Seed processing Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

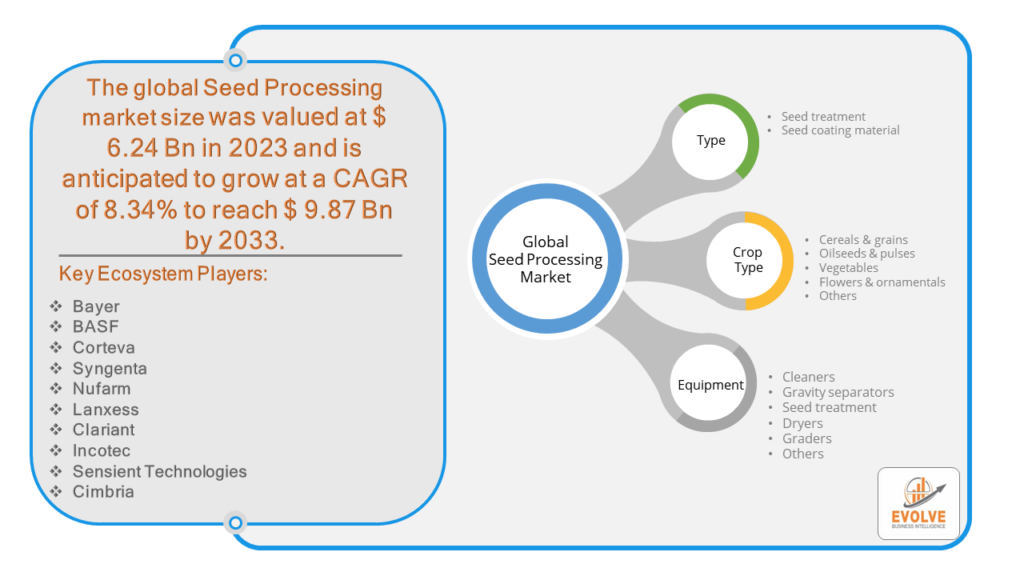

Seed processing Market Research Report: by Type (Seed treatment, Seed coating material), By Crop Type (Cereals & grains, Oilseeds & pulses, Vegetables, Flowers & ornamentals, Others, ), By Equipment (Cleaners, Gravity separators, Seed treatment, Dryers, Graders, Others,), and by Region — Forecast till 2033.

Page: 118

Seed processing Market Overview

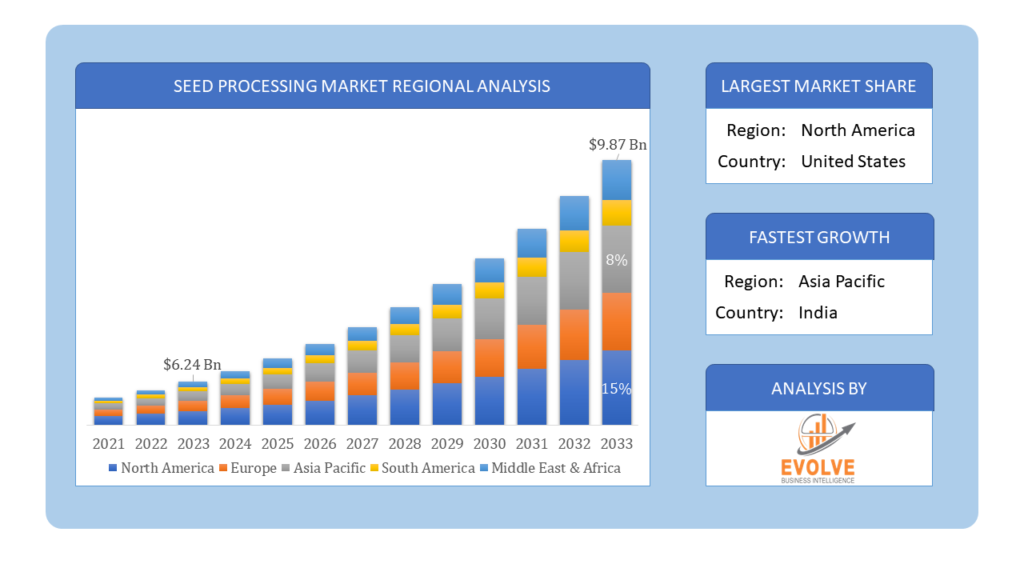

The Seed processing Market Size is expected to reach USD 9.87 Billion by 2033. The Seed processing industry size accounted for USD 6.24 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 8.34% from 2023 to 2033. The seed processing market involves preparing harvested seeds for marketing to farmers through processes like drying, threshing, and treatment. It aims to clean seeds, enhance quality, and ensure viability for planting. Key aspects include seed treatment and coating materials, catering to various crop types like vegetables, pulses, and cereals. Major players in the market include Bayer AG, BASF SE, Syngenta AG, Nufarm Ltd., and Clariant AG. The market is witnessing significant growth driven by factors like global population increase, agricultural modernization, and enhanced seed quality standards, with a projected market size of $13.11 billion in 2024 and expected growth to $19.64 billion by 2028.

Global Seed processing Market Synopsis

The Seed processing market experienced a positive impact due to the COVID-19 pandemic. Due to supply chain disruptions brought on by the COVID-19 epidemic, there are either shortages or decreased demand in the market for seed processing. Spending by consumers and businesses has decreased significantly as a result of the travel restrictions and social distancing measures, and this trend is expected to persist for some time. The epidemic has altered end-user trends and tastes, leading manufacturers, developers, and service providers to implement several measures in an attempt to stabilize their businesses.

Global Seed processing Market Dynamics

The major factors that have impacted the growth of Seed processing are as follows:

Drivers:

⮚ Technological Advancements

Advances in biotechnology, genetic engineering, and seed treatment technologies have revolutionized the seed processing industry. These technologies enable the development of genetically modified seeds, hybrid seeds, and treated seeds with enhanced characteristics such as improved yield, pest resistance, and drought tolerance.

Restraint:

- Climate Change Risks and Uncertainties

Climate change poses risks and uncertainties for agricultural productivity, affecting seed performance and market demand. Erratic weather patterns, extreme temperatures, water scarcity, and the spread of pests and diseases can disrupt seed production cycles, reduce crop yields, and increase production costs, impacting the profitability and stability of the seed processing market.

Opportunity:

⮚ Expansion of Specialty Crop Markets

Growing consumer demand for specialty crops, including fruits, vegetables, and niche crops, presents lucrative opportunities for seed processing companies. By focusing on breeding and processing specialty crop seeds with superior flavor, nutritional value, and shelf-life, companies can tap into premium market segments and capture higher margins compared to commodity crops.

Seed processing Market Segment Overview

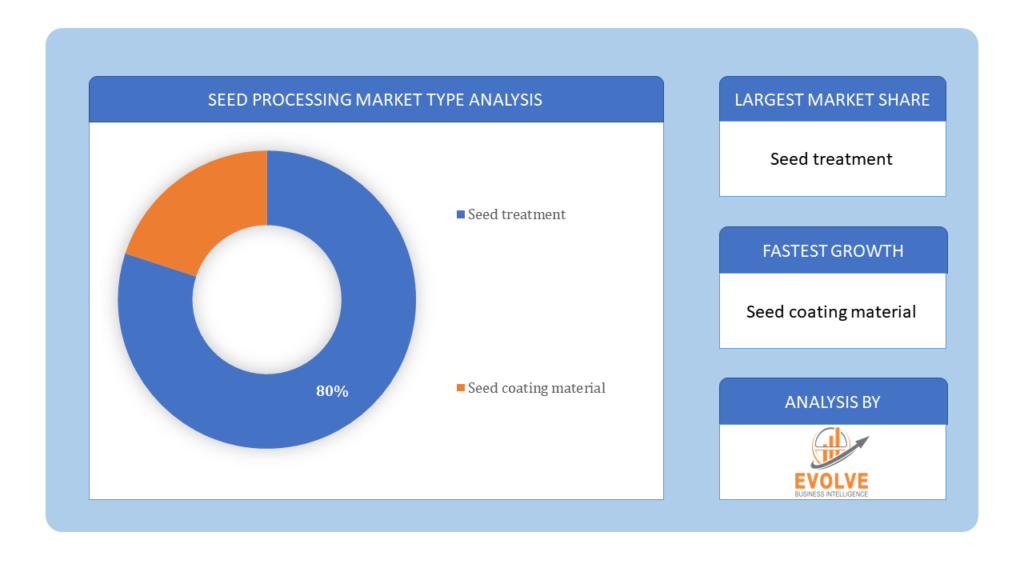

By Type

Based on the Type, the market is segmented based on Seed treatment and Seed coating material. Seed treatment dominates the seed processing market due to its efficacy in protecting seeds from diseases and pests, enhancing germination rates, and improving crop yields. Additionally, it offers cost-effective and environmentally sustainable solutions compared to conventional methods.

Based on the Type, the market is segmented based on Seed treatment and Seed coating material. Seed treatment dominates the seed processing market due to its efficacy in protecting seeds from diseases and pests, enhancing germination rates, and improving crop yields. Additionally, it offers cost-effective and environmentally sustainable solutions compared to conventional methods.

By Crop Type

Based on the Crop Type, the market has been divided into Cereals & grains, Oilseeds & pulses, Vegetables, Flowers & ornamentals, Others. Cereals segment is expected to hold the largest share in the market owing to the government’s strong focus on food security from developing markets.

