CHAPTER 1. Executive Summary

CHAPTER 2. Scope of the Study

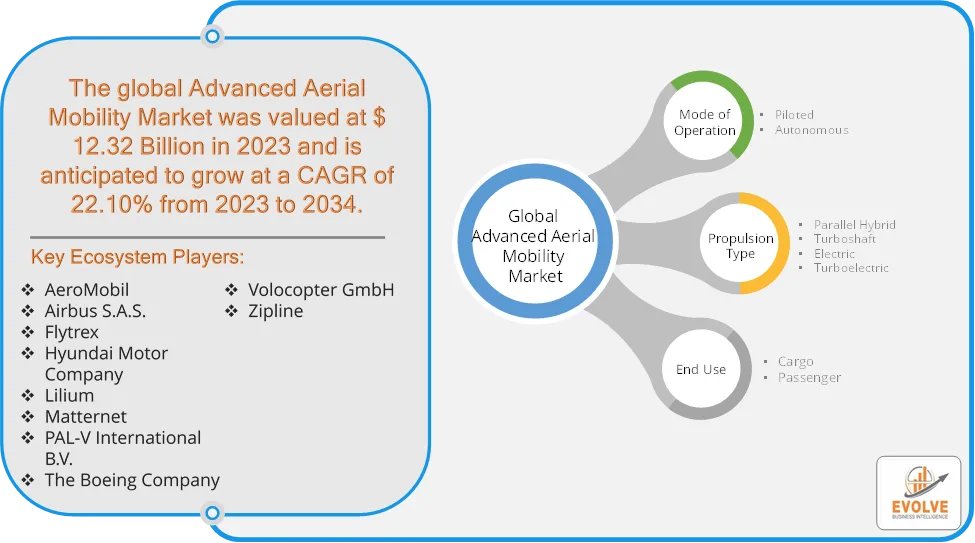

2.1. Market Definition

2.2. Market Scope & Segmentation

2.2.1. Objective of Report

CHAPTER 3. Evolve BI Methodology

3.1. Data Collection & Validation Approach

3.2. Market Size Estimation and Forecast

CHAPTER 4. Exclusive Analysis

4.1. Market Opportunity Score

4.1.1. Mode of Operation Segement – Market Opportunity Score

4.1.2. Propulsion Type Segment – Market Opportunity Score

4.1.3. End Use Segment – Market Opportunity Score

4.2. Key Market Influencing Indicators

CHAPTER 5. Market Insights and Trends

5.1. Value Chain Analysis

5.1.1. Raw Material

5.1.2. Manufacturing Process

5.1.3. Distribution Channel

5.1.4. End User

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining Power of Buyers

5.2.2. Bargaining Power of Suppliers

5.2.3. Threat of New Entrant

5.2.4. Threat of Substitute

5.2.5. Industry Rivalry

5.3. COVID-19 Impact and Post COVID Scenario on Advanced Aerial Mobility Market

5.3.1. Impact of COVID-19

5.3.2. Government Support and Industry Revival Policies

5.3.3. Measures Taken by Companies to Mitigate Negative Impact

5.3.4. Post COVID Trend

CHAPTER 6. Market Dynamics

6.1. Introduction

6.2. Drivers

6.2.1. Driver 1

6.2.2. Driver 2

6.2.3. Driver 3

6.3. Restraints

6.3.1. Restraint 1

6.3.2. Restraint 2

6.4. Opportunity

6.4.1. Opportunity 1

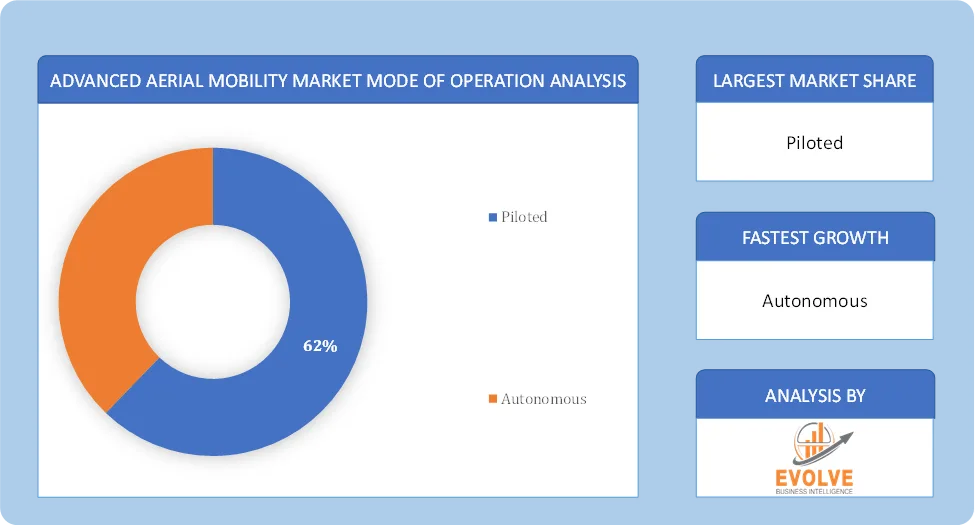

CHAPTER 7. Advanced Aerial Mobility Market, By Mode of Operation

7.1. Introduction

7.1.1. Piloted

7.1.2 Autonomous

CHAPTER 8 Advanced Aerial Mobility Market, By Propulsion Type

