Vacuum insulation panels market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

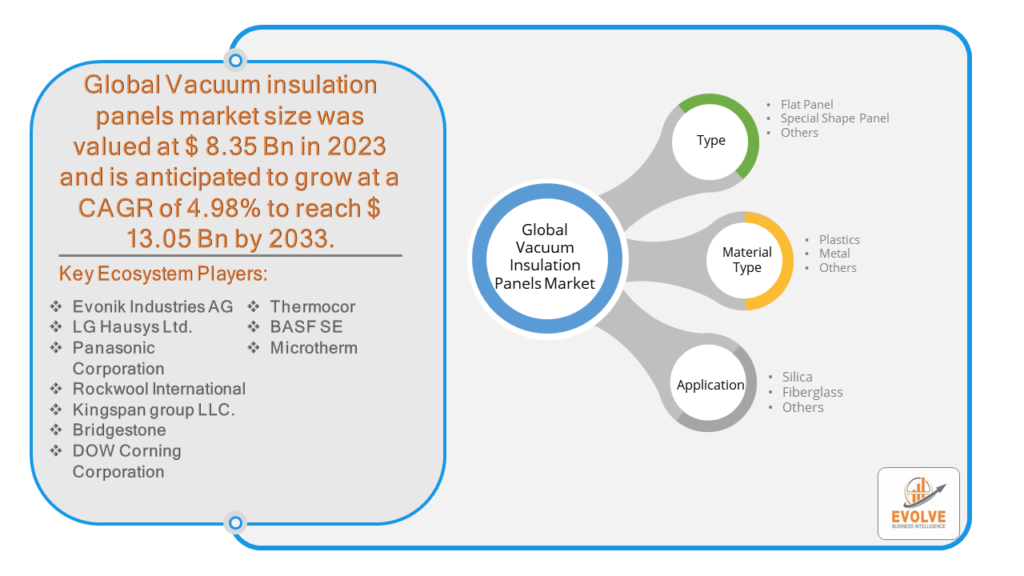

Vacuum insulation panels market Research Report: Information By Type (Flat Panel, Special Shape Panel, Others), By Raw Material (Plastics, Metal, Others), By Application (Silica, Fiberglass, Others), By End Use (Construction, Cooling & Freezing Devices, Logistics, Others), and by Region — Forecast till 2033

Page: 118

Vacuum insulation panels market Overview

The Vacuum insulation panels market Size is expected to reach USD 13.05 Billion by 2033. The Vacuum insulation panels’ market industry size accounted for USD 8.35 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.98% from 2023 to 2033. Vacuum insulation panels (VIPs) are advanced insulation materials used in various industries and applications to provide superior thermal insulation. These panels consist of a core material, typically silica or fiberglass, encased in a gas-tight envelope from which air has been removed to create a vacuum. This vacuum greatly reduces heat transfer by conduction and convection, resulting in extremely high levels of insulation performance.

The market for vacuum insulation panels has been growing steadily due to increasing awareness about energy efficiency, stringent building codes and regulations, and the need for sustainable and eco-friendly insulation solutions. Key drivers include the demand for high-performance insulation materials in construction for energy-efficient buildings, the need for temperature-controlled packaging in the food and pharmaceutical industries, and the desire for lightweight and compact insulation solutions in automotive and aerospace applications.

Global Vacuum insulation panels market Synopsis

The COVID-19 pandemic had significant impacts on the vacuum insulation panels (VIPs) market. The pandemic led to disruptions in global supply chains, affecting the production and distribution of raw materials and components used in the manufacturing of VIPs. Restrictions on movement, temporary closures of manufacturing facilities, and logistical challenges have caused delays in the supply of VIPs to end-users. Many construction projects were delayed or put on hold due to lockdowns, social distancing measures, and economic uncertainty caused by the pandemic. This reduction in construction activity has affected the demand for VIPs, particularly in the building and construction sector, where they are used for insulation in walls, roofs, and floors of buildings. The economic impact of the pandemic has led to budget constraints for businesses and governments, potentially affecting investment decisions and projects that require insulation solutions like VIPs. Uncertainty about future demand and financial stability has led some companies to postpone or scale back their investment in energy-efficient technologies, including VIPs.

Vacuum insulation panels market Dynamics

The major factors that have impacted the growth of Vacuum insulation panels market are as follows:

Drivers:

Ø Growing Construction Industry

The construction industry, particularly in emerging economies, is experiencing rapid growth due to urbanization, population growth, and infrastructure development. VIPs find extensive applications in residential, commercial, and industrial buildings for thermal insulation in walls, roofs, floors, and HVAC systems, driving demand in the construction sector. Ongoing research and development efforts lead to technological advancements in VIPs, resulting in improved performance, durability, and cost-effectiveness. Innovations such as new core materials, enhanced barrier films, and manufacturing processes contribute to the expansion of the VIPs market by making them more competitive and versatile. Increasing awareness of environmental issues and the need to reduce carbon emissions drive demand for sustainable building materials and energy-efficient technologies. VIPs offer a green alternative to conventional insulation materials by minimizing energy consumption, reducing greenhouse gas emissions, and enhancing the overall sustainability of buildings and infrastructure.

Restraint:

- Perception of High Initial Costs

VIPs typically have higher upfront costs compared to traditional insulation materials such as fiberglass or foam board. The initial investment required for VIPs may deter some consumers and businesses, especially in price-sensitive markets or projects with tight budgets. VIPs are fragile and sensitive to damage during handling, transportation, and installation. Special care and handling procedures are necessary to prevent punctures, tears, or compression of the vacuum core, which can compromise the insulation performance. This fragility can add complexity and cost to the supply chain and installation process.

Opportunity:

⮚ Energy Efficiency Initiatives

Increasing awareness of climate change and the need to reduce energy consumption drive the demand for energy-efficient solutions in buildings, appliances and transportation. VIPs offer superior thermal insulation properties, enabling significant energy savings and greenhouse gas emissions reduction. Opportunities exist to capitalize on energy efficiency initiatives, green building certifications, and government incentives that promote the adoption of VIPs. Rapid urbanization and population growth drive demand for residential, commercial, and industrial buildings, particularly in developing regions. VIPs find extensive applications in new construction and retrofit projects, offering space-saving, lightweight, and high-performance insulation solutions. Opportunities exist in supplying VIPs for construction projects, infrastructure upgrades, and urban development initiatives.

Vacuum insulation panels market Segment Overview

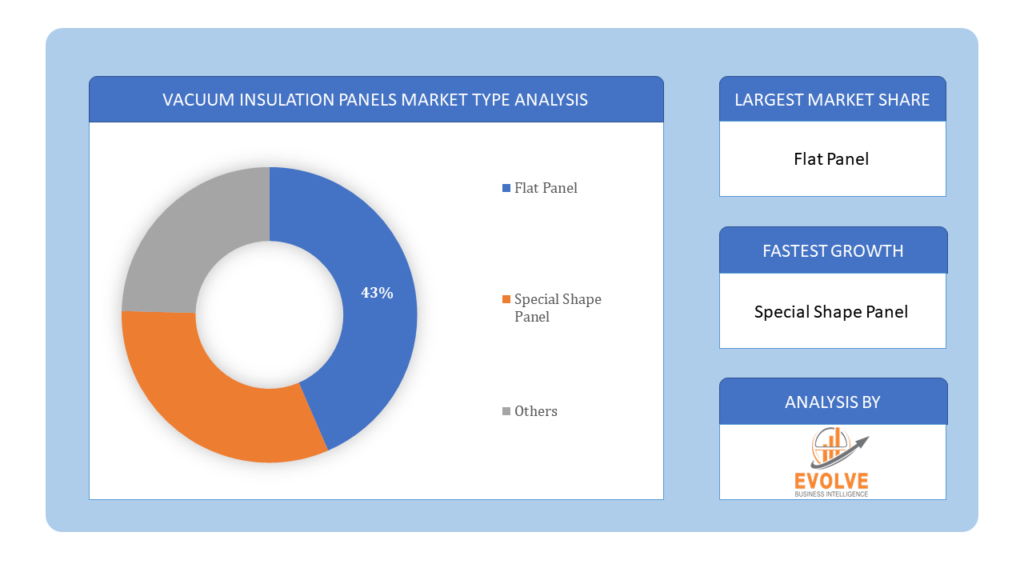

By Type

Based on Type, the market is segmented based on Flat Panel, Special Shape Panel and Others. The flat panel segment dominant the market. These panels can be used in building constructions, cooling & freezing devices, and also in the logistics industry. Growth of the segment is driven by the design flexibility and ease-to-manufacture attributes of flat panels. Increasing stringent regulations promoting energy-efficient materials, and R&D initiatives to introduce automated panels, with an aim to reduce VIPs cost are expected to provide opportunities for the market.

Based on Type, the market is segmented based on Flat Panel, Special Shape Panel and Others. The flat panel segment dominant the market. These panels can be used in building constructions, cooling & freezing devices, and also in the logistics industry. Growth of the segment is driven by the design flexibility and ease-to-manufacture attributes of flat panels. Increasing stringent regulations promoting energy-efficient materials, and R&D initiatives to introduce automated panels, with an aim to reduce VIPs cost are expected to provide opportunities for the market.

By Raw Material

Based on Raw Material, the market segment has been divided into Plastics, Metal and Others. The metal segment is anticipated to dominant the market. These panels will be used for insulation in buildings, offering energy efficiency, and meeting stricter building codes and regulations. The rise in e-commerce, cold chain logistics, and expansion of the construction industry across the globe is expected to drive vacuum insulation panels market growth. The increase in awareness related to sustainability and recycling of raw materials from waste products will provide many opportunities for the market’s development during the forecast period.

By Application

Based on Application, the market segment has been divided into Silica, Fiberglass and Others. The silica segment is dominant the market. Silica-based vacuum insulation panel offers are widely used in the construction industry. The presence of excellent properties compared to other conventional thermal insulation products will provide lucrative opportunities for the development of the market.

By End Use

Based on End Use, the market segment has been divided into Construction, Cooling & Freezing Devices, Logistics and Others. The construction sector accounted for the highest market share, owing to increased installation of vacuum insulation panels products in commercial, infrastructure, and other projects. This is mostly due to the maximum consumption of vacuum insulation panels in residential & underground constructions. Vacuum insulation panels also offer other advantages in the construction sector, such as the reduced thickness of building components, providing increased indoor space and optimization of land use, and recyclability of constitutive materials after their service life.

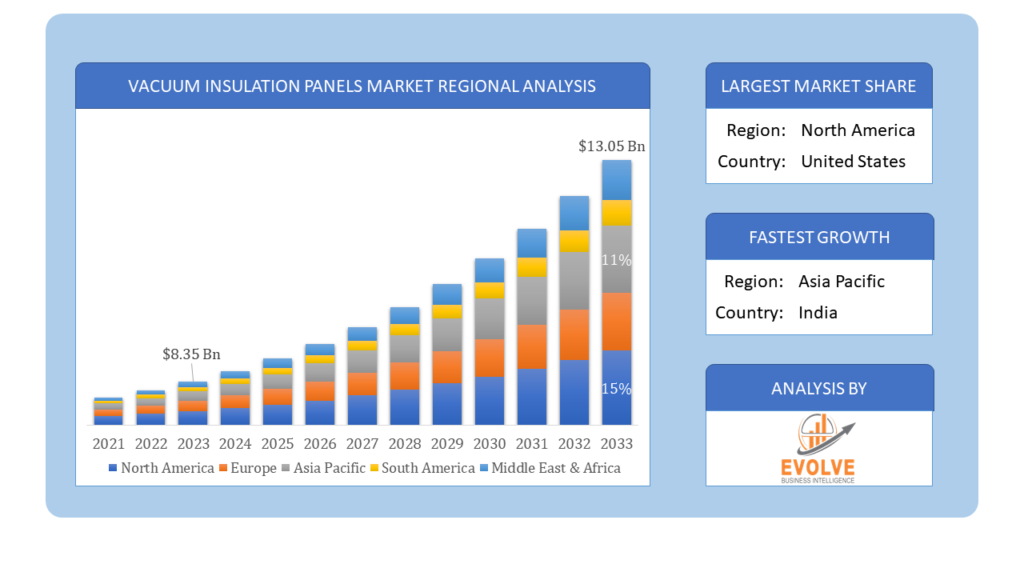

Global Vacuum insulation panels market Regional Analysis

Based on region, the global Vacuum insulation panels market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Vacuum insulation panels market followed by the Asia-Pacific and Europe regions.

Vacuum insulation panels North America Market

Vacuum insulation panels North America Market

North America holds a dominant position in the Vacuum insulation panels market. United States and Canada countries have well-established construction industries and stringent energy efficiency standards, driving demand for VIPs in residential, commercial, and industrial buildings. Government incentives and green building initiatives further stimulate market growth. The U.S. Department of Energy’s (DOE) Building Technologies Office supports research and development efforts to advance VIPs technology.

Vacuum insulation panels Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Vacuum insulation panels market industry. Rapid urbanization, infrastructure development, and government initiatives to improve energy efficiency create significant opportunities for VIPs in the Chinese market. Rising demand for green buildings, cold chain logistics, and temperature-controlled storage facilities drives growth. Domestic manufacturers in China are investing in technology upgrades and expanding production capacity. India’s construction sector is growing rapidly, driven by urbanization, population growth, and infrastructure investments. VIPs offer solutions for energy-efficient buildings, cold storage warehouses, and refrigerated transport. Government initiatives such as the Energy Conservation Building Code (ECBC) promote the adoption of VIPs and other energy-efficient technologies.

Competitive Landscape

The global Vacuum insulation panels market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Evonik Industries AG

- LG Hausys Ltd.

- Panasonic Corporation

- Rockwool International

- Kingspan group LLC.

- Bridgestone

- DOW Corning Corporation

- Thermocor

- BASF SE

- Microtherm

Scope of the Report

Global Vacuum insulation panels Market, by Type

- Flat Panel

- Special Shape Panel

- Others

Global Vacuum insulation panels market, by Raw Material

- Plastics

- Metal

- Others

Global Vacuum insulation panels market, by Application

- Silica

- Fiberglass

- Others

Global Vacuum insulation panels market, by End Use

- Construction

- Cooling & Freezing Devices

- Logistics

- Others

Global Vacuum insulation panels market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $13.05 Billion |

| CAGR | 4.98% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Raw Material, Application, End Use |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Evonik Industries AG, LG Hausys Ltd., Panasonic Corporation, Rockwool International, Kingspan group LLC., Bridgestone, DOW Corning Corporation, Thermocor, BASF SE and Microtherm. |

| Key Market Opportunities | • Energy Efficiency Initiatives • Urbanization and Construction Growth |

| Key Market Drivers | • Growing Construction Industry • Technological Advancements |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Vacuum insulation panels market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Vacuum insulation panels market historical market size for the year 2021, and forecast from 2023 to 2033

- Vacuum insulation panels market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Vacuum insulation panels market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Vacuum insulation panels market?

The study period encompasses historical data from 2021 and forecasts for the years 2023 to 2033.

What is the growth rate of the Vacuum insulation panels market?

The Vacuum insulation panels market is expected to expand at a compound annual growth rate (CAGR) of 4.98% from 2023 to 2033.

Which region has the highest growth rate in the Vacuum insulation panels market?

The Asia Pacific region is projected to have the highest growth rate in the Vacuum insulation panels market due to rapid urbanization, infrastructure development, and government initiatives promoting energy efficiency.

Which region has the largest share of the Vacuum insulation panels market?

Currently, North America holds the largest share of the Vacuum insulation panels market, driven by established construction industries, stringent energy efficiency standards, and government incentives.

Who are the key players in the Vacuum insulation panels market?

