Apron Feeder Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

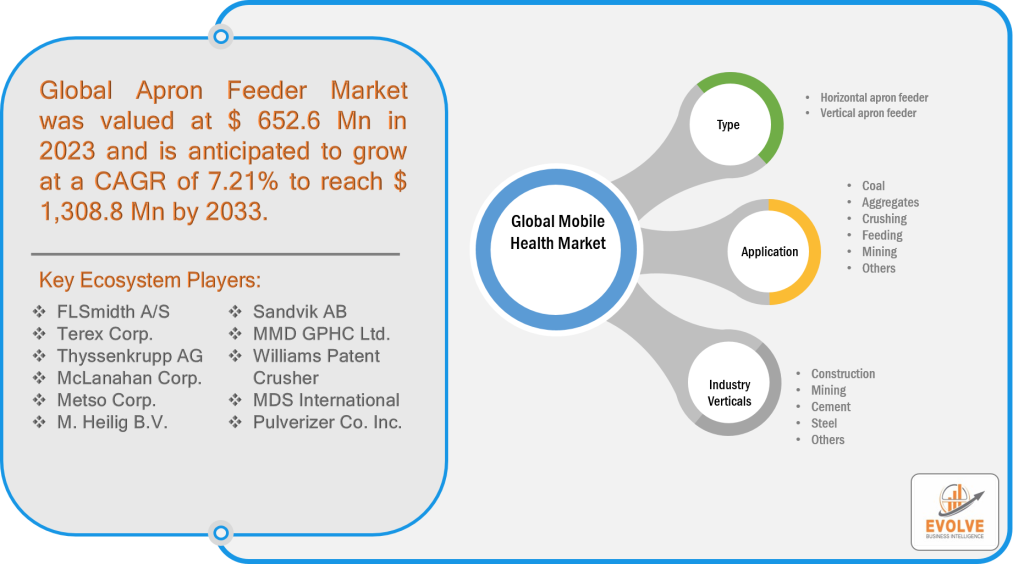

Apron Feeder Market Research Report: By Type (Horizontal Feeder, Vertical Feeder), By Application (Coal, Aggregates, Crushing, Feeding, Mining, Others), By Industry Vertical (Construction, Mining, Cement, Steel, Others), and by Region — Forecast till 2033

Report Code: EB_CO_3010 | Page: 208 | Report Status: Upcoming

Apron Feeder Market Overview, Forecast and CAGR

Apron Feeder Market Size is expected to reach USD 1,308.8 Million by 2033. The Apron Feeder industry size accounted for USD 652.6 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.21% from 2023 to 2033.

An apron feeder is a material-handling machine that is used to transport bulk materials over short distances. It consists of a conveyor belt that is supported by a series of idlers. The belt is inclined at a slight angle, which allows the material to slide down the belt and into a hopper or other collection device. They are used in a wide variety of industries, including mining, construction, and manufacturing. They are commonly used to feed materials into crushers, conveyors, and other processing equipment. They can also be used to reclaim material from stockpiles or hoppers.

The Apron Feeder industry trends is influenced by a number of factors, including the increasing demand for material handling equipment, the rising adoption of automation in manufacturing, and the increasing focus on safety and environmental compliance. These factors are driving the industry growth, and are expected to continue to do so in the coming years. Understanding the importance of market analysis is crucial for businesses to stay ahead of the competition and make informed decisions.

Global Apron Feeder Market Size, and Synopsis

What was the Impact of COVID-19 on the Apron Feeder Industry?

The COVID-19 pandemic has had a negative impact on the Apron Feeder industry in a number of ways. The pandemic has led to a decline in demand for material-handling equipment in some industries. For instance, the mining and construction industries have been hit hard by the pandemic, as they have seen a decrease in demand for their products and services. This has led to a decrease in demand for apron feeders in these industries and has affected the trends.

The pandemic has disrupted supply chains, which has made it difficult for manufacturers to obtain the raw materials and components they need to produce apron feeders. This has led to an increase in their price, which has made them less affordable for some customers.

The Market is set to recover in the post-COVID-19 era. As economies reopened and demand for goods and services increased, the demand for material handling equipment is increasing. This will create opportunities for manufacturers.

In addition, the pandemic has accelerated the adoption of automation in manufacturing. This is expected to drive demand in the post-COVID-19 era. They are used in a variety of automated manufacturing processes, such as loading and unloading machines and transporting materials between different stages of production. As more manufacturers adopt automation, the demand for small apron feeders is expected to increase.

