Semiconductor Manufacturing Equipment Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

Semiconductor Manufacturing Equipment Market Research Report: Information By Supply Chain Participant (OSAT Companies, IDM firms, Foundries), By Fab Facility Equipment (Automation, Chemical Control, Gas Control, Others), By Product (Memory, Foundry, Logic, MPU, Discrete, Others), By Front-end Equipment (Lithography, Wafer Surface Conditioning, Deposition, Cleaning, Others), By Back-end Equipment (Assembly and Packaging, Dicing, Bonding, Metrology, Testing), and by Region — Forecast till 2033

Page: 141

Semiconductor Manufacturing Equipment Market Overview

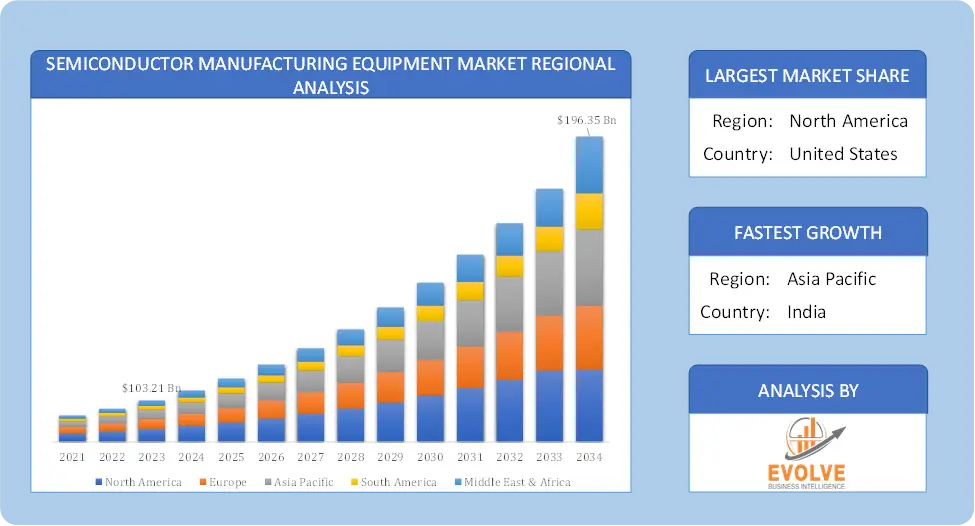

The Semiconductor Manufacturing Equipment Market Size is expected to reach USD 196.35 Billion by 2034. The Semiconductor Manufacturing Equipment Market industry size accounted for USD 103.21 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 9.95% from 2021 to 2034. The Semiconductor Manufacturing Equipment (SME) Market encompasses the industry involved in producing the machinery and tools used to fabricate semiconductor devices. These devices are crucial components in a wide range of electronic products, including computers, smartphones, and consumer electronics.

The semiconductor manufacturing equipment market is a dynamic and highly competitive industry that plays a crucial role in driving technological innovation and economic growth.

Global Semiconductor Manufacturing Equipment Market Synopsis

Semiconductor Manufacturing Equipment Market Dynamics

Semiconductor Manufacturing Equipment Market Dynamics

The major factors that have impacted the growth of Semiconductor Manufacturing Equipment Market are as follows:

Drivers:

Ø Technological Advancements

The push towards smaller, more powerful semiconductor devices drives demand for advanced manufacturing equipment capable of producing smaller process nodes (e.g., 7nm, 5nm). Innovations in semiconductor technologies, such as EUV (Extreme Ultraviolet) lithography, drive the need for sophisticated equipment to keep up with new manufacturing techniques. Semiconductor companies are investing in new manufacturing facilities and expanding existing ones to meet growing demand, which drives the need for new equipment. Efforts by countries to build or strengthen their semiconductor manufacturing capabilities can lead to increased investment in SME.

Restraint:

- Perception of High Capital Investment

The initial capital required to invest in advanced semiconductor manufacturing equipment is substantial, which can be a barrier for new entrants and smaller companies. Continuous research and development to keep up with technological advancements require significant financial resources. Economic downturns and market volatility can impact semiconductor demand and, in turn, affect investment in new manufacturing equipment. The semiconductor industry often experiences cyclical demand patterns, which can lead to fluctuations in equipment orders and revenue.

Opportunity:

⮚ Growth in Electronics and Computing

The continuous demand for more advanced and efficient consumer electronics (smartphones, tablets, wearables) drives the need for cutting-edge manufacturing equipment. The expanding market for HPC systems, driven by data centers and AI Application, creates demand for advanced semiconductor manufacturing solutions. The integration of automation and artificial intelligence in manufacturing processes can enhance efficiency and precision, opening new avenues for SME development. Developing equipment that supports energy efficiency and reduces environmental impact aligns with global sustainability goals and presents opportunities for innovation.

Semiconductor Manufacturing Equipment Market Segment Overview

By Supply Chain Participant

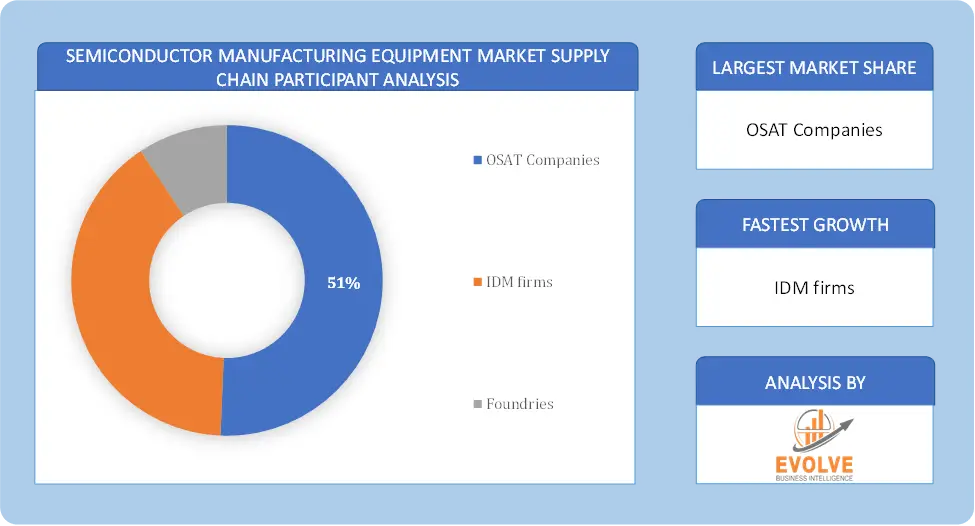

Based on Supply Chain Participant, the market is segmented based on OSAT Companies, IDM firms and Foundries. The IDM firms segment dominant the market. Integrated device manufacturer (IDM) firms represent the largest segment. IDM firms manage the entire semiconductor manufacturing process, from design to fabrication and assembly, offering a high level of control over product quality and supply chain efficiency. Their comprehensive approach, which includes both design and manufacturing capabilities under one roof, caters to a wide range of industries and applications.

Based on Supply Chain Participant, the market is segmented based on OSAT Companies, IDM firms and Foundries. The IDM firms segment dominant the market. Integrated device manufacturer (IDM) firms represent the largest segment. IDM firms manage the entire semiconductor manufacturing process, from design to fabrication and assembly, offering a high level of control over product quality and supply chain efficiency. Their comprehensive approach, which includes both design and manufacturing capabilities under one roof, caters to a wide range of industries and applications.

By Fab Facility Equipment

Based on Fab Facility Equipment, the market segment has been divided into Automation, Chemical Control, Gas Control and Others. The automation segment dominant the market. Automation in fab facilities is crucial for enhancing efficiency, precision, and scalability in semiconductor manufacturing. This segment includes advanced robotics, software systems, and automated material handling systems, which are integral for managing the complex and delicate processes in chip fabrication.

By Product

Based on Product, the market segment has been divided into Memory, Foundry, Logic, MPU, Discrete and Others. The memory segment dominant the market. This dominance is attributed to the widespread use of memory chips in various electronic devices, from smartphones and computers to servers and IoT devices. Memory components, including DRAM, SRAM, and flash memory, are essential for data storage and retrieval. The ever-increasing data generation and consumption, coupled with advancements in cloud computing and AI technologies, have significantly driven the demand for high-capacity and high-speed memory solutions, solidifying this segment’s leading position in the semiconductor market.

By Front-end Equipment

Based on Front-end Equipment, the market segment has been divided into Lithography, Wafer Surface Conditioning, Deposition, Cleaning and Others. The lithography segment dominant the market as it is a fundamental process in semiconductor manufacturing used to transfer circuit patterns onto semiconductor wafers. It plays a crucial role in defining the feature size and layout of integrated circuits (ICs). As semiconductor technology advances towards smaller nodes, the demand for high-resolution lithography equipment increases, driving market growth. Lithography is a fundamental process in semiconductor manufacturing used to transfer circuit patterns onto semiconductor wafers.

By Back-end Equipment

Based on Back-end Equipment, the market segment has been divided into Assembly and Packaging, Dicing, Bonding, Metrology and Testing. Testing equipment dominant the market, underlining its critical role in ensuring the functionality and reliability of semiconductor devices. This segment encompasses a range of equipment used for electrical testing of wafers and individual chips to identify defects and verify performance against specifications. The demand for testing equipment is driven by the increasing complexity of semiconductor devices and the need for high precision in performance, making rigorous testing essential to maintain quality standards in the rapidly evolving electronics industry.

Global Semiconductor Manufacturing Equipment Market Regional Analysis

Based on region, the global Semiconductor Manufacturing Equipment Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Semiconductor Manufacturing Equipment Market followed by the Asia-Pacific and Europe regions.

Semiconductor Manufacturing Equipment North America Market

Semiconductor Manufacturing Equipment North America Market

North America holds a dominant position in the Semiconductor Manufacturing Equipment Market. The U.S. is known for its strong focus on research and development in semiconductor technology and equipment. Companies like Applied Materials, Lam Research, and KLA are based here and there is increasing investment in semiconductor manufacturing facilities and R&D centers, contributing to the growth of the SME market in North America.

Semiconductor Manufacturing Equipment Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Semiconductor Manufacturing Equipment Market industry. APAC, particularly Taiwan and South Korea, is a major hub for semiconductor manufacturing, with leading companies like TSMC, Samsung, and GlobalFoundries based in this region. China has been heavily investing in expanding its domestic semiconductor manufacturing capabilities, including establishing new fabs and upgrading existing facilities and rising demand for consumer electronics, automotive electronics, and IoT devices drives the need for advanced semiconductor manufacturing equipment.

Competitive Landscape

The global Semiconductor Manufacturing Equipment Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Adams Lithographing

- AM Lithography Corporation

- Canon Inc

- Energetiq Technology

- Gigaphoton Inc.

- Inpria Corp

- Mapper Lithography

- Rudolph Technologies

- NuFlare Technology Inc

- Toshiba Corporation.

Recent Developments

In March 2023, SCREEN PE Solutions Co. Ltd., a subsidiary of SCREEN Holdings Co. Ltd., launched the Ledia 7F-L direct imaging system. Designed by SCREEN PE, this latest model addresses the rising demand for accurate pattern appearance on large-sized substrates with a particular focus on applications in IoT infrastructure and telecommunications.

Scope of the Report

Global Semiconductor Manufacturing Equipment Market, by Supply Chain Participant

- OSAT Companies

- IDM firms

- Foundries

Global Semiconductor Manufacturing Equipment Market, by Fab Facility

- Automation

- Chemical Control

- Gas Control

- Others

Global Semiconductor Manufacturing Equipment Market, by Product

- Memory

- Foundry

- Logic

- MPU

- Discrete

- Others

Global Semiconductor Manufacturing Equipment Market, by Front-end Equipment

- Lithography

- Wafer Surface Conditioning

- Deposition

- Cleaning

- Others

Global Semiconductor Manufacturing Equipment Market, by Back-end Equipment

- Assembly and Packaging

- Dicing

- Bonding

- Metrology

- Testing

Global Semiconductor Manufacturing Equipment Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $196.35 Billion |

| CAGR | 9.95% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Supply Chain Participant, Fab Facility Equipment, Product, Front-end Equipment, Back-end Equipment |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Adams Lithographing, AM Lithography Corporation, Canon Inc, Energetiq Technology, Gigaphoton Inc., Inpria Corp, Mapper Lithography, Rudolph Technologies, NuFlare Technology Inc and Toshiba Corporation |

| Key Market Opportunities | • Growth in Electronics and Computing |

| Key Market Drivers | • Technological Advancements • Increased Investment in Semiconductor Manufacturing |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Semiconductor Manufacturing Equipment Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Semiconductor Manufacturing Equipment Market historical market size for the year 2021, and forecast from 2023 to 2033

- Semiconductor Manufacturing Equipment Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Semiconductor Manufacturing Equipment Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Semiconductor Manufacturing Equipment Market is 2021- 2033

What is the growth rate of the global Semiconductor Manufacturing Equipment Market?

The global Semiconductor Manufacturing Equipment Market is growing at a CAGR of 9.95% over the next 10 years

Which region has the highest growth rate in the market of Semiconductor Manufacturing Equipment Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Semiconductor Manufacturing Equipment Market?

North America holds the largest share in 2022

Who are the key players in the global Semiconductor Manufacturing Equipment Market?

Adams Lithographing, AM Lithography Corporation, Canon Inc, Energetiq technology, Gigaphoton Inc., Inpria Corp, Mapper Lithography, Rudolph Technologies, NuFlare Technology Inc and Toshiba Corporation. are the major companies operating in the market

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw Material Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. Front-end Equipmentr 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on 3D Scanning Market 4.3.1. Impact on Market Size 4.3.2. Front-end Equipment Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges Chapter 6. Global Semiconductor Manufacturing Equipment Market, By Supply Chain Participant 6.1. Introduction 6.2. OSAT Companies 6.3. IDM firms 6.4. Foundries Chapter 7. Global Semiconductor Manufacturing Equipment Market, By Fab Facility Equipment 7.1. Introduction 7.2. Automation 7.3. Chemical control 7.4. Gas control 7.5. Others Chapter 8. Global Semiconductor Manufacturing Equipment Market, By Product 8.1. Introduction 8.2. Memory 8.3. Foundry 8.4. Logic 8.5. MPU 8.6. Discrete 8.7. Others Chapter 9. Global Semiconductor Manufacturing Equipment Market, By Front-end Equipment 9.1. Introduction 9.2. Lithography 9.3. Wafer Surface Conditioning 9.4. Deposition 9.5. Cleaning 9.6. Others Chapter 10. Global Semiconductor Manufacturing Equipment Market, By Back-end Equipment 10.1. Introduction 10.2. Assembly and Packaging 10.3. Dicing 10.4. Bonding 10.5. Metrology 10.6. Testing Chapter 11. Global Semiconductor Manufacturing Equipment Market, By Region 11.1. Introduction 11.2. North America 11.2.1. Introduction 11.2.2. Driving Factors, Opportunity Analyzed and Key Trends 11.2.3. Market Size and Forecast, By Country, 2020-2028 11.2.4. Market Size and Forecast, By Supply Chain Participant, 2020-2028 11.2.5. Market Size and Forecast, By Range, 2020-2028 11.2.6. Market Size and Forecast, By Service, 2020-2028 11.2.7. Market Size and Forecast, By Type, 2020-2028 11.2.8. Market Size and Forecast, By Products, 2020-2028 11.2.9. US 11.2.9.1. Introduction 11.2.9.2. Driving Factors, Opportunity Analyzed and Key Trends 11.2.9.3. Market Size and Forecast, By Supply Chain Participant, 2020-2028 11.2.9.4. Market Size and Forecast, By Range, 2020-2028 11.2.9.5. Market Size and Forecast, By Service, 2020-2028 11.2.9.6. Market Size and Forecast, By Type, 2020-2028 11.2.9.7. Market Size and Forecast, By Products, 2020-2028 11.2.10. Canada 11.2.10.1. Introduction 11.2.10.2. Driving Factors, Opportunity Analyzed and Key Trends 11.2.10.3. Market Size and Forecast, By Supply Chain Participant, 2020-2028 11.2.10.4. Market Size and Forecast, By Range, 2020-2028 11.2.10.5. Market Size and Forecast, By Service, 2020-2028 11.2.10.6. Market Size and Forecast, By Type, 2020-2028 11.2.10.7. Market Size and Forecast, By Products, 2020-2028 11.3. Europe 11.3.1. Introduction 11.3.2. Driving Factors, Opportunity Analyzed and Key Trends 11.3.3. Market Size and Forecast, By Country, 2020-2028 11.3.4. Market Size and Forecast, By Supply Chain Participant, 2020-2028 11.3.5. Market Size and Forecast, By Range, 2020-2028 11.3.6. Market Size and Forecast, By Service, 2020-2028 11.3.7. Market Size and Forecast, By Type, 2020-2028 11.3.8. Market Size and Forecast, By Products, 2020-2028 11.3.9. Germany 11.3.9.1. Introduction 11.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 11.3.9.3. Market Size and Forecast, By Supply Chain Participant, 2020-2028 11.3.9.4. Market Size and Forecast, By Range, 2020-2028 11.3.9.5. Market Size and Forecast, By Service, 2020-2028 11.3.9.6. Market Size and Forecast, By Type, 2020-2028 11.3.9.7. Market Size and Forecast, By Products, 2020-2028 11.3.10. France 11.3.10.1. Introduction 11.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 11.3.10.3. Market Size and Forecast, By Supply Chain Participant, 2020-2028 11.3.10.4. Market Size and Forecast, By Range, 2020-2028 11.3.10.5. Market Size and Forecast, By Service, 2020-2028 11.3.10.6. Market Size and Forecast, By Type, 2020-2028 11.3.10.7. Market Size and Forecast, By Products, 2020-2028 11.3.11. UK 11.3.11.1. Introduction 11.3.11.2. Driving Factors, Opportunity Analyzed and Key Trends 11.3.11.3. Market Size and Forecast, By Supply Chain Participant, 2020-2028 11.3.11.4. Market Size and Forecast, By Range, 2020-2028 11.3.11.5. Market Size and Forecast, By Service, 2020-2028 11.3.11.6. Market Size and Forecast, By Type, 2020-2028 11.3.11.7. Market Size and Forecast, By Products, 2020-2028 11.3.12. Nordic Region 11.3.12.1. Introduction 11.3.12.2. Driving Factors, Opportunity Analyzed and Key Trends 11.3.12.3. Market Size and Forecast, By Supply Chain Participant, 2020-2028 11.3.12.4. Market Size and Forecast, By Range, 2020-2028 11.3.12.5. Market Size and Forecast, By Service, 2020-2028 11.3.12.6. Market Size and Forecast, By Type, 2020-2028 11.3.12.7. Market Size and Forecast, By Products, 2020-2028 11.3.13. Rest Of Europe 11.3.13.1. Introduction 11.3.13.2. Driving Factors, Opportunity Analyzed and Key Trends 11.3.13.3. Market Size and Forecast, By Supply Chain Participant, 2020-2028 11.3.13.4. Market Size and Forecast, By Range, 2020-2028 11.3.13.5. Market Size and Forecast, By Service, 2020-2028 11.3.13.6. Market Size and Forecast, By Type, 2020-2028 11.3.13.7. Market Size and Forecast, By Products, 2020-2028 11.4. Asia-Pacific 11.4.1. Introduction 11.4.2. Driving Factors, Opportunity Analyzed and Key Trends 11.4.3. Market Size and Forecast, By Country, 2020-2028 11.4.4. Market Size and Forecast, By Supply Chain Participant, 2020-2028 11.4.5. Market Size and Forecast, By Range, 2020-2028 11.4.6. Market Size and Forecast, By Service, 2020-2028 11.4.7. Market Size and Forecast, By Type, 2020-2028 11.4.8. Market Size and Forecast, By Products, 2020-2028 11.4.9. China 11.4.9.1. Introduction 11.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 11.4.9.3. Market Size and Forecast, By Supply Chain Participant, 2020-2028 11.4.9.4. Market Size and Forecast, By Range, 2020-2028 11.4.9.5. Market Size and Forecast, By Service, 2020-2028 11.4.9.6. Market Size and Forecast, By Type, 2020-2028 11.4.9.7. Market Size and Forecast, By Products, 2020-2028 11.4.10. India 11.4.10.1. Introduction 11.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 11.4.10.3. Market Size and Forecast, By Supply Chain Participant, 2020-2028 11.4.10.4. Market Size and Forecast, By Range, 2020-2028 11.4.10.5. Market Size and Forecast, By Service, 2020-2028 11.4.10.6. Market Size and Forecast, By Type, 2020-2028 11.4.10.7. Market Size and Forecast, By Products, 2020-2028 11.4.11. Japan 11.4.11.1. Introduction 11.4.11.2. Driving Factors, Opportunity Analyzed and Key Trends 11.4.11.3. Market Size and Forecast, By Supply Chain Participant, 2020-2028 11.4.11.4. Market Size and Forecast, By Range, 2020-2028 11.4.11.5. Market Size and Forecast, By Service, 2020-2028 11.4.11.6. Market Size and Forecast, By Type, 2020-2028 11.4.11.7. Market Size and Forecast, By Products, 2020-2028 11.4.12. South Korea 11.4.12.1. Introduction 11.4.12.2. Driving Factors, Opportunity Analyzed and Key Trends 11.4.12.3. Market Size and Forecast, By Supply Chain Participant, 2020-2028 11.4.12.4. Market Size and Forecast, By Range, 2020-2028 11.4.12.5. Market Size and Forecast, By Service, 2020-2028 11.4.12.6. Market Size and Forecast, By Type, 2020-2028 11.4.12.7. Market Size and Forecast, By Products, 2020-2028 11.4.13. Rest Of Asia-Pacific 11.4.13.1. Introduction 11.4.13.2. Driving Factors, Opportunity Analyzed and Key Trends 11.4.13.3. Market Size and Forecast, By Supply Chain Participant, 2020-2028 11.4.13.4. Market Size and Forecast, By Range, 2020-2028 11.4.13.5. Market Size and Forecast, By Service, 2020-2028 11.4.13.6. Market Size and Forecast, By Type, 2020-2028 11.4.13.7. Market Size and Forecast, By Products, 2020-2028 11.5. Rest Of The World (RoW) 11.5.1. Introduction 11.5.2. Driving Factors, Opportunity Analyzed and Key Trends 11.5.3. Market Size and Forecast, By Supply Chain Participant, 2020-2028 11.5.4. Market Size and Forecast, By Range, 2020-2028 11.5.5. Market Size and Forecast, By Service, 2020-2028 11.5.6. Market Size and Forecast, By Type, 2020-2028 11.5.7. Market Size and Forecast, By Products, 2020-2028 Chapter 12. Company Landscape 12.1. Introduction 12.2. Vendor Share Analysis 12.3. Key Development Analysis 12.4. Competitor Dashboard Chapter 13. Company Profiles 13.1. Adams Lithographing. 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Financial – Existing/Funding 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. AM Lithography Corporation. 13.2.1. Business Overview 13.2.2. Financial Analysis 13.2.2.1. Financial – Existing/Funding 13.2.3. Product Portfolio 13.2.4. Recent Development and Strategies Adopted 13.2.5. SWOT Analysis 13.3. Canon Inc. 13.3.1. Business Overview 13.3.2. Financial Analysis 13.3.2.1. Financial – Existing/Funding 13.3.3. Product Portfolio 13.3.4. Recent Development and Strategies Adopted 13.3.5. SWOT Analysis 13.4. Energetiq Technology 13.4.1. Business Overview 13.4.2. Financial Analysis 13.4.2.1. Financial – Existing/Funding 13.4.3. Product Portfolio 13.4.4. Recent Development and Strategies Adopted 13.4.5. SWOT Analysis 13.5. Gigaphoton Inc. 13.5.1. Business Overview 13.5.2. Financial Analysis 13.5.2.1. Financial – Existing/Funding 13.5.3. Product Portfolio 13.5.4. Recent Development and Strategies Adopted 13.5.5. SWOT Analysis 13.6. Inpria Corp 13.6.1. Business Overview 13.6.2. Financial Analysis 13.6.2.1. Financial – Existing/Funding 13.6.3. Product Portfolio 13.6.4. Recent Development and Strategies Adopted 13.6.5. SWOT Analysis 13.7. Mapper Lithography 13.7.1. Business Overview 13.7.2. Financial Analysis 13.7.2.1. Financial – Existing/Funding 13.7.3. Product Portfolio 13.7.4. Recent Development and Strategies Adopted 13.7.5. SWOT Analysis 13.8. Rudolph Technologies 13.8.1. Business Overview 13.8.2. Financial Analysis 13.8.2.1. Financial – Existing/Funding 13.8.3. Product Portfolio 13.8.4. Recent Development and Strategies Adopted 13.8.5. SWOT Analysis 13.9. NuFlare Technology Inc 13.9.1. Business Overview 13.9.2. Financial Analysis 13.9.2.1. Financial – Existing/Funding 13.9.3. Product Portfolio 13.9.4. Recent Development and Strategies Adopted 13.9.5. SWOT Analysis 13.10. Toshiba Corporation. 13.10.1. Business Overview 13.10.2. Financial Analysis 13.10.2.1. Financial – Existing/Funding 13.10.3. Product Portfolio 13.10.4. Recent Development and Strategies Adopted 13.10.5. SWOT Analysis Chapter 14. Key Takeaways

Connect to Analyst

Research Methodology