Smart Gas Meter Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

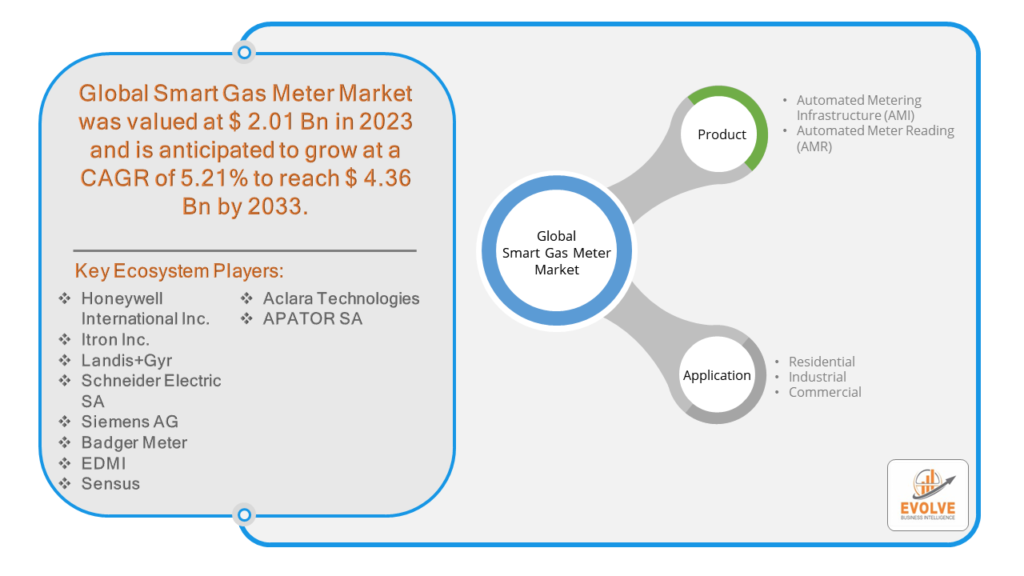

Smart Gas Meter Market Research Report: Information By Product Type (Automated Metering Infrastructure (AMI), Automated Meter Reading (AMR) By Application (Residential, Industrial, Commercial), and by Region — Forecast till 2033

Page: 149

Smart Gas Meter Market Overview

The Smart Gas Meter Market Size is expected to reach USD 4.36 Billion by 2033. The Smart Gas Meter industry size accounted for USD 2.01 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.21% from 2023 to 2033. The smart gas meter market refers to the industry focused on the development, production, and distribution of advanced gas meters equipped with digital technologies. These meters are capable of measuring gas consumption more accurately and transmitting data remotely, enabling utilities and consumers to monitor usage in real-time. The market is driven by the growing demand for efficient energy management, regulatory mandates for utility metering, and the desire for cost savings through improved billing accuracy. Key players in the market include manufacturers of gas meters, technology providers for data analytics and communication, and utility companies adopting smart metering solutions. The market is poised for significant growth as smart grid initiatives and sustainability goals drive the adoption of smart gas meters globally.

Global Smart Gas Meter Market Synopsis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the Smart Gas Meter market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers to adopt various strategies to stabilize the company.

Smart Gas Meter Market Dynamics

The major factors that have impacted the growth of Smart Gas Meter are as follows:

Drivers:

Ø Technological Advancements

The continuous advancement of technologies such as Internet of Things (IoT), wireless communication, and cloud computing has greatly enhanced the capabilities of smart gas meters. These technological innovations enable seamless integration with existing utility infrastructure, enhanced data security, and interoperability with other smart grid components, paving the way for a more resilient and interconnected energy ecosystem.

Restraint:

- Data Privacy and Security Concerns

The increased connectivity and data collection capabilities of smart gas meters raise concerns about data privacy and cybersecurity risks. Unauthorized access to sensitive consumption data could compromise consumer privacy, while cyber-attacks on metering infrastructure could disrupt utility operations and compromise the reliability of gas supply. Addressing these concerns requires robust data encryption, authentication mechanisms, and regulatory frameworks to safeguard consumer information and ensure the integrity of metering systems.

Opportunity:

⮚ Demand Response and Energy Management

Smart gas meters enable utilities to implement demand response programs and dynamic pricing mechanisms, empowering consumers to adjust their gas consumption in response to price signals and grid conditions. By incentivizing load shifting and demand flexibility, utilities can optimize resource allocation, reduce peak demand, and enhance grid stability.

Smart Gas Meter Segment Overview

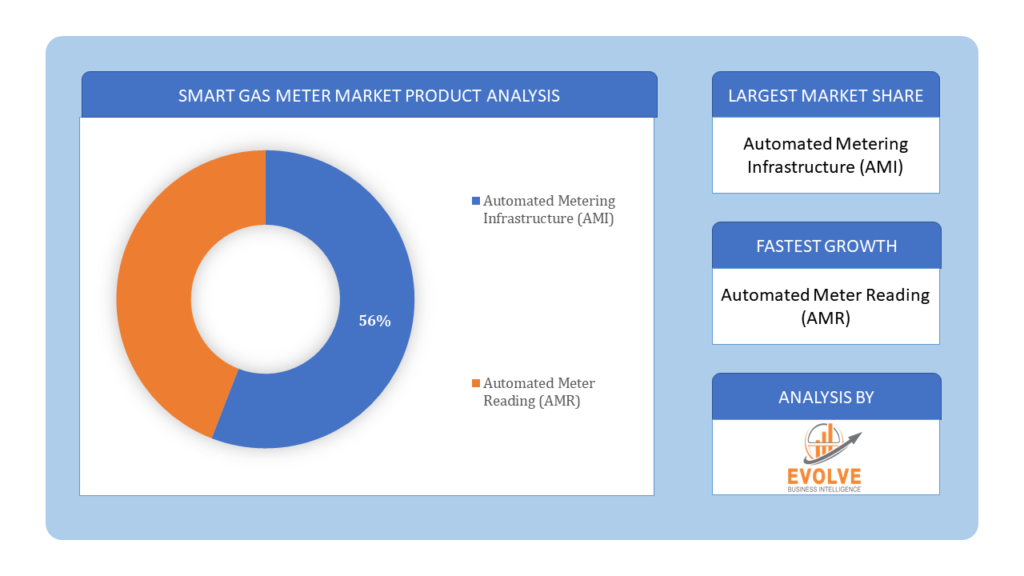

By Product Type

Based on Product Type, the market is segmented based on Automated Metering Infrastructure (AMI), Automated Meter Reading (AMR). In the smart gas meter market, Automated Metering Infrastructure (AMI) dominates the product type segment, offering advanced functionalities such as real-time data transmission, remote monitoring, and two-way communication, facilitating more sophisticated energy management and grid optimization compared to Automated Meter Reading (AMR) systems.

Based on Product Type, the market is segmented based on Automated Metering Infrastructure (AMI), Automated Meter Reading (AMR). In the smart gas meter market, Automated Metering Infrastructure (AMI) dominates the product type segment, offering advanced functionalities such as real-time data transmission, remote monitoring, and two-way communication, facilitating more sophisticated energy management and grid optimization compared to Automated Meter Reading (AMR) systems.

By Application

Based on Applications, the market has been divided into the Residential, Industrial, Commercial. The smart gas meter market, segmented based on applications into residential, industrial, and commercial sectors, caters to diverse end-user needs, ranging from individual households to large-scale industrial facilities, driving efficiency, accuracy, and sustainability in gas consumption monitoring and management.

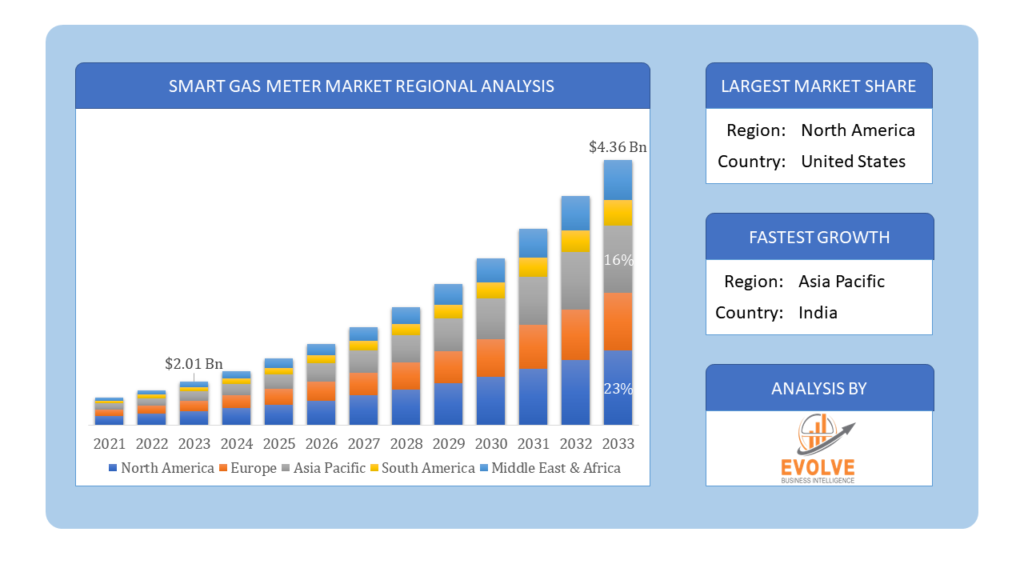

Global Smart Gas Meter Market Regional Analysis

Based on region, the global Smart Gas Meter market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. Asia-Pacific is projected to dominate the use of the Smart Gas Meter market followed by the North America and Europe regions.

Smart Gas Meter Asia-Pacific Market

Smart Gas Meter Asia-Pacific Market

Asia-Pacific holds a dominant position in the Smart Gas Meter Market. The market for smart gas meters in Asia-Pacific, which was valued at USD 1.23 billion in 2021, is anticipated to rise at a substantial CAGR during the course of the research. In the Asia Pacific region, China dominates the market for smart gas meters. The country saw success with the installation of its smart electric meters. The adoption of smart gas meters has increased due to rising energy use and local efforts to cut greenhouse gas emissions.

Smart Gas Meter North America Market

The North America region has indeed emerged as the fastest-growing market for the Smart Gas Meter industry. From 2022 to 2030, the North American smart gas meter market is anticipated to expand at the quickest rate. The US is now among the top gas producers in the world as a result of initiatives to encourage gas use and upgrade antiquated infrastructure with newer technology. Furthermore, the smart gas meter market in the US had the biggest market share, while the market in Canada was expanding at the quickest rate in the North American continent.

Competitive Landscape

The global Smart Gas Meter market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Honeywell International Inc.

- Itron Inc.

- Landis+Gyr

- Schneider Electric SA

- Siemens AG

- Badger Meter

- EDMI

- Sensus

- Aclara Technologies

- APATOR SA.

Key Development

In August 2022, Honeywell International Inc. introduced advanced smart gas metering technology, enhancing efficiency and accuracy in gas consumption monitoring, thereby consolidating its position as a leader in the smart meter market.

Scope of the Report

Global Smart Gas Meter Market, by Product

- Automated Metering Infrastructure (AMI)

- Automated Meter Reading (AMR)

Global Smart Gas Meter Market, by Application

- Residential

- Industrial

- Commercial

Global Smart Gas Meter Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $4.36 Billion/strong> |

| CAGR | 5.21% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Honeywell International Inc., Itron Inc., Landis+Gyr, Schneider Electric SA, Siemens AG, Badger Meter, EDMI, Sensus, Aclara Technologies, APATOR SA |

| Key Market Opportunities | • Needs for efficient energy usage |

| Key Market Drivers | • Government roll outs Increasing investment in smart grid projects |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Smart Gas Meter market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Smart Gas Meter market historical market size for the year 2021, and forecast from 2023 to 2033

- Smart Gas Meter market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Smart Gas Meter market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

1.What is the study period of this market?

- The study period of the global Smart Gas Meter market is 2021- 2033

2.What is the growth rate of the global Smart Gas Meter market?

- The global Smart Gas Meter market is growing at a CAGR of 5.21% over the next 10 years

3.Which region has the highest growth rate in the market of Frozen Food?

- North America is expected to register the highest CAGR during 2023-2033

4.Which region has the largest share of the global Smart Gas Meter market?

- Asia Pacific holds the largest share in 2022

5.Who are the key players in the global Smart Gas Meter market?

Honeywell International Inc., Itron Inc., Landis+Gyr, Schneider Electric SA, Siemens AG, Badger Meter, EDMI, Sensus, Aclara Technologies, and APATOR SA. are the major companies operating in the market

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw Applications Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Smart Gas Meter Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Smart Gas Meter Market 4.8. Import Analysis of the Smart Gas Meter Market 4.9. Export Analysis of the Smart Gas Meter Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Smart Gas Meter Market, By Product Type 6.1. Introduction 6.2. Automated Metering Infrastructure (AMI) 6.3. Automated Meter Reading (AMR) Chapter 7. Global Smart Gas Meter Market, By Application 7.1. Introduction 7.2. Residential 7.3. Industrial 7.4. Commercial Chapter 8. Global Smart Gas Meter Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.5. Market Size and Forecast, By Application, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By Application, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By Application, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By Application, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By Application, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By Application, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By Application, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By Application, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By Application, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By Application, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By Application, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By Application, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By Application, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By Application, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By Application, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By Application, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Honeywell International Inc. 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Itron Inc. 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Landis+Gyr 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Schneider Electric SA 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Siemens AG 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Badger Meter 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. EDMI 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Sensus 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Aclara Technologies 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. APATOR SA. 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology