Smart Shipping Containers Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

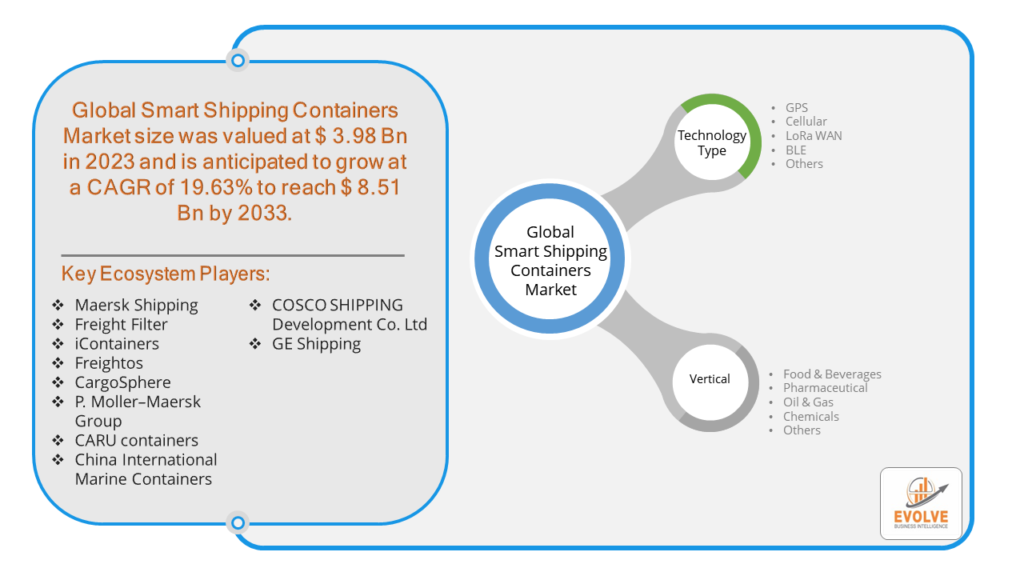

Smart Shipping Containers Market Research Report: Information By Technology Type (GPS, Cellular, LoRa WAN, BLE, Others), By Vertical (Food & Beverages, Pharmaceutical, Oil & Gas, Chemicals, Others), and by Region — Forecast till 2033

Page: 118

Smart Shipping Containers Market Overview

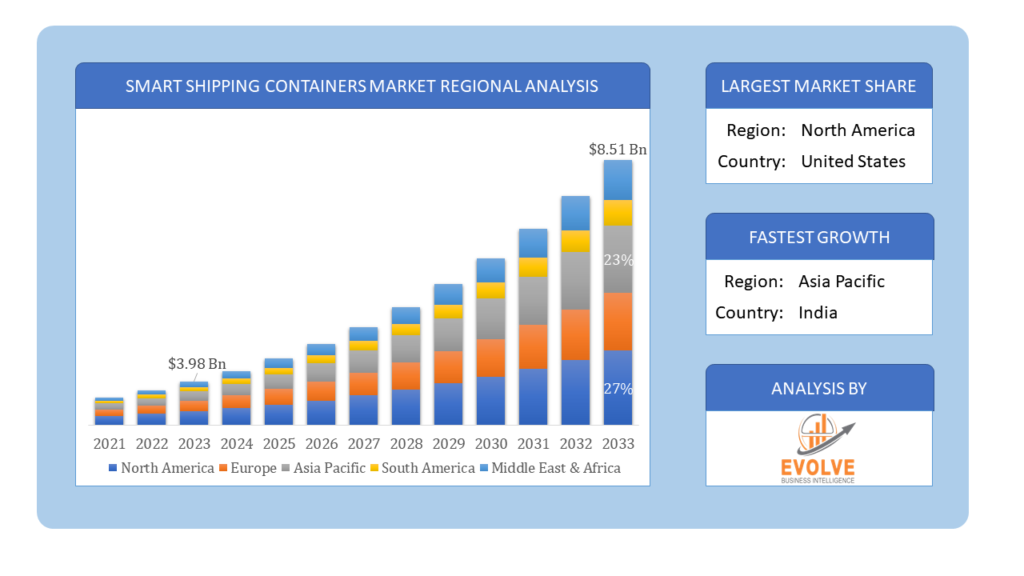

The Smart Shipping Containers Market Size is expected to reach USD 8.51 Billion by 2033. The Smart Shipping Containers Market industry size accounted for USD 3.98 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 19.63% from 2023 to 2033. The Smart Shipping Containers Market refers to the segment of the shipping industry that involves the integration of IoT (Internet of Things) and other advanced technologies into shipping containers. These containers are equipped with sensors, GPS tracking, and communication devices to provide real-time data on their location, condition, and contents. The key benefits of smart shipping containers include improved supply chain visibility, enhanced security, better inventory management, and more efficient logistics operations. This market is driven by the increasing need for transparency, efficiency, and sustainability in global logistics and transportation.

The growth is driven by factors like rising demand for real-time tracking, increasing concerns about cargo safety, and the need for efficient logistics in today’s globalized trade.

