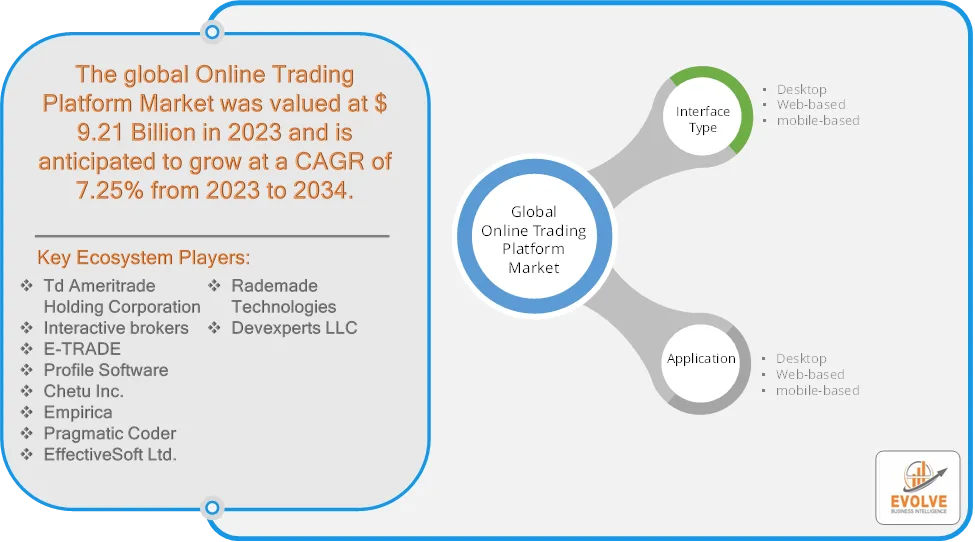

Global Online Trading Platform Market to Grow at 7.25% CAGR

Evolve Business Intelligence has published a research report on the Global Online Trading Platform Market, 2023–2033. The global Online Trading Platform Market is projected to exhibit a CAGR of around 7.25%during the forecast period of 2023 to 2033.

Evolve Business Intelligence has recognized the following companies as the key players in the global Online Trading Platform Market: Td Ameritrade Holding Corporation, Interactive brokers, E-TRADE, Profile Software, Chetu Inc., Empirica, Pragmatic Coder, EffectiveSoft Ltd., Rademade Technologies and Devexperts LLC.

Market Highlights

The Online Trading Platform Market is projected to be valued at USD 18.37 Billion by 2033, recording a CAGR of around 7.25% during the forecast period. The online trading platform market has experienced significant growth and transformation over recent years, driven by technological advancements, increased retail investor participation, and the emergence of innovative financial technologies. The online trading platform market is dynamic and continually evolving, influenced by technological innovations, changing investor behaviors, and regulatory developments. As platforms strive to offer more sophisticated tools and access to diverse financial instruments, they play a crucial role in shaping the future landscape of global financial markets.

The online trading platform market is dynamic and evolving, driven by technological innovation and changing investor behavior.

Download the full report now to discover market trends, opportunities, and strategies for success.

Segmental Analysis

The Online Trading Platform Market has been segmented based on Interface Type and End User.

Based on Interface Type, the Online Trading Platform Market is segmented into Desktop, Web-based, and mobile-based. The Desktop segment is anticipated to dominate the market.

Based on End User, the Online Trading Platform Market is segmented into Banking and Financial Institutions, Brokers, and Others. The Banking and Financial Institutions segment is anticipated to dominate the market.

Regional Analysis

The Online Trading Platform Market is divided into five regions: North America, Europe, Asia-Pacific, South America, and the Middle East, &Africa. North America holds a significant market share, driven by its well-established financial markets and advanced technological infrastructure. The region’s dominance is also attributed to the extensive and well-established financial industry, including major stock exchanges and institutional investors and a high adoption rate of online trading among retail investors is a key factor. European markets have experienced a surge in fintech services, offering innovative trading solutions that attract a new wave of retail investors. The introduction of diverse trading instruments, including cryptocurrencies and derivatives, has further broadened the investor base, particularly in countries like Switzerland and the Netherlands. The Asia-Pacific region is witnessing rapid growth in online trading, propelled by increasing smartphone penetration and financial literacy initiatives. Platforms like Zerodha in India and Tiger Brokers in China have capitalized on this trend. The region’s young, tech-savvy population is driving demand for mobile-friendly trading solutions. In Latin America, platforms like Bitso in Mexico are catering to a growing demand for online trading, driven by factors like unstable fiat currencies and remittance needs. Brazil’s regulatory approval for cryptocurrency trading has further accelerated this trend. The Middle East and Africa are experiencing growth in the online trading platform market, supported by fintech advancements and initiatives like Saudi Arabia’s Vision 2030, which fosters digital finance. South Africa has seen a robust interest in forex trading. The region’s untapped potential and rising internet penetration create opportunities for platforms tailored to regional needs.