8.1. Introduction

8.1.1. Parallel Hybrid

8.1.2. Turboshaft

8.1.3. Electric

8.1.4. Turboelectric

CHAPTER 9. Advanced Aerial Mobility Market, By End Use

9.1. Introduction

9.1.1. Cargo

9.1.2. Passenger

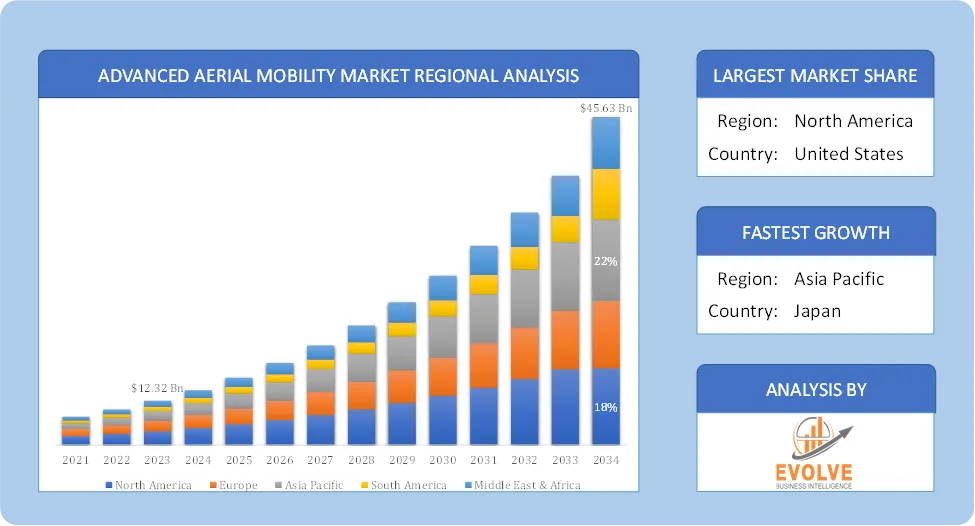

CHAPTER 10. Advanced Aerial Mobility Market, By Region

10.1. Introduction

10.2. NORTH AMERICA

10.2.1. North America: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.2.2. North America: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.2.3. North America: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.2.4. North America: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.2.5. US

10.2.5.1. US: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.2.5.2. US: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.2.5.3. US: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.2.6. CANADA

10.2.6.1. Canada: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.2.6.2. Canada: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.2.6.3. Canada: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.2.7. MEXICO

10.2.7.1. Mexico: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.2.7.2. Mexico: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.2.7.3. Mexico: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3. Europe

10.3.1. Europe: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.3.2. Europe: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.3.3. Europe: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.3.4. Europe: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.5. U.K.

