Private LTE Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

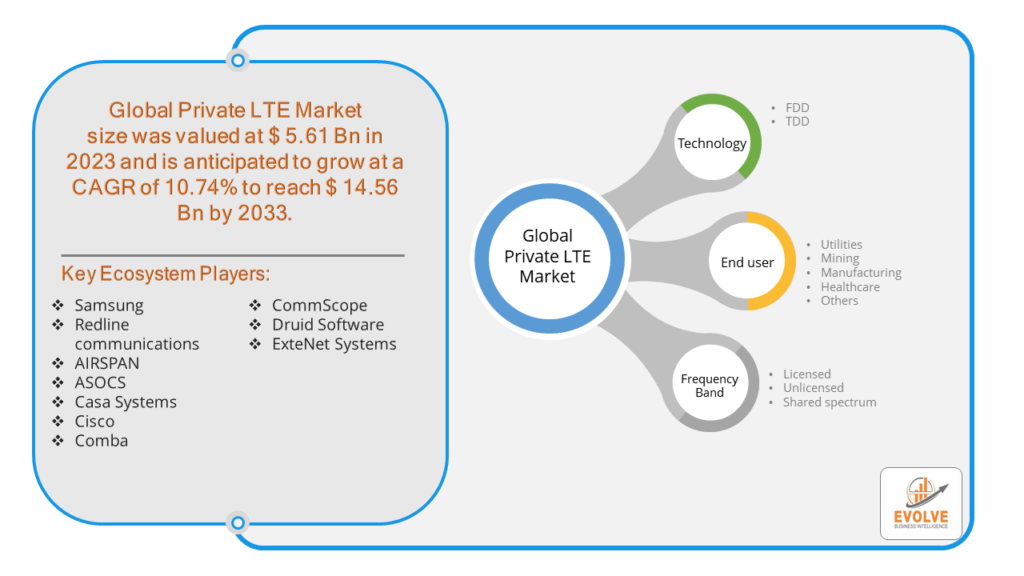

Private LTE Market Research Report: By Technology (FDD, TDD), By End user (Utilities, Mining, Manufacturing, Healthcare, Others), By Frequency Band (Licensed, Unlicensed, Shared spectrum), and by Region — Forecast till 2033

Page: 172

Private LTE Market Overview

The Private LTE Market Size is expected to reach USD 5.61 Billion by 2033. The Private LTE industry size accounted for USD 54.74 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 10.74% from 2023 to 2033. The Private LTE (Long-Term Evolution) market refers to a sector focused on providing dedicated, secure, and reliable wireless communication networks for specific organizations or industries. Unlike public LTE networks operated by telecom carriers, private LTE networks are customized for the unique needs of enterprises, offering enhanced control, security, and performance. These networks are widely used in sectors such as manufacturing, energy, transportation, and public safety, where they support mission-critical applications and IoT deployments. The market is driven by the growing demand for reliable and high-speed wireless connectivity, especially in remote or industrial environments.

Global Private LTE Market Synopsis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the Private LTE market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers to adopt various strategies to stabilize the company.

Global Private LTE Market Dynamics

The major factors that have impacted the growth of Private LTE are as follows:

Drivers:

⮚ Advancements in Wireless Technology

Innovations in LTE and 5G technology have enhanced the capabilities of private networks. Features such as network slicing, enhanced mobile broadband, and ultra-reliable low-latency communications (URLLC) make private LTE networks more efficient and adaptable to various industrial use cases.

Restraint:

- High Initial Deployment Costs

The setup of private LTE networks involves significant capital expenditure on infrastructure, including base stations, core networks, and user equipment. For many enterprises, especially small and medium-sized businesses, these high initial costs can be a considerable barrier to entry.

Opportunity:

⮚ Expansion in Industrial IoT Applications

As industrial IoT (IIoT) continues to grow, the need for reliable and high-performance networks becomes more critical. Private LTE networks can support a wide range of IIoT applications, such as remote monitoring, predictive maintenance, and automated manufacturing processes, leading to improved operational efficiency and productivity.

