Well Intervention Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

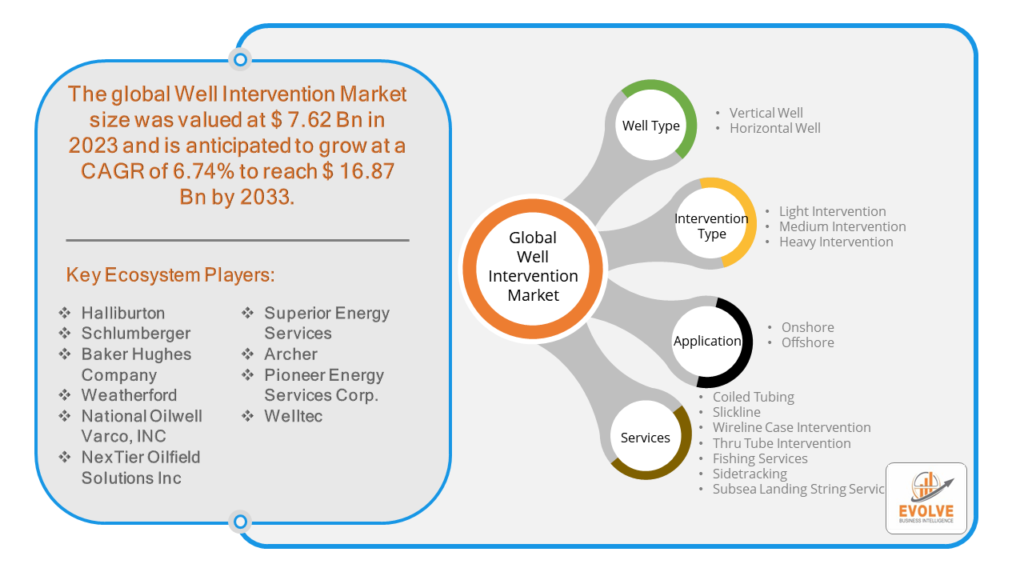

Well Intervention Market Research Report: By well Type (Vertical Well, Horizontal Well), By Intervention Type (Light Intervention, Medium Intervention, Heavy Intervention), By Application (Onshore , Offshore), By services (Coiled Tubing , Slickline , Wireline Case Intervention, Thru Tube Intervention, Fishing Services, Sidetracking, Subsea Landing String Services), and by Region — Forecast till 2033.

Page: 169

Well Intervention Market Overview

Well Intervention Market Size is expected to reach USD 16.87 Billion by 2033. The Well Intervention industry size accounted for USD 7.62 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.74% from 2023 to 2033. The well intervention market encompasses services and tools aimed at enhancing or restoring the productivity of oil and gas wells. It involves a range of activities such as logging, stimulation, and maintenance performed on both onshore and offshore wells. Well intervention techniques include wireline, coiled tubing, hydraulic workover units, and snubbing, among others. This market is driven by the need to optimize production from existing wells, extend their operational life, and address issues like well integrity and reservoir performance. Factors such as aging oilfields, technological advancements, and increasing energy demand contribute to the growth of this market.

Global Well Intervention Market Synopsis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the Well Intervention market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers to adopt various strategies to stabilize the company.

Global Well Intervention Market Dynamics

The major factors that have impacted the growth of Well Intervention are as follows:

Drivers:

- Increasing efforts for production enhancement from maturing oil & gas fields

The oil & gas extraction is one of the oldest business with several plants extracting for more than 25 years. In this type of oil field, drilling new wells do not provide a sustainable solution to increase the profitability of the oil field. This requires new and innovative techniques of well intervention to increase the profit and make the oil field more productive. This is expected to increase the demand for well intervention equipment and services during the next few years. Around 55% of the oil produced worldwide depends on the oil fields more than 20 years old. Thus, lack of new oil fields may lead to an increase in the productivity of mature oil fields to cater the continuously growing demand in the oil & gas sector.

Restraint:

- Technological Challenges

Advancements in drilling and intervention technologies have enhanced operational efficiency and safety. However, integrating new technologies into existing infrastructure poses challenges such as compatibility issues, technical failures, and the need for specialized training, limiting widespread adoption.

