Sustainable Aviation Fuel Market Overview

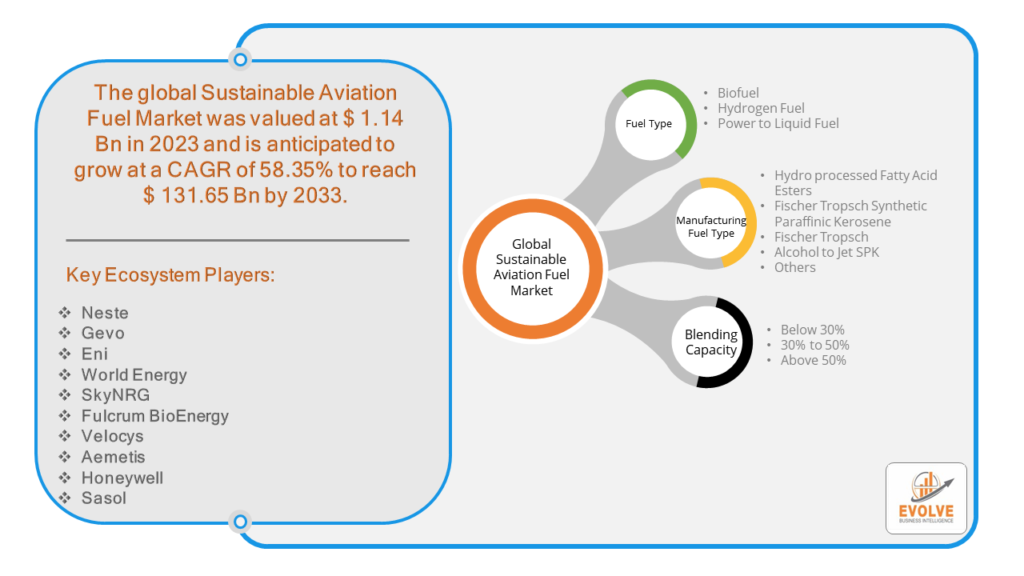

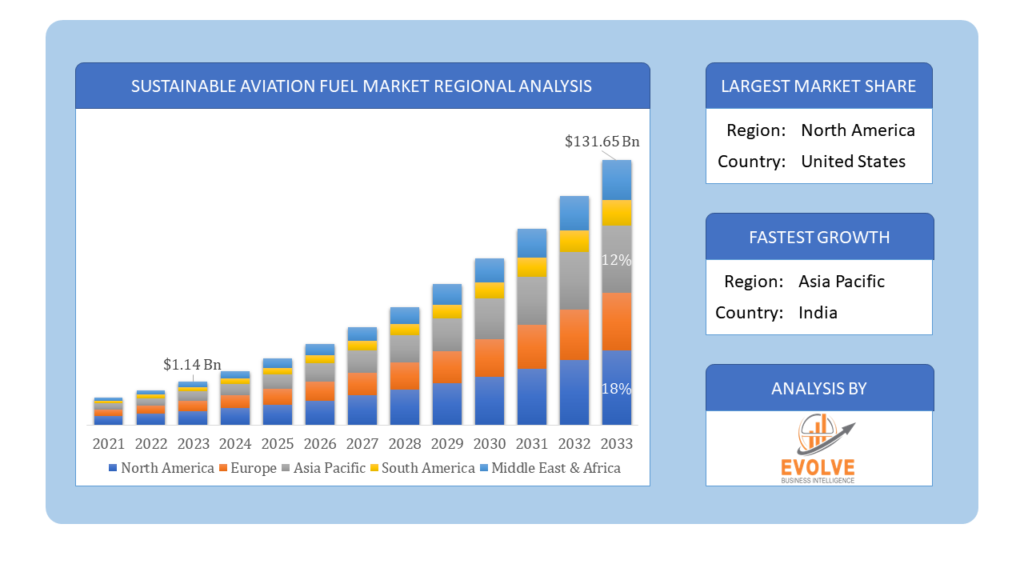

The Sustainable Aviation Fuel Market Size is expected to reach USD 131.65 Billion by 2033. The Sustainable Aviation Fuel Market industry size accounted for USD 1.14 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 58.35% from 2023 to 2033. The Sustainable Aviation Fuel (SAF) Market refers to the market for alternative aviation fuels that are produced sustainably, typically from renewable resources such as biomass, waste oils, or synthetic processes that minimize carbon emissions. SAF aims to reduce the aviation industry’s carbon footprint by offering lower or net-zero carbon emissions compared to conventional jet fuels derived from fossil fuels. This market is gaining traction due to increasing environmental regulations and initiatives aimed at reducing greenhouse gas emissions in aviation.

