Underwater Drone Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

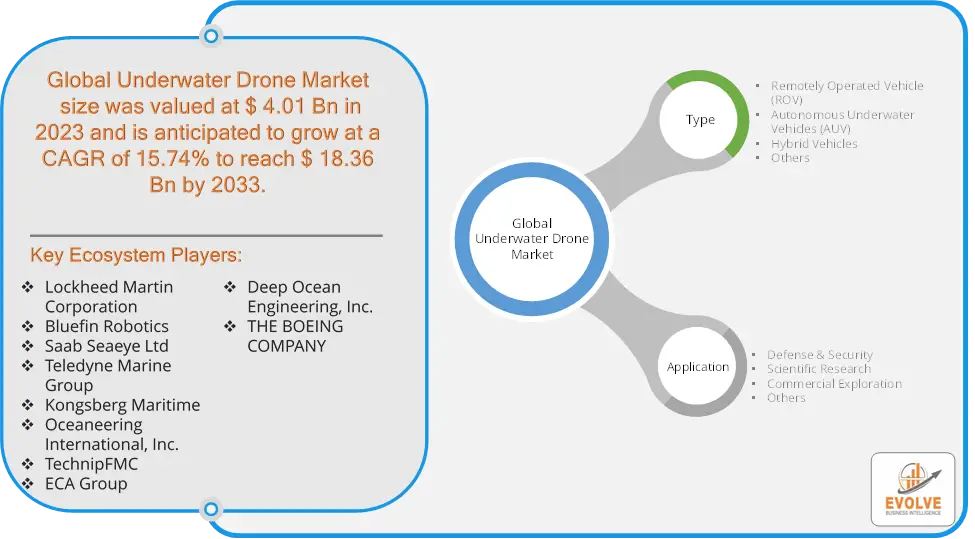

Underwater Drone Market Research Report: Information By Type (Remotely Operated Vehicle (ROV), Autonomous Underwater Vehicles (AUV), Hybrid Vehicles), By Application (Defense & Security, Scientific Research, Commercial Exploration, Others), and by Region — Forecast till 2033

Page: 171

Underwater Drone Market Overview

The Underwater Drone Market Size is expected to reach USD 18.36 Billion by 2033. The Underwater Drone industry size accounted for USD 4.01 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 15.74% from 2023 to 2033. The underwater drone market encompasses the development, manufacturing, and deployment of autonomous and remotely operated vehicles (AUVs and ROVs) designed for underwater exploration and operations. These drones are used in various applications such as marine research, underwater inspection, oceanographic data collection, environmental monitoring, and military operations. Key drivers for this market include advancements in drone technology, increasing demand for underwater surveillance and inspection, and the growing need for oceanographic research. The market is characterized by innovations in battery life, sensor integration, and navigation systems, enabling more efficient and longer missions.

Global Underwater Drone Market Synopsis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the underwater drone market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers to adopt various strategies to stabilize the company

Underwater Drone Market Dynamics

The major factors that have impacted the growth of Underwater Drone are as follows:

Drivers:

Ø Technological Advancements

Significant improvements in drone technology, such as enhanced battery life, advanced sensors, and improved navigation systems, have expanded the capabilities of underwater drones. These innovations enable more complex and prolonged missions, boosting market growth.

Restraint:

- High Development and Production Costs

Designing and manufacturing advanced underwater drones involves significant investment in research and development, high-quality materials, and sophisticated technology. These high costs can limit market entry for new players and impact the affordability of drones for some potential users.

Opportunity:

⮚ Expansion of Industrial and Commercial Uses

Industries such as oil and gas, mining, and aquaculture are increasingly adopting underwater drones for inspection, maintenance, and monitoring tasks. Expanding the use of drones in these sectors can drive market growth and create new revenue streams.