Global Apron Feeder Market Dynamics

The major factors that have impacted the growth of Apron Feeder are as follows:

Drivers:

- Increasing demand for material handling equipment in mining and construction industries

The increasing demand for material handling equipment in the mining and construction industries is one of the key driving factors for the growth of the apron feeder industry. This is due to the increasing automation of these industries, which requires more efficient and reliable material handling systems. In the mining industry, they are used to transport bulk materials, such as coal and ore, from one location to another. They are also used to feed materials into crushers and other processing equipment. In the construction industry, They are used to transport materials, such as concrete and gravel, to different areas of a construction site. They are also used to feed materials into concrete mixers and other equipment. The increasing demand for material handling equipment is also being driven by the growth of e-commerce. As more and more people shop online, there is a need for more efficient and reliable ways to transport goods from warehouses to distribution centers and then to customers’ homes. They can help to improve the efficiency of these operations by ensuring that materials are transported quickly and safely.

Restraint:

- High initial cost

The high initial cost of apron feeders is a major restraint for the industry because it can make them prohibitively expensive for some businesses. They are complex machines that require a significant amount of material and labor to manufacture. This drives up the cost, making them more expensive than other types of material handling equipment. The high initial cost can be a major barrier to entry for businesses that are considering using them. Businesses may not be able to afford the upfront cost, even if they believe that it would be a valuable investment in the long run. This can limit the growth of the market, as businesses are less likely to adopt this technology if it is too expensive. There are a few ways to address the high initial cost of apron feeders. One way is to develop more affordable models. This could be done by using less expensive materials or by simplifying the design of the machines. Another way to address the high initial cost is to offer financing options to businesses. This would allow businesses to purchase apron feeders without having to pay the full cost upfront.

Opportunity:

- Rising adoption of automation in manufacturing

The rising adoption of automation in manufacturing is one of the key market opportunities. This is because apron feeders are used in a variety of automated manufacturing processes, such as loading and unloading machines, and transporting materials between different stages of production. As more manufacturers adopt automation, the demand for apron feeders and growth opportunities is expected to increase with the use of restraints.

Apron Feeder Market Segment Overview

By Type

Based on the Type, the market is segmented based on horizontal feeders and vertical feeders. Horizontal feeders are more widely used than vertical feeders. This is because horizontal feeders are more versatile and can be used in a wider range of applications. However, market segmentation shows that vertical feeders are becoming increasingly popular in applications where materials need to be lifted from one level to another.

By Application

Based on Application, the market has been divided into coal, aggregates, crushing, feeding, and mining, among others. the mining application segment is expected to dominate the market during the forecast period. This is because mining is a major industry that requires a significant amount of material-handling equipment. Apron feeders are used in a variety of mining applications, such as loading and unloading trucks, feeding crushers, and transporting materials between different stages of production.

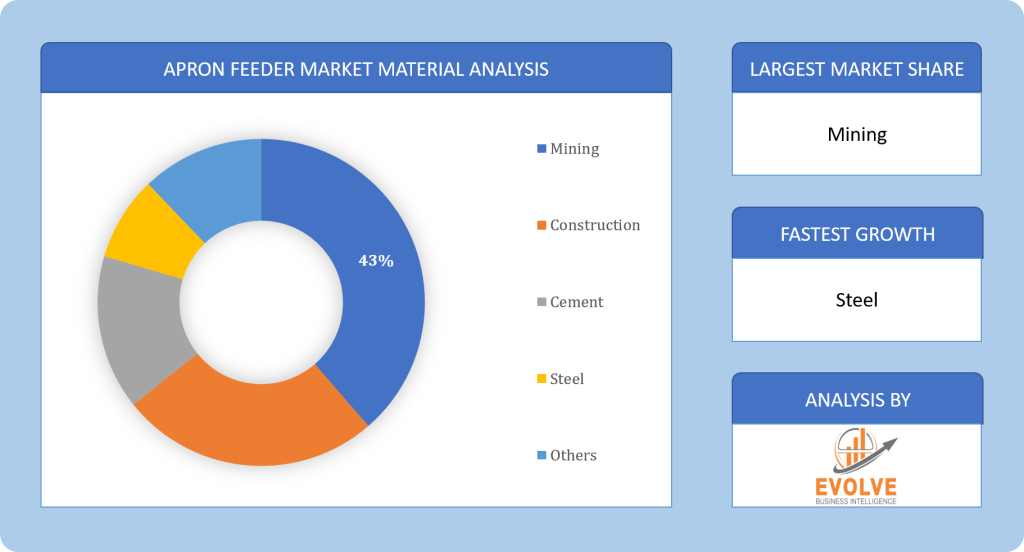

By Industry Vertical

Based on Industry Vertical, the market has been divided into construction, mining, cement, and steel, among others. the mining industry vertical is significantly larger than the other industry verticals. This is because mining is a major industry that requires a significant amount of material-handling equipment. Apron feeders are used in a variety of mining applications, such as loading and unloading trucks, feeding crushers, and transporting materials between different stages of production. The construction industry vertical is the second largest, followed by the cement industry vertical. The steel industry vertical is relatively small, but it is expected to grow in the coming years due to the increasing demand for steel in the various industries.

