Virtual Meeting Software Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

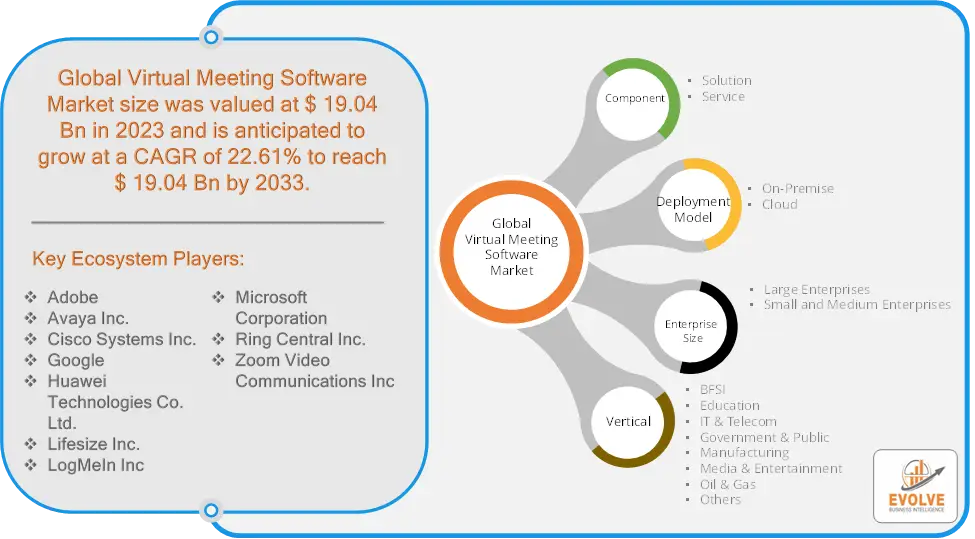

Virtual Meeting Software Market Research Report: Information By Component (Solution, Service), By Deployment Model (On-Premise, Cloud), By Enterprise Size (Large Enterprises, Small and Medium Enterprises), By Industry Vertical (BFSI, Education, IT & Telecom, Government & Public, Manufacturing, Media & Entertainment, Oil & Gas, Others), and by Region — Forecast till 2033

Page: 161

Virtual Meeting Software Market Overview

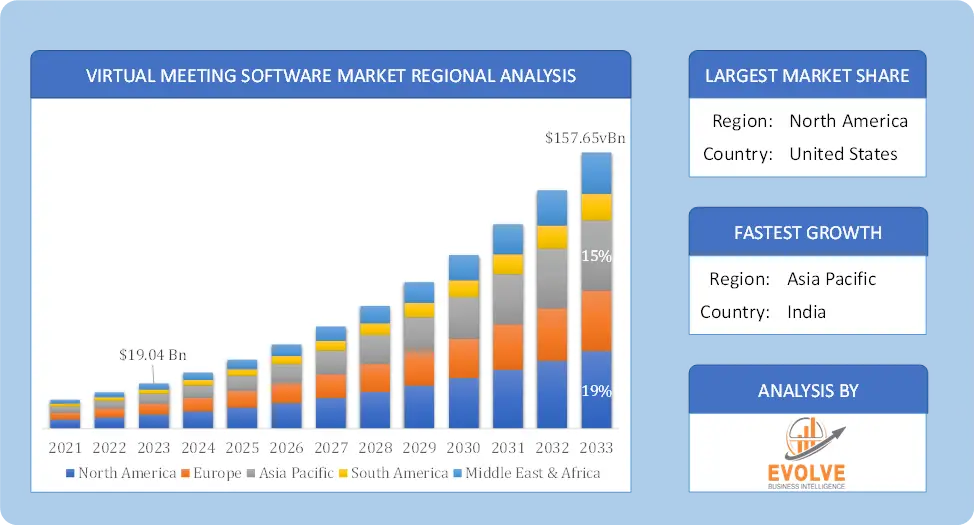

The Virtual Meeting Software Market Size is expected to reach USD 157.65 Billion by 2033. The Virtual Meeting Software Market industry size accounted for USD 19.04 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 22.61% from 2023 to 2033. The Virtual Meeting Software Market refers to the global industry focused on the development, distribution, and utilization of software solutions that facilitate online meetings, webinars, and video conferences. These software platforms enable users to conduct meetings and collaborate remotely through audio, video, chat, and file-sharing capabilities. The market encompasses various types of software, including cloud-based, on-premise, and hybrid solutions, catering to different business needs, from small enterprises to large corporations.

The driving growth of this market include the increasing adoption of remote work, globalization of businesses, the need for real-time collaboration, and advancements in communication technologies. The market is also influenced by trends such as integration with artificial intelligence (AI) for features like transcription and meeting analytics, as well as the growing emphasis on cybersecurity and data privacy.

Global Virtual Meeting Software Market Synopsis

The COVID-19 pandemic had a significant impact on the Virtual Meeting Software Market. With lockdowns and social distancing measures in place, businesses, educational institutions, and other organizations were forced to transition to remote work and learning environments. This created an unprecedented demand for virtual meeting software to facilitate communication and collaboration. The pandemic led to a significant increase in the global user base for virtual meeting platforms, as companies of all sizes and sectors adopted these tools to maintain business continuity. The pandemic also drove the integration of virtual meeting software with other enterprise tools like project management platforms, CRM systems, and learning management systems (LMS), further expanding the capabilities and utility of these platforms. Even as pandemic restrictions eased, the widespread success and convenience of virtual meeting software led to the adoption of hybrid work models, where employees split their time between remote and in-office work. This trend is expected to sustain the demand for virtual meeting tools post-pandemic.

Virtual Meeting Software Market Dynamics

The major factors that have impacted the growth of Virtual Meeting Software Market are as follows:

Drivers:

Ø Advancements in Communication Technology

The widespread availability of high-speed internet, including 4G and 5G networks, has enhanced the quality and reliability of virtual meetings, making them more accessible and effective. The integration of artificial intelligence (AI) into virtual meeting platforms, such as AI-driven transcription, automatic note-taking, and real-time language translation, has improved the functionality and appeal of these tools. Companies are increasingly focusing on business continuity and disaster recovery planning, which includes ensuring that communication can continue seamlessly during disruptions. Virtual meeting software plays a crucial role in maintaining operations during emergencies, such as natural disasters or pandemics. Virtual meeting platforms offer scalability, allowing businesses to easily adjust their capacity and features based on changing needs, which is essential for maintaining continuity.

Restraint:

- Perception of Security and Privacy Concerns

The growing reliance on virtual meeting platforms has raised concerns about data security and privacy. High-profile incidents of “Zoombombing” and other breaches have led to fears about the confidentiality of sensitive business and personal information. Different industries and regions have stringent data protection regulations, such as GDPR in Europe and HIPAA in the U.S., which can be challenging for virtual meeting software providers to comply with. Non-compliance can result in hefty fines and damage to reputation.

Opportunity:

⮚ Focus on Security and Compliance

As cybersecurity concerns grow, there is an opportunity for virtual meeting software providers to differentiate themselves by offering advanced security features, such as end-to-end encryption, secure data storage, and compliance with stringent data protection regulations like GDPR and HIPAA. This can attract customers from highly regulated industries. Incorporating blockchain technology to enhance data security and transparency in virtual meetings could be an innovative opportunity, particularly for sectors requiring immutable records of communication. Offering data analytics features that provide insights into meeting productivity, participant engagement, and collaboration patterns can help organizations optimize their virtual meetings and improve overall efficiency.

Virtual Meeting Software Market Segment Overview

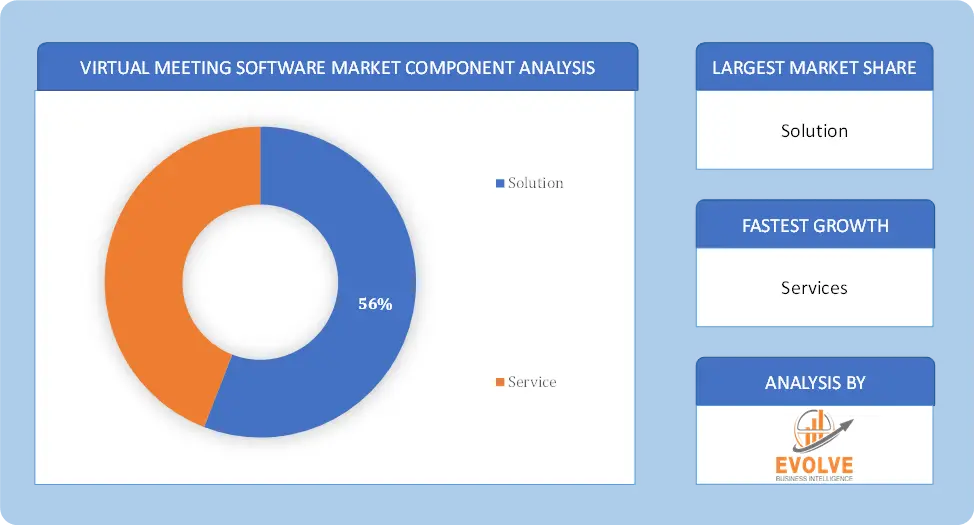

By Component

Based on Component, the market is segmented based on Solution and Service. The solutions segment dominant the market. The need to monitor and manage many cloud meetings, as well as the rise in the demand to stream meetings with a combination of live video and screen sharing in various organizations, are the primary factors contributing to the expansion of the market.

Based on Component, the market is segmented based on Solution and Service. The solutions segment dominant the market. The need to monitor and manage many cloud meetings, as well as the rise in the demand to stream meetings with a combination of live video and screen sharing in various organizations, are the primary factors contributing to the expansion of the market.

By Deployment Model

Based on Deployment Model, the market segment has been divided into On-Premise and Cloud. The on-premise segment dominant the market. Compared to more traditional methods, on-premise virtual meeting software speeds up communication between businesses, employees, and customers. As a result, on-premise virtual meeting software has grown to be a significant market driver. Organizations can also benefit from the on-premise virtual meeting software, which enables them to connect with employees in different locations and share important files with them with enhanced security.

By Enterprise Size

Based on Enterprise Size, the market segment has been divided into Large Enterprises and Small and Medium Enterprises. The large enterprise segment dominant the market. Many large organizations, such as educational institutions, healthcare providers, and government agencies, are adopting virtual meeting software solutions. During the pandemic, these companies use virtual meeting software to train their employees and better connect with their customers. Many large corporations are using video conferencing software to enhance communication with their workforces and increase productivity as the trend of working from home gains traction.

By Industry Vertical

Based on Industry Vertical, the market segment has been divided into BFSI, Education, IT & Telecom, Government & Public, Manufacturing, Media & Entertainment, Oil & Gas and Others. The IT and telecom segment dominant the market. The global virtual meeting software market is fueled by factors such as reduced travel costs for IT and telecom companies, the ability to share critical documents with employees, and the provision of instant meeting services. Virtual meeting software is also being introduced by many telecommunications service providers so that their employees can work from home.

Global Virtual Meeting Software Market Regional Analysis

Based on region, the global Virtual Meeting Software Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Virtual Meeting Software Market followed by the Asia-Pacific and Europe regions.

Virtual Meeting Software North America Market

Virtual Meeting Software North America Market

North America holds a dominant position in the Virtual Meeting Software Market. North America is the largest and most mature market for virtual meeting software, driven by the early adoption of technology, a strong presence of major software vendors, and widespread remote work practices and it has high internet penetration, a large number of tech-savvy enterprises, and significant investments in IT infrastructure are key factors driving the market. The U.S. and Canada have also seen a rapid shift towards hybrid work models, further boosting demand.

Virtual Meeting Software Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Virtual Meeting Software Market industry. Asia-Pacific is one of the fastest-growing regions in the virtual meeting software market, driven by the rapid digitization of businesses, increasing internet penetration, and a large population base. Key markets include China, India, Japan, South Korea, and Australia. Governments in countries like China and India are promoting digital infrastructure development, further enhancing the market’s growth potential. The education sector, particularly in India, has also seen a surge in the use of virtual meeting tools due to the rise of online education.

Competitive Landscape

The global Virtual Meeting Software Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Adobe

- Avaya Inc.

- Cisco Systems Inc.

- Huawei Technologies Co. Ltd.

- Lifesize Inc.

- LogMeIn Inc

- Microsoft Corporation

- Ring Central Inc.

- Zoom Video Communications Inc.

Scope of the Report

Global Virtual Meeting Software Market, by Component

- Solution

- Service

Global Virtual Meeting Software Market, by Deployment Model

- On-Premise

- Cloud

Global Virtual Meeting Software Market, by Enterprise Size

- Large Enterprises

- Small and Medium Enterprises

Global Virtual Meeting Software Market, by Industry Vertical

- BFSI

- Education

- IT & Telecom

- Government & Public

- Manufacturing

- Media & Entertainment

- Oil & Gas

- Others

Global Virtual Meeting Software Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $157.65 Billion |

| CAGR | 22.61% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Component, Deployment Model, Enterprise Size, Industry Vertical. |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Adobe, Avaya Inc., Cisco Systems, Inc., Google, Huawei Technologies Co., Ltd., Lifesize, Inc., LogMeIn, Inc, Microsoft Corporation, Ring Central, Inc. and Zoom Video Communications, Inc |

| Key Market Opportunities | • Focus on Security and Compliance • Data Analytics and Insights |

| Key Market Drivers | • Advancements in Communication Technology • Focus on Business Continuity and Disaster Recovery |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Virtual Meeting Software Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Virtual Meeting Software Market historical market size for the year 2021, and forecast from 2023 to 2033

- Virtual Meeting Software Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Virtual Meeting Software Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Virtual Meeting Software Market is 2021- 2033

What is the growth rate of the global Virtual Meeting Software Market?

The global Virtual Meeting Software Market is growing at a CAGR of 22.61% over the next 10 years

Which region has the highest growth rate in the market of Frozen Food?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Virtual Meeting Software Market?

North America holds the largest share in 2022

Who are the key players in the global Virtual Meeting Software Market?

Adobe, Avaya Inc., Cisco Systems, Inc., Google, Huawei Technologies Co., Ltd., Lifesize, Inc., LogMeIn, Inc, Microsoft Corporation, Ring Central, Inc. and Zoom Video Communications, Inc

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Virtual Meeting Software Market 4.3.1. Impact on Market Size 4.3.2. Industry Vertical Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Virtual Meeting Software Market, By Component 6.1. Introduction 6.2. Solution 6.3. Service Chapter 7. Global Virtual Meeting Software Market, By Deployment Model 7.1. Introduction 7.2. On-Premise 7.3. Cloud Chapter 8. Global Virtual Meeting Software Market, By Enterprise Size 8.1. Introduction 8.2. Large Enterprises 8.3. Small and Medium Enterprises Chapter 9. Global Virtual Meeting Software Market, By Industry Vertical 9.1. Introduction 9.2. BFSI 9.3. Education 9.4. IT & Telecom 9.5. Government & Public 9.6. Manufacturing 9.7. Media & Entertainment 9.8. Oil & Gas 9.9. Others Chapter 10. Global Virtual Meeting Software Market, By Region 10.1. Introduction 10.2. North America 10.2.1. Introduction 10.2.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.3. Market Size and Forecast, By Country, 2020 - 2028 10.2.4. Market Size and Forecast, By Component, 2020 - 2028 10.2.5. Market Size and Forecast, By Deployment Model, 2020 - 2028 10.2.6. Market Size and Forecast, By Enterprise Size, 2020 - 2028 10.2.7. Market Size and Forecast, By Industry Vertical, 2020 - 2028 10.2.8. US 10.2.8.1. Introduction 10.2.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.8.3. Market Size and Forecast, By Component, 2020 - 2028 10.2.8.4. Market Size and Forecast, By Deployment Model, 2020 - 2028 10.2.8.5. Market Size and Forecast, By Enterprise Size, 2020 - 2028 10.2.8.6. Market Size and Forecast, By Industry Vertical, 2020 - 2028 10.2.9. Canada 10.2.9.1. Introduction 10.2.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.9.3. Market Size and Forecast, By Component, 2020 - 2028 10.2.9.4. Market Size and Forecast, By Deployment Model, 2020 - 2028 10.2.9.5. Market Size and Forecast, By Enterprise Size, 2020 - 2028 10.2.9.6. Market Size and Forecast, By Industry Vertical, 2020 - 2028 10.3. Europe 10.3.1. Introduction 10.3.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.3. Market Size and Forecast, By Country, 2020 - 2028 10.3.4. Market Size and Forecast, By Component, 2020 - 2028 10.3.5. Market Size and Forecast, By Deployment Model, 2020 - 2028 10.3.6. Market Size and Forecast, By Enterprise Size, 2020 - 2028 10.3.7. Market Size and Forecast, By Industry Vertical, 2020 - 2028 10.3.8. Germany 10.3.8.1. Introduction 10.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.8.3. Market Size and Forecast, By Component, 2020 - 2028 10.3.8.4. Market Size and Forecast, By Deployment Model, 2020 - 2028 10.3.8.5. Market Size and Forecast, By Enterprise Size, 2020 - 2028 10.3.8.6. Market Size and Forecast, By Industry Vertical, 2020 - 2028 10.3.9. France 10.3.9.1. Introduction 10.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.9.3. Market Size and Forecast, By Component, 2020 - 2028 10.3.9.4. Market Size and Forecast, By Deployment Model, 2020 - 2028 10.3.9.5. Market Size and Forecast, By Enterprise Size, 2020 - 2028 10.3.9.6. Market Size and Forecast, By Industry Vertical, 2020 - 2028 10.3.10. UK 10.3.10.1. Introduction 10.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.10.3. Market Size and Forecast, By Component, 2020 - 2028 10.3.10.4. Market Size and Forecast, By Deployment Model, 2020 - 2028 10.3.10.5. Market Size and Forecast, By Enterprise Size, 2020 - 2028 10.3.10.6. Market Size and Forecast, By Industry Vertical, 2020 - 2028 10.3.11. Italy 10.3.11.1. Introduction 10.3.11.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.11.3. Market Size and Forecast, By Component, 2020 - 2028 10.3.11.4. Market Size and Forecast, By Deployment Model, 2020 - 2028 10.3.11.5. Market Size and Forecast, By Enterprise Size, 2020 - 2028 10.3.11.6. Market Size and Forecast, By Industry Vertical, 2020 - 2028 10.3.12. Rest Of Europe 10.3.12.1. Introduction 10.3.12.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.12.3. Market Size and Forecast, By Component, 2020 - 2028 10.3.12.4. Market Size and Forecast, By Deployment Model, 2020 - 2028 10.3.12.5. Market Size and Forecast, By Enterprise Size, 2020 - 2028 10.3.12.6. Market Size and Forecast, By Industry Vertical, 2020 - 2028 10.4. Asia-Pacific 10.4.1. Introduction 10.4.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.3. Market Size and Forecast, By Country, 2020 - 2028 10.4.4. Market Size and Forecast, By Component, 2020 - 2028 10.4.5. Market Size and Forecast, By Deployment Model, 2020 - 2028 10.4.6. Market Size and Forecast, By Enterprise Size, 2020 - 2028 10.4.7. Market Size and Forecast, By Industry Vertical, 2020 - 2028 10.4.8. China 10.4.8.1. Introduction 10.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.8.3. Market Size and Forecast, By Component, 2020 - 2028 10.4.8.4. Market Size and Forecast, By Deployment Model, 2020 - 2028 10.4.8.5. Market Size and Forecast, By Enterprise Size, 2020 - 2028 10.4.8.6. Market Size and Forecast, By Industry Vertical, 2020 - 2028 10.4.9. India 10.4.9.1. Introduction 10.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.9.3. Market Size and Forecast, By Component, 2020 - 2028 10.4.9.4. Market Size and Forecast, By Deployment Model, 2020 - 2028 10.4.9.5. Market Size and Forecast, By Enterprise Size, 2020 - 2028 10.4.9.6. Market Size and Forecast, By Industry Vertical, 2020 - 2028 10.4.10. Japan 10.4.10.1. Introduction 10.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.10.3. Market Size and Forecast, By Component, 2020 - 2028 10.4.10.4. Market Size and Forecast, By Deployment Model, 2020 - 2028 10.4.10.5. Market Size and Forecast, By Enterprise Size, 2020 - 2028 10.4.10.6. Market Size and Forecast, By Industry Vertical, 2020 - 2028 10.4.11. South Korea 10.4.11.1. Introduction 10.4.11.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.11.3. Market Size and Forecast, By Component, 2020 - 2028 10.4.11.4. Market Size and Forecast, By Deployment Model, 2020 - 2028 10.4.11.5. Market Size and Forecast, By Enterprise Size, 2020 - 2028 10.4.11.6. Market Size and Forecast, By Industry Vertical, 2020 - 2028 10.4.12. Rest Of Asia-Pacific 10.4.12.1. Introduction 10.4.12.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.12.3. Market Size and Forecast, By Component, 2020 - 2028 10.4.12.4. Market Size and Forecast, By Deployment Model, 2020 - 2028 10.4.12.5. Market Size and Forecast, By Enterprise Size, 2020 - 2028 10.4.12.6. Market Size and Forecast, By Industry Vertical, 2020 - 2028 10.5. Rest Of The World (RoW) 10.5.1. Introduction 10.5.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.3. Market Size and Forecast, By Component, 2020 - 2028 10.5.4. Market Size and Forecast, By Deployment Model, 2020 - 2028 10.5.5. Market Size and Forecast, By Enterprise Size, 2020 - 2028 10.5.6. Market Size and Forecast, By Industry Vertical, 2020 - 2028 10.5.7. Market Size and Forecast, By Region, 2020 - 2028 10.5.8. South America 10.5.8.1. Introduction 10.5.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.8.3. Market Size and Forecast, By Component, 2020 - 2028 10.5.8.4. Market Size and Forecast, By Deployment Model, 2020 - 2028 10.5.8.5. Market Size and Forecast, By Enterprise Size, 2020 - 2028 10.5.8.6. Market Size and Forecast, By Industry Vertical, 2020 - 2028 10.5.9. Middle East & Africa 10.5.9.1. Introduction 10.5.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.9.3. Market Size and Forecast, By Component, 2020 - 2028 10.5.9.4. Market Size and Forecast, By Deployment Model, 2020 - 2028 10.5.9.5. Market Size and Forecast, By Enterprise Size, 2020 - 2028 10.5.9.6. Market Size and Forecast, By Industry Vertical, 2020 - 2028 Chapter 11. Competitive Landscape 11.1. Introduction 11.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 12. Company Profiles 12.1. Adobe 12.1.1. Business Overview 12.1.2. Financial Analysis 12.1.3. Product Portfolio 12.1.4. Recent Development and Strategies Adopted 12.1.5. SWOT Analysis 12.2. Avaya Inc. 12.2.1. Business Overview 12.2.2. Financial Analysis 12.2.3. Product Portfolio 12.2.4. Recent Development and Strategies Adopted 12.2.5. SWOT Analysis 12.3. Cisco Systems, Inc. 12.3.1. Business Overview 12.3.2. Financial Analysis 12.3.3. Product Portfolio 12.3.4. Recent Development and Strategies Adopted 12.3.5. SWOT Analysis 12.4. Google 12.4.1. Business Overview 12.4.2. Financial Analysis 12.4.3. Product Portfolio 12.4.4. Recent Development and Strategies Adopted 12.4.5. SWOT Analysis 12.5. Huawei Technologies Co., Ltd. 12.5.1. Business Overview 12.5.2. Financial Analysis 12.5.3. Product Portfolio 12.5.4. Recent Development and Strategies Adopted 12.5.5. SWOT Analysis 12.6. Lifesize, Inc. 12.6.1. Business Overview 12.6.2. Financial Analysis 12.6.3. Product Portfolio 12.6.4. Recent Development and Strategies Adopted 12.6.5. SWOT Analysis 12.7. LogMeIn, Inc 12.7.1. Business Overview 12.7.2. Financial Analysis 12.7.3. Product Portfolio 12.7.4. Recent Development and Strategies Adopted 12.7.5. SWOT Analysis 12.8. Microsoft Corporation 12.8.1. Business Overview 12.8.2. Financial Analysis 12.8.3. Product Portfolio 12.8.4. Recent Development and Strategies Adopted 12.8.5. SWOT Analysis 12.9. Ring Central, Inc. 12.9.1. Business Overview 12.9.2. Financial Analysis 12.9.3. Product Portfolio 12.9.4. Recent Development and Strategies Adopted 12.9.5. SWOT Analysis 12.10. Zoom Video Communications, Inc. 12.10.1. Business Overview 12.10.2. Financial Analysis 12.10.3. Product Portfolio 12.10.4. Recent Development and Strategies Adopted 12.10.5. SWOT Analysis Chapter 13. Key Takeaways

Connect to Analyst

Research Methodology