Underwater Drone Segment Overview

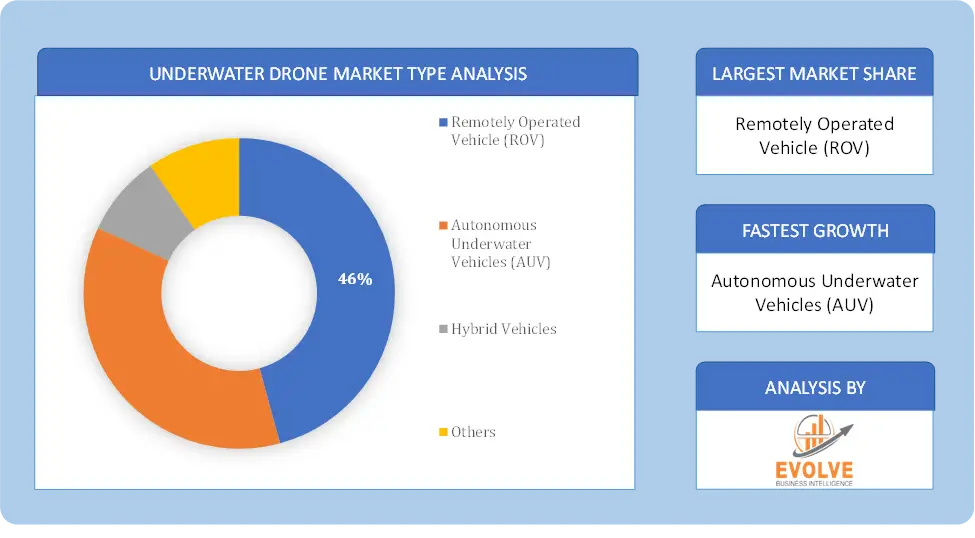

By Type

Based on Type, the market is segmented based on Remotely Operated Vehicle (ROV), Autonomous Underwater Vehicles (AUV), Hybrid Vehicles. Remotely Operated Vehicles (ROVs) currently dominate the underwater drone market due to their widespread use in industrial inspection, maintenance, and underwater exploration, offering real-time control and high maneuverability.

Based on Type, the market is segmented based on Remotely Operated Vehicle (ROV), Autonomous Underwater Vehicles (AUV), Hybrid Vehicles. Remotely Operated Vehicles (ROVs) currently dominate the underwater drone market due to their widespread use in industrial inspection, maintenance, and underwater exploration, offering real-time control and high maneuverability.

By Application

Based on Applications, the market has been divided into the Defense & Security, Scientific Research, Commercial Exploration, Others. the Defense & Security segment dominates the underwater drone market, driven by significant investments in surveillance, reconnaissance, and mine detection by military and defense organizations.

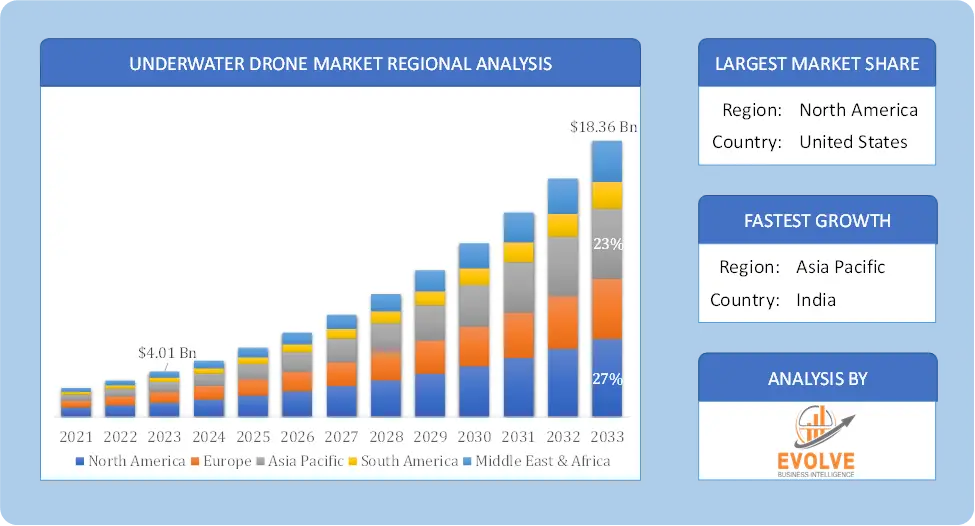

Global Underwater Drone Market Regional Analysis

Based on region, the global Underwater Drone market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Underwater Drone market followed by the Asia-Pacific and Europe regions.

