UK SME Non-Life Insurance Market Analysis and UK Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

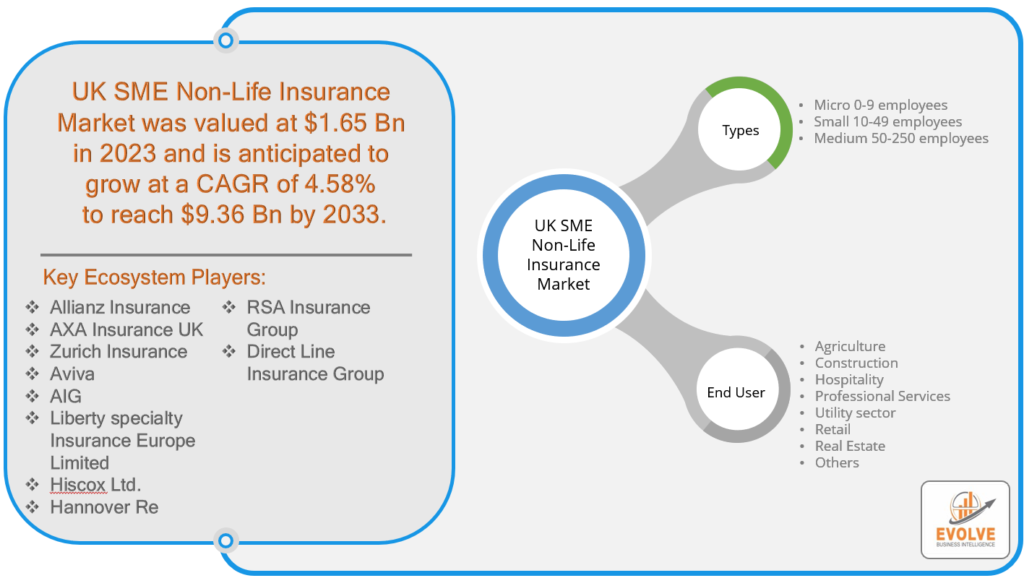

UK SME Non-Life Insurance Market By Type (Micro 0-9 employees, Small 10-49 employees, Medium 50-250 employees), By End-User (Agriculture, Construction, Hospitality, Professional Services, Utility sector, Retail, Real Estate, Others) and By Geography – COVID-19 Impact Analysis, Post COVID Analysis, Opportunities, Trends and Forecast from 2021 to 2027

Report Code: EB_LS_1276 | Page: 85 | Published Date: Feb 2022

SME Non-Life Insurance Market Overview

The UK SME Non-Life Insurance market is projected to be valued at USD 9.36 Billion by 2033, recording a CAGR of around 4.58% during the forecast period. SME (Small and Medium Enterprises) Non-Life Insurance refers to insurance products designed for small and medium-sized businesses that provide coverage for risks other than those related to life. This type of insurance typically includes policies that protect businesses from various non-life risks, such as property damage, liability claims, business interruption, theft, and other perils. SME non-life insurance aims to safeguard the assets, operations, and financial stability of small and medium-sized enterprises by offering tailored coverage based on their specific needs and risk profiles. These insurance policies play a crucial role in helping SMEs mitigate potential financial losses arising from unforeseen events, allowing them to operate with greater confidence and resilience.

UK SME Non-Life Insurance Market Synopsis

The COVID-19 pandemic did not generally have a positive impact on the SME Non-Life Insurance market. Instead, it brought about a range of challenges for businesses across various sectors, leading to increased uncertainty and disruptions. Many SMEs faced financial difficulties, closures, and changes in business operations due to lockdowns and restrictions, resulting in an uptick in insurance claims related to business interruption, event cancellations, and other non-life risks. Insurers also had to reassess and adapt their risk models in response to the changing landscape. While the pandemic prompted innovation in insurance products and services, such as the development of coverage for pandemic-related risks, the overall impact on the SME Non-Life Insurance market was more characterized by increased claims and heightened uncertainties rather than a positive influence.

SME Non-Life Insurance Market Dynamics

The major factors that have impacted the growth of SME Non-Life Insurance are as follows:

Drivers:

Ø Digital Transformation and Technological Advancements

The ongoing digital transformation and technological advancements within the insurance industry. The adoption of advanced technologies, including artificial intelligence, data analytics, and digital platforms, allows insurers to streamline processes, enhance customer experiences, and offer more personalized and efficient insurance solutions to SMEs. This technological evolution contributes to improved underwriting accuracy, quicker claims processing, and the development of innovative insurance products, fostering growth in the SME non-life insurance sector.

Restraint:

- Economic Uncertainty and Business Risks

Economic uncertainties and business risks, particularly those intensified by external factors such as the COVID-19 pandemic or geopolitical events, act as a significant restraint for the UK SME Non-Life Insurance market. SMEs, being sensitive to economic fluctuations, may face challenges in sustaining operations and maintaining insurance coverage during periods of economic downturns. Uncertain business environments can lead to increased risk exposure, making it challenging for insurers to accurately assess and underwrite policies for SMEs, impacting the overall growth of the non-life insurance market.

