Blog

Private Health Insurance Market: 5.12% CAGR Expected

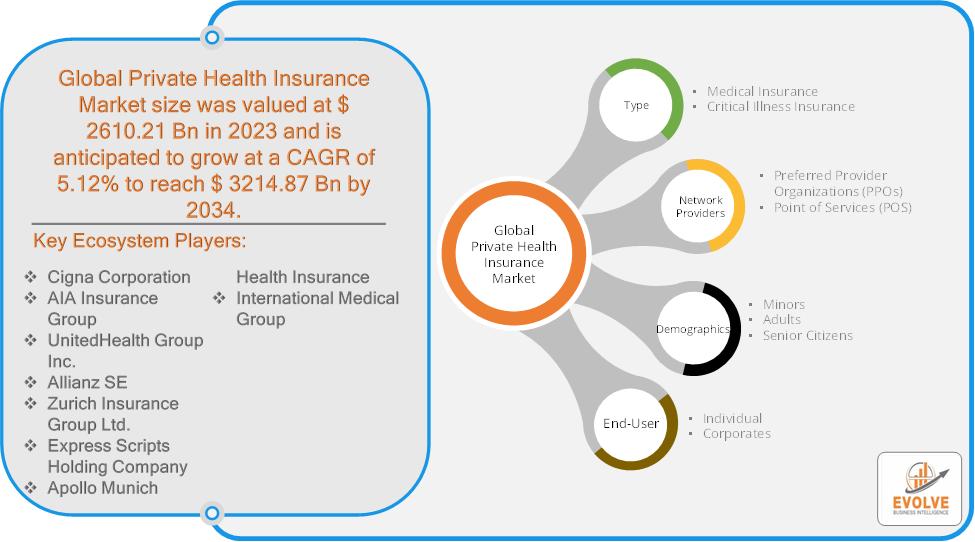

Evolve Business Intelligence has published a research report on the Global Private Health Insurance Market, 2021–2034. The Global Private Health Insurance market is projected to exhibit a CAGR of around 5.12%during the forecast period of 2021 to 2034.

Evolve Business Intelligence has recognized the following companies as the key players in the Global Private Health Insurance Market: Cigna Corporation, AIA Insurance Group, UnitedHealth Group Inc., Allianz SE, Zurich Insurance Group Ltd., Express Scripts Holding Company, AXA, Aviva plc, Aetna, Inc., Apollo Munich Health Insurance, and International Medical Group

The Global Global Private Health Insurance market is projected to be valued at USD 607.2 Billion by 2034, recording a CAGR of around 4.41% during the forecast period. Employing health insurance will help protect one against the potential financial burdens that can come with a medical emergency. Coverage includes expenses such as ambulance fees and doctor consultations. It also covers hospitalization, medicines, and daycare proceedings. Generally, the reimbursement is calculated using the original medical bills or the estimated cost to diagnose a disease. Health insurance helps with financial protection, allows easy access to treatment at network hospitals, and provides a cashless option. Apart from this, health insurance also provides many tax benefits for a wide variety of medical conditions. Many health insurance providers are now providing coverage for at-home disease diagnosis and treatment. With follow-up care handled by a doctor in one of their offices, this method of service is cost-effective.

Download the full report now to discover market trends, opportunities, and strategies for success.

Segmental Analysis

The global Global Private Health Insurance market has been segmented based on Type, Network Providers, Demographics, End-Use

Based on the Type, the Private Health Insurance market is segmented based on Medical Insurance and Critical Illness Insurance. The Medical Insurance segment is anticipated to account for the large market share owing to the increasing adoption of a sedentary lifestyle, the surging obese population with multiple health issues, and rising accidental care expenses both in developed markets and emerging economies. The increasing prevalence of chronic diseases such as cancer, cardiac diseases, diabetes, and others would support greater growth in this niche market.

Based on the Network Provider, the Private Health Insurance market is segmented based on Preferred Provider Organizations (PPOs), and Point of Services (POS). The PPOs segment is anticipated to account for the large market share. PPOs are the most common health insurance plans as it’s possible to access a large network of providers with just one plan. They’re also marketed as providing “flexibility” when it comes to choosing your healthcare provider, so the policyholders don’t have to worry about choice paralysis. The POS segment held the second position owing to the low premiums compared to PPOs.

Based on Demographics, the global Private Health Insurance market has been divided into Minors, Adults, and Senior Citizens. The Adult segment is expected to hold the largest market share. Adults have a high risk of lifestyle diseases, which may make them more susceptible to health concerns in the future. Moreover, the population is becoming more prone to various diseases that require hospitalization. The Senior Citizen segment made the second-highest CAGR in the market for Private healthcare insurance. This is due to their increased vulnerability to chronic diseases which leads to an increased hospitalization rate.

Based on End-Use, the global Private Health Insurance market has been divided into Individual and Corporates. The Individuals segment is expected to hold the largest market share. The individual plans offer more benefits and thus provide much more value for the high premium. As a result, these plans are generally in higher demand and attract a lot of customers. Corporate insurance coverage is provided by the company but at a lower cost. This is because of its limited benefits while individual plans offer more comprehensive coverage. In addition, these types of insurance often become invalid once the employee leaves the job, making it difficult to guarantee the growth of this sector.

Regional Analysis

The Global Private Health Insurance market is divided into five regions: North America, Europe, Asia-Pacific, South America, and the Middle East, &Africa. The North American region holds a dominant position in the Global Private Health Insurance market. The North American market is expected to be a dominant presence in the Private Health Insurance market. The presence of significant Insurance providers in the region accounts for the region’s largest market share. Also, in the United States, it is mandatory to have health care coverage under the Affordable Care Act. If a state did not comply, it would be penalized by the federal government The Asia Pacific region is forecast to experience accelerated growth Private Health Insurance market growth over the next few years. This increase in health care spending would be largely due to an increase in public and private health expenditures, as well as the penetration of insurance services rendered to rural and urban centers, along with favorable government policies. Middle-class consumers in the developing countries in the region are increasing the demand for insurance. Insurance providers are focusing more on protection-based products with accident and health policies over fee-based products in the region.