Global Smart Shipping Containers Market Synopsis

The COVID-19 pandemic had several impacts on the Smart Shipping Containers Market. The pandemic disrupted global supply chains, leading to delays in manufacturing and deployment of smart shipping containers. Restrictions on movement and trade also affected the logistics and transportation sector, impacting the overall demand. With restrictions and safety concerns, there was a heightened demand for remote monitoring capabilities offered by smart containers. This includes real-time tracking of cargo and temperature-sensitive goods, which became crucial during the pandemic to ensure supply chain resilience. COVID-19 accelerated the adoption of contactless and automated solutions. Smart containers, equipped with IoT sensors and communication technologies, played a role in minimizing physical interactions during handling and monitoring processes, thereby reducing the risk of virus transmission. The pandemic prompted companies to reassess their supply chain strategies and invest in technologies that enhance resilience and agility. Smart shipping containers, by providing real-time data and analytics, became integral to these resilience efforts.

Smart Shipping Containers Market Dynamics

The major factors that have impacted the growth of Smart Shipping Containers Market are as follows:

Drivers:

Ø Efficiency and Cost Savings

Smart containers help optimize logistics operations by improving route planning, reducing idle time, and minimizing transportation costs. This efficiency gains appeal to shipping companies looking to enhance profitability and operational effectiveness. With growing environmental concerns, there is a shift towards sustainable practices in logistics. Smart containers contribute to reducing carbon footprints by optimizing routes, minimizing fuel consumption, and enhancing resource efficiency. The rapid expansion of e-commerce increases demand for efficient and reliable logistics solutions. Smart containers play a crucial role in supporting e-commerce logistics by ensuring timely delivery and enhancing customer satisfaction.

Restraint:

- Perception of High Initial Investment and compatibility challenges

The deployment of smart shipping containers requires significant upfront investment in IoT devices, sensors, communication infrastructure, and integration with existing logistics systems. This cost can be prohibitive for some companies, especially smaller players or those operating on tight budgets. Integrating smart containers into existing logistics and transportation networks may pose compatibility challenges. Ensuring seamless communication and data integration across different platforms and stakeholders can be complex and time-consuming.

Opportunity:

⮚ Growing Demand for Real-Time Visibility

There is a rising demand for real-time tracking and monitoring of goods throughout the supply chain. Smart containers equipped with sensors can provide accurate information on location, temperature, humidity, and other conditions, addressing the need for transparency and supply chain resilience. The rapid growth of e-commerce is driving increased demand for efficient and reliable logistics solutions. Smart shipping containers support e-commerce logistics by ensuring timely delivery, reducing delays, and enhancing customer satisfaction through improved shipment visibility. Environmental concerns and regulatory pressures are pushing the logistics industry towards sustainable practices. Smart containers contribute to sustainability efforts by optimizing transportation routes, reducing fuel consumption, and minimizing carbon footprints.

Smart Shipping Containers Market Segment Overview

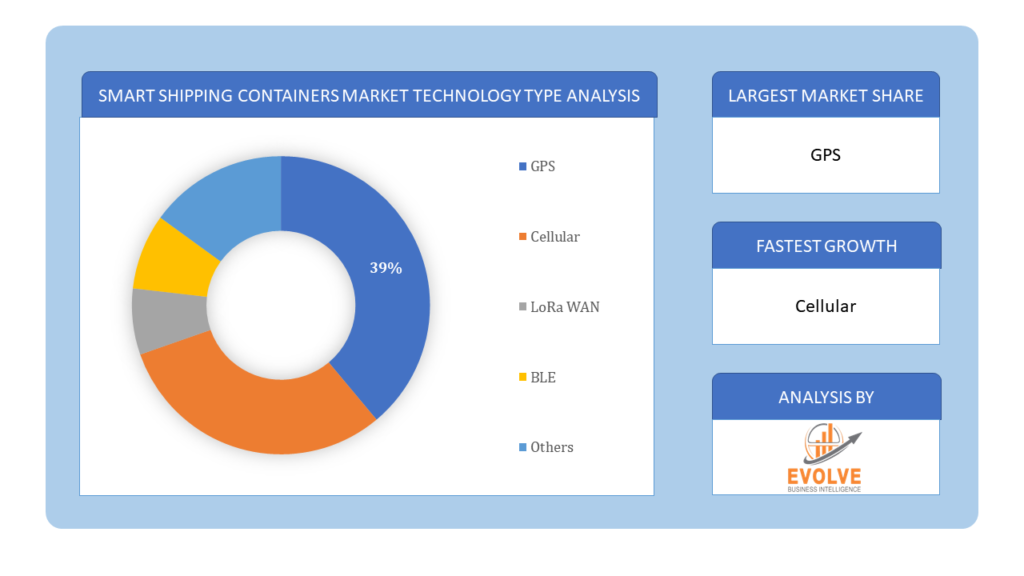

By Technology Type

Based on Technology Type, the market is segmented based on GPS, Cellular, LoRa WAN, BLE and Others. The GPS segment dominant the market. GPS enables precise location tracking of containers during transit, ensuring real-time visibility and helping logistics providers optimize routes and enhance security. Cellular connectivity allows for seamless data transmission, enabling constant monitoring of cargo conditions and container security.