Opportunity:

⮚ Customization of Insurance Products

The customization of insurance products to meet the unique needs of different industries and businesses. As SMEs vary widely in their operations, risk profiles, and sectors, insurers have the opportunity to develop flexible and tailored insurance solutions. Offering specialized coverage for specific risks faced by different SME segments, such as cybersecurity for technology firms or supply chain protection for manufacturing businesses, can enhance market competitiveness and attract a broader range of SME clients, presenting growth opportunities in the non-life insurance sector.

SME Non-Life Insurance Segment Overview

By Type

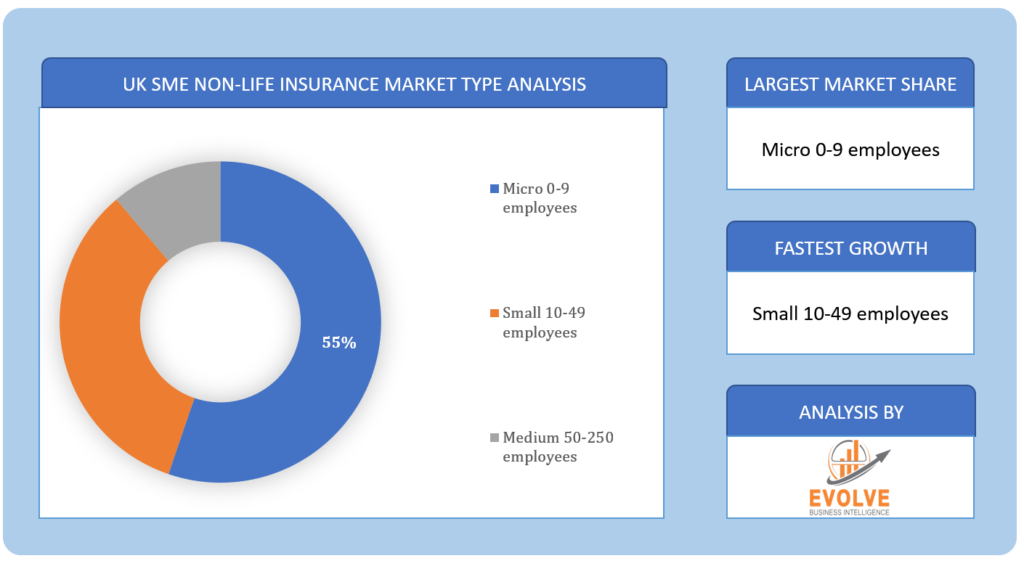

Based on Type, the market is segmented based on Micro 0-9 employees, Small 10-49 employees, and Medium 50-250 employees. The anticipated substantial growth in the Micro 0-9 employees segment of the SME Non-Life Insurance market throughout the forecast period is primarily driven by increasing recognition among small businesses of the crucial need for comprehensive insurance coverage to mitigate diverse risks and uncertainties.

Based on Type, the market is segmented based on Micro 0-9 employees, Small 10-49 employees, and Medium 50-250 employees. The anticipated substantial growth in the Micro 0-9 employees segment of the SME Non-Life Insurance market throughout the forecast period is primarily driven by increasing recognition among small businesses of the crucial need for comprehensive insurance coverage to mitigate diverse risks and uncertainties.

By End User

Based on the End User, the market has been divided into Agriculture, Construction, Hospitality, Professional Services, Utility sector, Retail, Real Estate, and Others. The Agriculture segment is poised for substantial growth in the SME Non-Life Insurance market during the forecast period owing to heightened awareness among farmers and agribusinesses about the importance of risk mitigation, coupled with the increasing adoption of specialized insurance products tailored to address the unique challenges faced by the agricultural sector.

Competitive Landscape

The UK SME Non-Life Insurance market is highly competitive, with numerous players offering a wide range of solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Allianz Insurance

- AXA Insurance UK

- Zurich Insurance

- Aviva

- AIG

- Liberty Specialty Insurance Europe Limited

- Hiscox Ltd.

- Hannover Re

- RSA Insurance Group

- Direct Line Insurance Group

Key Development:

In July 2023, Aviva aligned with Axa in stating that the crisis in the National Health Service (NHS) offers opportunities for business expansion.

In September 2023, Aviva revealed its intention to purchase AIG Life Limited (“AIG Life UK”) from Corebridge Financial, Inc. (“Corebridge”), a publicly listed subsidiary of American International Group, Inc. (“AIG”), for a total consideration of £460 million. This strategic move enhances Aviva’s presence in the protection market, leveraging the company’s robust organic growth and business momentum in this sector.

