Utility Poles Market Analysis and Global Forecast 2021-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

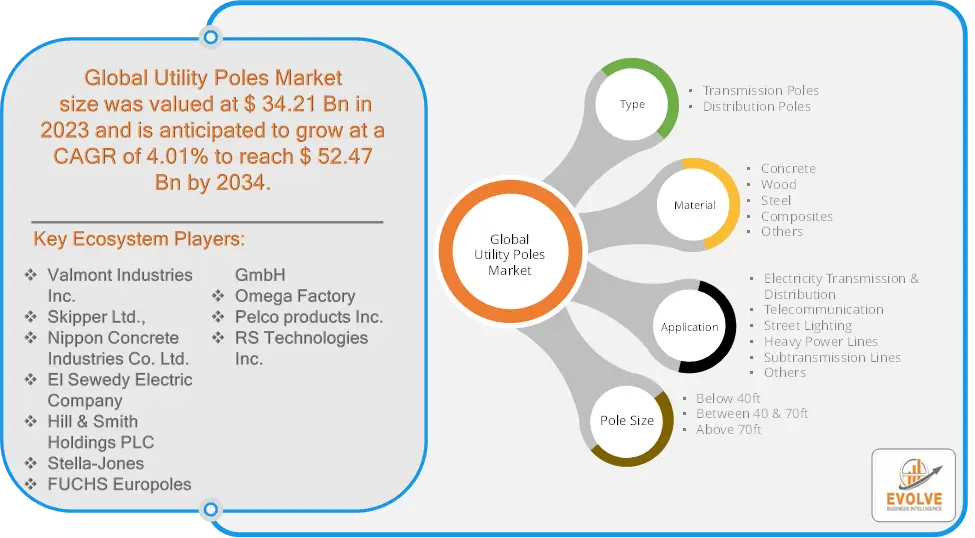

Utility Poles Market Research Report: By Type (Transmission Poles, Distribution Poles), By Material (Concrete, Wood, Steel, Composites, Others,), By Application (Electricity Transmission & Distribution, Telecommunication, Street Lighting, Heavy Power Lines, Subtransmission Lines, Others), By Pole Size (Below 40ft, Between 40 & 70ft, Above 70ft), and by Region — Forecast till 2034

Page: 115

Utility Poles Market Overview

The Utility Poles Market size accounted for USD 34.21 Billion in 2023 and is estimated to account for 35.54 Billion in 2024. The Market is expected to reach USD 52.47 Billion by 2034 growing at a compound annual growth rate (CAGR) of 4.01% from 2024 to 2034. The industry that produces and supplies poles used to support overhead electricity lines, communication lines, and other utilities like transformers and streetlights is known as the utility poles market. Usually constructed of steel, concrete, wood, or composite materials, these poles offer a variety of advantages in terms of strength, longevity, and cost. The upgrade of electrical grids, electrification initiatives in rural areas, and rising electricity consumption are the main factors driving the industry. Concerns about the environment have made people want eco-friendly materials more and more, and innovations in technology like smart grids are also having an impact on the industry. Important factors in the electric pole industry are weather resistance, maintenance costs, and regulatory rules.

Global Utility Poles Market Synopsis

Global Utility Poles Market Dynamics

Global Utility Poles Market Dynamics

The major factors that have impacted the growth of Utility Poles are as follows:

Drivers:

⮚ Technological Advancements – Smart Grids

Utility pole sales are being impacted by the emergence of smart grids, which combine sophisticated communication technology with sensors to monitor and optimize electricity delivery. These days, it’s common for these poles to hold sensors, communication wires, and other equipment. The need for more durable, multipurpose poles that can handle data transmission and power generation is increased by smart grids.

Restraint:

- High Initial Costs and Installation Challenges

The high initial cost of installing new utility poles, particularly those composed of sophisticated materials like steel, concrete, or composites, is one of the main barriers to the utility pole business. These materials can cost a lot more than conventional timber poles, although being more durable and having longer lifespans. Furthermore, the total cost may increase due to installation-related expenses such as personnel, transportation, and equipment. This is especially tough in isolated or difficult-to-reach places where installation and shipment are expensive and time-consuming.

Opportunity:

⮚ Increasing Investment in Smart Grid Infrastructure

The market for utility poles has a lot of potential due to the growing trend of smart grid adoption. In order to increase the effectiveness and dependability of power distribution, smart grids integrate cutting-edge technology including automation, sensors, and two-way communication. Utility poles are essential to the support of smart grid infrastructure since they frequently hold wireless communication devices, transformers, and other equipment. Particularly in industrialized nations, governments and utility corporations are heavily investing in grid modernization projects, which is driving demand for poles that can handle these cutting-edge systems. This potential is increased when renewable energy sources like solar and wind power are included into smart grids.

Utility Poles Market Segment Overview

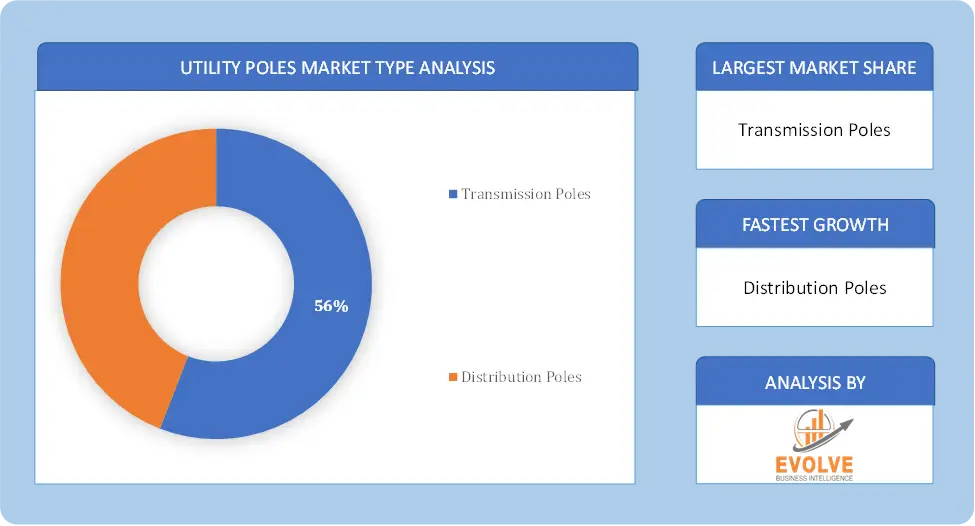

By Type

Based on the Type, the market is segmented based on Transmission Poles, Distribution Poles. the “Distribution Poles” segment dominates, as they are essential for connecting power lines to residential and commercial consumers, reflecting the high demand for localized electricity distribution.

Based on the Type, the market is segmented based on Transmission Poles, Distribution Poles. the “Distribution Poles” segment dominates, as they are essential for connecting power lines to residential and commercial consumers, reflecting the high demand for localized electricity distribution.

By Material

Based on Material, the market has been divided into Concrete, Wood, Steel, Composites, Others. the “Wood” segment dominates due to its cost-effectiveness and widespread use in traditional power distribution, although the demand for Concrete and Composites is steadily increasing due to their durability and lower maintenance requirements.

By Application

Based on the Application, the market has been divided into Electricity Transmission & Distribution, Telecommunication, Street Lighting, Heavy Power Lines, Subtransmission Lines, Others. the “Electricity Transmission & Distribution” segment dominates, driven by the ongoing demand for robust infrastructure to deliver power efficiently across urban and rural areas.

By Pole Size

Based on Pole Size, the market has been divided into Below 40ft, Between 40 & 70ft, Above 70ft. the “Between 40 & 70ft” segment dominates, as poles of this size are widely used in both urban and rural power distribution and telecommunication applications due to their balance of height, strength, and versatility.

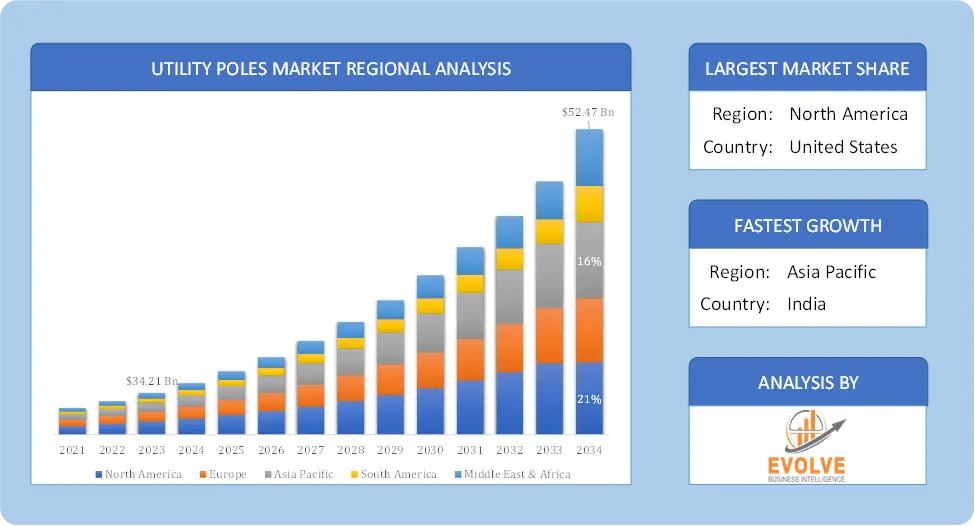

Global Utility Poles Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Utility Poles, followed by those in Asia-Pacific and Europe.

Utility Poles North America Market

Utility Poles North America Market

The North American region holds a dominant position in the Utility Poles market. Due to the existence of well-established utilities and rising investments in infrastructure development, North America is predicted to lead the market in 2023 and generate a sizeable portion of worldwide revenue. Another important region is Europe, where efforts to implement smart grids and emphasize renewable energy are fueling market expansion. Growing urbanization, increased electricity consumption, and government attempts to upgrade power transmission networks are expected to propel significant growth in the APAC area. increases the likelihood of this happening.

Utility Poles Asia Pacific Market

The Asia-Pacific region is witnessing rapid growth and emerging as a significant market for the Utility Poles industry. The Utility Poles Market in the Asia-Pacific region is experiencing significant growth due to rapid urbanization, increasing electricity demand, and ongoing rural electrification initiatives. Countries like India, China, and Indonesia are investing heavily in expanding their power infrastructure to meet rising energy needs. Additionally, the integration of renewable energy sources and smart grid technologies is driving the demand for modern utility poles, further enhancing market opportunities in this region.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Valmont Industries Inc., Skipper Ltd.,, Nippon Concrete Industries Co. Ltd., El Sewedy Electric Company, and Hill & Smith Holdings PLC are some of the leading players in the global Utility Poles Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Valmont Industries Inc.

- Skipper Ltd.,

- Nippon Concrete Industries Co. Ltd.

- El Sewedy Electric Company

- Hill & Smith Holdings PLC

- Stella-Jones

- FUCHS Europoles GmbH

- Omega Factory

- Pelco products Inc.

- RS Technologies Inc.

Key Development:

In September 2023, Nippon Concrete Industries Co. Ltd announced the launch of a new line of environmentally friendly concrete utility poles, designed to enhance durability and reduce maintenance costs, aligning with sustainability trends in the infrastructure sector.

Scope of the Report

Global Utility Poles Market, by Type

- Transmission Poles

- Distribution Poles

Global Utility Poles Market, by Material

- Concrete

- Wood

- Steel

- Composites

- Others

Global Utility Poles Market, by Application

- Electricity Transmission & Distribution

- Telecommunication

- Street Lighting

- Heavy Power Lines

- Subtransmission Lines

- Others

Global Utility Poles Market, by Pole Size

- Below 40ft

- Between 40 & 70ft

- Above 70ft

Global Utility Poles Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $52.47 Billion |

| CAGR | 4.01% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Material, Application, Pole Size. |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Valmont Industries Inc., Skipper Ltd.,, Nippon Concrete Industries Co. Ltd., El Sewedy Electric Company, Hill & Smith Holdings PLC, Stella-Jones, FUCHS Europoles GmbH, Omega Factory, Pelco products Inc., RS Technologies Inc. |

| Key Market Opportunities | Smart grid infrastructure upgrades Growing demand for renewable energy Government incentives for energy efficiency Increasing urbanization and population growth Technological advancements in pole design |

| Key Market Drivers | Aging infrastructure increasing demand Technological advancements in composite poles Growing preference for renewable energy smart grids Government regulations and environmental concerns Fluctuating raw material prices supply chain disruptions |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Utility Poles market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Utility Poles market historical market size for the year 2022, and forecast from 2021 to 2034

- Utility Poles market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Utility Poles market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Utility Poles market is 2021- 2034

What are the 10 Years CAGR (2021 to 2034) of the global Utility Poles market?

The global Utility Poles market is growing at a CAGR of ~4.01% over the next 10 years

Which region has the highest growth rate in the market of Utility Poles?

Asia Pacific is expected to register the highest CAGR during 2021-2034

Which region accounted for the largest share of the market of Utility Poles?

North America holds the largest share in 2023

Major Key Players in the Market of Utility Poles?

Valmont Industries Inc., Skipper Ltd.,, Nippon Concrete Industries Co. Ltd., El Sewedy Electric Company, Hill & Smith Holdings PLC, Stella-Jones, FUCHS Europoles GmbH, Omega Factory, Pelco products Inc., and RS Technologies Inc. are the major companies operating in the Utility Poles Industry.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope of The Study 2.1. Market Definition 2.2. Scope of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat of New Entrants 4.2.2. Bargaining Power of Buyers 4.2.3. Bargaining Power of Suppliers 4.2.4. Threat of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on utility poles Market 4.3.1. Impact on Market Size 4.3.2. Pole Sizer Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global utility poles Market, By Type 6.1. Introduction 6.2. Transmission Poles 6.3. Distribution Poles Chapter 7. Global utility poles Market, By Material 7.1. Introduction 7.2. Concrete 7.3. Wood 7.4. Steel 7.5. Composites 7.6. Others Chapter 8. Global utility poles Market, By Application 8.1. Introduction 8.2. Electricity Transmission & Distribution 8.3. Telecommunication 8.4. Street Lighting 8.5. Heavy Power Lines 8.6. Subtransmission Lines 8.7. Others Chapter 9. Global utility poles Market, By Pole Size 9.1. Introduction 9.2. Below 40ft 9.3. Between 40 & 70ft 9.4. Above 70ft Chapter 10. Global utility poles Market, By Region 10.1. Introduction 10.2. North America 10.2.1. Introduction 10.2.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.3. Market Size and Forecast, By Country, 2020 - 2028 10.2.4. Market Size and Forecast, By Type, 2020 - 2028 10.2.5. Market Size and Forecast, By Material, 2020 - 2028 10.2.6. Market Size and Forecast, By Application, 2020 – 2028 10.2.7. Market Size and Forecast, By Pole Sizer, 2020 – 2028 10.2.8. US 10.2.8.1. Introduction 10.2.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.8.3. Market Size and Forecast, By Type, 2020 - 2028 10.2.8.4. Market Size and Forecast, By Material, 2020 - 2028 10.2.8.5. Market Size and Forecast, By Application, 2020 – 2028 10.2.8.6. Market Size and Forecast, By Pole Sizer, 2020 - 2028 10.2.9. Canada 10.2.9.1. Introduction 10.2.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.9.3. Market Size and Forecast, By Type, 2020 - 2028 10.2.9.4. Market Size and Forecast, By Material, 2020 - 2028 10.2.9.5. Market Size and Forecast, By Application, 2020 – 2028 10.2.9.6. Market Size and Forecast, By Pole Sizer, 2020 - 2028 10.3. Europe 10.3.1. Introduction 10.3.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.3. Market Size and Forecast, By Country, 2020 - 2028 10.3.4. Market Size and Forecast, By Type, 2020 - 2028 10.3.5. Market Size and Forecast, By Material, 2020 - 2028 10.3.6. Market Size and Forecast, By Application, 2020 – 2028 10.3.7. Market Size and Forecast, By Pole Sizer, 2020 – 2028 10.3.8. Germany 10.3.8.1. Introduction 10.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.8.3. Market Size and Forecast, By Type, 2020 - 2028 10.3.8.4. Market Size and Forecast, By Material, 2020 - 2028 10.3.8.5. Market Size and Forecast, By Application, 2020 – 2028 10.3.8.6. Market Size and Forecast, By Pole Sizer, 2020 - 2028 10.3.9. France 10.3.9.1. Introduction 10.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.9.3. Market Size and Forecast, By Type, 2020 - 2028 10.3.9.4. Market Size and Forecast, By Material, 2020 - 2028 10.3.9.5. Market Size and Forecast, By Application, 2020 – 2028 10.3.9.6. Market Size and Forecast, By Pole Sizer, 2020 - 2028 10.3.10. UK 10.3.10.1. Introduction 10.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.10.3. Market Size and Forecast, By Type, 2020 - 2028 10.3.10.4. Market Size and Forecast, By Material, 2020 - 2028 10.3.10.5. Market Size and Forecast, By Application, 2020 – 2028 10.3.10.6. Market Size and Forecast, By Pole Sizer, 2020 - 2028 10.3.11. Italy 10.3.11.1. Introduction 10.3.11.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.11.3. Market Size and Forecast, By Type, 2020 - 2028 10.3.11.4. Market Size and Forecast, By Material, 2020 - 2028 10.3.11.5. Market Size and Forecast, By Application, 2020 – 2028 10.3.11.6. Market Size and Forecast, By Pole Sizer, 2020 - 2028 10.3.12. Rest of Europe 10.3.12.1. Introduction 10.3.12.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.12.3. Market Size and Forecast, By Type, 2020 - 2028 10.3.12.4. Market Size and Forecast, By Material, 2020 - 2028 10.3.12.5. Market Size and Forecast, By Application, 2020 – 2028 10.3.12.6. Market Size and Forecast, By Pole Sizer, 2020 - 2028 10.4. Asia-Pacific 10.4.1. Introduction 10.4.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.3. Market Size and Forecast, By Country, 2020 - 2028 10.4.4. Market Size and Forecast, By Type, 2020 - 2028 10.4.5. Market Size and Forecast, By Material, 2020 - 2028 10.4.6. Market Size and Forecast, By Application, 2020 – 2028 10.4.7. Market Size and Forecast, By Pole Sizer, 2020 - 2028 10.4.8. China 10.4.8.1. Introduction 10.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.8.3. Market Size and Forecast, By Type, 2020 - 2028 10.4.8.4. Market Size and Forecast, By Material, 2020 - 2028 10.4.8.5. Market Size and Forecast, By Application, 2020 – 2028 10.4.8.6. Market Size and Forecast, By Pole Sizer, 2020 - 2028 10.4.9. India 10.4.9.1. Introduction 10.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.9.3. Market Size and Forecast, By Type, 2020 - 2028 10.4.9.4. Market Size and Forecast, By Material, 2020 - 2028 10.4.9.5. Market Size and Forecast, By Application, 2020 – 2028 10.4.9.6. Market Size and Forecast, By Pole Sizer, 2020 - 2028 10.4.10. Japan 10.4.10.1. Introduction 10.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.10.3. Market Size and Forecast, By Type, 2020 - 2028 10.4.10.4. Market Size and Forecast, By Material, 2020 - 2028 10.4.10.5. Market Size and Forecast, By Application, 2020 – 2028 10.4.10.6. Market Size and Forecast, By Pole Sizer, 2020 - 2028 10.4.11. South Korea 10.4.11.1. Introduction 10.4.11.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.11.3. Market Size and Forecast, By Type, 2020 - 2028 10.4.11.4. Market Size and Forecast, By Material, 2020 - 2028 10.4.11.5. Market Size and Forecast, By Application, 2020 – 2028 10.4.11.6. Market Size and Forecast, By Pole Sizer, 2020 - 2028 10.4.12. Rest of Asia-Pacific 10.4.12.1. Introduction 10.4.12.