Tape Storage Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

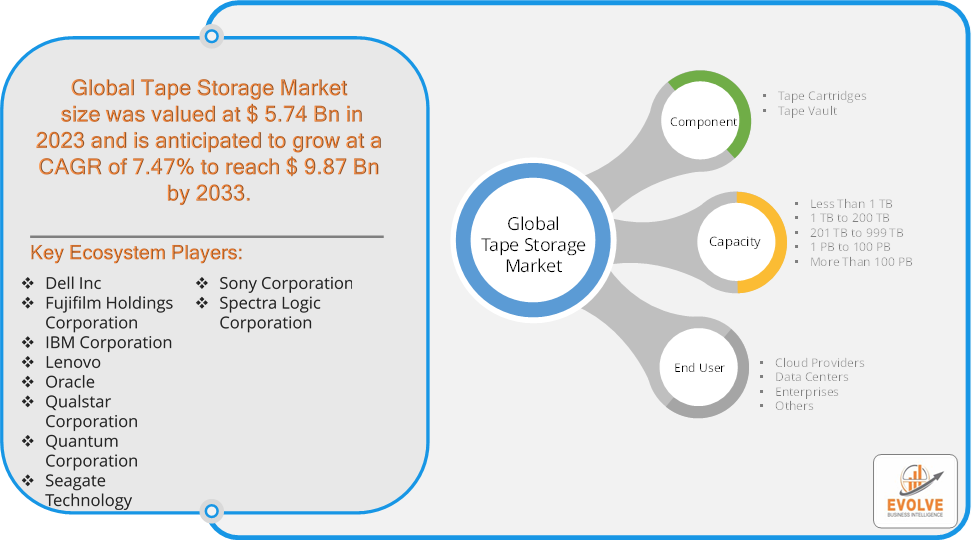

Tape Storage Market Research Report: Information By Component (Tape Cartridges, Tape Vault), By End User (Cloud Providers, Data Centers, Enterprises, Others), By Capacity (Less Than 1 TB, 1 TB to 200 TB, 201 TB to 999 TB, 1 PB to 100 PB, More Than 100 PB), By End Use (LTO-1 to LTO-5, LTO-6, LTO-7, LTO-8, LTO-9, DDS-1, DDS-2, DDS-3, DDS-4), and by Region — Forecast till 2033

Page: 157

Tape Storage Market Overview

The Tape Storage Market Size is expected to reach USD 9.87 Billion by 2033. The Tape Storage Market industry size accounted for USD 5.74 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.47% from 2023 to 2033. The Tape Storage Market refers to the industry involved in the production, distribution, and sales of tape storage devices and related technologies. Tape storage is a type of data storage that uses magnetic tape as a medium for storing digital information. It is commonly used for archival storage, backup, and disaster recovery due to its cost-effectiveness, high capacity, and long-term durability.

The Tape Storage Market continues to play a critical role in data management strategies, particularly for organizations requiring cost-effective and reliable long-term storage solutions.

Global Tape Storage Market Synopsis

COVID-19 Impact Analysis

COVID-19 Impact Analysis

The COVID-19 pandemic had a significant impact on the Tape Storage Market. With the rise of remote work, online education, and increased digital transactions, there has been a surge in data generation. This has led to increased demand for data storage solutions, including tape storage, for backup and archival purposes. The pandemic highlighted the importance of robust disaster recovery and business continuity plans. Organizations have invested in tape storage as part of their strategies to ensure data protection and resilience against unforeseen events. With the shift to remote work, IT departments had to adapt to managing tape storage systems remotely. This required enhancements in remote monitoring and management tools for tape libraries and storage systems. The pandemic accelerated digital transformation initiatives, leading to increased adoption of hybrid storage solutions. Tape storage was integrated with cloud and other storage technologies to create more flexible and scalable data management strategies. The pandemic underscored the importance of having resilient and scalable data storage solutions. Organizations are likely to continue investing in tape storage as part of their long-term data management and disaster recovery strategies.

Tape Storage Market Dynamics

The major factors that have impacted the growth of Tape Storage Market are as follows:

Drivers:

Ø Cost-Effectiveness and High Storage Capacity

Tape storage offers a significantly lower cost per gigabyte compared to other storage mediums like SSDs and HDDs, making it an economical choice for large-scale data storage. The overall cost of maintaining tape storage systems, including power, cooling, and physical space, is lower than for disk-based systems. Tape storage solutions provide high capacity, with individual cartridges capable of storing terabytes of data. This makes tape an ideal solution for storing large volumes of data. The high capacity and durability of tape storage make it suitable for archiving data that needs to be retained for long periods. Continuous advancements in tape technology, such as increased storage capacities, faster data transfer rates, and enhanced data compression, keep tape storage competitive with other storage solutions.

Restraint:

- Perception of Initial Investment and Maintenance Costs

The initial investment in tape storage infrastructure, including tape drives and automated libraries, can be high. This can be a barrier for small and medium-sized enterprises (SMEs). Maintaining tape storage systems, including regular tape drive cleaning and tape cartridge replacement, can incur additional costs and require specialized knowledge. Moving data from other storage mediums to tape storage or vice versa can be time-consuming and resource-intensive, deterring organizations from adopting tape storage. Ensuring data integrity during migration processes can be challenging, especially for large volumes of data.

Opportunity:

⮚ Increasing Data Generation and Storage Needs

The exponential growth of data generated by IoT devices, social media, and digital transactions creates a massive demand for scalable storage solutions. Tape storage can provide the high capacity required for big data storage and archival. As more organizations undergo digital transformation, the need for reliable and cost-effective data storage solutions increases, offering an opportunity for tape storage. The cost-effectiveness of tape storage, especially for long-term archival, remains a significant advantage. As organizations seek to reduce storage costs, tape storage provides a viable solution. Tape storage systems consume less energy compared to spinning disk systems when not in use. This aligns with the growing focus on energy efficiency and sustainability in data centers.

Tape Storage Market Segment Overview

By Component

By Component

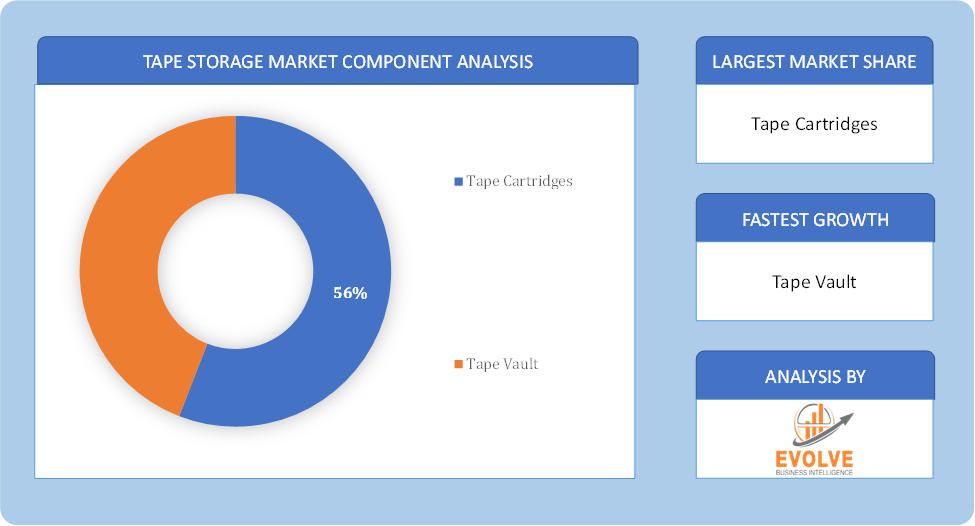

Based on Component, the market is segmented based on Tape Cartridges and Tape Vault. The tape cartridges segment dominant the market. Tape cartridges serve as the primary medium for storing and transporting data in tape storage systems. They are designed to securely hold the magnetic tape, protecting it from physical damage, dust, and other environmental factors. This makes tape cartridges essential components for data storage and archiving. With advancements in tape technology, modern tape cartridges can accommodate terabytes or petabytes of data on a single cartridge.