Global Apron Feeder Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of Asia-Pacific is anticipated to dominate the industry for the usage of Apron Feeder, followed by those in North America, Europe, and Russia.

Asia Pacific

The Asia Pacific region is significantly larger than the other regions. This is because the Asia Pacific region is home to a number of major mining countries, such as China, India, and Australia, which are driving the demand for material-handling equipment in the global market. The region is also home to a number of rapidly growing economies, such as China and India, which are driving the demand for material handling equipment.

North America

North America is expected to experience significant market growth during the forecast period. The growth of the market is being driven by the increasing demand for material handling equipment in a variety of industries, such as mining, construction, and manufacturing. The mining industry is the largest end-user of apron feeders in North America. The United States is the largest market in North America.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as FLSmidth, Metso Outotec, ThyssenKrupp, Terex, and MDS International are some of the leading players in the global Apron Feeder Industry. These players hold around 55% of the global Apron Feeder market share.

Apron Feeder Manufacturers and Ecosystem Players:

- FLSmidth A/S

- Terex Corp.

- Thyssenkrupp AG

- McLanahan Corp.

- Metso Corp.

- Heilig B.V.

- Sandvik AB

- MMD GPHC Ltd.

- Williams Patent Crusher

- MDS International

- Pulverizer Co. Inc.

Key Development:

- In January 2023, Metso Outotec announced the launch of its new heavy-duty apron feeder. The feeder is designed for use in high-capacity applications, such as mining and quarrying.

- In February 2023, FLSmidth announced the acquisition of Amberg Process Systems. Amberg is a leading manufacturer of apron feeders for the cement industry.

Scope of the Report

Global Apron Feeder Market, by Type

- Horizontal Feeder

- Vertical Feeder

Global Apron Feeder Market, by Application

- Coal

- Aggregates

- Crushing

- Feeding

- Mining

- Others

Global Apron Feeder Market, by Industry Vertical

- Construction

- Mining

- Cement

- Steel

- Others

Global Apron Feeder Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Values |

|---|---|

| Market Size | 2033: USD 1,308.8 Million |

| Compounded Average Growth Rate (CAGR) 2023 to 2033 | 7.21% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Application, and Industry Vertical |

| Key Market Opportunities | Rising adoption of automation in manufacturing Growth of e-commerce |

| Key Market Drivers | Increasing demand for material handling equipment Increasing focus on safety and environmental compliance |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | FLSmidth A/S, Terex Corp., Thyssenkrupp AG, McLanahan Corp., Metso Corp., M. Heilig B.V., Sandvik AB, MMD GPHC Ltd., Williams Patent Crusher, MDS International, and Pulverizer Co. Inc. |

REPORT CONTENT BRIEF:

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Apron Feeder market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Apron Feeder Market on demand.

Frequently Asked Questions (FAQ)

