Vibration Monitoring Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

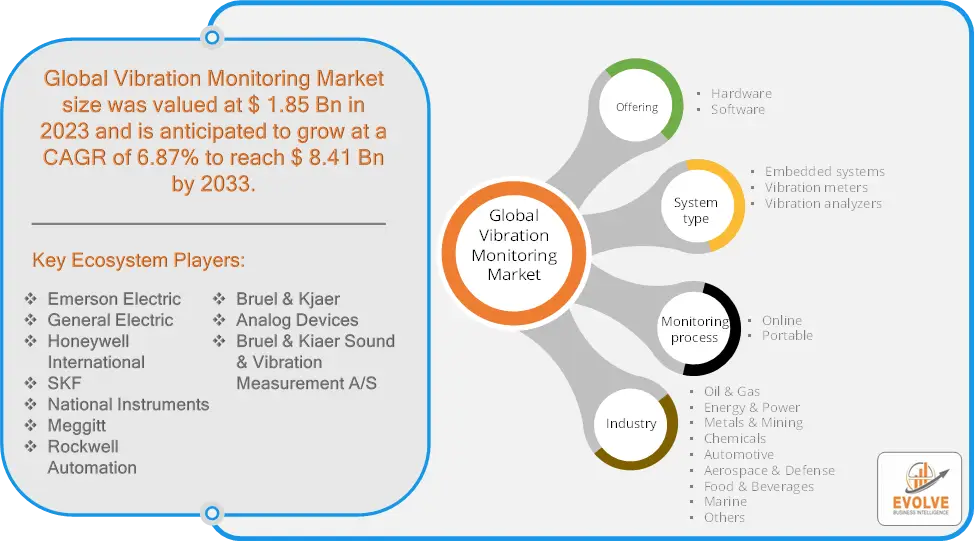

Vibration Monitoring Market Research Report: Information By Offering (Hardware, Software), By System Type (Embedded systems, Vibration meters, Vibration analyzers), By Monitoring Process (Online, Portable), By Industry (Oil & Gas, Energy & Power, Metals & Mining, Chemicals, Automotive, Aerospace & Defense, Food & Beverages, Marine, Others), and by Region — Forecast till 2033

Page: 162

Vibration Monitoring Market Overview

The Vibration Monitoring Market Size is expected to reach USD 8.41 Billion by 2033. The Vibration Monitoring Market industry size accounted for USD 1.85 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.87% from 2023 to 2033. The Vibration Monitoring Market refers to the global industry focused on the development, production, and sale of systems and solutions designed to monitor and analyze vibrations in machinery and equipment. These systems are essential for predictive maintenance, condition monitoring, and overall machinery health diagnostics, helping industries prevent equipment failures, reduce downtime, and optimize performance.

The market is expanding as industries increasingly recognize the importance of predictive maintenance and asset management to reduce operational costs and enhance efficiency.

Global Vibration Monitoring Market Synopsis

The COVID-19 pandemic had a significant impact on the Vibration Monitoring Market. The pandemic caused significant disruptions in global supply chains, leading to delays in the production and delivery of vibration monitoring equipment. Many manufacturers faced challenges in sourcing components and materials, which affected their ability to meet demand. Lockdowns and social distancing measures limited on-site operations and maintenance activities. This led to a slowdown in the installation and maintenance of vibration monitoring systems, as well as a reduction in on-site service and support. The pandemic accelerated the adoption of remote monitoring solutions as industries sought ways to maintain operations with reduced on-site staff. Vibration monitoring systems with remote capabilities gained traction, allowing companies to monitor equipment health from a distance. The pandemic accelerated digital transformation across industries, including the adoption of Industrial IoT (IIoT) technologies. Vibration monitoring systems increasingly integrated with IoT platforms to provide real-time data and analytics, enhancing overall operational efficiency.

Vibration Monitoring Market Dynamics

The major factors that have impacted the growth of Vibration Monitoring Market are as follows:

Drivers:

Ø Technological Advancements

The development of wireless vibration monitoring systems has made it easier to monitor equipment in remote or hard-to-reach locations, expanding the market’s potential. Improvements in data analytics and machine learning have enhanced the ability of vibration monitoring systems to predict failures more accurately, making them more valuable to industries. Vibration monitoring helps in extending the life of machinery by detecting and addressing issues early, thus optimizing asset management strategies. By maintaining equipment in optimal condition, businesses can achieve higher operational efficiency, which is a key driver for adopting vibration monitoring systems.

Restraint:

- Perception of High Initial Costs and Cybersecurity Risks

The initial cost of purchasing and installing vibration monitoring systems, including sensors, software, and other associated equipment, can be high. This can be a significant barrier for small and medium-sized enterprises (SMEs) with limited budgets. More advanced systems that offer enhanced features such as real-time monitoring, wireless capabilities, and predictive analytics are often more expensive, which may deter some businesses from adopting them. As vibration monitoring systems increasingly integrate with IoT and cloud-based platforms, concerns about data security and privacy arise. The potential for cyberattacks on industrial systems can deter companies from fully embracing these technologies.

Opportunity:

⮚ Sustainability and Energy Efficiency Initiatives

As industries increasingly focus on sustainability and energy efficiency, vibration monitoring systems can play a critical role in optimizing equipment performance, reducing energy consumption, and minimizing waste, aligning with global green initiatives. The growing renewable energy sector, particularly wind and solar power, presents an opportunity for vibration monitoring systems to ensure the reliability and efficiency of turbines, generators, and other critical equipment in these installations. The demand for remote monitoring solutions has increased, especially in the wake of the COVID-19 pandemic. Vibration monitoring systems that offer remote monitoring capabilities can meet the needs of industries with distributed assets or limited on-site personnel.

Vibration Monitoring Market Segment Overview

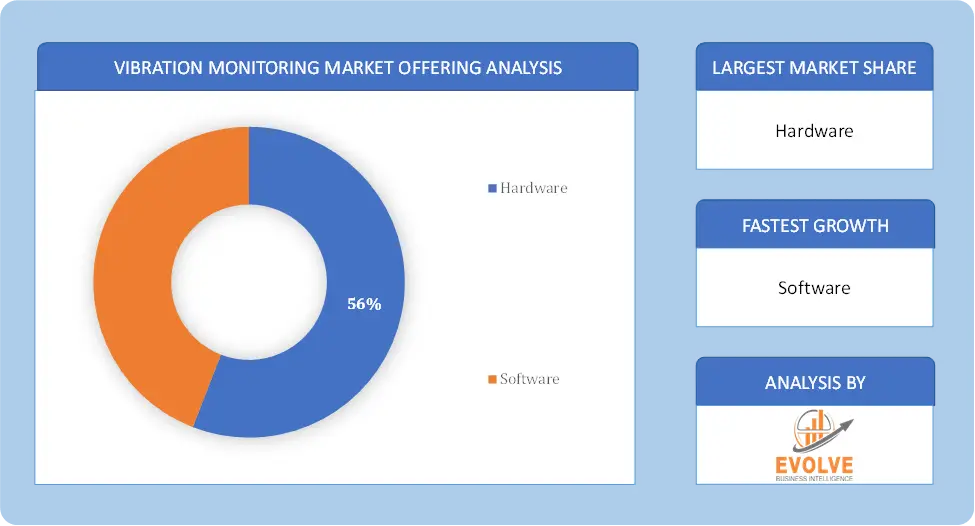

By Offering

Based on Offering, the market is segmented based on Hardware and Software. The hardware segment dominant the market. Speed sensors, temperature sensors, vibration sensors, including tri-axial vibration sensors, amperage sensors, RPM sensors, general purpose sensor adapters, display panels, and other hardware components make up the hardware section of the system. Compared to earlier models, the performance of the vibration monitoring system has significantly improved thanks to the development of sensors. This has enabled large-scale industries to plan and carry out machine maintenance effectively.