Private LTE Market Segment Overview

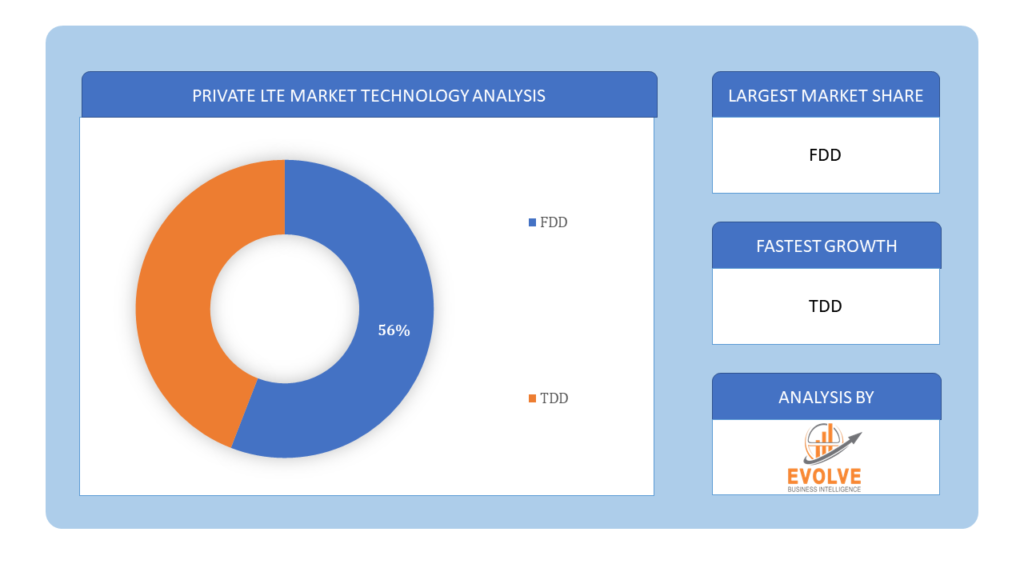

By Technology

Based on the Technology, the market is segmented based on FDD, TDD. In the Private LTE market, the FDD (Frequency Division Duplex) segment dominates due to its widespread use, better coverage, and higher spectral efficiency, making it suitable for various enterprise applications.

Based on the Technology, the market is segmented based on FDD, TDD. In the Private LTE market, the FDD (Frequency Division Duplex) segment dominates due to its widespread use, better coverage, and higher spectral efficiency, making it suitable for various enterprise applications.

By End user

Based on the End user, the market has been divided into Utilities, Mining, Manufacturing, Healthcare, Others. Based on the End user, the market has been divided into Utilities, Mining, Manufacturing, Healthcare, Others.

By Frequency Band

Based on Frequency Band, the market has been divided into Licensed, Unlicensed, Shared spectrum. Based on Frequency Band, the market has been divided into Licensed, Unlicensed, Shared spectrum.

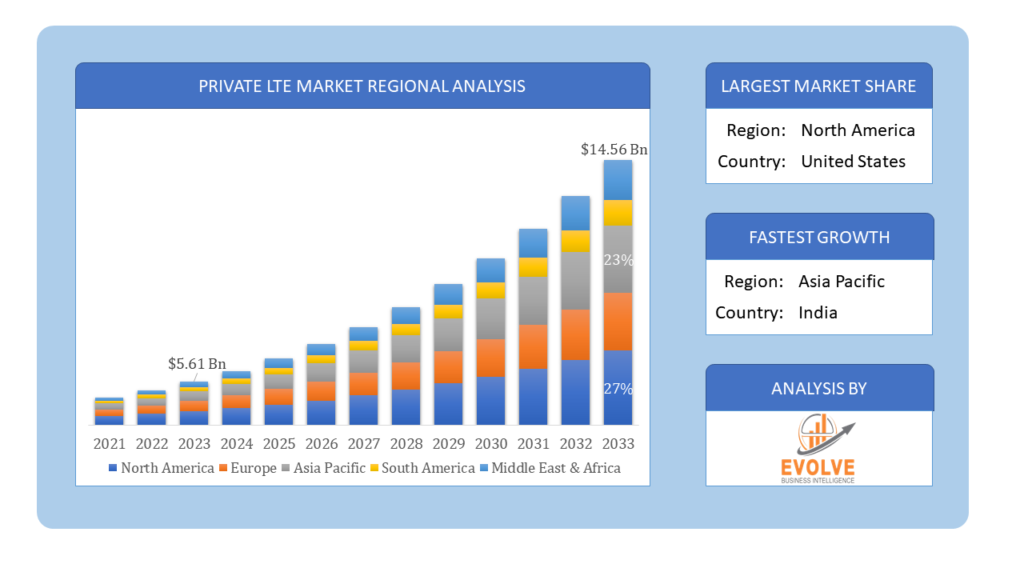

Global Private LTE Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Private LTE, followed by those in Asia-Pacific and Europe.