This is due to the increasing demand for sustainable travel and the falling production costs of SAF. The growth of this market will help to reduce greenhouse gas emissions from aviation and make air travel more sustainable.

Global Sustainable Aviation Fuel Market Synopsis

The COVID-19 pandemic had a significant impact on the Sustainable Aviation Fuel (SAF) Market. During the height of the pandemic, global air travel plummeted due to travel restrictions and reduced demand. This led to decreased consumption of jet fuel, including SAF, as airlines grounded flights and focused on cost-cutting measures. The pandemic also highlighted the aviation industry’s vulnerability to global crises and intensified efforts towards sustainability. Governments and aviation stakeholders increasingly focused on recovery plans that included investments in SAF as part of broader environmental goals. Many governments introduced or strengthened policies supporting SAF production and adoption post-pandemic as part of economic recovery and climate change mitigation strategies. This has contributed to renewed interest and investments in the SAF market. The SAF market faced supply chain disruptions and logistical challenges during the pandemic, affecting production and distribution.

Sustainable Aviation Fuel Market Dynamics

The major factors that have impacted the growth of Sustainable Aviation Fuel Market are as follows:

Drivers:

Ø Technological Advancements

Advances in technology have made SAF production more efficient and cost-effective. Innovations in feedstock sourcing, conversion processes (such as biomass-to-liquid and synthetic fuels), and distribution infrastructure are reducing barriers to entry. Government subsidies, tax credits, and financial incentives encourage investment in SAF production and usage. These incentives help mitigate the higher costs associated with SAF compared to conventional jet fuels. Growing public awareness and concern about climate change are influencing consumer choices and putting pressure on industries, including aviation, to adopt sustainable practices. This shift in consumer sentiment can drive demand for SAF among airlines and passengers.

Restraint:

- Perception of High Production Costs

SAF currently has higher production costs compared to conventional jet fuels, primarily due to limited economies of scale and higher costs associated with feedstock procurement, processing, and refining. This cost barrier limits widespread adoption, especially without substantial government subsidies or incentives. Fluctuations in crude oil prices can impact the economic competitiveness of SAF relative to conventional jet fuels. Price volatility and market uncertainties can deter long-term investments in SAF production and adoption.

Opportunity:

⮚ Corporate Sustainability Commitments

Airlines and aviation stakeholders are increasingly integrating sustainability into their business strategies. Corporate sustainability commitments, including carbon neutrality pledges and ESG goals, drive demand for SAF as a key component of achieving environmental targets. Ongoing advancements in SAF production technologies, such as synthetic fuels and advanced biofuels, are improving efficiency and reducing production costs. Innovations in feedstock sourcing and conversion processes enhance scalability and competitiveness in the market. Increasing public awareness of climate change and sustainability is driving demand for greener aviation options. Consumer preferences and corporate responsibility initiatives are influencing airlines to offer SAF as a choice, creating a market pull for sustainable alternatives.

Sustainable Aviation Fuel Market Segment Overview

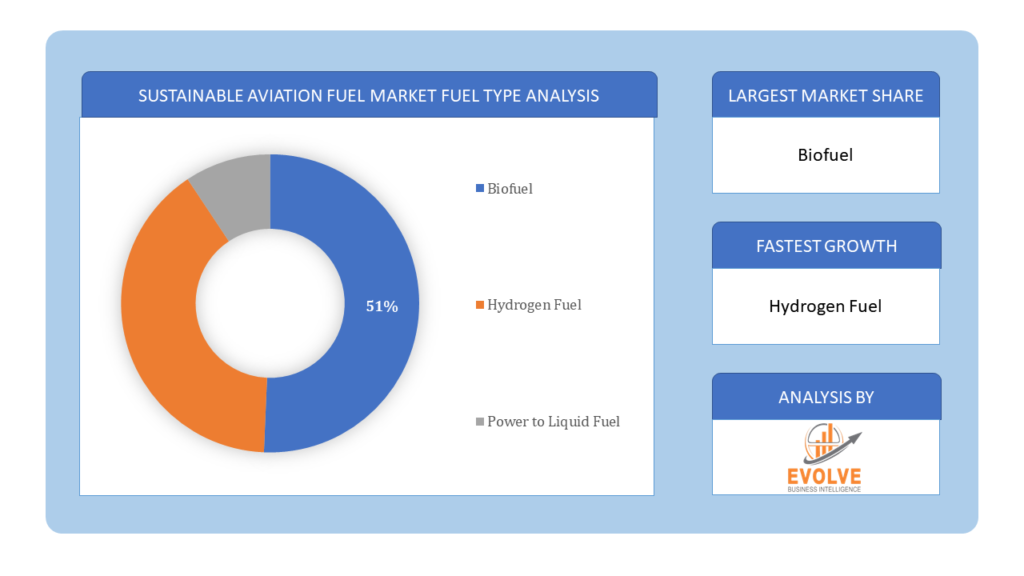

By Fuel Type

Based on Fuel Type, the market is segmented based on Biofuel, Hydrogen Fuel and Power to Liquid Fuel. The biofuel segment dominated the market. Technologies for producing biofuels have been created and improved over time, becoming economically viable. The fact that biofuels rule the market in large part is due to the established infrastructure and production methods.

