Radio Access Network Market Analysis and Global Forecast 2024-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

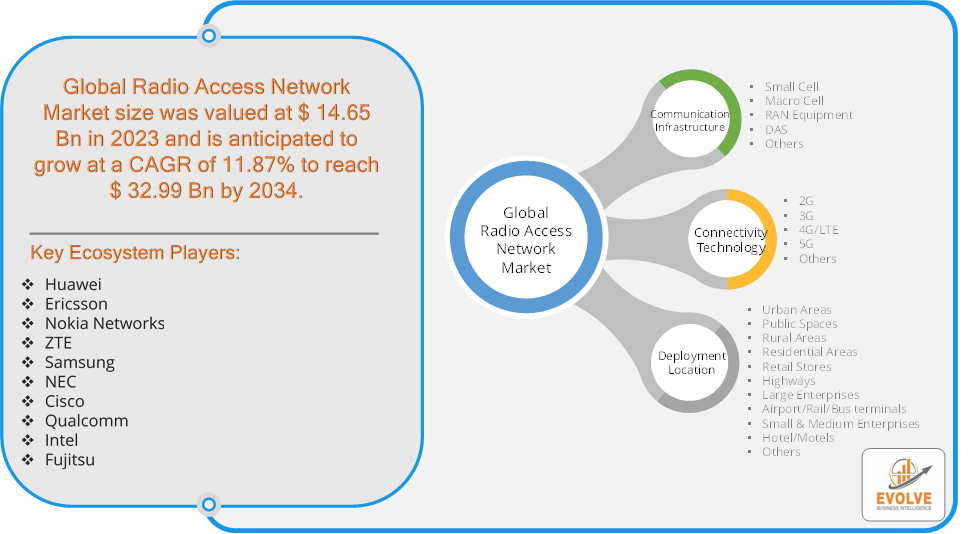

Radio Access Network Market Research Report: Information By Communication Infrastructure (Small Cell, Macro Cell, RAN Equipment, DAS, Others), By Connectivity Technology (2G, 3G, 4G/LTE, 5G, Others), By Deployment Location (Urban Areas, Public Spaces, Rural Areas, Residential Areas, Retail Stores, Highways, Large Enterprises, Airport/Rail/Bus terminals, Small & Medium Enterprises, Hotel/Motels, Others), and by Region — Forecast till 2034

Page: 120

Radio Access Network Market Overview

The Radio Access Network Market size accounted for USD 14.65 Billion in 2023 and is estimated to account for 16.36 Billion in 2024. The Market is expected to reach USD 32.99 Billion by 2034 growing at a compound annual growth rate (CAGR) of 11.87% from 2024 to 2034. The Radio Access Network (RAN) Market refers to the global industry focused on the development, deployment, and sale of technology and infrastructure that enable mobile devices to connect with telecom networks. The RAN is a crucial component of wireless communication systems, primarily responsible for transmitting data between mobile devices (such as smartphones and IoT devices) and the core network.

The market is driven by the rise of 5G technology, increasing data traffic, and demand for high-speed and low-latency communication services. The RAN market is a dynamic and rapidly evolving sector that plays a vital role in our connected world.

Global Radio Access Network Market Synopsis

Radio Access Network Market Dynamics

Radio Access Network Market Dynamics

The major factors that have impacted the growth of Radio Access Network Market are as follows:

Drivers:

Ø Increasing Mobile Data Traffic

With the growing use of smartphones, streaming services, and mobile apps, mobile data consumption has skyrocketed. This has led to higher demand for improved network capacity and coverage, boosting investments in RAN technology. The expanding use of IoT devices in various sectors like smart cities, industrial automation, and connected cars demands robust wireless networks. This trend increases the need for RAN infrastructure to handle the diverse and high-volume traffic generated by IoT devices. Constant technological advancements in wireless communication (e.g., LTE-Advanced, 4G enhancements) and network upgrades also push the demand for modern RAN solutions to ensure higher performance and efficiency in existing infrastructure.