Based on Technology Type, the market is segmented based on GPS, Cellular, LoRa WAN, BLE and Others. The GPS segment dominant the market. GPS enables precise location tracking of containers during transit, ensuring real-time visibility and helping logistics providers optimize routes and enhance security. Cellular connectivity allows for seamless data transmission, enabling constant monitoring of cargo conditions and container security.

By Vertical

Based on Vertical, the market segment has been divided into the Food & Beverages, Pharmaceutical, Oil & Gas, Chemicals and Others. The Food & Beverages segment dominant the market. Smart container market statistics shows, the surging demand across the food and beverages (F&B) industry is driven by the need to ensure the safe transportation of perishable goods. These containers enable this by monitoring temperature, humidity, and integrity, reducing spoilage and ensuring quality.

Global Smart Shipping Containers Market Regional Analysis

Based on region, the global Smart Shipping Containers Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Smart Shipping Containers Market followed by the Asia-Pacific and Europe regions.

Smart Shipping Containers North America Market

Smart Shipping Containers North America Market

North America holds a dominant position in the Smart Shipping Containers Market. North America leads in the deployment of smart shipping containers. The region’s strong logistics infrastructure, emphasis on supply chain efficiency, and regulatory environment promoting technological innovation contribute to market growth.

Smart Shipping Containers Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Smart Shipping Containers Market industry. With rapid economic growth and expanding e-commerce sectors, Asia-Pacific is a key growth area for smart shipping containers. Countries such as China, Japan, and South Korea are investing in smart logistics solutions to manage large volumes of international trade efficiently. The region also benefits from advancements in IoT technology and government initiatives supporting digital transformation in logistics.

Competitive Landscape

The global Smart Shipping Containers Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Maersk Shipping

- Freight Filter

- iContainers

- Freightos

- CargoSphere

- P. Moller–Maersk Group

- CARU containers

- China International Marine Containers

- COSCO SHIPPING Development Co. Ltd

- GE Shipping

Scope of the Report

Global Smart Shipping Containers Market, by Technology Type

- GPS

- Cellular

- LoRa WAN

- BLE

- Others

Global Smart Shipping Containers Market, by Vertical

- Food & Beverages

- Pharmaceutical

- Oil & Gas

- Chemicals

- Others

Global Smart Shipping Containers Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $8.51 Billion |

| CAGR | 19.63% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Technology Type, Vertical |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Maersk Shipping, Freight Filter, iContainers, Freightos, CargoSphere, P. Moller–Maersk Group, CARU containers, China International Marine Containers, COSCO SHIPPING Development Co. Ltd and GE Shipping |

| Key Market Opportunities | • Growing Demand for Real-Time Visibility • Focus on Sustainability |

| Key Market Drivers | • Efficiency and Cost Savings • E-commerce Growth |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Smart Shipping Containers Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Smart Shipping Containers Market historical market size for the year 2021, and forecast from 2023 to 2033

- Smart Shipping Containers Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Smart Shipping Containers Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

1.What is the study period of this market?

- The study period of the global Smart Shipping Containers Market is 2021- 2033

2.What is the growth rate of the global Smart Shipping Containers Market?

- The global Smart Shipping Containers Market is growing at a CAGR of 19.63% over the next 10 years

3.Which region has the highest growth rate in the market of Smart Shipping Containers Market?

- Asia Pacific is expected to register the highest CAGR during 2023-2033

4.Which region has the largest share of the global Smart Shipping Containers Market?

- North America holds the largest share in 2022

5.Who are the key players in the global Smart Shipping Containers Market?

- Maersk Shipping, Freight Filter, iContainers, Freightos, CargoSphere, P. Moller–Maersk Group, CARU containers, China International Marine Containers, COSCO SHIPPING Development Co. Ltd and GE Shipping. are the major companies operating in the market.

6.Do you offer Post Sale Support?

- Yes, we offer 16 hours of analyst support to solve the queries

7.Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Smart Shipping Containers Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Smart Shipping Containers Market 4.8. Import Analysis of the Smart Shipping Containers Market 4.9. Export Analysis of the Smart Shipping Containers Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Smart Shipping Containers Market, By Technology Type 6.1. Introduction 6.2. GPS 6.3. Cellular 6.4. LoRa WAN 6.5. BLE 6.6. Others Chapter 7. Global Smart Shipping Containers Market, By Vertical 7.1. Introduction 7.2. Food & Beverages 7.3. Pharmaceutical 7.4. Oil & Gas 7.5. Chemicals 7.6. Others Chapter 8. Global Smart Shipping Containers Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.5. Market Size and Forecast, By End User, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By End User, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By End User, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By End User, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By End User, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By End User, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By End User, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By End User, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By End User, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By End User, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By End User, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By End User, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By End User, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By End User, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By End User, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By End User, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Maersk Shipping 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Freight Filter 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. iContainers 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Freightos 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. CargoSphere 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. P. Moller–Maersk Group 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. CARU containers 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 China International Marine Containers 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 COSCO SHIPPING Development Co. Ltd 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. GE Shipping 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology