V2X Technology Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

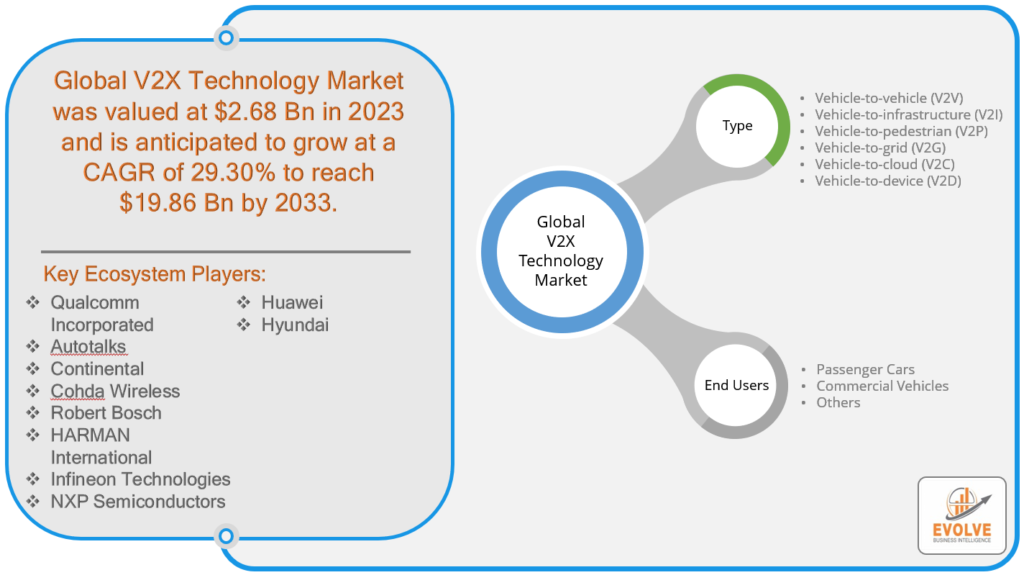

V2X Technology Market Research Report: Information By Type (Vehicle-to-vehicle (V2V), Vehicle-to-infrastructure (V2I), Vehicle-to-pedestrian (V2P), Vehicle-to-grid (V2G), Vehicle-to-cloud (V2C), Vehicle-to-device (V2D)), By End Users (Passenger Cars, Commercial Vehicles, Others), and by Region — Forecast till 2033

V2X Technology Market Overview

The V2X Technology Market Size is expected to reach USD 19.86 Billion by 2033. The V2X Technology industry size accounted for USD 2.68 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 29.30% from 2023 to 2033. V2X (Vehicle-to-Everything) technology refers to a set of communication protocols and systems that enable vehicles to exchange information with various entities in their surroundings. The “X” in V2X represents the wide range of communication scenarios, including other vehicles (V2V), infrastructure (V2I), pedestrians (V2P), cyclists (V2C), and networks (V2N). V2X technology utilizes wireless communication technologies, such as Dedicated Short-Range Communication (DSRC) or Cellular Vehicle-to-Everything (C-V2X), to facilitate real-time data exchange between vehicles and their environment. This data exchange can encompass crucial safety information, traffic conditions, road hazards, and even non-safety-related services like infotainment and cloud-based applications.

Global V2X Technology Market Synopsis

The COVID-19 pandemic has had a profound and transformative impact on the V2X Technology market. The crisis has brought about significant changes in the way people travel and interact with their surroundings, leading to an increased demand for safer and more efficient mobility solutions. V2X Technology, with its ability to facilitate real-time communication between vehicles, infrastructure, and various stakeholders, has emerged as a critical enabler in addressing these challenges. The pandemic has highlighted the importance of V2X in ensuring public safety, optimizing traffic flow, and enabling contactless services. As a result, there has been a surge in the adoption and development of V2X technology, paving the way for enhanced road safety, improved transportation efficiency, and the advancement of autonomous driving capabilities. The pandemic has not only accelerated the market growth of V2X Technology but also reshaped its landscape, positioning it as a crucial component of the future mobility ecosystem.

V2X Technology Market Dynamics

The major factors that have impacted the growth of V2X Technology are as follows:

Drivers:

Increased Emphasis on Road Safety

One of the primary drivers for the V2X Technology market is the increased emphasis on road safety. With the rise in road accidents and fatalities, there is a growing need for advanced technologies that can improve safety on the roads. V2X Technology, through its real-time communication capabilities, enables vehicles to exchange information about potential hazards, road conditions, and other critical data, allowing for proactive safety measures. This driver is particularly significant as governments and regulatory bodies worldwide are focusing on reducing road accidents and promoting safer transportation systems.

Restraint:

- Infrastructure Readiness and Compatibility

A significant restraint for the V2X Technology market is the readiness and compatibility of infrastructure. For V2X systems to function effectively, it requires robust and well-established infrastructure, including roadside units, traffic management systems, and network coverage. However, the deployment of such infrastructure can be challenging, especially in areas with limited resources or outdated transportation systems. Additionally, ensuring compatibility and standardization across different regions and manufacturers poses another hurdle. The lack of consistent infrastructure and compatibility issues can hinder the widespread adoption and implementation of V2X Technology, thereby restraining market growth.

Opportunity:

Intelligent Transportation Systems (ITS)

An opportunity for the V2X Technology market lies in the integration with Intelligent Transportation Systems (ITS). ITS encompasses various technologies and systems that aim to optimize transportation efficiency, reduce congestion, and enhance overall mobility. V2X Technology complements ITS by providing real-time communication and data exchange capabilities between vehicles, infrastructure, and traffic management systems. By integrating V2X with ITS, it becomes possible to create a more connected and intelligent transportation ecosystem, enabling advanced features like traffic signal optimization, dynamic routing, and cooperative adaptive cruise control. This integration presents a significant opportunity for the V2X Technology market to expand its applications and contribute to the advancement of smarter transportation systems.

V2X Technology Segment Overview

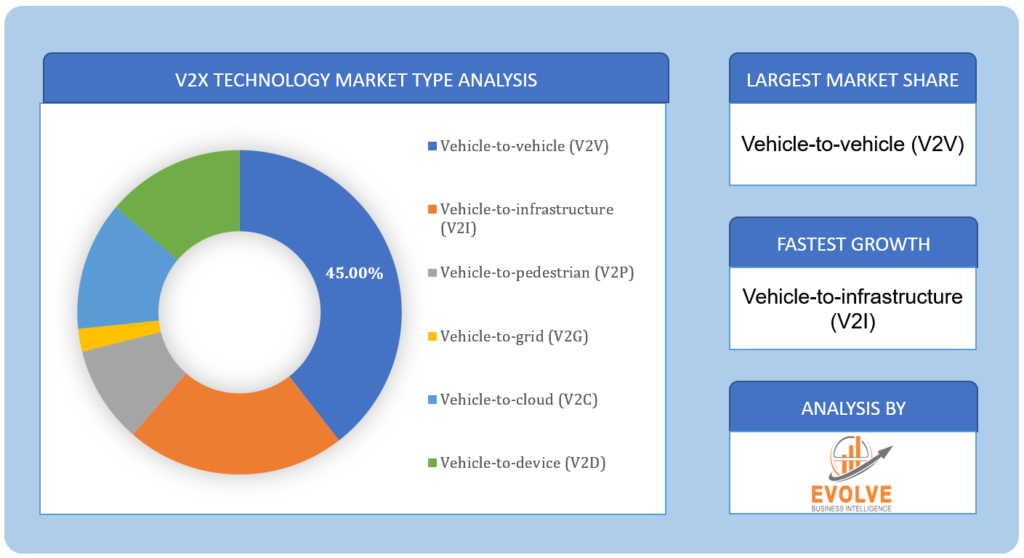

By Type

Based on Type, the market is segmented based on Vehicle-to-vehicle (V2V), Vehicle-to-infrastructure (V2I), Vehicle-to-pedestrian (V2P), Vehicle-to-grid (V2G), Vehicle-to-cloud (V2C), Vehicle-to-device (V2D). The Vehicle-to-vehicle (V2V) segment is expected to have a larger market share throughout the forecast period. V2V communication is considered a foundational element of V2X Technology, forming the basis for other communication scenarios such as Vehicle-to-infrastructure (V2I) and Vehicle-to-pedestrian (V2P). Therefore, the widespread adoption and implementation of V2V communication is crucial for the overall success and effectiveness of the V2X ecosystem.

Based on Type, the market is segmented based on Vehicle-to-vehicle (V2V), Vehicle-to-infrastructure (V2I), Vehicle-to-pedestrian (V2P), Vehicle-to-grid (V2G), Vehicle-to-cloud (V2C), Vehicle-to-device (V2D). The Vehicle-to-vehicle (V2V) segment is expected to have a larger market share throughout the forecast period. V2V communication is considered a foundational element of V2X Technology, forming the basis for other communication scenarios such as Vehicle-to-infrastructure (V2I) and Vehicle-to-pedestrian (V2P). Therefore, the widespread adoption and implementation of V2V communication is crucial for the overall success and effectiveness of the V2X ecosystem.

By End Users

Based on End Users, the market has been divided into Passenger Cars, Commercial Vehicles, and Others. The Passenger Cars segment is anticipated to dominate the market. Passenger cars are increasingly equipped with advanced safety and connectivity features. Many automakers are integrating V2X capabilities into their passenger car models to enhance road safety, provide driver assistance, and enable connected services. This integration is driven by regulatory requirements, consumer demand for advanced safety features, and the desire for enhanced driving experiences.

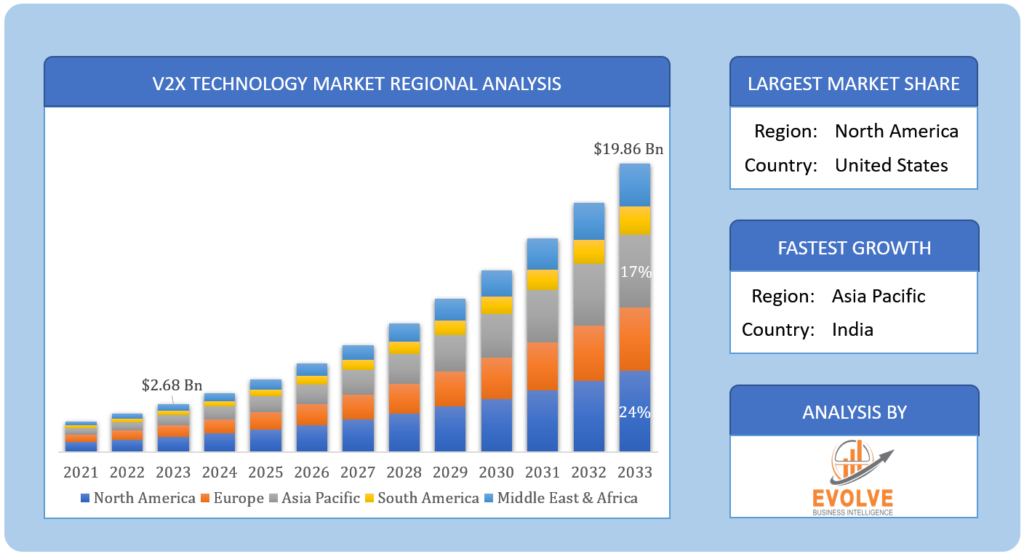

Global V2X Technology Market Regional Analysis

Based on region, the global V2X Technology market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the V2X Technology market followed by the Asia-Pacific and Europe regions.

North America Market

North America Market

North America has played a crucial role in the development and early deployment of V2X Technology. The region has been at the forefront of technological innovation and has seen active participation from government agencies, research institutions, and industry stakeholders in promoting and advancing V2X initiatives. One of the key reasons for North America’s involvement in the V2X Technology market is the emphasis on road safety and intelligent transportation systems. Regulatory bodies, such as the National Highway Traffic Safety Administration (NHTSA) in the United States, have been actively supporting V2X initiatives, recognizing the potential to reduce accidents and improve traffic management. Additionally, North America has seen significant collaborations between automotive manufacturers, technology companies, and infrastructure providers to pilot and implement V2X systems. These collaborations have facilitated the development of interoperable solutions and the establishment of testbeds and proving grounds to validate the effectiveness of V2X Technology.

Asia-Pacific Market

The Asia-Pacific region has emerged as a rapidly growing market for the V2X Technology industry. The region’s increasing economic development, expanding automotive sector, and growing focus on smart transportation solutions have contributed to the rising adoption and implementation of V2X Technology. Several factors have propelled the growth of the V2X Technology market in the Asia-Pacific region. Firstly, the region is home to some of the world’s largest automotive markets, including China, Japan, and South Korea. These countries have witnessed significant investments in V2X Technology, driven by government initiatives, industry collaborations, and a strong market demand for advanced safety and connectivity features. The Asia-Pacific region has been at the forefront of smart city initiatives and urban mobility transformations. Governments and transportation authorities in countries like China and Singapore are actively promoting the integration of V2X systems to enhance road safety, reduce congestion, and improve overall transportation efficiency.

Competitive Landscape

The Global V2X Technology market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Qualcomm Incorporated

- Autotalks

- Continental

- Cohda Wireless

- Robert Bosch

- HARMAN International

- Infineon Technologies

- NXP Semiconductors

- Huawei

- Hyundai

Key Development

In May 2023, Qualcomm Incorporated made an announcement regarding its subsidiary, Qualcomm Technologies, Inc., reaching a definitive agreement to acquire Autotalks. The completion of this transaction is contingent upon meeting the customary closing conditions.

Scope of the Report

Global V2X Technology Market, by Type

- Vehicle-to-vehicle (V2V)

- Vehicle-to-infrastructure (V2I)

- Vehicle-to-pedestrian (V2P)

- Vehicle-to-grid (V2G)

- Vehicle-to-cloud (V2C)

- Vehicle-to-device (V2D)

Global V2X Technology Market, by End Users

- Passenger Cars

- Commercial Vehicles

- Others

Global V2X Technology Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

• The rapid advancements in autonomous

• The demand for V2X-enabled systems• The rising concern over road safety

• Governments and regulatory bodies

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $19.86 Billion |

| CAGR | 29.30% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, End Users |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Qualcomm Incorporated, Autotalks, Continental, Cohda Wireless, Robert Bosch, HARMAN International, Infineon Technologies, NXP Semiconductors, Huawei, Hyundai |

| Key Market Opportunities | |

| Key Market Drivers |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future V2X Technology market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- V2X Technology market historical market size for the year 2021, and forecast from 2023 to 2033

- V2X Technology market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global V2X Technology market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

The study period of the global V2X Technology market is 2021- 2033

The Global V2X Technology market is growing at a CAGR of 29.30% over the next 10 years

Asia Pacific is expected to register the highest CAGR during 2023-2033

North America holds the largest share in 2022

Qualcomm Incorporated, Autotalks, Continental, Cohda Wireless, Robert Bosch, HARMAN International, Infineon Technologies, NXP Semiconductors, Huawei, and Hyundai are the major companies operating in the market.

Yes, we offer 16 hours of analyst support to solve the queries

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw Material Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the V2X Technology Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the V2X Technology Market 4.8. Import Analysis of the V2X Technology Market 4.9. Export Analysis of the V2X Technology Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global V2X Technology Market, By Type 6.1. Introduction 6.2. Vehicle-to-vehicle (V2V) 6.3. Vehicle-to-infrastructure (V2I) 6.4. Vehicle-to-pedestrian (V2P) 6.5. Vehicle-to-grid (V2G) 6.6. Vehicle-to-cloud (V2C) 6.7. Vehicle-to-device (V2D) Chapter 7. Global V2X Technology Market, By End Users 7.1. Introduction 7.2. Passenger Cars 7.3. Commercial Vehicles 7.4. Others Chapter 8. Global V2X Technology Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Type, 2023-2033 8.2.5. Market Size and Forecast, By End Users, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Type, 2023-2033 8.2.6.4. Market Size and Forecast, By End Users, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Type, 2023-2033 8.2.7.5. Market Size and Forecast, By End Users, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Type, 2023-2033 8.3.5. Market Size and Forecast, By End Users, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Type, 2023-2033 8.3.6.4. Market Size and Forecast, By End Users, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Type, 2023-2033 8.3.7.4. Market Size and Forecast, By End Users, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Type, 2023-2033 8.3.8.4. Market Size and Forecast, By End Users, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Type, 2023-2033 8.3.9.4. Market Size and Forecast, By End Users, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Type, 2023-2033 8.3.11.4. Market Size and Forecast, By End Users, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Type, 2023-2033 8.12.28. Market Size and Forecast, By End Users, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Type, 2023-2033 8.4.6.4. Market Size and Forecast, By End Users, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Type, 2023-2033 8.4.7.4. Market Size and Forecast, By End Users, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Type, 2023-2033 8.4.8.4. Market Size and Forecast, By End Users, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Type, 2023-2033 8.4.9.4. Market Size and Forecast, By End Users, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Type, 2023-2033 8.4.10.4. Market Size and Forecast, By End Users, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Type, 2023-2033 8.5.4. Market Size and Forecast, By End Users, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Qualcomm Incorporated 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Autotalks 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Continental 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Cohda Wireless 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Robert Bosch 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. HARMAN International 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Infineon Technologies 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 NXP Semiconductors 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Huawei 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.9 Hyundai 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis

Connect to Analyst

Research Methodology