Opportunity:

⮚ Continuous shale developments

Shale gas has significant potential in terms of exploration and development. There are several concerns regarding the well integrity of shale gas development. These concerns relate to the potential for the unintended flow of fluid out of, or into, the well, between layers of rock or to the surface via the well. This increases the use of well intervention equipment and services in shale gas development. Shale gas production is expected to witness significant growth during the forecast period with one of the major extracting countries to be the US. Mentioned below is the Shale production in the US from 20017 to 2018,

Well Intervention Market Segment Overview

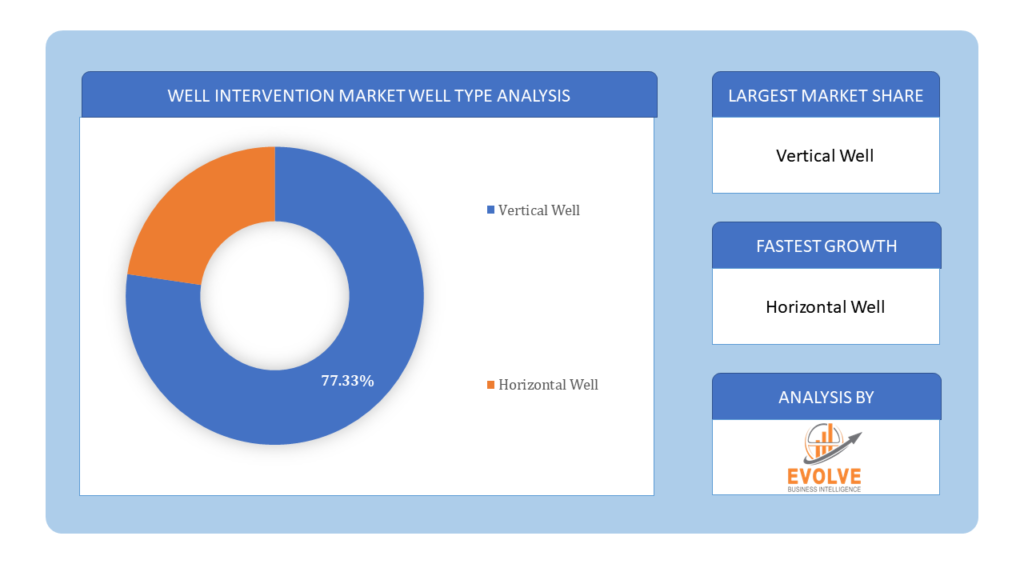

By Well Type

Based on the Well Type, the market is segmented based on Vertical Well, Horizontal Well. In the well intervention market segmented by well type, Vertical Wells currently dominate due to their long-standing presence in the industry and widespread adoption. While horizontal wells have gained prominence in recent years, vertical wells still constitute a significant portion of intervention activities, particularly in mature oil and gas fields.

Based on the Well Type, the market is segmented based on Vertical Well, Horizontal Well. In the well intervention market segmented by well type, Vertical Wells currently dominate due to their long-standing presence in the industry and widespread adoption. While horizontal wells have gained prominence in recent years, vertical wells still constitute a significant portion of intervention activities, particularly in mature oil and gas fields.

By Intervention Type

Based on Intervention Type, the market has been divided into Light Intervention, Medium Intervention, Heavy Intervention. In the well intervention market segmented by intervention type, Medium Intervention services dominate, as they strike a balance between cost efficiency and the ability to address a wide range of well complexities.

By Application

Based on the Application, the market has been divided into Onshore, Offshore. In the well intervention market segmented by application, Offshore interventions hold dominance due to the increasing exploration and production activities in deepwater and ultra-deepwater regions. Offshore interventions require specialized equipment and expertise, catering to the unique challenges of offshore drilling environments, thus contributing significantly to market share.

