Sugar Substitutes Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

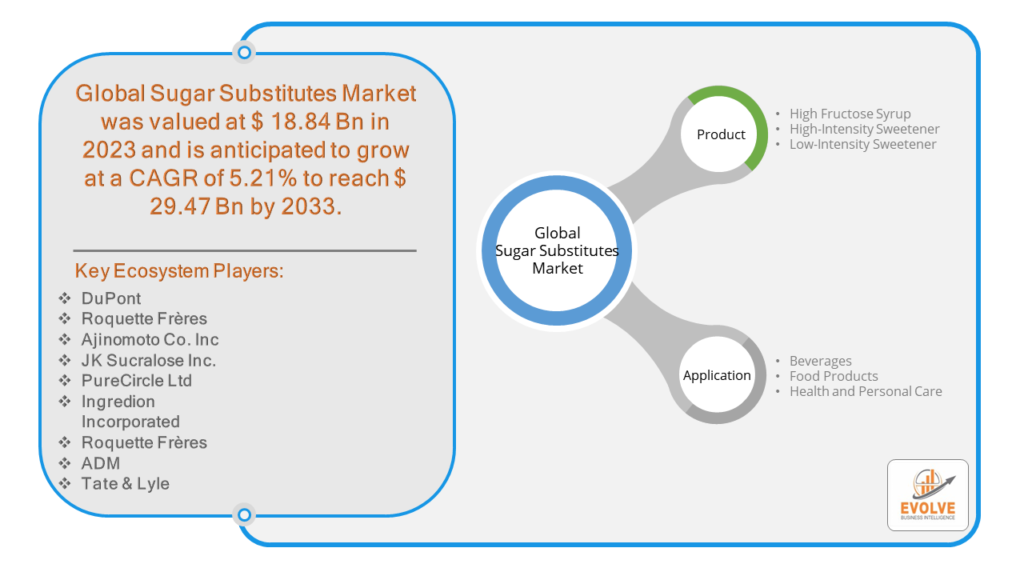

Sugar Substitutes Market Research Report: Information By Product Type (High Fructose Syrup, High-Intensity Sweetener, Low-Intensity Sweetener) And By Application (Beverages, Food Products, Health And Personal Care Products), and by Region — Forecast till 2033

Page: 165

Sugar Substitutes Market Overview

The Sugar Substitutes Market Size is expected to reach USD 29.47 Billion by 2033. The Sugar Substitutes industry size accounted for USD 18.84 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.21% from 2023 to 2033. The sugar substitutes market encompasses a variety of products used as alternatives to traditional sugar, including artificial sweeteners (like aspartame and sucralose), natural sweeteners (such as stevia and monk fruit), and sugar alcohols (like xylitol and erythritol). This market is driven by rising health consciousness, increasing diabetes prevalence, and a growing demand for low-calorie and low-glycemic index foods. Regulatory approvals and advancements in product formulations further support market growth.

Global Sugar Substitutes Market Synopsis

The Sugar Substitutes market was significantly influenced by the COVID-19 pandemic, as global lockdowns and restrictions were implemented to mitigate the virus’s spread. The COVID-19 pandemic has caused supply chain interruptions, which have decreased demand or created shortages in the market for sugar replacements. Spending by consumers and businesses has decreased significantly as a result of the travel restrictions and social distancing measures, and this trend is expected to persist for some time. The epidemic has altered end-user trends and tastes, leading manufacturers, developers, and service providers to implement several measures in an attempt to stabilize their businesses.

Sugar Substitutes Market Dynamics

The major factors that have impacted the growth of Sugar Substitutes are as follows:

Drivers:

Ø Innovation and Product Development

Continuous innovation by major companies in the food and beverage industry is another key driver. Companies are developing new, more palatable, and versatile sugar substitutes that cater to consumer demands for natural, plant-based, and clean-label products. Innovations such as Cargill’s EverSweet + ClearFlo technology and Tate & Lyle’s ERYTESSE erythritol highlight the industry’s commitment to creating better-tasting and more effective sugar substitutes

Restraint:

- High R&D Costs

Developing new sugar substitutes involves significant research and development (R&D) expenses. This includes the costs of discovering and isolating new compounds, conducting safety and efficacy tests, and navigating regulatory approvals. These high upfront costs can be a barrier, particularly for smaller companies lacking extensive resources

Opportunity:

⮚ Technology Integration

Keep an eye on emerging technologies and assess how they can be integrated into your products or services to improve functionality, efficiency, or user experience. Technologies like artificial intelligence, blockchain, and Internet of Things (IoT) offer various opportunities for innovation.

Sugar Substitutes Segment Overview

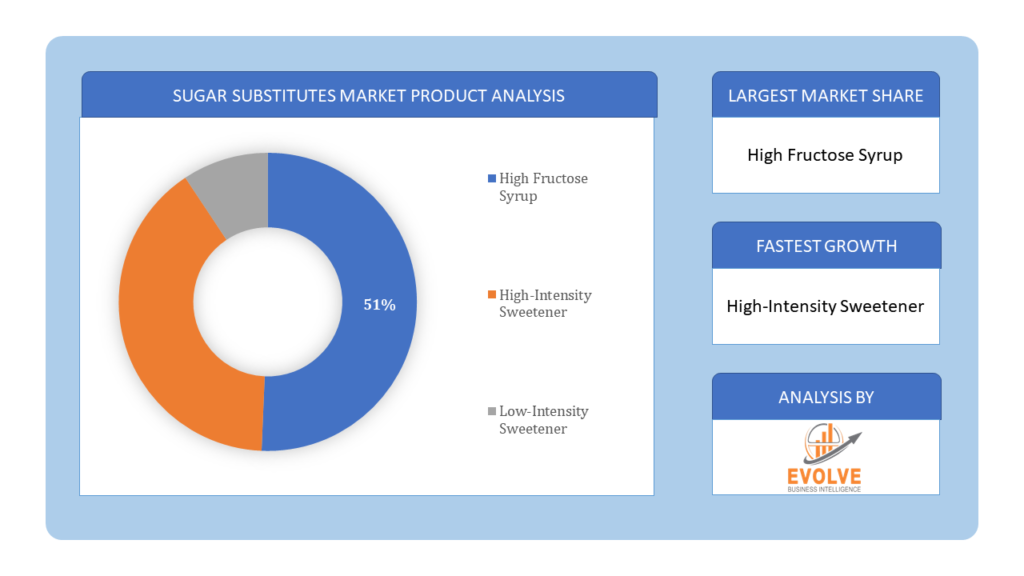

By Product Type

Based on Product Type, the market is segmented based on High Fructose Syrup, High-Intensity Sweetener, Low-Intensity Sweetener. Innovation and product development in the market segment based on product type focus on High Fructose Syrup, High-Intensity Sweeteners, and Low-Intensity Sweeteners, with each category driving advancements in formulation and application to meet varying consumer preferences and health trends.

Based on Product Type, the market is segmented based on High Fructose Syrup, High-Intensity Sweetener, Low-Intensity Sweetener. Innovation and product development in the market segment based on product type focus on High Fructose Syrup, High-Intensity Sweeteners, and Low-Intensity Sweeteners, with each category driving advancements in formulation and application to meet varying consumer preferences and health trends.

By Application

Based on Applications, the market has been divided into the Beverages, Food Products, Health And Personal Care Products. Innovation and product development in the market segment based on applications has led to tailored advancements for specific sectors: Beverages, Food Products, and Health and Personal Care Products, each leveraging unique technologies and consumer trends to drive growth and differentiation.

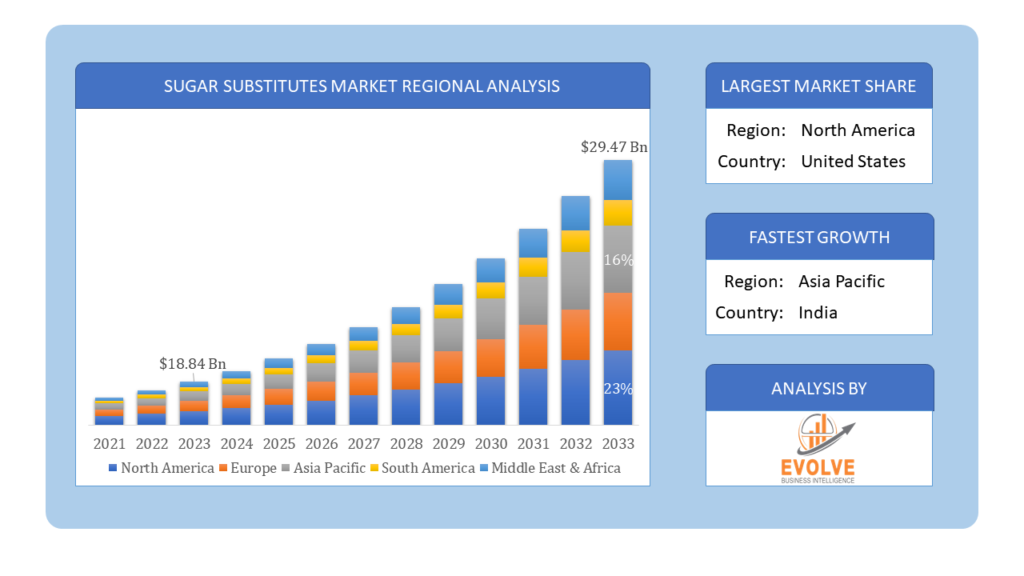

Global Sugar Substitutes Market Regional Analysis

Based on region, the global Sugar Substitutes market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Sugar Substitutes market followed by the Asia-Pacific and Europe regions.

