Veterinary Software Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

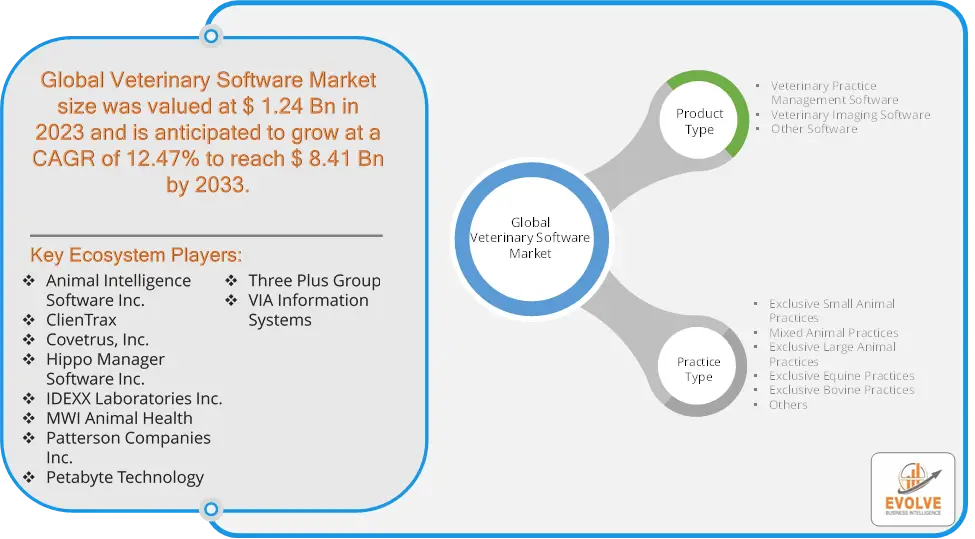

Veterinary Software Market Research Report: Information By Product Type (Veterinary Practice Management Software, Veterinary Imaging Software, Other Software), By Practice type (Exclusive Small Animal Practices, Mixed Animal Practices, Exclusive Large Animal Practices, Exclusive Equine Practices, Exclusive Bovine Practices, Others), and by Region — Forecast till 2033

Page: 100

Veterinary Software Market Overview

The Veterinary Software Market Size is expected to reach USD 8.41 Billion by 2033. The Veterinary Software Market industry size accounted for USD 1.24 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 12.47% from 2023 to 2033. The Veterinary Software Market refers to the industry focused on the development, distribution, and implementation of software solutions designed specifically for veterinary practices and animal healthcare providers.

The Veterinary Software Market is driven by factors such as the increasing adoption of pets, the growing need for efficient management of veterinary practices, and the rising demand for advanced healthcare solutions for animals. The market includes both cloud-based and on-premise solutions and caters to veterinary clinics, hospitals, and individual practitioners.

Global Veterinary Software Market Synopsis

The COVID-19 pandemic significantly impacted the Veterinary Software Market. With social distancing measures and lockdowns in place, veterinary practices saw a surge in the use of telemedicine. Veterinary software providers adapted by enhancing their platforms to support remote consultations, allowing veterinarians to diagnose and treat animals without requiring in-person visits. The pandemic accelerated the adoption of cloud-based veterinary software as practices sought flexible, scalable solutions that could be accessed remotely. This shift helped veterinary practices maintain operations despite restrictions on physical presence. The initial phases of the pandemic caused disruptions in the implementation and training of new software systems due to travel restrictions and limited in-person interactions. However, this was mitigated by the rise in virtual training sessions and remote support. The pandemic led to an increase in pet adoptions as people sought companionship during lockdowns. This, in turn, increased the demand for veterinary services and software to manage the growing number of patients.

Veterinary Software Market Dynamics

The major factors that have impacted the growth of Veterinary Software Market are as follows:

Drivers:

Ø Technological Advancements

Advances in technology, including cloud computing, artificial intelligence, and data analytics, enhance the capabilities of veterinary software, leading to improved practice management, diagnostics, and client engagement. The increasing adoption of telemedicine, accelerated by the COVID-19 pandemic, drives demand for veterinary software that supports remote consultations, virtual appointments, and digital communication between veterinarians and pet owners.

Restraint:

- Perception of High Initial Costs and Risk of Breaches

The initial cost of implementing veterinary software, including purchasing licenses, hardware, and training, can be significant, particularly for small or newly established practices. The handling of sensitive client and animal health data raises concerns about data security and privacy. Ensuring compliance with data protection regulations and preventing breaches can be challenging and costly.

Opportunity:

⮚ Enhanced Data Analytics and Reporting

Offering advanced data analytics and reporting features can help veterinary practices gain insights into their performance, client trends, and patient outcomes, supporting better decision-making and operational improvements. Cloud-based veterinary software solutions provide scalability, remote access, and reduced infrastructure costs, making them attractive to both small and large practices. Integrating software with diagnostic and imaging equipment can streamline data management, improve diagnostic accuracy, and enhance overall practice efficiency.

Veterinary Software Market Segment Overview

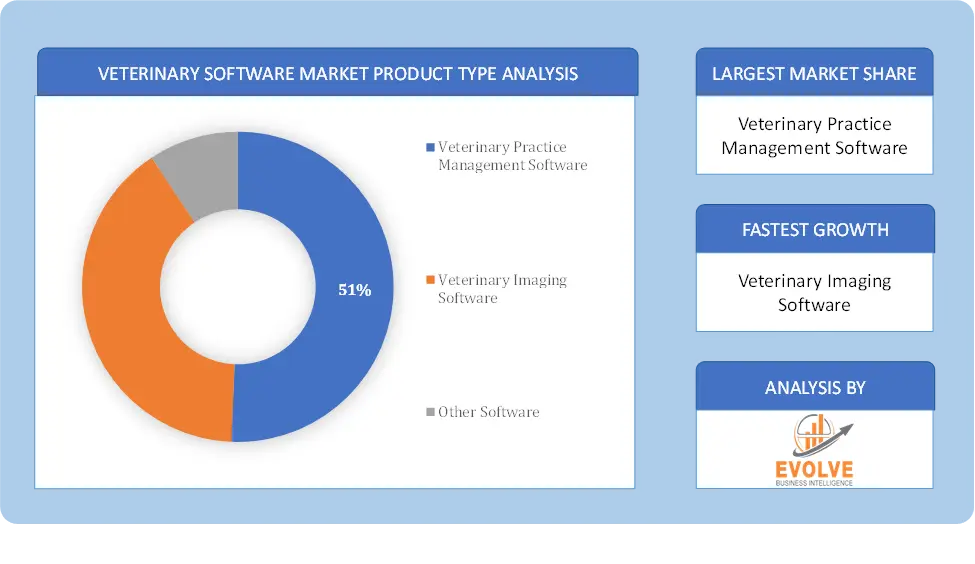

By Product Type

Based on Product Type, the market is segmented based on Veterinary Practice Management Software, Veterinary Imaging Software and Other Software. The veterinary practice management software segment dominant the market. Software for managing a veterinary clinic’s day-to-day activities is called “veterinary practice management software.” Essential veterinarian administrative duties such as appointment scheduling, patient demographic capture, and more are made possible. Veterinary hospitals and clinics can improve their efficiency with the help of practice management software, which also helps veterinarians stay in touch with their patients and their owners.

Based on Product Type, the market is segmented based on Veterinary Practice Management Software, Veterinary Imaging Software and Other Software. The veterinary practice management software segment dominant the market. Software for managing a veterinary clinic’s day-to-day activities is called “veterinary practice management software.” Essential veterinarian administrative duties such as appointment scheduling, patient demographic capture, and more are made possible. Veterinary hospitals and clinics can improve their efficiency with the help of practice management software, which also helps veterinarians stay in touch with their patients and their owners.

By Practice Type

Based on Practice Type, the market segment has been divided into Exclusive Small Animal Practices, Mixed Animal Practices, Exclusive Large Animal Practices, Exclusive Equine Practices, Exclusive Bovine Practices and Others. The exclusive small animal practices segment dominant the market. The largest share of the veterinary software industry comes from small animal operations, where many pets and their owners make regular appointments. Revenue from pet-related businesses has been rising along with the rising tide of pet owners.

Global Veterinary Software Market Regional Analysis

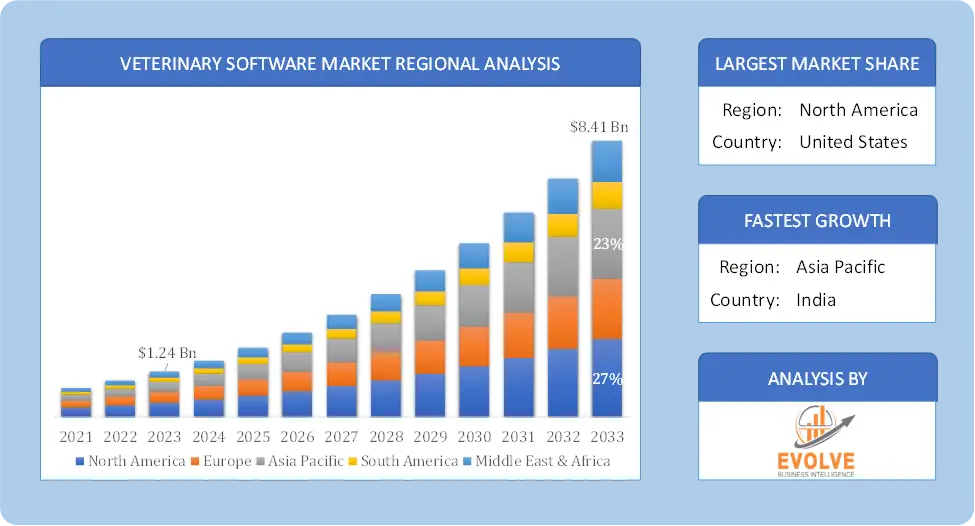

Based on region, the global Veterinary Software Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Veterinary Software Market followed by the Asia-Pacific and Europe regions.

Veterinary Software North America Market

Veterinary Software North America Market

North America holds a dominant position in the Veterinary Software Market. North America, particularly the United States and Canada, is one of the largest and most developed markets for veterinary software. The high adoption rate of advanced technology, coupled with a large number of veterinary practices and pet owners, drives significant demand and high pet ownership rates, well-established veterinary infrastructure, and advanced technological adoption contribute to its dominance.

Veterinary Software Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Veterinary Software Market industry. The Asia-Pacific region is a rapidly emerging market for veterinary software, driven by factors such as increasing pet ownership, rising disposable income, and growing awareness of animal healthcare. Rising pet population, growing awareness of animal health, and improving healthcare infrastructure and expansion into emerging markets, development of cost-effective solutions, and increased adoption of telemedicine and cloud-based systems.

Competitive Landscape

The global Veterinary Software Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Animal Intelligence Software Inc.

- ClienTrax

- Covetrus, Inc.

- Hippo Manager Software Inc.

- IDEXX Laboratories Inc.

- MWI Animal Health

- Patterson Companies Inc.

- Petabyte Technology

- Three Plus Group

- VIA Information Systems

Key Development

In March 2024 (Acquisition) – Herdwatch, a prominent AgTech software firm, acquired Lilac Technology, which is recognized for its TB Master software in the UK, and ComTag in Ireland. The deal is intended to advance Herdwatch’s efforts in offering software solutions within the veterinary sector.

Scope of the Report

Global Veterinary Software Market, by Product Type

- Veterinary Practice Management Software

- Veterinary Imaging Software

- Other Software.

Global Veterinary Software Market, by Practice Type

- Exclusive Small Animal Practices

- Mixed Animal Practices

- Exclusive Large Animal Practices

- Exclusive Equine Practices

- Exclusive Bovine Practices

- Others

Global Veterinary Software Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $8.41 Billion |

| CAGR | 12.47% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Practice Type |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Animal Intelligence Software Inc., ClienTrax, Covetrus, Inc., Hippo Manager Software Inc., IDEXX Laboratories Inc., MWI Animal Health, Patterson Companies Inc., Petabyte Technology, Three Plus Group and VIA Information Systems |

| Key Market Opportunities | • Enhanced Data Analytics and Reporting • Integration with Veterinary Equipment |

| Key Market Drivers | • Technological Advancements • Growth in Telemedicine |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Veterinary Software Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Veterinary Software Market historical market size for the year 2021, and forecast from 2023 to 2033

- Veterinary Software Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Veterinary Software Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Veterinary Software Market is 2021- 2033

What is the growth rate of the global Veterinary Software Market?

The global Veterinary Software Market is growing at a CAGR of 8.41% over the next 10 years

Which region has the highest growth rate in the market of Veterinary Software Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Veterinary Software Market?