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.12.3. Market Size and Forecast, By Type, 2020 - 2028 10.4.12.4. Market Size and Forecast, By Material, 2020 - 2028 10.4.12.5. Market Size and Forecast, By Application, 2020 – 2028 10.4.12.6. Market Size and Forecast, By Pole Sizer, 2020 - 2028 10.5. Rest of The World (RoW) 10.5.1. Introduction 10.5.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.3. Market Size and Forecast, By Type, 2020 - 2028 10.5.4. Market Size and Forecast, By Material, 2020 - 2028 10.5.5. Market Size and Forecast, By Application, 2020 – 2028 10.5.6. Market Size and Forecast, By Pole Sizer, 2020 - 2028 10.5.7. Market Size and Forecast, By Region, 2020 - 2028 10.5.8. South America 10.5.8.1. Introduction 10.5.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.8.3. Market Size and Forecast, By Type, 2020 - 2028 10.5.8.4. Market Size and Forecast, By Material, 2020 - 2028 10.5.8.5. Market Size and Forecast, By Application, 2020 – 2028 10.5.8.6. Market Size and Forecast, By Pole Sizer, 2020 - 2028 10.5.9. Middle East & Africa 10.5.9.1. Introduction 10.5.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.9.3. Market Size and Forecast, By Type, 2020 - 2028 10.5.9.4. Market Size and Forecast, By Material, 2020 - 2028 10.5.9.5. Market Size and Forecast, By Application, 2020 – 2028 10.5.9.6. Market Size and Forecast, By Pole Sizer, 2020 - 2028 Chapter 11. Competitive Landscape 11.1. Introduction 11.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 12. Company Profiles 12.1. Valmont Industries Inc. 12.1.1. Business Overview 12.1.2. Financial Analysis 12.1.3. Product Portfolio 12.1.4. Recent Development and Strategies Adopted 12.1.5. SWOT Analysis 12.2. Skipper Ltd., 12.2.1. Business Overview 12.2.2. Financial Analysis 12.2.3. Product Portfolio 12.2.4. Recent Development and Strategies Adopted 12.2.5. SWOT Analysis 12.3. Nippon Concrete Industries Co. Ltd. 12.3.1. Business Overview 12.3.2. Financial Analysis 12.3.3. Product Portfolio 12.3.4. Recent Development and Strategies Adopted 12.3.5. SWOT Analysis 12.4. El Sewedy Electric Company 12.4.1. Business Overview 12.4.2. Financial Analysis 12.4.3. Product Portfolio 12.4.4. Recent Development and Strategies Adopted 12.4.5. SWOT Analysis 12.5. Hill & Smith Holdings PLC 12.5.1. Business Overview 12.5.2. Financial Analysis 12.5.3. Product Portfolio 12.5.4. Recent Development and Strategies Adopted 12.5.5. SWOT Analysis 12.6. Stella-Jones 12.6.1. Business Overview 12.6.2. Financial Analysis 12.6.3. Product Portfolio 12.6.4. Recent Development and Strategies Adopted 12.6.5. SWOT Analysis 12.7. FUCHS Europoles GmbH 12.7.1. Business Overview 12.7.2. Financial Analysis 12.7.3. Product Portfolio 12.7.4. Recent Development and Strategies Adopted 12.7.5. SWOT Analysis 12.8. Omega Factory 12.8.1. Business Overview 12.8.2. Financial Analysis 12.8.3. Product Portfolio 12.8.4. Recent Development and Strategies Adopted 12.8.5. SWOT Analysis 12.9. Pelco products Inc. 12.9.1. Business Overview 12.9.2. Financial Analysis 12.9.3. Product Portfolio 12.9.4. Recent Development and Strategies Adopted 12.9.5. SWOT Analysis 12.10. RS Technologies Inc. 12.10.1. Business Overview 12.10.2. Financial Analysis 12.10.3. Product Portfolio 12.10.4. Recent Development and Strategies Adopted 12.10.5. SWOT Analysis Chapter 13. Key Takeaways

Connect to Analyst

Research Methodology