Underwater Drone North America Market

Underwater Drone North America Market

North America holds a dominant position in the Underwater Drone Market. In 2022, the Underwater Drone Market in North America held a 45.80% market share. A large portion of North America’s budget goes into defense and security, especially in the US. This fuels the need for underwater drones in the military for tasks like mine detection, reconnaissance, and surveillance.

Underwater Drone Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Underwater Drone industry. From 2023 to 2032, the Asia-Pacific Underwater Drone Market is anticipated to develop at the quickest compound annual growth rate (CAGR). Underwater drone demand is rising in naval and maritime security applications as a result of several Asia-Pacific nations raising their defense budgets. Furthermore, the Underwater Drone market in China commanded the most market share, while the Underwater Drone market in India grew at the fastest rate in the Asia-Pacific area.

Competitive Landscape

The global Underwater Drone market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as Typelaunches, and strategic alliances.

Prominent Players:

- Lockheed Martin Corporation

- Bluefin Robotics

- Saab Seaeye Ltd

- Teledyne Marine Group

- Kongsberg Maritime

- Oceaneering International, Inc.

- TechnipFMC

- ECA Group

- Deep Ocean Engineering, Inc.

- THE BOEING COMPANY

Key Development

In September 2022, Oceaneering International, Inc. advanced its underwater drone capabilities by enhancing its range of Remotely Operated Vehicles (ROVs) and Autonomous Underwater Vehicles (AUVs), focusing on improved technology for subsea inspection and exploration.

Scope of the Report

Global Underwater Drone Market, by Type

- Remotely Operated Vehicle (ROV)

- Autonomous Underwater Vehicles (AUV)

- Hybrid Vehicles

- Others

Global Underwater Drone Market, by Application

- Defense & Security

- Scientific Research

- Commercial Exploration

- Others

Global Underwater Drone Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $18.36 Billion |

| CAGR | 15.74% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Lockheed Martin Corporation, Bluefin Robotics, Saab Seaeye Ltd, Teledyne Marine Group, Kongsberg Maritime, Oceaneering International, Inc., TechnipFMC, ECA Group, Deep Ocean Engineering, Inc., THE BOEING COMPANY |

| Key Market Opportunities | • Technological Advancements |

| Key Market Drivers | • Technological Advancements |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Underwater Drone market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Underwater Drone market historical market size for the year 2021, and forecast from 2023 to 2033

- Underwater Drone market share analysis at each Typelevel

- Competitor analysis with detailed insight into its Typesegment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including Typelaunches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Underwater Drone market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, Typeoffering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Underwater Drone market is 2021- 2033

What is the growth rate of the global Underwater Drone market?

The global Underwater Drone market is growing at a CAGR of 15.74% over the next 10 years

Which region has the highest growth rate in the market of Underwater Drone?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Underwater Drone market?

North America holds the largest share in 2022

Who are the key players in the global Underwater Drone market?