Based on Fuel Type, the market is segmented based on Biofuel, Hydrogen Fuel and Power to Liquid Fuel. The biofuel segment dominated the market. Technologies for producing biofuels have been created and improved over time, becoming economically viable. The fact that biofuels rule the market in large part is due to the established infrastructure and production methods.

By Manufacturing Fuel Type

Based on Manufacturing Fuel Type, the market segment has been divided into the Hydro processed Fatty Acid Esters, Fischer Tropsch Synthetic Paraffinic Kerosene, Fischer Tropsch, Alcohol to Jet SPK and Others. The Fischer Tropsch Synthetic Paraffinic Kerosene segment dominant the market. Coal, natural gas, or biomass feedstocks have been gasified into syngas of hydrogen and carbon monoxide in the FTSPK process. In the FT reactor, this syngas is enzymatically transformed into a liquid hydrocarbon fuel mixing component. The raw material used in the kerosene process includes wood waste, municipal solid waste, and grass.

By Blending Capacity

Based on Blending Capacity, the market segment has been divided into the Below 30%, 30% to 50% and Above 50%. The 30% to 50% segment dominated the market. In order to suit the needs of both commercial and military aviation, drop-in capability, moderate blend capacity, supply logistics transportation, and aircraft fleet enable lower overall costs.

Global Sustainable Aviation Fuel Market Regional Analysis

Based on region, the global Sustainable Aviation Fuel Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Sustainable Aviation Fuel Market followed by the Asia-Pacific and Europe regions.

North America holds a dominant position in the Sustainable Aviation Fuel Market. The United States and Canada are significant players in the SAF market, driven by a combination of regulatory support, corporate sustainability goals, and research investments. States like California have implemented Low Carbon Fuel Standards (LCFS) that incentivize SAF production and use.

Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Sustainable Aviation Fuel Market industry. Countries like Japan, Australia, and Singapore are emerging as key markets for SAF, supported by government initiatives and growing airline commitments to sustainability. Japan, for instance, has launched programs to promote bio jet fuels and hydrogen-based SAF.

Competitive Landscape

The global Sustainable Aviation Fuel Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Neste

- Gevo

- Eni

- World Energy

- SkyNRG

- Fulcrum BioEnergy

- Velocys

- Aemetis

- Honeywell

- Sasol

Key Development

In, January 2022, Cepsa approved a contract with Iberia and Iberia Express for the development and mass production of sustainable aviation fuel. According to the agreement, SAF must be generated from waste, recovered oils, and second-generation plant-based biofeedstock.

In March 2022, Neste Company and DHL Express unveiled the biggest SAF transactions ever. One of the most significant sustainable aviation fuel contracts in the aviation sector, this arrangement represents Neste’s most noticeable SAF. Global connectivity from this partnership will improve Neste’s current web.

Scope of the Report

Global Sustainable Aviation Fuel Market, by Fuel Type

- Biofuel

- Hydrogen Fuel

- Power to Liquid Fuel

Global Sustainable Aviation Fuel Market, by Manufacturing Fuel Type

- Hydro processed Fatty Acid Esters

- Fischer Tropsch Synthetic Paraffinic Kerosene

- Fischer Tropsch

- Alcohol to Jet SPK

- Others

Global Sustainable Aviation Fuel Market, by Blending Capacity

- Below 30%

- 30% to 50%

- Above 50%

Global Sustainable Aviation Fuel Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $131.65 Billion |

| CAGR | 58.35% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Fuel Type, Manufacturing Fuel Type, Blending Capacity |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Neste, Gevo, Eni, World Energy, SkyNRG, Fulcrum BioEnergy, Velocys, Aemetis, Honeywell and Sasol |

| Key Market Opportunities | • Corporate Sustainability Commitments • Public Awareness and Consumer Demand |

| Key Market Drivers | • Technological Advancements • Public and Consumer Awareness |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Sustainable Aviation Fuel Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Sustainable Aviation Fuel Market historical market size for the year 2021, and forecast from 2023 to 2033

- Sustainable Aviation Fuel Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Sustainable Aviation Fuel Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.