Based on Offering, the market is segmented based on Hardware and Software. The hardware segment dominant the market. Speed sensors, temperature sensors, vibration sensors, including tri-axial vibration sensors, amperage sensors, RPM sensors, general purpose sensor adapters, display panels, and other hardware components make up the hardware section of the system. Compared to earlier models, the performance of the vibration monitoring system has significantly improved thanks to the development of sensors. This has enabled large-scale industries to plan and carry out machine maintenance effectively.

By System type

Based on System type, the market segment has been divided into the Embedded systems, Vibration meters and Vibration analyzers. The embedded system segment dominant the market. When compared to the implementation of individual technologies, embedded systems offer significant advantages. Vibration monitoring can accomplish its long-sought benefit if a more intentional and planned entire systems approach is taken instead of using unique technologies to address a complicated problem. Users are therefore seeking these embedded systems.

By Monitoring process

Based on Monitoring process, the market segment has been divided into the Online and Portable. The online segment dominant the market. Online vibration monitoring combines sophisticated data processing, intricate measuring methods, a user-friendly user interface, and a wide range of options for an individual personalized system. Online systems produce a highly adaptable, high-performing system that sends clear condition information directly to the control room.

By Industry

Based on Industry, the market segment has been divided into the Oil & Gas, Energy & Power, Metals & Mining, Chemicals, Automotive, Aerospace & Defense, Food & Beverages, Marine and Others. The oil & gas segment dominant the market. Coal, minerals, nuclear power, and clean fuels are some of the several segments of the energy and power industry. Increased government and private sector spending on alternative energy and power sources in developed and developing nations results in more energy and power plants installed, which fuels the demand for vibration monitoring systems.

Global Vibration Monitoring Market Regional Analysis

Based on region, the global Vibration Monitoring Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Vibration Monitoring Market followed by the Asia-Pacific and Europe regions.

Vibration Monitoring North America Market

Vibration Monitoring North America Market

North America holds a dominant position in the Vibration Monitoring Market. North America, particularly the United States, is one of the largest markets for vibration monitoring. The region benefits from advanced industrial infrastructure, widespread adoption of predictive maintenance strategies, and a strong focus on operational efficiency. The High levels of automation and integration of Industrial IoT (IIoT) have spurred the adoption of advanced vibration monitoring solutions, including wireless and cloud-based systems and the growing emphasis on reducing operational costs and enhancing equipment reliability, coupled with advancements in AI and machine learning, continues to drive market growth.

Vibration Monitoring Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Vibration Monitoring Market industry. The Asia-Pacific region is experiencing rapid growth in the vibration monitoring market due to industrialization, urbanization, and the expansion of manufacturing and energy sectors. China, India, Japan, and South Korea are key contributors to the market’s growth. The region offers significant growth potential, challenges such as cost sensitivity and the need for localized solutions must be addressed to increase adoption and the increasing adoption of automation, the rise of smart factories, and the development of affordable vibration monitoring solutions tailored for small and medium-sized enterprises (SMEs) present significant opportunities.

Competitive Landscape

The global Vibration Monitoring Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Emerson Electric

- General Electric

- Honeywell International

- SKF

- National Instruments

- Meggitt

- Rockwell Automation

- Bruel & Kjaer

- Analog Devices

- Bruel & Kiaer Sound & Vibration Measurement A/S

Key Development

In August 2022, Rockwell Automation Inc. partnered with Bravo Motor Company, a California-based manufacturer of batteries, automobiles, and energy-storage systems. Automotive manufacturers use noise, vibration, and harshness (NVH) testing to improve vehicle performance and maintain a consistent level of comfort across their vehicle lineup.

In September 2021, Reality AI and Fujitsu Component announced a collaboration to provide contactless vibration sensing powered by Machine Learning to the manufacturing and industrial industries. Because the sensor uses doppler radar to detect extremely small vibrations, it was used for vibration detection applications where human touch is impractical or impossible.

Scope of the Report

Global Vibration Monitoring Market, by Offering

- Hardware

- Software

Global Vibration Monitoring Market, by System type

- Embedded systems

- Vibration meters

- Vibration analyzers

Global Vibration Monitoring Market, by Monitoring process

- Online

- Portable

Global Vibration Monitoring Market, by Industry

- Oil & Gas

- Energy & Power

- Metals & Mining

- Chemicals

- Automotive

- Aerospace & Defense

- Food & Beverages

- Marine

- Others

Global Vibration Monitoring Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $8.41 Billion |

| CAGR | 6.87% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Offering, System Type, Monitoring Process, Industry |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Emerson Electric, General Electric, Honeywell International, SKF, National Instruments, Meggitt, Rockwell Automation, Bruel & Kjaer, Analog Devices and Bruel & Kiaer Sound & Vibration Measurement A/S |

| Key Market Opportunities | • Sustainability and Energy Efficiency Initiatives • Expansion of Remote Monitoring |

| Key Market Drivers | • Technological Advancements • Rising Demand for Asset Management |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Vibration Monitoring Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Vibration Monitoring Market historical market size for the year 2021, and forecast from 2023 to 2033

- Vibration Monitoring Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Vibration Monitoring Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Vibration Monitoring Market is 2021- 2033

What is the growth rate of the global Vibration Monitoring Market?

The global Vibration Monitoring Market is growing at a CAGR of 6.87% over the next 10 years

Which region has the highest growth rate in the market of Vibration Monitoring Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Vibration Monitoring Market?

North America holds the largest share in 2022

Who are the key players in the global Vibration Monitoring Market?

Emerson Electric, General Electric, Honeywell International, SKF, National Instruments, Meggitt, Rockwell Automation, Bruel & Kjaer, Analog Devices and Bruel & Kiaer Sound & Vibration Measurement A/S are the major companies operating in the market

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Vibration Monitoring Market 4.3.1. Impact on Market Size 4.3.2. Industry r Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Vibration Monitoring Market, By Offering 6.1. Introduction 6.2. Hardware 6.3. Software Chapter 7. Global Vibration Monitoring Market, By System Type 7.1. Introduction 7.2. Embedded systems 7.3. Vibration meters 7.4. Vibration analyzers Chapter 8. Global Vibration Monitoring Market, By Monitoring Process 8.1. Introduction 8.2. Online 8.3. Portable Chapter 9. Global Vibration Monitoring Market, By Industry 9.1. Introduction 9.2. Oil & Gas 9.3. Energy & Power 9.4. Metals & Mining 9.5. Chemicals 9.6. Automotive 9.7. Aerospace & Defense 9.8. Food & Beverages 9.9. Marine 9.10. Others Chapter 10. Global Vibration Monitoring Market, By Region 10.1. Introduction 10.2. North America 10.2.1. Introduction 10.2.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.3. Market Size and Forecast, By Country, 2020 - 2028 10.2.4. Market Size and Forecast, By Offering, 2020 - 2028 10.2.5. Market Size and Forecast, By System Type, 2020 - 2028 10.2.6. Market Size and Forecast, By Monitoring Process, 2020 – 2028 10.2.7. Market Size and Forecast, By Industry r, 2020 – 2028 10.2.8. US 10.2.8.1. Introduction 10.2.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.8.3. Market Size and Forecast, By Offering, 2020 - 2028 10.2.8.4. Market Size and Forecast, By System Type, 2020 - 2028 10.2.8.5. Market Size and Forecast, By Monitoring Process, 2020 – 2028 10.2.8.6. Market Size and Forecast, By Industry r, 2020 - 2028 10.2.9. Canada 10.2.9.1. Introduction 10.2.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.9.3. Market Size and Forecast, By Offering, 2020 - 2028 10.2.9.4. Market Size and Forecast, By System Type, 2020 - 2028 10.2.9.5. Market Size and Forecast, By Monitoring Process, 2020 – 2028 10.2.9.6. Market Size and Forecast, By Industry r, 2020 - 2028 10.3. Europe 10.3.1. Introduction 10.3.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.3. Market Size and Forecast, By Country, 2020 - 2028 10.3.4. Market Size and Forecast, By Offering, 2020 - 2028 10.3.5. Market Size and Forecast, By System Type, 2020 - 2028 10.3.6. Market Size and Forecast, By Monitoring Process, 2020 – 2028 10.3.7. Market Size and Forecast, By Industry r, 2020 – 2028 10.3.8. Germany 10.3.8.1. Introduction 10.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.8.3. Market Size and Forecast, By Offering, 2020 - 2028 10.3.8.4. Market Size and Forecast, By System Type, 2020 - 2028 10.3.8.5. Market Size and Forecast, By Monitoring Process, 2020 – 2028 10.3.8.6. Market Size and Forecast, By Industry r, 2020 - 2028 10.3.9. France 10.3.9.1. Introduction 10.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.9.3. Market Size and Forecast, By Offering, 2020 - 2028 10.3.9.4. Market Size and Forecast, By System Type, 2020 - 2028 10.3.9.5. Market Size and Forecast, By Monitoring Process, 2020 – 2028 10.3.9.6. Market Size and Forecast, By Industry r, 2020 - 2028 10.3.10. UK 10.3.10.1. Introduction 10.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.10.3. Market Size and Forecast, By Offering, 2020 - 2028 10.3.10.4. Market Size and Forecast, By System Type, 2020 - 2028 10.3.10.5. Market Size and Forecast, By Monitoring Process, 2020 – 2028 10.3.10.6. Market Size and Forecast, By Industry r, 2020 - 2028 10.3.11. Italy 10.3.11.1. Introduction 10.3.11.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.11.3. Market Size and Forecast, By Offering, 2020 - 2028 10.3.11.4. Market Size and Forecast, By System Type, 2020 - 2028 10.3.11.5. Market Size and Forecast, By Monitoring Process, 2020 – 2028 10.3.11.6. Market Size and Forecast, By Industry r, 2020 - 2028 10.3.12. Rest Of Europe 10.3.12.1. Introduction 10.3.12.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.12.3. Market Size and Forecast, By Offering, 2020 - 2028 10.3.12.4. Market Size and Forecast, By System Type, 2020 - 2028 10.3.12.5. Market Size and Forecast, By Monitoring Process, 2020 – 2028 10.3.12.6. Market Size and Forecast, By Industry r, 2020 - 2028 10.4. Asia-Pacific 10.4.1. Introduction 10.4.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.3. Market Size and Forecast, By Country, 2020 - 2028 10.4.4. Market Size and Forecast, By Offering, 2020 - 2028 10.4.5. Market Size and Forecast, By System Type, 2020 - 2028 10.4.6. Market Size and Forecast, By Monitoring Process, 2020 – 2028 10.4.7. Market Size and Forecast, By Industry r, 2020 - 2028 10.4.8. China 10.4.8.1. Introduction 10.