By Capacity

Based on Capacity, the market segment has been divided into the Less Than 1 TB, 1 TB to 200 TB, 201 TB to 999 TB, 1 PB to 100 PB and More Than 100 PB. 1 TB to 200 TB is anticipated to hold the largest market. Increased desire to meet the backup needs of businesses with optimal speed and security at a low cost drives the usage of tape storage. In addition, several market participants provide unique solutions for tape storage with hardware compression, hence increasing storage capacity. This factor contributes to the expansion of this segment.

By End User

Based on End User, the market segment has been divided into the Cloud Providers, Data Centers, Enterprises and Others. The data centers represented the largest segment. Data centers serve as centralized hubs for storing and processing data for various organizations, including enterprises, government agencies, and cloud service providers. With the exponential growth of data, data centers require reliable and scalable storage solutions to meet the expanding storage demands of their clients. The ability of tape storage systems to provide massive storage capacity in a compact form allows data centers to efficiently manage and store petabytes or exabytes of data.

By End Use

Based on End Use, the market segment has been divided into the LTO-1 to LTO-5, LTO-6, LTO-7, LTO-8, LTO-9, DDS-1, DDS-2, DDS-3 and DDS-4. LTO-8 segment dominant the market. Linear Tape-Open 8 (LTO-8) offers significant storage capacity compared to previous generations. With a native capacity of up to 12 terabytes and a compressed capacity of up to 30 terabytes, LTO-8 provides organizations with sufficient space to store and manage their data volumes. Furthermore, LTO-8 technology maintains backward compatibility, allowing for seamless integration with existing LTO tape drives and libraries. This compatibility ensures that organizations can continue utilizing their previous investments in LTO technology while utilizing the enhanced capabilities of LTO-8.

Global Tape Storage Market Regional Analysis

Based on region, the global Tape Storage Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Tape Storage Market followed by the Asia-Pacific and Europe regions.

Tape Storage North America Market

North America holds a dominant position in the Tape Storage Market. North America is a significant market for tape storage, driven by the presence of large data centers, technology companies, and robust IT infrastructure. High demand for data storage solutions due to the growth of big data, cloud computing, and digital transformation initiatives. Regulatory compliance requirements in industries like healthcare and finance also drive the adoption of tape storage. Major technology companies and tape storage vendors, such as IBM and Quantum, are based in this region, contributing to market growth through innovation and product development.

Tape Storage Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Tape Storage Market industry. The Asia-Pacific region is experiencing rapid growth in the tape storage market, driven by the expansion of IT infrastructure, increasing digitization, and the rise of big data analytics. Growing economies like China, India, and Japan are investing heavily in data centers and IT infrastructure, leading to increased demand for scalable and cost-effective storage solutions. The rise of e-commerce, social media, and online services also contributes to data growth.

Competitive Landscape

The global Tape Storage Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as Product launches, and strategic alliances.

Prominent Players:

- Dell Inc

- Fujifilm Holdings Corporation

- IBM Corporation

- Lenovo

- Oracle

- Qualstar Corporation

- Quantum Corporation

- Seagate Technology

- Sony Corporation

- Spectra Logic Corporation

Scope of the Report

Global Tape Storage Market, by Component

- Tape Cartridges

- Tape Vault

Global Tape Storage Market, by Capacity

- Less Than 1 TB

- 1 TB to 200 TB

- 201 TB to 999 TB

- 1 PB to 100 PB

- More Than 100 PB

Global Tape Storage Market, by End User

- Cloud Providers

- Data Centers

- Enterprises

- Others

Global Tape Storage Market, by End Use

- LTO-1 to LTO-5

- LTO-6

- LTO-7

- LTO-8

- LTO-9

- DDS-1

- DDS-2

- DDS-3

- DDS-4

Global Tape Storage Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 9.87 Billion |