Key players in the Vacuum insulation panels market include Evonik Industries AG, LG Hausys Ltd., Panasonic Corporation, Rockwool International, Kingspan group LLC., Bridgestone, DOW Corning Corporation, Thermocor, BASF SE, and Microtherm, among others.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Type Segement – Market Opportunity Score 4.1.2. Raw Material Segment – Market Opportunity Score 4.1.3. Application Segment – Market Opportunity Score 4.1.4. End Use Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Vacuum insulation panels market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Vacuum insulation panels market, By Type 7.1. Introduction 7.1.1. Flat Panel 7.1.2 Special Shape Panel 7.1.3. Others CHAPTER 8. Global Vacuum insulation panels market, By Raw Material 8.1. Introduction 8.1.1. Plastics 8.1.2. Metal 8.1.3. Others CHAPTER 9. Global Vacuum insulation panels market, By Application 9.1. Introduction 9.1.1. Foliar spray 9.1.2. Soil treatment 9.1.3. Seed treatment 9.1.4. Others CHAPTER 10. Global Vacuum insulation panels market, By End Use 10.1.Introduction 10.1.1. Construction 10.1.2. Cooling & Freezing Devices 10.1.3. Logistics 10.1.4. Others CHAPTER 11. Global Vacuum insulation panels market, By Region 11.1. Introduction 11.2. NORTH AMERICA 11.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.2.2. North America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.2.3. North America: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.2.4. North America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.5. North America: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.2.6. US 11.2.6.1. US: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.2.6.2. US: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.2.6.3. US: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.6.4. US: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.2.7. CANADA 11.2.7.1. Canada: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.2.7.2. Canada: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.2.7.3. Canada: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.7.4. Canada: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.2.8. MEXICO 11.2.8.1. Mexico: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.2.8.2. Mexico: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.2.8.3. Mexico: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.8.4. Mexico: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.3. Europe 11.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.3.2. Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.3. Europe: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.3.4. Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.5. Europe: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.3.6. U.K. 11.3.6.1. U.K.: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.6.2. U.K.: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.3.6.3. U.K.: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.6.4. U.K.: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.3.7. GERMANY 11.3.7.1. Germany: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.7.2. Germany: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.3.7.3. Germany: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.7.4. Germany: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.3.8. FRANCE 11.3.8.1. France: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.8.2. France: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.3.8.3. France: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.8.4. France: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.3.9. ITALY 11.3.9.1. Italy: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.9.2. Italy: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.3.9.3. Italy: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.9.4. Italy: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.3.10. SPAIN 11.3.10.1. Spain: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.10.2. Spain: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.3.10.3. Spain: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.10.4. Spain: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.3.11. BENELUX 11.3.11.1. BeNeLux: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.11.2. BeNeLux: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.3.11.3. BeNeLux: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.11.4. BeNeLux: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.3.12. RUSSIA 11.3.12.1. Russia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.12.2. Russia: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.3.12.3. Russia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.12.4. Russia: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.3.13. REST OF EUROPE 11.3.13.1. Rest of Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.13.2. Rest of Europe: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.3.13.3. Rest of Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.13.4. Rest of Europe: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.4. Asia Pacific 11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.4.2. Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.3. Asia Pacific: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.4.4. Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.5. Asia Pacific: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.4.6. CHINA 11.4.6.1. China: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.6.2. China: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.4.6.3. China: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.6.4. China: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.4.7. JAPAN 11.4.7.1. Japan: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.7.2. Japan: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.4.7.3. Japan: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.7.4. Japan: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.4.8. INDIA 11.4.8.1. India: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.8.2. India: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.4.8.3. India: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.8.4. India: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.4.9. SOUTH KOREA 11.4.9.1. South Korea: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.9.2. South Korea: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.4.9.3. South Korea: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.9.4. South Korea: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.4.10. THAILAND 11.4.10.1. Thailand: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.10.2. Thailand: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.4.10.3. Thailand: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.10.4. Thailand: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.4.11. INDONESIA 11.4.11.1. Indonesia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.11.2. Indonesia: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.4.11.3. Indonesia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.11.4. Indonesia: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.4.12. MALAYSIA 11.4.12.1. Malaysia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.12.2. Malaysia: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.4.12.3. Malaysia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.12.4. Malaysia: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.4.13. AUSTRALIA 11.4.13.1. Australia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.13.2. Australia: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.4.13.3. Australia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.13.4. Australia: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.4.14. REST FO ASIA PACIFIC 11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.5. South America 11.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.5.2. South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.5.3. South America: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.5.4. South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.5. South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.5.6. BRAZIL 11.5.6.1. Brazil: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.5.6.2. Brazil: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.5.6.3. Brazil: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.6.4. Brazil: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.5.7. ARGENTINA 11.5.7.1. Argentina: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.5.7.2. Argentina: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.5.7.3. Argentina: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.7.4. Argentina: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.5.8. REST OF SOUTH AMERICA 11.5.8.1. Rest of South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.5.8.2. Rest of South America: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.5.8.3. Rest of South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.8.4. Rest of South America: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.6. Middle East & Africa 11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.3. Middle East & Africa: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.6.4. Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.5. Middle East & Africa: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.6.6. SAUDI ARABIA 11.6.6.1. Saudi Arabia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.6.2. Saudi Arabia: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.6.6.3. Saudi Arabia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.6.4. Saudi Arabia: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.6.7. UAE 11.6.7.1. UAE: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.7.2. UAE: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.6.7.3. UAE: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.7.4. UAE: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.6.8. EGYPT 11.6.8.1. Egypt: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.8.2. Egypt: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.6.8.3. Egypt: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.8.4. Egypt: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.6.9. SOUTH AFRICA 11.6.9.1. South Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.9.2. South Africa: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.6.9.3. South Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.9.4. South Africa: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.6.10. REST OF MIDDLE EAST & AFRICA 11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Raw Material, 2023 – 2033 ($ Million) 11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Evonik Industries AG 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. LG Hausys Ltd. 13.3. Panasonic Corporation 13.4. Rockwool International 13.5. Kingspan group LLC. 13.6. Bridgestone 13.7. DOW Corning Corporation 13.8. Thermocor 13.9. BASF SE 13.10. Microtherm

Connect to Analyst

Research Methodology