10.3.5.1. U.K.: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.3.5.2. U.K.: Market Size and Forecast, By Mode of Transport, 2024 – 2034($ Million)

10.3.5.3. U.K.: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.6. GERMANY

10.3.6.1. Germany: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.3.6.2. Germany: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.3.6.3. Germany: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.7. FRANCE

10.3.7.1. France: Market Size and Forecast, By Service Mode of Operation, 2024 – 2034($ Million)

10.3.7.2. France: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.3.7.3. France: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.8. ITALY

10.3.8.1. Italy: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.3.8.2. Italy: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.3.8.3. Italy: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.9. SPAIN

10.3.9.1. Spain: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.3.9.2. Spain: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.3.9.3. Spain: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.10. BENELUX

10.3.10.1. BeNeLux: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.3.10.2. BeNeLux: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.3.10.3. BeNeLux: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.11. RUSSIA

10.3.11.1. Russia: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.3.11.2. Russia: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.3.11.3. Russia: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.12. REST OF EUROPE

10.3.12.1. Rest of Europe: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.3.12.2. Rest of Europe: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.3.12.3. Rest of Europe: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4. Asia Pacific

10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.4.2. Asia Pacific: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.4.3. Asia Pacific: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.4.4. Asia Pacific: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.5. CHINA

10.4.5.1. China: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.4.5.2. China: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.4.5.3. China: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.6. JAPAN

10.4.6.1. Japan: Market Size and Forecast, By Service Mode of Operation, 2024 – 2034($ Million)

10.4.6.2. Japan: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.4.6.3. Japan: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.7. INDIA

10.4.7.1. India: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.4.7.2. India: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.4.7.3. India: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.8. SOUTH KOREA

10.4.8.1. South Korea: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.4.8.2. South Korea: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.4.8.3. South Korea: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.9. THAILAND

10.4.9.1. Thailand: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.4.9.2. Thailand: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.4.9.3. Thailand: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.10. INDONESIA

10.4.10.1. Indonesia: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.4.10.2. Indonesia: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.4.10.3. Indonesia: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.11. MALAYSIA

10.4.11.1. Malaysia: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.4.11.2. Malaysia: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.4.11.3. Malaysia: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.12. AUSTRALIA

10.4.12.1. Australia: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.4.12.2. Australia: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.4.12.3. Australia: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.13. REST FO ASIA PACIFIC

10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.5. South America

10.5.1. South America: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.5.2. South America: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.5.3. South America: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.5.4. South America: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.5.5. BRAZIL

10.5.5.1. Brazil: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.5.5.2. Brazil: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.5.5.3. Brazil: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.5.6. ARGENTINA

10.5.6.1. Argentina: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.5.6.2. Argentina: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.5.6.3. Argentina: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.5.7. REST OF SOUTH AMERICA

10.5.7.1. Rest of South America: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.5.7.2. Rest of South America: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.5.7.3. Rest of South America: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6. Middle East & Africa

10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.6.2. Middle East & Africa: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.6.3. Middle East & Africa: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.6.4. Middle East & Africa: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6.5. SAUDI ARABIA

10.6.5.1. Saudi Arabia: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.6.5.2. Saudi Arabia: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.6.5.3. Saudi Arabia: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6.6. UAE

10.6.6.1. UAE: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.6.6.2. UAE: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.6.6.3. UAE: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6.7. EGYPT

10.6.7.1. Egypt: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.6.7.2. Egypt: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.6.7.3. Egypt: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6.8. SOUTH AFRICA

10.6.8.1. South Africa: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.6.8.2. South Africa: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.6.8.3. South Africa: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6.9. REST OF MIDDLE EAST & AFRICA

10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Mode of Operation, 2024 – 2034($ Million)

10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Propulsion Type, 2024 – 2034($ Million)

10.6.9.3.Rest of Middle East & Africa: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

CHAPTER 12. Competitive Landscape

12.1. Competitior Benchmarking 2023-

12.2. Market Share Analysis

12.3. Key Developments Analysis By Top 5 Companies

12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players

CHAPTER 13. Company Profiles

13.1. AeroMobil

13.1.1. Hanon Systems

13.1.2. Financial Analysis

13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million

13.1.2.2. Geographic Revenue Mix, 2022 (% Share)

13.1.3. Product Portfolio

13.1.4. Recent Development and Strategies Adopted

13.1.5. SWOT Analysis

13.2. Airbus S.A.S.

13.3. Flytrex

13.4. Hyundai Motor Company

13.5. Lilium

13.6. Matternet

13.7. PAL-V International B.V.

13.8. The Boeing Company

13.9 Volocopter GmbH

13.10 Zipline.