Restraint:

- Perception of High Deployment and Infrastructure Costs

Implementing new RAN infrastructure, particularly for 5G, requires significant capital expenditure (CapEx) for base stations, antennas, and small cells. Building dense networks for 5G, especially in urban areas, can be very expensive, limiting deployment in some regions and for smaller telecom operators. The complexity of integrating new RAN technologies, particularly in transitioning from 4G to 5G, poses a challenge for operators. Ensuring backward compatibility, seamless handovers, and managing multi-vendor environments can slow down network upgrades and deployments.

Opportunity:

⮚ Growing demand for 5G Rollout and Expansion

The ongoing global deployment of 5G networks offers significant opportunities for the RAN market. Telecom operators need to upgrade existing infrastructure and build new small cells and base stations to support higher bandwidth, low latency, and massive device connectivity. The growth of 5G standalone (SA) networks further drives investment in advanced RAN solutions. There is a growing focus on energy-efficient and sustainable RAN solutions. Innovations in energy management, solar-powered base stations, and low-power network components provide opportunities for companies to differentiate their offerings while addressing environmental concerns.

Radio Access Network Market Segment Overview

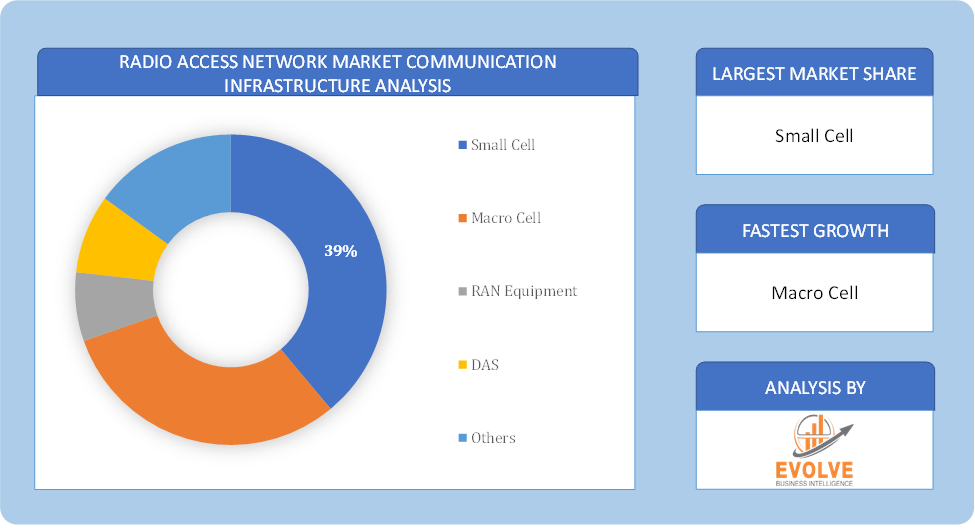

By Communication Infrastructure

By Communication Infrastructure

Based on Communication Infrastructure, the market is segmented based on Small Cell, Macro Cell, RAN Equipment, DAS and Others. The Small Cell segment dominant the market. Mobile operators are facing a hurdle while providing high data transfer rate services. To accomplish this, mobile network operators are mainly focusing on enhancing their network. To address these needs, operators are developing and deploying small cells at a faster pace and on a high scale. The adoption of small cells would increase at a faster pace to meet the increasing consumer demand, as small cells help increase the network capacity.

By Connectivity Technology

Based on Connectivity Technology, the market segment has been divided into 2G, 3G, 4G/LTE, 5G and Others. The 5G segment dominant the market. The need to provide a rapid and high-capacity network is an essential factor in the demand for broadband services on mobile networks. To accelerate the development of 5G networking technologies, it is expected that there will be increased demand for High-Speed Data Communication. The demand for this sector is increasing as a result of the rising Internet of Things and the growth in telecommunications.

By Deployment Location

Based on Deployment Location, the market segment has been divided into Urban Areas, Public Spaces, Rural Areas, Residential Areas, Retail Stores, Highways, Large Enterprises, Airport/Rail/Bus terminals, Small & Medium Enterprises, Hotel/Motels and Others. The urban area location segment dominant the market. The factors that can be attributed to the increase in urban populations across the world. In highly populated urban areas, subscribers are densely concentrated and utilize data services more extensively.

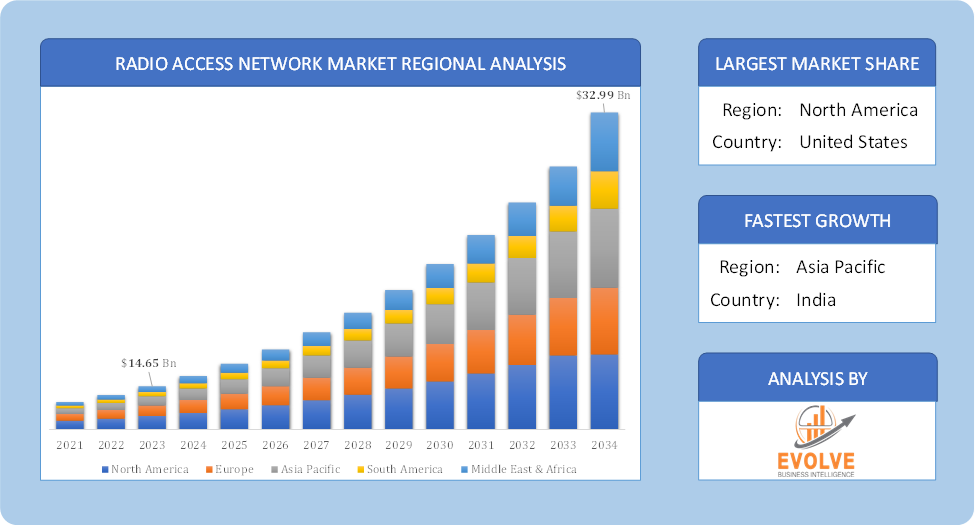

Global Radio Access Network Market Regional Analysis

Based on region, the global Radio Access Network Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Radio Access Network Market followed by the Asia-Pacific and Europe regions.

Radio Access Network North America Market

Radio Access Network North America Market

North America holds a dominant position in the Radio Access Network Market. The RAN market in North America is primarily driven by early 5G deployments and the strong presence of major telecom operators like Verizon, AT&T, and T-Mobile. The region is also home to significant investments in private 5G networks, particularly in industries such as manufacturing, healthcare, and defense and the U.S. government has supported 5G infrastructure through policies and investments aimed at enhancing national competitiveness. Open RAN is also gaining traction due to regulatory backing, creating opportunities for new vendors.

Radio Access Network Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Radio Access Network Market industry. The Asia-Pacific region leads the RAN market, driven by rapid 5G rollouts in countries like China, South Korea, Japan, and India. China, in particular, has aggressively invested in 5G infrastructure, deploying millions of base stations to support both urban and rural connectivity and government policies in countries like China and South Korea are highly supportive of 5G development. Additionally, the region’s tech-savvy population, coupled with the rapid adoption of IoT, smart devices, and edge computing, contributes to market growth.

Competitive Landscape

The global Radio Access Network Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Huawei

- Ericsson

- Nokia Networks

- ZTE

- Samsung

- NEC

- Cisco

- Qualcomm

- Intel

- Fujitsu

Key Development

In October 2021, Rakuten Symphony, Juniper Networks, and Intel Corporation announced a Symware development collaboration. It is a carrier-grade Open RAN (Radio Access Network) solution designed exclusively for mobile network operators to upgrade radio cell sites using the most recent cloud-native architecture.

In August 2020, VMware Inc. announced a partnership with Intel Corporation. The goal of this collaboration is to integrate a software platform specifically designed for virtualized Radio Access Networks (RAN) in order to accelerate the deployment of both 5G and LTE networks.

Scope of the Report

Global Radio Access Network Market, by Communication Infrastructure

- Small Cell

- Macro Cell

- RAN Equipment

- DAS

- Others

Global Radio Access Network Market, by Connectivity Technology

- 2G

- 3G

- 4G/LTE

- 5G

- Others

Global Radio Access Network Market, by Deployment Location

- Urban Areas

- Public Spaces

- Rural Areas

- Residential Areas

- Retail Stores

- Highways

- Large Enterprises

- Airport/Rail/Bus terminals

- Small & Medium Enterprises

- Hotel/Motels

- Others

Global Radio Access Network Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 32.99 Billion |

| CAGR (2024-2034) | 11.87% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Communication Infrastructure, Connectivity Technology, Deployment Location |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Huawei, Ericsson, Nokia Networks, ZTE, Samsung, NEC, Cisco, Qualcomm, Intel and Fujitsu. |

| Key Market Opportunities | · The growing demand for 5G Rollout and Expansion · Sustainability and Green Networks |

| Key Market Drivers | · Increasing Mobile Data Traffic · Ongoing Network Upgrades |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Radio Access Network Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Radio Access Network Market historical market size for the year 2021, and forecast from 2023 to 2033

- Radio Access Network Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Radio Access Network Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Radio Access Network Market is 2024- 2034

What is the growth rate of the global Radio Access Network Market?

The global Radio Access Network Market is growing at a CAGR of 11.87% over the next 10 years

Which region has the highest growth rate in the market of Radio Access Network Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Radio Access Network Market?

North America holds the largest share in 2022

Who are the key players in the global Radio Access Network Market?

Huawei, Ericsson, Nokia Networks, ZTE, Samsung, NEC, Cisco, Qualcomm, Intel and Fujitsu. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Communication Infrastructure Segement – Market Opportunity Score 4.1.2. Connectivity Technology Segment – Market Opportunity Score 4.1.3. Deployment Location Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Radio Access Network Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. Market Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Radio Access Network Market, By Communication Infrastructure 7.1. Introduction 7.1.1. Small Cell 7.1.2. Macro Cell 7.1.3 RAN Equipment 7.1.4 DAS 7.1.5 Others CHAPTER 8 Radio Access Network Market, By Connectivity Technology 8.1. Introduction 8.1.1. 2G 8.1.2. 3G 8.1.3. 4G/LTE 8.1.4. 5G 8.1.5. Others CHAPTER 9. Radio Access Network Market, By Deployment Location 9.1. Introduction 9.1.1. Urban Areas 9.1.2 Public Spaces 9.1.3 Rural Areas 9.1.4. Residential Areas 9.1.5. Retail Stores 9.1.6. Highways 9.1.7. Large Enterprises 9.1.8. Airport/Rail/Bus terminals 9.1.9. Small & Medium Enterprises 9.1.10 Hotel/Motels 9.1.11 Others CHAPTER 10. Radio Access Network Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2024 – 2034($ Million) 10.2.2. North America: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.2.3. North America: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.2.4. North America: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.2.5.2. US: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.2.5.3. US: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2024 – 2034($ Million) 10.3.2. Europe: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.3.3. Europe: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.3.4. Europe: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.3.7.2. France: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.3.7.3. France: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2024 – 2034($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.4.5.2. China: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.4.5.3. China: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.4.7.2. India: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.4.7.3. India: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2024 – 2034($ Million) 10.5.2. South America: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.5.3. South America: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.5.4. South America: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2024 – 2034($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Communication Infrastructure, 2024 – 2034($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Connectivity Technology, 2024 – 2034($ Million) 10.6.9.3.Rest of Middle East & Africa: Market Size and Forecast, By Deployment Location, 2024 – 2034($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Huawei 13.1.1. Hanon Systems 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Ericsson 13.3. Nokia Networks 13.4. ZTE 13.5. Samsung 13.6. NEC 13.7. Cisco 13.8. Qualcomm 13.9 Intel 13.10 Fujitsu

Connect to Analyst

Research Methodology