Private LTE North America Market

Private LTE North America Market

North America dominates the Private LTE market due to several factors. Due to the strong adoption rate of 5G networks, the increasing usage of artificial intelligence (AI) and other smart connected devices in the region, and other factors, the private LTE market in North America was valued at USD 2,348.67 million in 2021. Furthermore, as businesses move toward digitization, there is a growing need for wireless networks. These factors, along with the availability of unlicensed and shared spectrum in private LTE networks, present opportunities for service providers to offer the newest technological advancements in high-speed internet service.

Private LTE Asia Pacific Market

The Asia-Pacific region has been witnessing remarkable growth in recent years. The Private LTE market in the Asia-Pacific region is experiencing rapid growth, driven by increasing industrial automation, expanding IoT applications, and significant investments in smart city projects. Countries like China, Japan, and South Korea are leading the way with substantial advancements in telecommunications infrastructure and strong governmental support for private network deployments. The region’s diverse industrial landscape, from manufacturing to mining and utilities, fuels the demand for reliable and secure communication networks. Additionally, the availability of shared and unlicensed spectrum bands further accelerates the adoption of private LTE solutions in Asia-Pacific.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Samsung, Redline communications, AIRSPAN, ASOCS, and Casa Systems are some of the leading players in the global Private LTE Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Samsung

- Redline communications

- AIRSPAN

- ASOCS

- Casa Systems

- Cisco

- Comba

- CommScope

- Druid Software

- ExteNet Systems

Key development:

In September 2022, Samsung made a key development in the Private LTE market by launching its advanced private 5G solutions, aimed at enhancing connectivity and operational efficiency for enterprises across various industries.

Scope of the Report

Global Private LTE Market, by Technology

- FDD

- TDD

Global Private LTE Market, by End user

- Utilities

- Mining

- Manufacturing

- Healthcare

- Others

Global Private LTE Market, by Frequency Band

- Licensed

- Unlicensed

- Shared spectrum

Global Private LTE Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $14.56 Billion |

| CAGR | 10.74% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Technology, End user, Frequency Band |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Samsung, Redline communications, AIRSPAN, ASOCS, Casa Systems, Cisco, Comba, CommScope, Druid Software, ExteNet Systems |

| Key Market Opportunities | • Adoption Of LTE technology in smart cities applications |

| Key Market Drivers | • Surge In Demand for Unique and Defined Network Qualities ·Growing Deployment of Private LTE Networks in Public Safety Agencies ·Emergence Of 5g In Conjunction with Private LTE |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Private LTE Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Private LTE market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Private LTE market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

Provide Total Addressable Market (TAM) for the Global Private LTE Market

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

1.What is the study period of this market?

- The study period of the global Private LTE market is 2022- 2033

hat are the 10 Years CAGR (2023 to 2033) of the global Private LTE market?

- The global Private LTE market is growing at a CAGR of ~74% over the next 10 years

3.Which region has the highest growth rate in the market of Private LTE?

- Asia Pacific is expected to register the highest CAGR during 2023-2033

4.Which region accounted for the largest share of the market of Private LTE?

- North America holds the largest share in 2022

5.Major Key Players in the Market of Private LTE?

- Samsung, Redline communications, AIRSPAN, ASOCS, Casa Systems, Cisco, Comba, CommScope, Druid Software, ExteNet Systems

6.Do you offer Post Sale Support?

- Yes, we offer 16 hours of analyst support to solve the queries

7.Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Technology Segement – Market Opportunity Score 4.1.2. End user Segment – Market Opportunity Score 4.1.3. Frequency Band Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Private LTE Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Private LTE Market, By Technology 7.1. Introduction 7.1.1. FDD 7.1.2. TDD CHAPTER 8. Global Private LTE Market, By End user 8.1. Introduction 8.1.1. Utilities 8.1.2. Mining 8.1.3. Manufacturing 8.1.4. Healthcare 8.1.5. Others CHAPTER 9. Global Private LTE Market, By Frequency Band 9.1. Introduction 9.1.1. Licensed 9.1.2. Unlicensed 9.1.3. Shared spectrum CHAPTER 10. Global Private LTE Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Frequency Band, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Samsung 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Redline communications 13.3. AIRSPAN 13.4. ASOCS 13.5. Casa Systems 13.6. Cisco 13.7. Comba 13.8. CommScope 13.9. Druid Software 13.10. Genie AI Ltd

Connect to Analyst

Research Methodology