Lockheed Martin Corporation, Bluefin Robotics, Saab Seaeye Ltd, Teledyne Marine Group, Kongsberg Maritime, Oceaneering International, Inc., TechnipFMC, ECA Group, Deep Ocean Engineering, Inc., and THE BOEING COMPANY are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Underwater Drone Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Underwater Drone Market, By Type 6.1. Introduction 6.2. Remotely Operated Vehicle (ROV) 6.3. Autonomous Underwater Vehicles (AUV) 6.3. Hybrid Vehicles Chapter 7. Global Underwater Drone Market, By Application 7.1. Introduction 7.2. Defense & Security 7.3. Scientific Research 7.4. Commercial Exploration Chapter 8. Global Underwater Drone Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.3. Market Size and Forecast, By Country, 2020 - 2028 8.2.4. Market Size and Forecast, By Type, 2020 - 2028 8.2.5. Market Size and Forecast, By Application, 2020 – 2028 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.6.3. Market Size and Forecast, By Type, 2020 - 2028 8.2.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.7.3. Market Size and Forecast, By Type, 2020 - 2028 8.2.7.4. Market Size and Forecast, By Application, 2020 - 2028 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.3. Market Size and Forecast, By Country, 2020 - 2028 8.3.4. Market Size and Forecast, By Type, 2020 - 2028 8.3.5. Market Size and Forecast, By Application, 2020 – 2028 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.6.3. Market Size and Forecast, By Type, 2020 - 2028 8.3.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.7.3. Market Size and Forecast, By Type, 2020 - 2028 8.3.7.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.8.3. Market Size and Forecast, By Type, 2020 - 2028 8.3.8.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.9.3. Market Size and Forecast, By Type, 2020 - 2028 8.3.9.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.10. Rest Of Europe 8.3.10.1. Introduction 8.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.10.3. Market Size and Forecast, By Type, 2020 - 2028 8.3.10.4. Market Size and Forecast, By Application, 2020 - 2028 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.3. Market Size and Forecast, By Country, 2020 - 2028 8.4.4. Market Size and Forecast, By Type, 2020 - 2028 8.4.5. Market Size and Forecast, By Application, 2020 - 2028 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.6.3. Market Size and Forecast, By Type, 2020 - 2028 8.4.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.7.3. Market Size and Forecast, By Type, 2020 - 2028 8.4.7.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.8.3. Market Size and Forecast, By Type, 2020 - 2028 8.4.8.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.9.3. Market Size and Forecast, By Type, 2020 - 2028 8.4.9.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.10.3. Market Size and Forecast, By Type, 2020 - 2028 8.4.10.4. Market Size and Forecast, By Application, 2020 - 2028 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.3. Market Size and Forecast, By Type, 2020 - 2028 8.5.4. Market Size and Forecast, By Application, 2020 - 2028 8.5.5. Market Size and Forecast, By Region, 2020 - 2028 8.5.6. South America 8.5.6.1. Introduction 8.5.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.6.3. Market Size and Forecast, By Type, 2020 - 2028 8.5.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.5.7. Middle East and Africa 8.5.7.1. Introduction 8.5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.7.3. Market Size and Forecast, By Type, 2020 - 2028 8.5.7.4. Market Size and Forecast, By Application, 2020 - 2028 Chapter 9. Competitive Landscape 9.1. Introduction 9.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 10. Company Profiles 10.1. Lockheed Martin Corporation 10.1.1. Business Overview 10.1.2. Financial Analysis 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Bluefin Robotics 10.2.1. Business Overview 10.2.2. Financial Analysis 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Saab Seaeye Ltd 10.3.1. Business Overview 10.3.2. Financial Analysis 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Teledyne Marine Group 10.4.1. Business Overview 10.4.2. Financial Analysis 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. Kongsberg Maritime 10.5.1. Business Overview 10.5.2. Financial Analysis 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Oceaneering International, Inc. 10.6.1. Business Overview 10.6.2. Financial Analysis 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. TechnipFMC 10.7.1. Business Overview 10.7.2. Financial Analysis 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8. ECA Group 10.8.1. Business Overview 10.8.2. Financial Analysis 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9. Deep Ocean Engineering, Inc. 10.9.1. Business Overview 10.9.2. Financial Analysis 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. The Boeing Company 10.10.1. Business Overview 10.10.2. Financial Analysis 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis Chapter 11. Key Takeaways

Connect to Analyst

Research Methodology