By Equipment

Based on Equipment, the market has been divided into Cleaners, Gravity separators, Seed treatment, Dryers, Graders and Others. The seed processing equipment segment includes various machines used to prepare harvested seeds for marketing. These machines are designed to dry, clean, size-grade, treat, and package seeds. The air screen cleaner is a crucial machine in every cleaning plant, using screens and aspiration for two separations. Other equipment includes cleaner-cum-graders, which clean and grade dried seeds, and extraction, threshing, enhancement, drying, cleaning, treatment, and transport equipment

Global Seed processing Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of Asia-Pacific is anticipated to dominate the market for the usage of Seed processing, followed by those in North America and Europe.

Seed processing Asia-Pacific Market

Seed processing Asia-Pacific Market

Asia-Pacific dominates the Seed processing market due to several factors. The market for seeds in the Asia-Pacific region will be the largest due to the region’s growing urbanization and agricultural expansion. The adoption of hybrids and increasing rates of seed replacement in vital crops including vegetables, rice, and maize will spur market expansion in this area.

Seed processing North America Market

The Asia-Pacific region has been witnessing remarkable growth in recent years. From 2023 to 2032, the North American Seeds Market is anticipated to develop at the quickest CAGR. This is caused by the rising demand for agricultural products, which is further supported by the government’s supportive policies, extensive R&D, and reasonably priced seed. In addition, the Asia-Pacific region’s fastest-growing market for seeds was Canada, while the United States had the biggest market share.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Bayer, BASF, CORTEVA, Syngenta, and Nufarm are some of the leading players in the global Seed processing Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Bayer

- BASF

- CORTEVA

- Syngenta

- Nufarm

- Lanxess

- Clariant

- Incotec

- Sensient Technologies

Key development:

July 2022: Corteva Agriscience, BASF, and MS Technologies signed Agreement to develop next-generation Enlist E3 soybeans with the nematode-resistant soybean (NRS) trait for farmers in the United States and Canada.

June 2022: A new range of tropicalized lettuce is introduced, which is named Arunas RZ. This is expected to boost the market share of the company.

May 2022: Syngenta Canada has introduced new Pelta seed pelleting technology for canola, which helps in optimizing seed size and uniformity, enabling improved singulation planter performance.

Scope of the Report

Global Seed processing Market, by Type

- Seed treatment

- Seed coating material

Global Seed processing Market, by Crop Type

- Cereals & grains

- Oilseeds & pulses

- Vegetables

- Flowers & ornamentals

- Others

Global Seed processing Market, by Equipment

- Cleaners

- Gravity separators

- Seed treatment

- Dryers

- Graders

- Others

Global Seed processing Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $9.87 Billion |

| CAGR | 8.34% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Crop Type, Equipment |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Bayer, BASF, CORTEVA, Syngenta, Nufarm, Lanxess, Clariant, Incotec, Sensient Technologies, Cimbria. |

| Key Market Opportunities | • Increasing demand for healthy products Demand for organic products |

| Key Market Drivers | • Increasing use of oilseeds Increasing replacement of seeds |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Seed processing Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Seed processing market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Seed processing market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Seed processing Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Seed processing market?

The study period encompasses historical data from 2021 to forecasts extending from 2023 to 2033.

What is the growth rate of the Seed processing market?

The Seed processing market is projected to expand at a compound annual growth rate (CAGR) of 8.34% from 2023 to 2033.

Which region has the highest growth rate in the Seed processing market?

The Asia-Pacific region is expected to exhibit the highest growth rate in the Seed processing market, driven by factors such as urbanization, agricultural expansion, and increasing adoption of hybrids.

Which region has the largest share of the Seed processing market?

Asia-Pacific dominates the Seed processing market, with the largest share attributed to factors like growing urbanization, government support for agriculture, and extensive research and development.

Who are the key players in the Seed processing market?

Key players in the Seed processing market include Bayer, BASF, CORTEVA, Syngenta, Nufarm, Lanxess, Clariant, Incotec, Sensient Technologies, and Cimbria, among others.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Type Segement – Market Opportunity Score 4.1.2. Crop Type Segment – Market Opportunity Score 4.1.3. Equipment Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Seed processing Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Seed processing Market, By Type 7.1. Introduction 7.1.1. Seed treatment 7.1.2. Seed coating material CHAPTER 8. Global Seed processing Market, By Crop Type 8.1. Introduction 8.1.1. Cereals & grains 8.1.2. Oilseeds & pulses 8.1.3. Vegetables 8.1.4. Flowers & ornamentals 8.1.5. Others CHAPTER 9. Global Seed processing Market, By Equipment 9.1. Introduction 9.1.1. Cleaners 9.1.2. Gravity separators 9.1.3. Seed treatment 9.1.4. Dryers 9.1.5. Graders 9.1.6. Others CHAPTER 10. Global Seed processing Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Equipment, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Bayer 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. BASF 13.3. CORTEVA 13.4. Syngenta 13.5. Nufarm 13.6. Lanxess 13.7. Clariant 13.8. Incotec 13.9. Sensient Technologies 13.10. Cimbria

Connect to Analyst

Research Methodology