process

5.1.3. Distribution Channel

5.1.4. End User

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining Power of Buyers

5.2.2. Bargaining Power of Suppliers

5.2.3. Threat of New Entrant

5.2.4. Threat of Substitute

5.2.5. Industry Rivalry

5.3. COVID-19 Impact and Post COVID Scenario on Aspirin Drugs Market

5.3.1. Impact of COVID-19

5.3.2. Government Support and Industry Revival Policies

5.3.3. Measures Taken by Companies to Mitigate Negative Impact

5.3.4. Post COVID Trend

CHAPTER 6. Market Dynamics

6.1. Introduction

6.2. Drivers

6.2.1. Driver 1

6.2.2. Driver 2

6.2.3. Driver 3

6.3. Restraints

6.3.1. Restraint 1

6.3.2. Restraint 2

6.4. Opportunity

6.4.1. Opportunity 1

CHAPTER 7. Aspirin Drugs Market, By Dosage Form

7.1. Introduction

7.1.1. Injections

7.1.2 Capsules

7.1.3. Tablets

CHAPTER 8 Aspirin Drugs Market, By Product

8.1. Introduction

8.1.1. Prescription

8.1.2. Over-the-Counter (OTC)

CHAPTER 9. Aspirin Drugs Market, By Application

9.1. Introduction

9.1.1. Cardiovascular Diseases

9.1.2. Inflammation

9.1.3. Others

CHAPTER 10. Aspirin Drugs Market, By Region

10.1. Introduction

10.2. NORTH AMERICA

10.2.1. North America: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.2.2. North America: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.2.3. North America: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.2.4. North America: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.2.5. US

10.2.5.1. US: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.2.5.2. US: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.2.5.3. US: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.2.6. CANADA

10.2.6.1. Canada: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.2.6.2. Canada: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.2.6.3. Canada: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.2.7. MEXICO

10.2.7.1. Mexico: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.2.7.2. Mexico: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.2.7.3. Mexico: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.3. Europe

10.3.1. Europe: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.3.2. Europe: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.3.3. Europe: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.3.4. Europe: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.3.5. U.K.

10.3.5.1. U.K.: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.3.5.2. U.K.: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.3.5.3. U.K.: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.3.6. GERMANY

10.3.6.1. Germany: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.3.6.2. Germany: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.3.6.3. Germany: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.3.7. FRANCE

10.3.7.1. France: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.3.7.2. France: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.3.7.3. France: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.3.8. ITALY

10.3.8.1. Italy: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.3.8.2. Italy: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.3.8.3. Italy: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.3.9. SPAIN

10.3.9.1. Spain: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.3.9.2. Spain: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.3.9.3. Spain: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.3.10. BENELUX

10.3.10.1. BeNeLux: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.3.10.2. BeNeLux: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.3.10.3. BeNeLux: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.3.11. RUSSIA

10.3.11.1. Russia: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.3.11.2. Russia: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.3.11.3. Russia: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.3.12. REST OF EUROPE

10.3.12.1. Rest of Europe: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.3.12.2. Rest of Europe: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.3.12.3. Rest of Europe: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.4. Asia Pacific

10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.4.2. Asia Pacific: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.4.3. Asia Pacific: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.4.4. Asia Pacific: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.4.5. CHINA

10.4.5.1. China: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.4.5.2. China: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.4.5.3. China: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.4.6. JAPAN

10.4.6.1. Japan: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.4.6.2. Japan: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.4.6.3. Japan: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.4.7. INDIA

10.4.7.1. India: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.4.7.2. India: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.4.7.3. India: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.4.8. SOUTH KOREA

10.4.8.1. South Korea: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.4.8.2. South Korea: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.4.8.3. South Korea: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.4.9. THAILAND

10.4.9.1. Thailand: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.4.9.2. Thailand: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.4.9.3. Thailand: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.4.10. INDONESIA

10.4.10.1. Indonesia: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.4.10.2. Indonesia: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.4.10.3. Indonesia: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.4.11. MALAYSIA

10.4.11.1. Malaysia: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.4.11.2. Malaysia: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.4.11.3. Malaysia: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.4.12. AUSTRALIA

10.4.12.1. Australia: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.4.12.2. Australia: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.4.12.3. Australia: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.4.13. REST FO ASIA PACIFIC

10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.5. South America

10.5.1. South America: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.5.2. South America: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.5.3. South America: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.5.4. South America: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.5.5. BRAZIL

10.5.5.1. Brazil: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.5.5.2. Brazil: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.5.5.3. Brazil: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.5.6. ARGENTINA

10.5.6.1. Argentina: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.5.6.2. Argentina: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.5.6.3. Argentina: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.5.7. REST OF SOUTH AMERICA

10.5.7.1. Rest of South America: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.5.7.2. Rest of South America: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.5.7.3. Rest of South America: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.6. Middle East & Africa

10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.6.2. Middle East & Africa: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.6.3. Middle East & Africa: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.6.4. Middle East & Africa: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.6.5. SAUDI ARABIA

10.6.5.1. Saudi Arabia: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.6.5.2. Saudi Arabia: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.6.5.3. Saudi Arabia: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.6.6. UAE

10.6.6.1. UAE: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.6.6.2. UAE: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.6.6.3. UAE: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.6.7. EGYPT

10.6.7.1. Egypt: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.6.7.2. Egypt: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.6.7.3. Egypt: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.6.8. SOUTH AFRICA

10.6.8.1. South Africa: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.6.8.2. South Africa: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.6.8.3. South Africa: Market Size and Forecast, By Application, 2024 – 2034($ Million)

10.6.9. REST OF MIDDLE EAST & AFRICA

10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Dosage Form, 2024 – 2034($ Million)

10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Product, 2024 – 2034($ Million)

10.6.9.3.Rest of Middle East & Africa: Market Size and Forecast, By Application, 2024 – 2034($ Million)

CHAPTER 12. Competitive Landscape

12.1. Competitior Benchmarking 2023-

12.2. Market Share Analysis

12.3. Key Developments Analysis By Top 5 Companies

12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players

CHAPTER 13. Company Profiles

13.1. Bal Pharma Limited

13.1.1. Hanon Systems

13.1.2. Financial Analysis

13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million

13.1.2.2. Geographic Revenue Mix, 2022 (% Share)

13.1.3. Product Portfolio

13.1.4. Recent Development and Strategies Adopted

13.1.5. SWOT Analysis

13.2. Umang Pharmatech Pvt. Ltd.

13.3. Mayne Pharma Group Limited

13.4. Par Pharmaceutical

13.5. Cardinal Health

13.6. Globela Pharma Pvt. Ltd

13.7. Allegiant Health

13.8. LNK International Inc.

13.9 Perrigo Company plc

13.10 Anastacio Chemistry.

Connect to Analyst

Research Methodology