Sugar Substitutes North America Market

North America holds a dominant position in the Sugar Substitutes Market. Market size for sugar substitutes in North America was estimated to be USD 6.37 billion in 2022, and it is anticipated to rise at a substantial CAGR during the course of the study. The increasing need in the area to promote low-calorie food consumption is one of the main motivators. The popularity of healthy meals and beverages among North American consumers is the main factor expected to drive the growth of the market for sugar substitutes. Changes in the US population and socioeconomic landscape have had a significant impact on food trends. The younger generation thinks it’s important to try out novel and inventive items, and with rising knowledge of diet-related illnesses and regulatory changes in the US, they think sugar addition should only be used in minimal or necessary amounts.

Sugar Substitutes Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Sugar Substitutes industry. From 2022 to 2030, the Asia-Pacific Sugar Substitutes Market is anticipated to develop at the quickest compound annual growth rate (CAGR). The middle class population in Asia Pacific now has more disposable money thanks to industrialization. Consequently, there is an increased need for goods that promote health, including wholesome food. There is a rise in demand for low-calorie foods and beverages throughout Asia Pacific.

Competitive Landscape

The global Sugar Substitutes market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- DuPont

- Roquette Frères

- Ajinomoto Co. Inc

- JK Sucralose Inc.

- PureCircle Ltd

- Ingredion Incorporated

- Roquette Frères

- ADM

- Tate & Lyle

Key Development

April 2022: Tate & Lyle increased allulose production to meet the rising demand for the rare sugar, which gained popularity after the FDA decided to exclude it from the Nutrition Facts panel’s total and added sugars declarations.

Scope of the Report

Global Sugar Substitutes Market, by Product

- High Fructose Syrup

- High-Intensity Sweetener

- Low-Intensity Sweetener

Global Sugar Substitutes Market, by Application

- Beverages

- Food Products

- Health and Personal Care

Global Sugar Substitutes Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $29.47 Billion/strong> |

| CAGR | 5.21% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | DuPont, Roquette Frères, Ajinomoto Co. Inc, JK Sucralose Inc., PureCircle Ltd, Ingredion Incorporated, Roquette Frères, ADM, Tate & Lyle, JBS S.A |

| Key Market Opportunities | • Rising consumer health consciousness to drive growth for healthier food options |

| Key Market Drivers | • Increased investment by manufacturers in R&D activities to develop newer and better products. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Sugar Substitutes market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Sugar Substitutes market historical market size for the year 2021, and forecast from 2023 to 2033

- Sugar Substitutes market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Sugar Substitutes market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

1.What is the study period of this market?

- The study period of the global Sugar Substitutes market is 2021- 2033

2.What is the growth rate of the global Sugar Substitutes market?

- The global Sugar Substitutes market is growing at a CAGR of 5.21% over the next 10 years

3.Which region has the highest growth rate in the market of Sugar Substitutes?

- Asia Pacific is expected to register the highest CAGR during 2023-2033

4.Which region has the largest share of the global Sugar Substitutes market?

- North America holds the largest share in 2022

5.Who are the key players in the global Sugar Substitutes market?

- DuPont, Roquette Frères, Ajinomoto Co. Inc, JK Sucralose Inc., PureCircle Ltd, Ingredion Incorporated, Roquette Frères, ADM and Tate & Lyle are the major companies operating in the market.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw Applications Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Sugar Substitutes Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Sugar Substitutes Market 4.8. Import Analysis of the Sugar Substitutes Market 4.9. Export Analysis of the Sugar Substitutes Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Sugar Substitutes Market, By Product Type 6.1. Introduction 6.2. High Fructose Syrup 6.3. High-Intensity Sweetener 6.4. Low-Intensity Sweetener Chapter 7. Global Sugar Substitutes Market, By Application 7.1. Introduction 7.2. Beverages 7.3. Food Products 7.4. Health and Personal Care Chapter 8. Global Sugar Substitutes Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.5. Market Size and Forecast, By Application, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By Application, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By Application, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By Application, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By Application, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By Application, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By Application, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By Application, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By Application, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By Application, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By Application, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By Application, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By Application, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By Application, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By Application, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By Application, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. DuPont 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Roquette Frères 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Ajinomoto Co. Inc 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. JK Sucralose Inc. 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. PureCircle Ltd 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Ingredion Incorporated 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Roquette Frères 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 ADM 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Tate & Lyle 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. JBS S.A. 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology