Bidets Market Analysis and US Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

US Bidets Market By Type (Ceramic Bidets, Over the Rim Bidets, Handheld Bidets, Others), By Category (Electronics, Manual), By Distribution Channel (Store-Based, Non-Store-Based), By End Use (Residential, Commercial) and By Geography – COVID-19 Impact Analysis, Post COVID Analysis, Opportunities, Trends and Forecast from 2021 to 2028

Report Code: EB_LS_1279 | Page: 59 | Published Date: April 2022

Bidets Market Overview

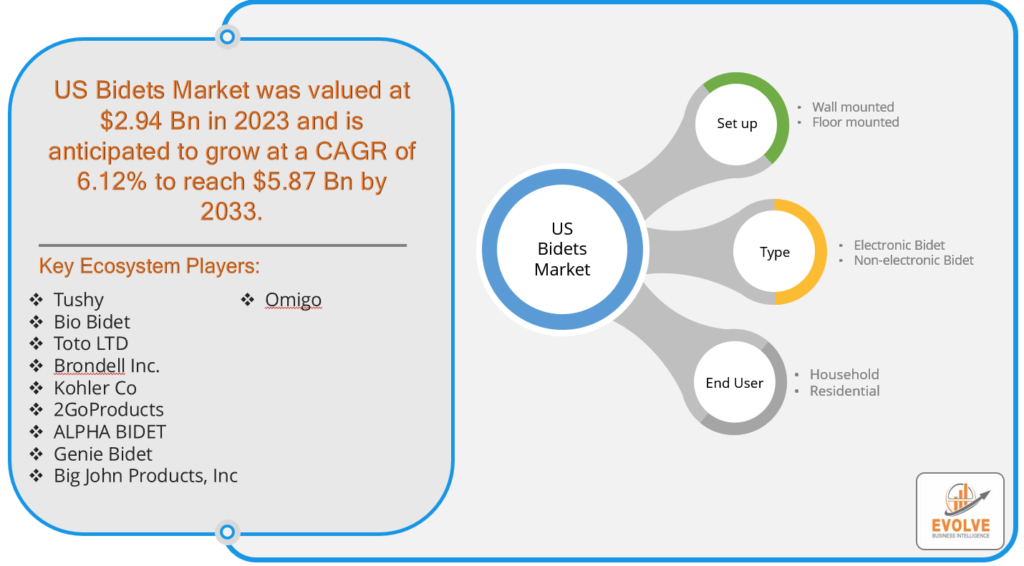

The US Bidets Market Size is expected to reach USD 5.87 Billion by 2033. The US Bidets industry size accounted for USD 2.94 Billion in 2023 and is expected to expand at a CAGR of 6.12% from 2023 to 2033. A bidet is a bathroom fixture designed for personal hygiene, typically used to clean and wash the genital and anal areas after using the toilet. It often looks like a low-mounted basin or bowl with a water spray nozzle. Bidets can be standalone fixtures, separate from the toilet, or integrated into the toilet seat. The primary purpose of a bidet is to provide a more thorough and hygienic cleansing compared to using toilet paper alone. Some bidets also come with additional features such as adjustable water temperature, air drying, and electronic controls. Bidets are common in many parts of the world, particularly in Europe, Asia, and the Middle East.

US Bidets Market Synopsis

The US bidets market experienced a moderate impact from the COVID-19 pandemic. In the initial phases of the crisis, there was a notable surge in demand for bidets as consumers, influenced by concerns over toilet paper shortages and an increased focus on hygiene, sought alternative methods for personal cleanliness. This heightened interest in bidets, however, gradually subsided as the availability of toilet paper stabilized. Despite the temporary surge, the bidet market in the US has shown resilience, with a sustained awareness of improved hygiene practices potentially leading to a lasting shift in consumer preferences. The pandemic-induced changes in hygiene consciousness and home improvement trends have contributed to a continued but more stabilized demand for bidet products in the market.

US Bidets Market Dynamics

The major factors that have impacted the growth of Bidets are as follows:

Drivers:

⮚ Growing Awareness of Hygiene and Sustainable Practices

The increasing awareness of personal hygiene and sustainable practices. The COVID-19 pandemic has accentuated the importance of thorough cleanliness, driving consumers to seek more effective and environmentally friendly alternatives to traditional toilet paper. Bidets, offering a hygienic cleansing solution and reducing the reliance on disposable paper products, have gained traction as a more sustainable and eco-friendly option.

Restraint:

- Limited Infrastructure and Cultural Resistance

The bidets market in the US is the existing bathroom infrastructure in many households. Retrofitting bathrooms to accommodate bidets can be a barrier, particularly in older homes or regions with traditional bathroom designs. Moreover, cultural habits and a longstanding reliance on toilet paper in certain demographics may contribute to resistance to adopting bidet technology. Overcoming these infrastructure and cultural barriers remains a challenge for widespread bidet adoption.

Opportunity:

⮚ Technological Advancements and Customization Features

An opportunity for the US bidets market lies in technological advancements and the integration of innovative features. Bidet manufacturers are introducing smart and customizable options, such as adjustable water temperature, pressure settings, and heated seats, catering to consumers’ preferences for a personalized and comfortable experience. The evolution of bidet technology presents an opportunity to attract a broader consumer base and enhance market penetration by addressing diverse user needs and preferences.

Bidets Market Segment Overview

By Set up

Based on the Set up, the market is segmented based on Wall mounted and floor mounted. The Wall-mounted segment was anticipated to dominate the bidets market, holding the largest market share, driven by the increasing trend towards space-efficient and modern bathroom designs, as well as the convenience and aesthetic appeal offered by wall-mounted bidet fixtures. This growing preference for sleek and integrated bathroom solutions was expected to fuel the demand for wall-mounted bidets, contributing to their dominant position in the market.

Based on the Set up, the market is segmented based on Wall mounted and floor mounted. The Wall-mounted segment was anticipated to dominate the bidets market, holding the largest market share, driven by the increasing trend towards space-efficient and modern bathroom designs, as well as the convenience and aesthetic appeal offered by wall-mounted bidet fixtures. This growing preference for sleek and integrated bathroom solutions was expected to fuel the demand for wall-mounted bidets, contributing to their dominant position in the market.

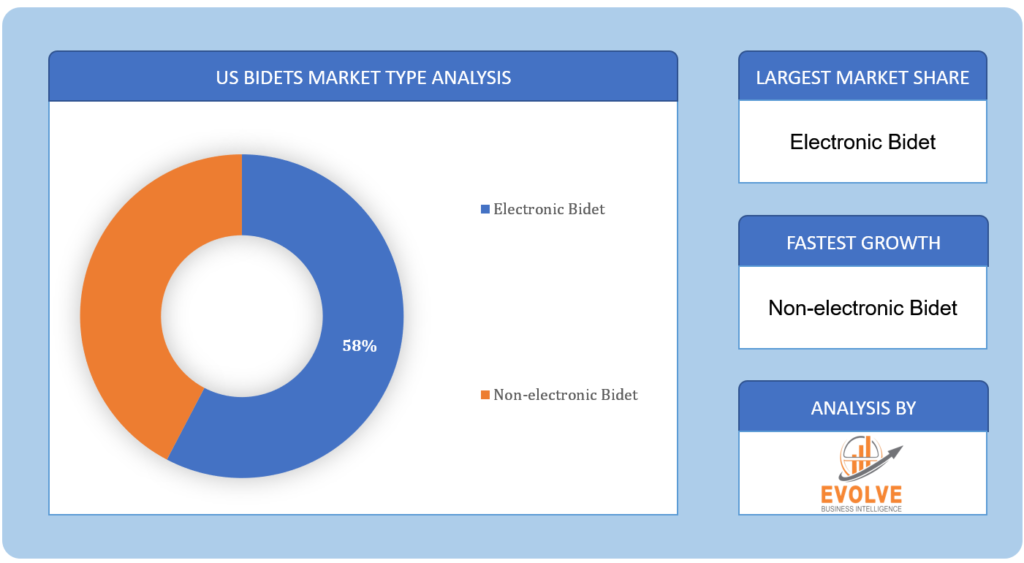

By Type

Based on the Type, the market has been divided into Electronic Bidet and Non-electronic Bidet. The Electronic Bidet segment is poised to claim the largest market share in the Bidets market, driven by the rising demand for advanced features such as customizable cleansing options, heated seats, and automated functionalities, reflecting a growing consumer preference for high-tech and convenient bathroom solutions.

By End User

Based on End Users, the market has been divided into Household and residential. The Household segment is anticipated to secure the largest market share in the Bidets market, attributed to the increasing awareness of hygiene and sanitation, coupled with the rising adoption of bidet fixtures in residential spaces for enhanced personal cleanliness and comfort.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Tushy, Bio Bidet, Toto LTD, Brondell Inc, and Kohler Co are some of the leading players in the US Bidets Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Tushy

- Bio Bidet

- Toto LTD

- Brondell Inc.

- Kohler Co

- 2GoProducts

- ALPHA BIDET

- Genie Bidet

- Big John Products, Inc

- Omigo

Key development:

In July 2023, Tushy bidet attachments are available at significant discounts (30% and more) for Prime Day.

In February 2023, Toto, a Japanese company renowned for its bidet toilets, plans to more than double the number of U.S. cities with dealer-operated showrooms for its products, reflecting the company’s expansion efforts abroad.

Scope of the Report

US Bidets Market, by Set up

- Wall mounted

- Floor mounted

US Bidets Market, by Type

- Electronic Bidet

- Non-electronic Bidet

US Bidets Market, by End User

- Household

- Residential

US Bidets Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $5.87 Billion |

| CAGR | 6.12% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Set up, Type, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Tushy, Bio Bidet, Toto LTD, Brondell Inc., Kohler Co, 2GoProducts, ALPHA BIDET, Genie Bidet, Big John Products, Inc, Omigo |

| Key Market Opportunities | • Growing awareness and acceptance of bidet fixtures • Increasing emphasis on health and wellness |

| Key Market Drivers | • Increasing awareness of hygiene and sanitation • Technological innovations in bidet features, such as electronic controls, customizable settings, and smart functionalities |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Bidets Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Bidets market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the US Bidets market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the US Bidets Market.

<p class=”Release”>Press Release</p>

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the US Bidets market is 2022- 2033

What is the 10-year CAGR (2023 to 2033) of the US Bidets market?

The US Bidets market is growing at a CAGR of ~12% over the next 10 years

Major Key Players in the Market of Bidets Manufacturers?

Tushy, Bio Bidet, Toto LTD, Brondell Inc., Kohler Co, 2GoProducts, ALPHA BIDET, Genie Bidet, Big John Products, Inc, Omigo.

Do you offer post-sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on US Bidets Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. US Bidets Market, By Type 6.1. Introduction 6.2. Ceramic Bidets 6.3. Over the Rim Bidets 6.4. Handheld Bidets 6.5. Portable Bidets 6.6. Others Chapter 7. US Bidets Market, By Category 7.1. Introduction 7.2. Electronics 7.3. Manual Chapter 8. US Bidets Market, By Distribution Channel 8.1. Introduction 8.2. Store-Based 8.3. Non-Store-Based Chapter 9. US Bidets Market, By End Use 9.1. Introduction 9.2. Residential 9.3. Commercial Chapter 10. Competitive Landscape 10.1. Introduction 10.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 11. Company Profiles 11.1. Tushy 11.1.1. Business Overview 11.1.2. Financial Analysis 11.1.3. Product Portfolio 11.1.4. Recent Development and Strategies Adopted 11.1.5. SWOT Analysis 11.2. Bio Bidet 11.2.1. Business Overview 11.2.2. Financial Analysis 11.2.3. Product Portfolio 11.2.4. Recent Development and Strategies Adopted 11.2.5. SWOT Analysis 11.3. Toto LTD 11.3.1. Business Overview 11.3.2. Financial Analysis 11.3.3. Product Portfolio 11.3.4. Recent Development and Strategies Adopted 11.3.5. SWOT Analysis 11.4. Brondell Inc. 11.4.1. Business Overview 11.4.2. Financial Analysis 11.4.3. Product Portfolio 11.4.4. Recent Development and Strategies Adopted 11.4.5. SWOT Analysis 11.5. Kohler Co 11.5.1. Business Overview 11.5.2. Financial Analysis 11.5.3. Product Portfolio 11.5.4. Recent Development and Strategies Adopted 11.5.5. SWOT Analysis 11.6. 2Go Products, LLC 11.6.1. Business Overview 11.6.2. Financial Analysis 11.6.3. Product Portfolio 11.6.4. Recent Development and Strategies Adopted 11.6.5. SWOT Analysis 11.7. Alpha Bidet 11.7.1. Business Overview 11.7.2. Financial Analysis 11.7.3. Product Portfolio 11.7.4. Recent Development and Strategies Adopted 11.7.5. SWOT Analysis 11.8. Genie bidets 11.8.1. Business Overview 11.8.2. Financial Analysis 11.8.3. Product Portfolio 11.8.4. Recent Development and Strategies Adopted 11.8.5. SWOT Analysis 11.9. Big John Products, Inc. 11.9.1. Business Overview 11.9.2. Financial Analysis 11.9.3. Product Portfolio 11.9.4. Recent Development and Strategies Adopted 11.9.5. SWOT Analysis 11.10. Omigo 11.10.1. Business Overview 11.10.2. Financial Analysis 11.10.3. Product Portfolio 11.10.4. Recent Development and Strategies Adopted 11.10.5. SWOT Analysis

Connect to Analyst

Research Methodology