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.8.3. Market Size and Forecast, By Offering, 2020 - 2028 10.4.8.4. Market Size and Forecast, By System Type, 2020 - 2028 10.4.8.5. Market Size and Forecast, By Monitoring Process, 2020 – 2028 10.4.8.6. Market Size and Forecast, By Industry r, 2020 - 2028 10.4.9. India 10.4.9.1. Introduction 10.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.9.3. Market Size and Forecast, By Offering, 2020 - 2028 10.4.9.4. Market Size and Forecast, By System Type, 2020 - 2028 10.4.9.5. Market Size and Forecast, By Monitoring Process, 2020 – 2028 10.4.9.6. Market Size and Forecast, By Industry r, 2020 - 2028 10.4.10. Japan 10.4.10.1. Introduction 10.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.10.3. Market Size and Forecast, By Offering, 2020 - 2028 10.4.10.4. Market Size and Forecast, By System Type, 2020 - 2028 10.4.10.5. Market Size and Forecast, By Monitoring Process, 2020 – 2028 10.4.10.6. Market Size and Forecast, By Industry r, 2020 - 2028 10.4.11. South Korea 10.4.11.1. Introduction 10.4.11.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.11.3. Market Size and Forecast, By Offering, 2020 - 2028 10.4.11.4. Market Size and Forecast, By System Type, 2020 - 2028 10.4.11.5. Market Size and Forecast, By Monitoring Process, 2020 – 2028 10.4.11.6. Market Size and Forecast, By Industry r, 2020 - 2028 10.4.12. Rest Of Asia-Pacific 10.4.12.1. Introduction 10.4.12.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.12.3. Market Size and Forecast, By Offering, 2020 - 2028 10.4.12.4. Market Size and Forecast, By System Type, 2020 - 2028 10.4.12.5. Market Size and Forecast, By Monitoring Process, 2020 – 2028 10.4.12.6. Market Size and Forecast, By Industry r, 2020 - 2028 10.5. Rest Of The World (RoW) 10.5.1. Introduction 10.5.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.3. Market Size and Forecast, By Offering, 2020 - 2028 10.5.4. Market Size and Forecast, By System Type, 2020 - 2028 10.5.5. Market Size and Forecast, By Monitoring Process, 2020 – 2028 10.5.6. Market Size and Forecast, By Industry r, 2020 - 2028 10.5.7. Market Size and Forecast, By Region, 2020 - 2028 10.5.8. South America 10.5.8.1. Introduction 10.5.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.8.3. Market Size and Forecast, By Offering, 2020 - 2028 10.5.8.4. Market Size and Forecast, By System Type, 2020 - 2028 10.5.8.5. Market Size and Forecast, By Monitoring Process, 2020 – 2028 10.5.8.6. Market Size and Forecast, By Industry r, 2020 - 2028 10.5.9. Middle East & Afirica 10.5.9.1. Introduction 10.5.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.9.3. Market Size and Forecast, By Offering, 2020 - 2028 10.5.9.4. Market Size and Forecast, By System Type, 2020 - 2028 10.5.9.5. Market Size and Forecast, By Monitoring Process, 2020 – 2028 10.5.9.6. Market Size and Forecast, By Industry r, 2020 - 2028 Chapter 11. Competitive Landscape 11.1. Introduction 11.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 12. Company Profiles 12.1. Emerson Electric 12.1.1. Business Overview 12.1.2. Financial Analysis 12.1.3. Product Portfolio 12.1.4. Recent Development and Strategies Adopted 12.1.5. SWOT Analysis 12.2. General Electric 12.2.1. Business Overview 12.2.2. Financial Analysis 12.2.3. Product Portfolio 12.2.4. Recent Development and Strategies Adopted 12.2.5. SWOT Analysis 12.3. Honeywell International 12.3.1. Business Overview 12.3.2. Financial Analysis 12.3.3. Product Portfolio 12.3.4. Recent Development and Strategies Adopted 12.3.5. SWOT Analysis 12.4. SKF 12.4.1. Business Overview 12.4.2. Financial Analysis 12.4.3. Product Portfolio 12.4.4. Recent Development and Strategies Adopted 12.4.5. SWOT Analysis 12.5. National Instruments 12.5.1. Business Overview 12.5.2. Financial Analysis 12.5.3. Product Portfolio 12.5.4. Recent Development and Strategies Adopted 12.5.5. SWOT Analysis 12.6. Meggitt 12.6.1. Business Overview 12.6.2. Financial Analysis 12.6.3. Product Portfolio 12.6.4. Recent Development and Strategies Adopted 12.6.5. SWOT Analysis 12.7. Rockwell Automation 12.7.1. Business Overview 12.7.2. Financial Analysis 12.7.3. Product Portfolio 12.7.4. Recent Development and Strategies Adopted 12.7.5. SWOT Analysis 12.8. Brüel & Kjaer 12.8.1. Business Overview 12.8.2. Financial Analysis 12.8.3. Product Portfolio 12.8.4. Recent Development and Strategies Adopted 12.8.5. SWOT Analysis 12.9. Analog Devices 12.9.1. Business Overview 12.9.2. Financial Analysis 12.9.3. Product Portfolio 12.9.4. Recent Development and Strategies Adopted 12.9.5. SWOT Analysis 12.10. Bruel & Kiaer Sound & Vibration Measurement A/S 12.10.1. Business Overview 12.10.2. Financial Analysis 12.10.3. Product Portfolio 12.10.4. Recent Development and Strategies Adopted 12.10.5. SWOT Analysis Chapter 13. Key Takeaways

Connect to Analyst

Research Methodology