| CAGR (2023-2033) | 7.47% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Component, Capacity, End User, End Use |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Dell Inc, Fujifilm Holdings Corporation, IBM Corporation, Lenovo, Oracle, Qualstar Corporation, Quantum Corporation, Seagate Technology, Sony Corporation and Spectra Logic Corporation. |

| Key Market Opportunities | · Increasing Data Generation and Storage Needs · Cost Reduction and Energy Efficiency |

| Key Market Drivers | · Cost-Effectiveness and High Storage Capacity · Technological Advancements |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Tape Storage Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Tape Storage Market historical market size for the year 2021, and forecast from 2023 to 2033

- Tape Storage Market share analysis at each Product level

- Competitor analysis with detailed insight into its Product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including Product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Tape Storage Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, Product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Tape Storage Market is 2021- 2033

What is the growth rate of the global Tape Storage Market?

The global Tape Storage Market is growing at a CAGR of 9.87% over the next 10 years

Which region has the highest growth rate in the market of Tape Storage Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Tape Storage Market?

North America holds the largest share in 2022

Who are the key players in the global Tape Storage Market?

Dell Inc, Fujifilm Holdings Corporation, IBM Corporation, Lenovo, Oracle, Qualstar Corporation, Quantum Corporation, Seagate Technology, Sony Corporation and Spectra Logic Corporation. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Component Segement – Market Opportunity Score 4.1.2. Capacity Segment – Market Opportunity Score 4.1.3. End User Segment – Market Opportunity Score 4.1.4. End Use Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End Users 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Tape Storage Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Tape Storage Market, By Component 7.1. Introduction 7.1.1. Tape Cartridges 7.1.2. Tape Vault CHAPTER 8. Tape Storage Market, By Capacity 8.1. Introduction 8.1.1. Less Than 1 TB 8.1.2. 1 TB to 200 TB 8.1.3. 201 TB to 999 TB 8.1.4. 1 PB to 100 PB 8.1.5. More Than 100 PB CHAPTER 9. Tape Storage Market, By End User 9.1. Introduction 9.1.1. Cloud Providers 9.1.2. Data Centers 9.1.3. Enterprises 9.1.4. Others CHAPTER 10. Tape Storage Market, By End Use 10.1.Introduction 10.1.1. LTO-1 to LTO-5 10.1.2. LTO-6 10.1.3. LTO-7 10.1.4. LTO-8 10.1.5. LTO-9 10.1.6. DDS-1 10.1.7. DDS-2 10.1.8. DDS-3 10.1.9. DDS-4 CHAPTER 11. Tape Storage Market, By Region 11.1. Introduction 11.2. NORTH AMERICA 11.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.2.2. North America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.3. North America: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.2.4. North America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.2.5. North America: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.2.6. US 11.2.6.1. US: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.6.2. US: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.2.6.3. US: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.2.6.4. US: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.2.7. CANADA 11.2.7.1. Canada: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.7.2. Canada: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.2.7.3. Canada: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.2.7.4. Canada: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.2.8. MEXICO 11.2.8.1. Mexico: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.8.2. Mexico: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.2.8.3. Mexico: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.2.8.4. Mexico: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.3. Europe 11.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.3.2. Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.3. Europe: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.3.4. Europe: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.5. Europe: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.3.6. U.K. 11.3.6.1. U.K.: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.6.2. U.K.: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.3.6.3. U.K.: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.6.4. U.K.: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.3.7. GERMANY 11.3.7.1. Germany: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.7.2. Germany: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.3.7.3. Germany: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.7.4. Germany: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.3.8. FRANCE 11.3.8.1. France: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.8.2. France: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.3.8.3. France: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.8.4. France: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.3.9. ITALY 11.3.9.1. Italy: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.9.2. Italy: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.3.9.3. Italy: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.9.4. Italy: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.3.10. SPAIN 11.3.10.1. Spain: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.10.2. Spain: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.3.10.3. Spain: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.10.4. Spain: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.3.11. BENELUX 11.3.11.1. BeNeLux: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.11.2. BeNeLux: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.3.11.3. BeNeLux: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.11.4. BeNeLux: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.3.12. RUSSIA 11.3.12.1. Russia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.12.2. Russia: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.3.12.3. Russia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.12.4. Russia: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.3.13. REST OF EUROPE 11.3.13.1. Rest of Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.13.2. Rest of Europe: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.3.13.3. Rest of Europe: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.13.4. Rest of Europe: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.4. Asia Pacific 11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.4.2. Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.3. Asia Pacific: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.4.4. Asia Pacific: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.5. Asia Pacific: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.4.6. CHINA 11.4.6.1. China: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.6.2. China: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.4.6.3. China: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.6.4. China: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.4.7. JAPAN 11.4.7.1. Japan: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.7.2. Japan: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.4.7.3. Japan: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.7.4. Japan: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.4.8. INDIA 11.4.8.1. India: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.8.2. India: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.4.8.3. India: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.8.4. India: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.4.9. SOUTH KOREA 11.4.9.1. South Korea: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.9.2. South Korea: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.4.9.3. South Korea: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.9.4. South Korea: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.4.10. THAILAND 11.4.10.1. Thailand: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.10.2. Thailand: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.4.10.3. Thailand: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.10.4. Thailand: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.4.11. INDONESIA 11.4.11.1. Indonesia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.11.2. Indonesia: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.4.11.3. Indonesia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.11.4. Indonesia: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.4.12. MALAYSIA 11.4.12.1. Malaysia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.12.2. Malaysia: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.4.12.3. Malaysia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.12.4. Malaysia: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.4.13. AUSTRALIA 11.4.13.1. Australia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.13.2. Australia: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.4.13.3. Australia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.13.4. Australia: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.4.14. REST FO ASIA PACIFIC 11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.5. South America 11.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.5.2. South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.3. South America: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.5.4. South America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.5.5. South America: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.5.6. BRAZIL 11.5.6.1. Brazil: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.6.2. Brazil: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.5.6.3. Brazil: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.5.6.4. Brazil: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.5.7. ARGENTINA 11.5.7.1. Argentina: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.7.2. Argentina: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.5.7.3. Argentina: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.5.7.4. Argentina: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.5.8. REST OF SOUTH AMERICA 11.5.8.1. Rest of South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.8.2. Rest of South America: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.5.8.3. Rest of South America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.5.8.4. Rest of South America: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.6. Middle East & Africa 11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.6.2. Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.3. Middle East & Africa: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.6.4. Middle East & Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.6.5. Middle East & Africa: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.6.6. SAUDI ARABIA 11.6.6.1. Saudi Arabia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.6.2. Saudi Arabia: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.6.6.3. Saudi Arabia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.6.6.4. Saudi Arabia: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.6.7. UAE 11.6.7.1. UAE: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.7.2. UAE: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.6.7.3. UAE: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.6.7.4. UAE: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.6.8. EGYPT 11.6.8.1. Egypt: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.8.2. Egypt: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.6.8.3. Egypt: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.6.8.4. Egypt: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.6.9. SOUTH AFRICA 11.6.9.1. South Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.9.2. South Africa: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.6.9.3. South Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.6.9.4. South Africa: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 11.6.10. REST OF MIDDLE EAST & AFRICA 11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Capacity, 2023 – 2033 ($ Million) 11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Dell Inc 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Fujifilm Holdings Corporation 13.3. IBM Corporation 13.4. Lenovo 13.5. Oracle 13.6. Qualstar Corporation 13.7. Quantum Corporation 13.8. Seagate Technology 13.9. Sony Corporation 13.10. Spectra Logic Corporation

Connect to Analyst

Research Methodology