Blog

Neo and Challenger Bank Market Booms: 41.25% CAGR

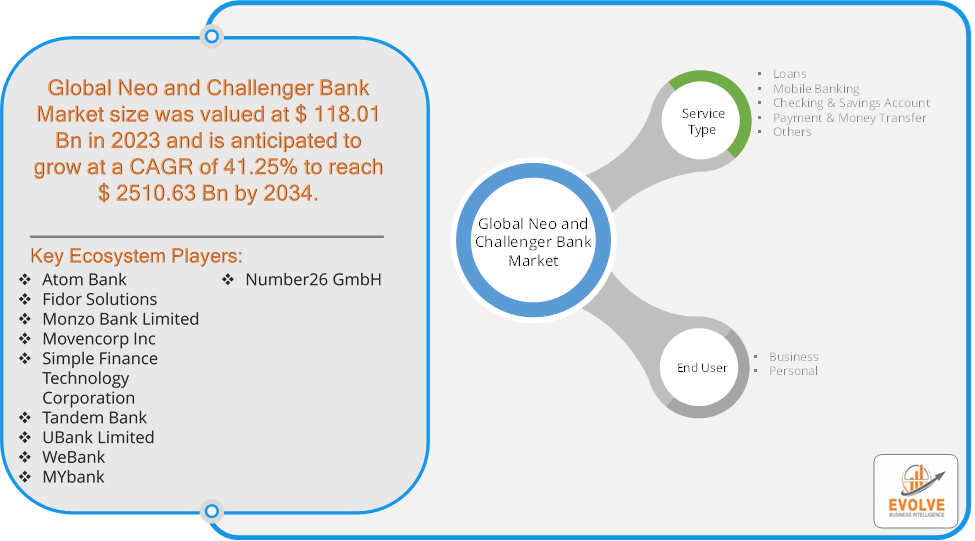

Evolve Business Intelligence has published a research report on the Global Neo and Challenger Bank Market, 2024–2034. The Global Neo and Challenger Bank Market is projected to exhibit a CAGR of around 41.25% during the forecast period of 2024 to 2034.

Evolve Business Intelligence has recognized the following companies as the key players in the Global Neo and Challenger Bank Market: Atom Bank, Fidor Solutions, Monzo Bank Limited, Movencorp Inc, Simple Finance Technology Corporation, Tandem Bank, UBank Limited, WeBank, MYbank and Number26 GmbH.

The Global Neo and Challenger Bank Market is projected to be valued at USD 2510.63 Billion by 2034, recording a CAGR of around 41.25% during the forecast period. The Global Neo and Challenger Bank Market refers to the sector composed of digital-first financial institutions that aim to disrupt traditional banking systems by offering modern, technology-driven services. Neo banks and challenger banks primarily operate online or via mobile platforms, providing banking services without the need for physical branches.

This market has experienced significant growth in recent years, driven by factors such as increased adoption of digital technologies, rising consumer expectations for convenience and personalized services, and the desire for more transparent and affordable financial solutions.

Download the full report now to discover market trends, opportunities, and strategies for success.

Segmental Analysis

The Global Neo and Challenger Bank Market has been segmented based on Service Type and End User.

Based on Service Type, the Global Neo and Challenger Bank Market is segmented into Loans, Mobile Banking, Checking & Savings Account, Payment & Money Transfer and Others. The Mobile Banking segment is anticipated to dominate the market.

Based on End User, the Global Neo and Challenger Bank Market has been divided into Business and Personal. The Business segment is anticipated to dominate the market.

Regional Analysis

The Global Neo and Challenger Bank Market is divided into five regions: North America, Europe, Asia-Pacific, South America, and the Middle East, & Africa. North America, especially the U.S., has a well-developed financial system, but there is growing consumer demand for digital banking services. Neo and challenger banks are gaining traction, particularly among tech-savvy and younger demographics and the shift toward mobile banking, dissatisfaction with traditional banks, and the rise of fintech ecosystems are fueling growth in this region. U.S. consumers are increasingly turning to digital-first banks for features like no-fee accounts, higher interest rates on savings, and innovative financial tools. Europe is one of the most advanced regions for neo and challenger banks, particularly in countries like the UK, Germany, and the Nordics. The region’s strong regulatory support, especially with initiatives like PSD2 (Payment Services Directive 2) and open banking, has fostered innovation and competition and High internet and smartphone penetration, open banking regulations, and a strong fintech ecosystem drive the growth of neo banks in Europe. The region’s regulatory framework encourages competition, making it easier for digital-only banks to operate. The Asia-Pacific region, particularly countries like China, India, Singapore, and Australia, represents a significant growth area for neo and challenger banks. There is a large, tech-savvy population, with growing demand for mobile-first financial services and rapid digital transformation, the increasing use of smartphones, and government initiatives promoting financial inclusion are key drivers of growth. In emerging markets, many people are bypassing traditional banks in favor of mobile and digital banking. Latin America has a relatively large unbanked and underbanked population, presenting a significant opportunity for neo and challenger banks. Brazil, Mexico, and Argentina are the primary markets driving growth in the region. The Middle East and Africa represent untapped potential for neo and challenger banks, particularly in regions where financial inclusion is low and mobile penetration is increasing. South Africa, Nigeria, and the UAE are key markets and increasing mobile phone penetration, the rise of digital payments, and government initiatives aimed at improving financial inclusion are driving growth in the region. Many people in these markets are skipping traditional banking services in favor of mobile-based solutions.