By Services

Based on Services, the market has been divided into Coiled Tubing , Slickline , Wireline Case Intervention, Thru Tube Intervention, Fishing Services, Sidetracking, Subsea Landing String Services. Among the segments in the well intervention market, Coiled Tubing and Wireline services dominate due to their versatility, cost-effectiveness, and wide range of applications in well maintenance, stimulation, and intervention activities. These services offer efficient solutions for tasks such as cleanouts, logging, perforating, and hydraulic fracturing, contributing significantly to the overall market share.

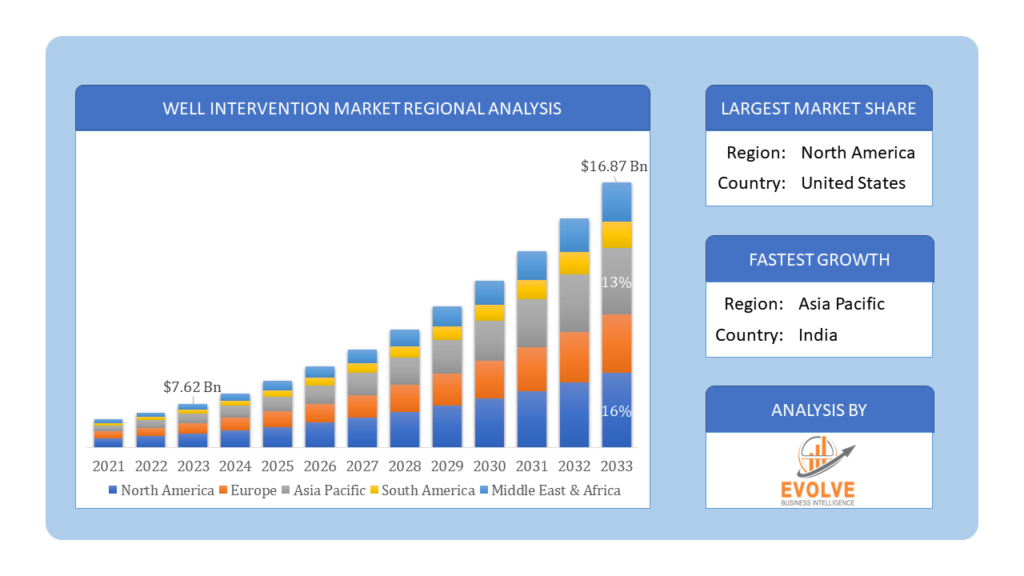

Global Well Intervention Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Well Intervention, followed by those in Asia-Pacific and Europe.

Well Intervention North America Market

Well Intervention North America Market

The North American region holds a dominant position in the Well Intervention market. In 2022, the Well Intervention Market in North America held a 45.80% market share. North America is home to a large number of well-established oilfields that have been in operation for a long time. Well intervention is essential to optimizing recovery and prolonging the lives of these assets because the production rates in these fields are decreasing. The dominant position of the market has been significantly impacted by the requirement for well intervention services in mature oilfields.

Well Intervention Asia Pacific Market

The Asia-Pacific region is witnessing rapid growth and emerging as a significant market for the Well Intervention industry. From 2023 to 2032, the well intervention market in Asia-Pacific is anticipated to develop at the quickest compound annual growth rate (CAGR). In the Asia-Pacific area, more modern well intervention methods and technologies are being used. Technological developments can save costs, boost operational efficiency, and improve the efficacy of interventions. The well intervention sector is expected to grow faster as local business owners implement new technologies.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Halliburton, Schlumberger, Baker Hughes Company, Weatherford, and National Oilwell Varco, INC are some of the leading players in the global Well Intervention Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Halliburton

- Schlumberger

- Baker Hughes Company

- Weatherford

- National Oilwell Varco, INC

- NexTier Oilfield Solutions Inc

- Superior Energy Services

- Archer

- Pioneer Energy Services Corp.

- Welltec

Key Development:

In September 2022, Baker Hughes made significant strides in advancing its digital solutions portfolio, launching innovative technologies aimed at enhancing well intervention efficiency and performance, thereby strengthening its position as a leader in the oilfield services sector.

Scope of the Report

Global Well Intervention Market, by Well Type

- Vertical Well

- Horizontal Well

Global Well Intervention Market, by Intervention Type

- Light Intervention

- Medium Intervention

- Heavy Intervention

Global Well Intervention Market, by Application

- Onshore

- Offshore

Global Well Intervention Market, by Services

- Coiled Tubing

- Slickline

- Wireline Case Intervention

- Thru Tube Intervention

- Fishing Services

- Sidetracking

- Subsea Landing String Services

Global Well Intervention Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $16.87 Billion |

| CAGR | 6.74% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Well Type, Intervention Type , Application, Services |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Halliburton, Schlumberger, Baker Hughes Company, Weatherford, National Oilwell Varco, INC, NexTier Oilfield Solutions Inc, Superior Energy Services, Archer, Pioneer Energy Services Corp., Welltec |

| Key Market Opportunities | Oil and gas output is rising, and old fields and wells are being rejuvenated |

| Key Market Drivers | The global need for oil, which is constantly rising |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Well Intervention Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Well Intervention market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Well Intervention market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Well Intervention Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

1.What is the study period of this market?

- The study period of the global Well Intervention market is 2022- 2033

2.What are the 10 Years CAGR (2023 to 2033) of the global Well Intervention market?

- The global Well Intervention market is growing at a CAGR of ~74% over the next 10 years

3.Which region has the highest growth rate in the market of Well Intervention?

- Asia Pacific is expected to register the highest CAGR during 2023-2033

4.Which region accounted for the largest share of the market of Well Intervention?

- North America holds the largest share in 2022

5.Major Key Players in the Market of Well Intervention?

Halliburton, Schlumberger, Baker Hughes Company, Weatherford, National Oilwell Varco, INC, NexTier Oilfield Solutions Inc, Superior Energy Services, Archer, Pioneer Energy Services Corp., and Welltec are the major companies operating in the Well Intervention Industry

6.Do you offer Post Sale Support?

- Yes, we offer 16 hours of analyst support to solve the queries

7.Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Well Type Segement – Market Opportunity Score 4.1.2. Intervention Type Segment – Market Opportunity Score 4.1.3. Application Segment – Market Opportunity Score 4.1.4. Services Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Well Type 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Well Intervention Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Well Intervention Market, By Well Type 7.1. Introduction 7.1.1. Vertical Well 7.1.2. Horizontal Well CHAPTER 8. Global Well Intervention Market, By Intervention Type 8.1. Introduction 8.1.1. Light Intervention 8.1.2. Medium Intervention 8.1.3. Heavy Intervention CHAPTER 9. Global Well Intervention Market, By Application 9.1. Introduction 9.1.1. Onshore 9.1.2. Offshore CHAPTER 10. Global Well Intervention Market, By Services 10.1. Introduction 10.1.1. Coiled Tubing 10.1.2. Slickline 101.3. Wireline Case Intervention 10.1.4. Thru Tube Intervention 10.1.5. Fishing Services 101.6. Sidetracking 10.1.7. Subsea Landing String Services CHAPTER 11. Global Well Intervention Market, By Region 11.1. Introduction 11.2. NORTH AMERICA 11.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.2.2. North America: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.2.3. North America: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.2.4. North America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.5. North America: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.2.6. US 11.2.6.1. US: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.2.6.2. US: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.2.6.3. US: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.6.4. US: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.2.7. CANADA 11.2.7.1. Canada: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.2.7.2. Canada: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.2.7.3. Canada: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.7.4. Canada: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.2.8. MEXICO 11.2.8.1. Mexico: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.2.8.2. Mexico: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.2.8.3. Mexico: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.8.4. Mexico: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.3. Europe 11.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.3.2. Europe: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.3.3. Europe: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.3.4. Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.5. Europe: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.3.6. U.K. 11.3.6.1. U.K.: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.3.6.2. U.K.: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.3.6.3. U.K.: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.6.4. U.K.: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.3.7. GERMANY 11.3.7.1. Germany: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.3.7.2. Germany: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.3.7.3. Germany: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.7.4. Germany: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.3.8. FRANCE 11.3.8.1. France: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.3.8.2. France: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.3.8.3. France: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.8.4. France: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.3.9. ITALY 11.3.9.1. Italy: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.3.9.2. Italy: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.3.9.3. Italy: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.9.4. Italy: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.3.10. SPAIN 11.3.10.1. Spain: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.3.10.2. Spain: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.3.10.3. Spain: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.10.4. Spain: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.3.11. BENELUX 11.3.11.1. BeNeLux: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.3.11.2. BeNeLux: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.3.11.3. BeNeLux: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.11.4. BeNeLux: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.3.12. RUSSIA 11.3.12.1. Russia: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.3.12.2. Russia: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.3.12.3. Russia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.12.4. Russia: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.3.13. REST OF EUROPE 11.3.13.1. Rest of Europe: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.3.13.2. Rest of Europe: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.3.13.3. Rest of Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.13.4. Rest of Europe: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.4. Asia Pacific 11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.4.2. Asia Pacific: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.4.3. Asia Pacific: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.4.4. Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.5. Asia Pacific: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.4.6. CHINA 11.4.6.1. China: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.4.6.2. China: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.4.6.3. China: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.6.4. China: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.4.7. JAPAN 11.4.7.1. Japan: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.4.7.2. Japan: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.4.7.3. Japan: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.7.4. Japan: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.4.8. INDIA 11.4.8.1. India: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.4.8.2. India: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.4.8.3. India: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.8.4. India: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.4.9. SOUTH KOREA 11.4.9.1. South Korea: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.4.9.2. South Korea: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.4.9.3. South Korea: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.9.4. South Korea: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.4.10. THAILAND 11.4.10.1. Thailand: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.4.10.2. Thailand: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.4.10.3. Thailand: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.10.4. Thailand: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.4.11. INDONESIA 11.4.11.1. Indonesia: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.4.11.2. Indonesia: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.4.11.3. Indonesia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.11.4. Indonesia: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.4.12. MALAYSIA 11.4.12.1. Malaysia: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.4.12.2. Malaysia: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.4.12.3. Malaysia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.12.4. Malaysia: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.4.13. AUSTRALIA 11.4.13.1. Australia: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.4.13.2. Australia: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.4.13.3. Australia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.13.4. Australia: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.4.14. REST FO ASIA PACIFIC 11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.5. South America 11.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.5.2. South America: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.5.3. South America: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.5.4. South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.5. South America: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.5.6. BRAZIL 11.5.6.1. Brazil: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.5.6.2. Brazil: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.5.6.3. Brazil: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.6.4. Brazil: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.5.7. ARGENTINA 11.5.7.1. Argentina: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.5.7.2. Argentina: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.5.7.3. Argentina: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.7.4. Argentina: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.5.8. REST OF SOUTH AMERICA 11.5.8.1. Rest of South America: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.5.8.2. Rest of South America: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.5.8.3. Rest of South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.8.4. Rest of South America: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.6. Middle East & Africa 11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.6.2. Middle East & Africa: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.6.3. Middle East & Africa: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.6.4. Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.5. Middle East & Africa: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.6.6. SAUDI ARABIA 11.6.6.1. Saudi Arabia: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.6.6.2. Saudi Arabia: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.6.6.3. Saudi Arabia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.6.4. Saudi Arabia: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.6.7. UAE 11.6.7.1. UAE: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.6.7.2. UAE: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.6.7.3. UAE: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.7.4. UAE: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.6.8. EGYPT 11.6.8.1. Egypt: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.6.8.2. Egypt: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.6.8.3. Egypt: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.8.4. Egypt: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.6.9. SOUTH AFRICA 11.6.9.1. South Africa: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.6.9.2. South Africa: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.6.9.3. South Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.9.4. South Africa: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) 11.6.10. REST OF MIDDLE EAST & AFRICA 11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Well Type, 2023 – 2033 ($ Million) 11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Intervention Type , 2023 – 2033 ($ Million) 11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By Services, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Halliburton 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Schlumberger 13.3. Baker Hughes Company 13.4. Weatherford 13.5. National Oilwell Varco, INC 13.6. NexTier Oilfield Solutions Inc 13.7. Superior Energy Services 13.8. Archer 13.9. Pioneer Energy Services Corp. 13.10. Welltec

Connect to Analyst

Research Methodology