North America holds the largest share in 2022

Who are the key players in the global Veterinary Software Market?

Animal Intelligence Software, Inc., ClienTrax, Covetrus, Inc., Hippo Manager Software Inc., IDEXX Laboratories, Inc., MWI Animal Health, Patterson Companies Inc., Petabyte Technology, Three Plus Group and VIA Information Systems. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope of The Study 2.1. Market Definition 2.2. Scope of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat of New Entrants 4.2.2. Bargaining Power of Buyers 4.2.3. Bargaining Power of Suppliers 4.2.4. Threat of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Veterinary Software Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Veterinary Software Market, By Product Type 6.1. Introduction 6.2. Veterinary Practice Management Software 6.3. Veterinary Imaging Software 6.4. Other Software Chapter 7. Global Veterinary Software Market, By Practice type 7.1. Introduction 7.2. Exclusive Small Animal Practices 7.3. Mixed Animal Practices 7.4. Exclusive Large Animal Practices 7.5. Exclusive Equine Practices 7.6. Exclusive Bovine Practices 7.7. Others Chapter 8. Global Veterinary Software Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.3. Market Size and Forecast, By Country, 2020 - 2028 8.2.4. Market Size and Forecast, By Product Type, 2020 - 2028 8.2.5. Market Size and Forecast, By Practice type, 2020 – 2026 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.2.6.4. Market Size and Forecast, By Practice type, 2020 - 2028 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.2.7.4. Market Size and Forecast, By Practice type, 2020 - 2028 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.3. Market Size and Forecast, By Country, 2020 - 2028 8.3.4. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.5. Market Size and Forecast, By Practice type, 2020 – 2026 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.6.4. Market Size and Forecast, By Practice type, 2020 - 2028 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.7.4. Market Size and Forecast, By Practice type, 2020 - 2028 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.8.4. Market Size and Forecast, By Practice type, 2020 - 2028 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.9.4. Market Size and Forecast, By Practice type, 2020 - 2028 8.3.10. Rest of Europe 8.3.10.1. Introduction 8.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.10.4. Market Size and Forecast, By Practice type, 2020 - 2028 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.3. Market Size and Forecast, By Country, 2020 - 2028 8.4.4. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.5. Market Size and Forecast, By Practice type, 2020 - 2028 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.6.4. Market Size and Forecast, By Practice type, 2020 - 2028 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.7.4. Market Size and Forecast, By Practice type, 2020 - 2028 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.8.4. Market Size and Forecast, By Practice type, 2020 - 2028 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.9.4. Market Size and Forecast, By Practice type, 2020 - 2028 8.4.10. Rest of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.10.4. Market Size and Forecast, By Practice type, 2020 - 2028 8.5. Rest of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.5.4. Market Size and Forecast, By Practice type, 2020 - 2028 8.5.5. Market Size and Forecast, By Region, 2020 - 2028 8.5.6. South America 8.5.6.1. Introduction 8.5.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.5.6.4. Market Size and Forecast, By Practice type, 2020 - 2028 8.5.7. Middle East and Africa 8.5.7.1. Introduction 8.5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.5.7.4. Market Size and Forecast, By Practice type, 2020 - 2028 Chapter 9. Competitive Landscape 9.1. Introduction 9.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 10. Company Profiles 10.1. Animal Intelligence Software, Inc. 10.1.1. Business Overview 10.1.2. Financial Analysis 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. ClienTrax 10.2.1. Business Overview 10.2.2. Financial Analysis 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Covetrus, Inc. 10.3.1. Business Overview 10.3.2. Financial Analysis 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Hippo Manager Software Inc. 10.4.1. Business Overview 10.4.2. Financial Analysis 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. IDEXX Laboratories, Inc. 10.5.1. Business Overview 10.5.2. Financial Analysis 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. MWI Animal Health 10.6.1. Business Overview 10.6.2. Financial Analysis 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Patterson Companies Inc. 10.7.1. Business Overview 10.7.2. Financial Analysis 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8. Petabyte Technology 10.8.1. Business Overview 10.8.2. Financial Analysis 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9. Three Plus Group 10.9.1. Business Overview 10.9.2. Financial Analysis 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. VIA Information Systems 10.10.1. Business Overview 10.10.2. Financial Analysis 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis Chapter 11. Key Takeaways

Connect to Analyst

Research Methodology