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Type Segement – Market Opportunity Score 4.1.2. Application Segement – Market Opportunity Score 4.1.3. Industry Verticals Segment – Market Opportunity Score 4.1.4. Regional Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material Providers 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End-User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Apron Feeder Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. Market Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Demand for efficient and reliable material handling solutions in industries such as mining, cement, and power generation 6.2.2. Increase in infrastructure development projects 6.2.3. XXX 6.3. Restraints 6.3.1. High initial cost of installation 6.3.2. XXX 6.4. Opportunity 6.4.1. Trowth of the mining and construction industries 6.4.2. Advancement in technology CHAPTER 7. Global Apron Feeder Market, By Type 7.1. Introduction 7.1.1. Vertical apron feeder 7.1.2. Horizontal apron feeder CHAPTER 8. Global Apron Feeder Market, By Application 8.1. Introduction 8.1.1. Coal 8.1.2. Aggregates 8.1.3. Crushing 8.1.4. Feeding 8.1.5. Mining 8.1.6. Others CHAPTER 9. Global Apron Feeder Market, By Industry Verticals 9.1. Introduction 9.1.1. Construction 9.1.2. Mining 9.1.3. Cement 9.1.4. Steel 9.1.5. Others CHAPTER 10. Global Apron Feeder Market, By Region 10.1. Introduction 10.2. North America 10.2.1. North America: Market Size and Forecast, By Country, 2021 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.2.5. US 10.2.6. US: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.2.7. US: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.2.8. US: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.2.9. Canada 10.2.9.1. Canada: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.2.9.2. Canada: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.2.9.3. Canada: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.2.10. Mexico 10.2.10.1. Mexico: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.2.10.2. Mexico: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.2.10.3. Mexico: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2021 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.3.6. Germany 10.3.6.1. Germany: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.3.7. France 10.3.7.1. France: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.3.8. Italy 10.3.8.1. Italy: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.3.9. Spain 10.3.9.1. Spain: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.3.10. BeNeLux 10.3.10.1. BeNeLux: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.3.11. Russia 10.3.11.1. Russia: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.3.12. Rest of Europe 10.3.12.1. Rest of Europe: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2021 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.4.5. China 10.4.5.1. China: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.4.6. Japan 10.4.6.1. Japan: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.4.7. India 10.4.7.1. India: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.4.8. South Korea 10.4.8.1. South Korea: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.4.9. Thailand 10.4.9.1. Thailand: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.4.10. Indonesia 10.4.10.1. Indonesia: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.4.11. Malaysia 10.4.11.1. Malaysia: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.4.12. Australia 10.4.12.1. Australia: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.4.13. Rest of Asia Pacific 10.4.13.1. Rest of Asia Pacific: Market Size and Ofrecast, By Type, 2021 – 2033 ($ Million) 10.4.13.2. Rest of Asia Pacific: Market Size and Ofrecast, By Application, 2021 – 2033 ($ Million) 10.4.13.3. Rest of Asia Pacific: Market Size and Ofrecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2021 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.5.5. Brazil 10.5.5.1. Brazil: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.5.6. Argentina 10.5.6.1. Argentina: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.5.7. Rest of South America 10.5.7.1. Rest of South America: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2021 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.6.5. Saudi Arabia 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.6.7. Egypt 10.6.7.1. Egypt: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.6.8. South Africa 10.6.8.1. South Africa: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) 10.6.9. Rest of Middle East & Africa 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Type, 2021 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2021 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Industry Verticals, 2021 – 2033 ($ Million) CHAPTER 11. Competitive Landscape 11.1. Competitior Benchmarking 2023 11.2. Market Share Analysis 11.3. Key Developments Analysis By Top 5 Companies 11.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 12. Company Profiles 12.1. FLSmidth A/S 12.1.1. Business Overview 12.1.2. Financial Analysis 12.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 12.1.2.2. Geographic Revenue Mix, 2020 (% Share) 12.1.3. Product Portfolio 12.1.4. Recent Development and Strategies Adopted 12.1.5. SWOT Analysis 12.2. Terex Corp. 12.3. Thyssenkrupp AG 12.4. McLanahan Corp. 12.5. Metso Corp. 12.6. M. Heilig B.V. 12.7. Sandvik AB 12.8. MMD GPHC Ltd. 12.9. Williams Patent Crusher 12.10. MDS International 12.11. Pulverizer Co. Inc

Connect to Analyst

Pricing

| Report Type | Description | Price | How to Purchase |

|---|---|---|---|

| Full Report (200+ Pages PDF Report) | This report gives a detailed analysis of the industry which includes Market Dynamics, Industry Trends, Segmental, Regional and Country level market estimation & forecast to 2033, competitive landscape, and company profiles. (Customization Possible as per your need) | $3,475 | Click on Buy Now |

| Market Overview Report (10-15 Page PDF Summary Report) | This report gives a brief idea about the industry, without being too heavy on your budget. It gives you an understanding of current and future market scenarios (long-term and short-term), major dynamics and their impact analysis, top-level regional analysis, and competitive benchmarking of 10 key competitors in the market. (Customization Possible as per your need) | $250 | Connect with our Sales Representative by Email or Filling Form on the side |

| Competitive Intelligence Report (35-45 Pages PDF Report) | This report gives you a detailed understanding of key competitors in the market. This report includes competitive benchmarking of 15 key competitors, market share of the top 5 competitors, key strategies adopted by the top 5 players, and key market share acquisition strategies adopted in the market. (Customization Possible as per your need) | $750 | Connect with our Sales Representative by Email or Filling Form on the side |

| Excel Data Pack (Excel Report) | This report includes market Segmental, Regional, and Country level market estimation & forecast to 2033 in Excel format. (Customization Possible as per your need) | $2,499 | Connect with our Sales Representative by Email or Filling Form on the side |

Research Methodology