Scope of the Report

UK SME Non-Life Insurance Market, by Type

- Micro 0-9 employees

- Small 10-49 employees

- Medium 50-250 employees

UK SME Non-Life Insurance Market, by End User

- Agriculture

- Construction

- Hospitality

- Professional Services

- Utility sector

- Retail

- Real Estate

- Others

UK SME Non-Life Insurance Market, by Region

- UK

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $9.36 Billion (UK) |

| CAGR | 4.58%CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Allianz Insurance, AXA Insurance UK, Zurich Insurance, Aviva, AIG, Liberty Specialty Insurance Europe Limited, Hiscox Ltd., Hannover Re, RSA Insurance Group, Direct Line Insurance Group |

| Key Market Opportunities | • Customization of Insurance Products |

| Key Market Drivers | • Digital Transformation and Technological Advancements |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future SME Non-Life Insurance market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- SME Non-Life Insurance market historical market size for the year 2021, and forecast from 2023 to 2033

- SME Non-Life Insurance market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government and defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the UK SME Non-Life Insurance market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government and defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

<p class=”Release”>Press Release</p>

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the UK SME Non-Life Insurance market is 2021- 2033

What is the growth rate of the UK SME Non-Life Insurance market?

The UK SME Non-Life Insurance market is growing at a CAGR of 4.58% over the next 10 years

Which region has the largest share of the UK SME Non-Life Insurance market?

UK holds the largest share in 2022

Who are the key players in the UK SME Non-Life Insurance market?

Allianz Insurance, AXA Insurance UK, Zurich Insurance, Aviva, AIG, Liberty Specialty Insurance Europe Limited, Hiscox Ltd., Hannover Re, RSA Insurance Group, and Direct Line Insurance Group are the major companies operating in the market.

Do you offer post-sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on UK SME Non-Life Insurance Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. UK SME Non-Life Insurance Market, By Type 6.1. Introduction 6.2. Micro 0-9 employees 6.3. Small 10-49 employees 6.4. Medium 50-250 employees Chapter 7. UK SME Non-Life Insurance Market, By End-User 7.1. Introduction 7.2. Agriculture 7.3. Construction 7.4. Hospitality 7.5. Professional Services 7.6. Utility sector 7.7. Retail 7.8. Real Estate 7.9. Others Chapter 9. Competitive Landscape 9.1. Introduction 9.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 10. Company Profiles 10.1. Allianz Insurance 10.1.1. Business Overview 10.1.2. Financial Analysis 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. AXA Insurance UK 10.2.1. Business Overview 10.2.2. Financial Analysis 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Zurich Insurance 10.3.1. Business Overview 10.3.2. Financial Analysis 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Aviva 10.4.1. Business Overview 10.4.2. Financial Analysis 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. AIG 10.5.1. Business Overview 10.5.2. Financial Analysis 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Liberty specialty Insurance Europe Limited 10.6.1. Business Overview 10.6.2. Financial Analysis 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Hiscox Ltd. 10.7.1. Business Overview 10.7.2. Financial Analysis 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8. Hannover Re 10.8.1. Business Overview 10.8.2. Financial Analysis 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9. RSA Insurance Group 10.9.1. Business Overview 10.9.2. Financial Analysis 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Direct Line Insurance Group 10.10.1. Business Overview 10.10.2. Financial Analysis 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology

Our Most Viewed Report and gain instant expertise

E-books Market Analysis and Global Forecast 2023-2033

Global & Australia Vocational Training Market Analysis and Global Forecast 2024-2034

Global & Australia Vocational Training Market Research Report: Information By Type (Accredited, Non-Accredited), by Program Type (High School programs, Tech Prep Education, Postsecondary Vocational School, Apprenticeship Programs, On-the-job Training, Others), by RTO Types (Private RTOs, TAFE Institutes, Community RTOs, Schools, Enterprise RTOs, Universities), and by Region — Forecast till 2034

Page: 55Global and India Online Culinary Education Market Analysis and Global Forecast 2024-2034

Global and India Online Culinary Education Market Research Report: Information By Product Type (Free, Charges, Washer’s repair, Dryer’s repair), By Application (Personal, Enterprise), and by Region — Forecast till 2034

Page: 47Global Career & Education Counselling Market Analysis and Forecast 2020-2028

Global Commercial Aquarium Market Analysis and Global Forecast 2021-2034

Global Commercial Aquarium Market Research Report: Information By Type (Inland, Ocean, Comprehensive), By Application (Male, Female, Kids), and by Region — Forecast till 2034

Page: 93Hard-Surface Flooring Market Analysis and Global Forecast 2023-2033

Hard-Surface Flooring Market Research Report: Information by Type (Ceramic Flooring, Wood and Laminate Flooring, Vinyl Flooring, Other), By Application (Residential Buildings, Nonresidential Buildings, Transportation), and by Region — Forecast till 2033

PRESS RELEASE: https://evolvebi.com/hard-surface-flooring-market-is-estimated-to-record-a-cagr-of-around-5-12-during-the-forecast-period/