Plant Based Meat Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

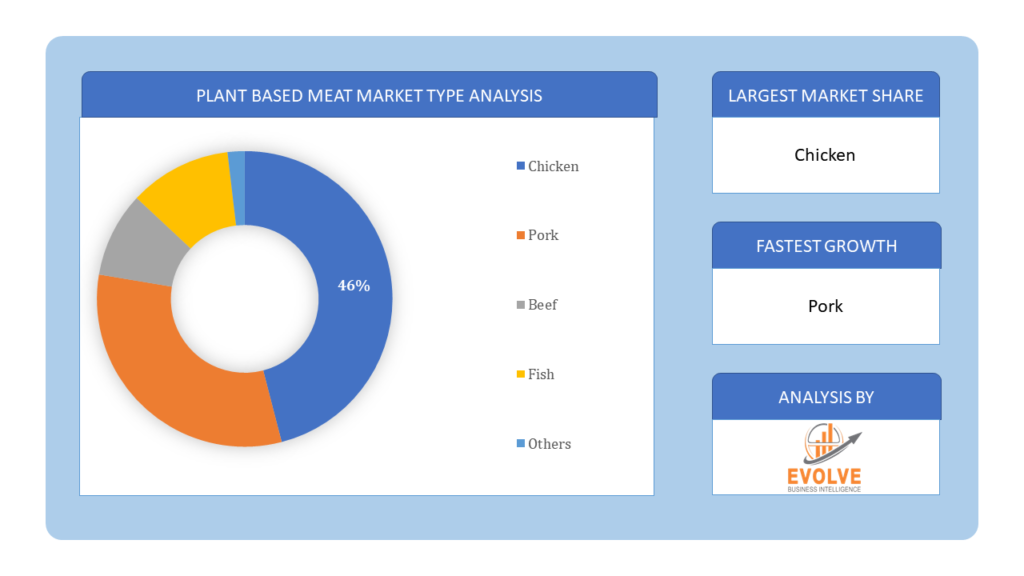

Plant Based Meat Market Research Report: Information By Type (Chicken, Pork, Beef, Fish and Others), By Sales channel (Store based and Non-Store-Based.), and by Region — Forecast till 2033.

Plant Based Meat Market Overview

The Plant Based Meat Market Size is expected to reach USD 26.98 Billion by 2033. The Plant Based Meat industry size accounted for USD 20.54 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 15.47% from 2023 to 2033. The portion of the food industry dedicated to manufacturing and marketing food items generated from plants as opposed to animal sources is known as the “plant-based food market.” The goal of these goods is to meet the increasing demand for plant-based solutions due to a variety of issues, including health, environmental concerns, ethical considerations, and lifestyle choices, by offering alternatives to traditional animal-based diets.

Global Plant Based Meat Market Synopsis

The market for plant-based foods has been impacted by the COVID-19 epidemic in both positive and negative ways. The epidemic has increased people’s interest in wellness and health, which has led many shoppers to look for plant-based food options that are well-known for their health advantages. Because plant-based diets have a smaller environmental impact, the epidemic has brought attention to the connection between human health and the environment. This has encouraged more people to embrace plant-based diets. The demand for plant-based solutions in restaurants and foodservice establishments may have been impacted by lockdowns and limitations. Even if the supply chains for plant-based foods were largely stable, occasional disruptions nevertheless occurred that had an impact on distribution and manufacturing.

Plant Based Meat Market Dynamics

The major factors that have impacted the growth of Plant Based Meat are as follows:

Drivers:

Ø Innovations in Food Technology

Advances in food technology have enabled the development of plant-based meats that closely mimic the taste, texture, and appearance of conventional meat products. Improvements in plant protein extraction, flavoring, and texturizing techniques have made plant-based meats more appealing to a wider audience.

Restraint:

- Cost and Price Competitiveness

Plant-based meat products can be more expensive to produce compared to conventional meat due to factors such as ingredient sourcing, processing, and technology. Higher production costs may translate to higher retail prices, limiting adoption among price-sensitive consumers.

Opportunity:

⮚ Product Innovation and Diversification

There is significant potential for innovation in plant-based meat product development, including the creation of new flavors, formats, and formulations. Companies can explore expanding their product portfolios to include plant-based alternatives for a wide range of meat products, including burgers, sausages, chicken nuggets, and seafood substitutes.

Plant Based Meat Segment Overview

By Type

Based on Product Type, the Plant Based Food Market is segmented into Chicken, Pork, Beef, Fish and Others. In 2022, the market leader and largest revenue contributor worldwide was the plant-based chicken sector, with 33.57% of total revenue. Because it is high in animal fats, cholesterol, and protein, chicken is the main ingredient in many classic meat products, including patties, cutlets, and nuggets.

Based on Product Type, the Plant Based Food Market is segmented into Chicken, Pork, Beef, Fish and Others. In 2022, the market leader and largest revenue contributor worldwide was the plant-based chicken sector, with 33.57% of total revenue. Because it is high in animal fats, cholesterol, and protein, chicken is the main ingredient in many classic meat products, including patties, cutlets, and nuggets.

By Sales channel

Based on Sales channel, the global Plant Based Food Market has been divided into Store based and Non-Store-Based. The store-based segment dominated the market and is projected to be the faster-growing segment. The huge number of supermarkets and hypermarkets has enhanced overall product sales.

Global Plant Based Meat Market Regional Analysis

Based on region, the global Plant Based Meat market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Plant Based Meat market followed by the Asia-Pacific and Europe regions.

Plant Based Meat North America Market

North America holds a dominant position in the Plant Based Meat Market. The market for plant-based foods has been significantly influenced by North America, mainly by the United States and Canada. Demand for plant-based meat substitutes, dairy substitutes, and other plant-based products has increased significantly in the area. Growth-promoting factors include environmental concerns, a surge in vegetarian and flexitarian diets, health consciousness, and the existence of well-known plant-based food firms. The market for plant-based foods has grown significantly in Europe as well. The use of plant-based diets and lifestyles has increased significantly in nations like Sweden, Germany, and the United Kingdom. Concerns about animal welfare, sustainability, and the effects of animal husbandry on the environment all have an impact on the European market.

Plant Based Meat Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Plant Based Meat industry. The market for plant-based foods faces both potential and difficulties in the Asia-Pacific area. Largely populated nations like China and India are seeing an increase in health-conscious consumers. Since tofu and other traditional plant-based meals have been a staple of Asian diets for generations, the development of contemporary plant-based choices has had a solid foundation. Growing interest in plant-based diets and sustainable food options has been observed in Latin America. Options that are plant-based are becoming more widely available in nations like Mexico, Argentina, and Brazil. Because local plant-based foods like quinoa, lentils, and beans are already a staple of many diets, the area is open to plant-based dietary options.

Competitive Landscape

The global Plant Based Meat market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as Type launches, and strategic alliances.

Prominent Players:

- Beyond Meat

- Impossible Foods Inc

- Maple Leaf Foods (Field Roast & Maple Leaf)

- Vegetarian Butcher

- Conagra, Inc.

- Kellogg NA Co.

- Quorn

- Amy’s Kitchen, Inc.

- Tofurky

- JBS

Key Development

In October 2022, JBS SA-owned plant-based meat division Planterra shut down its operations in the U.S. to focus on growing alternative protein markets such as European countries and Brazil. This is primarily due to sluggish plant-based meat sales in 2022 in the U.S.

Scope of the Report

Global Plant Based Meat Market, by Type

- Chicken

- Pork

- Beef

- Fish

- Others

Global Plant Based Meat Market, by Sales channel

- Store based

- Non-Store-Based

Global Plant Based Meat Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $26.98 Billion |

| CAGR | 15.47% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type , Sales channel |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Beyond Meat, Impossible Foods Inc, Maple Leaf Foods (Field Roast & Maple Leaf), Vegetarian Butcher, Conagra, Inc. , Kellogg NA Co., Quorn, Amy’s Kitchen, Inc., Tofurky, JBS |

| Key Market Opportunities | • Product Innovation and Diversification |

| Key Market Drivers | • Technological Advancements • Regulatory Support and Incentives |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Plant Based Meat market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Plant Based Meat market historical market size for the year 2021, and forecast from 2023 to 2033

- Plant Based Meat market share analysis at each Type level

- Competitor analysis with detailed insight into its Type segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including Type launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Plant Based Meat market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, Type offering, recent developments, SWOT analysis, and key strategies.

<p class=”Release”>Press Release</p>

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the projected market size of the Plant Based Meat industry by 2033?

The Plant Based Meat Market is expected to reach USD 26.98 Billion by 2033, with a compound annual growth rate (CAGR) of 15.47% from 2023 to 2033

How has COVID-19 impacted the Plant Based Meat market?

COVID-19 increased interest in plant-based foods due to health consciousness and environmental concerns, though lockdowns affected demand in restaurants

What are the primary drivers fueling the growth of Plant Based Meat?

Innovations in food technology have enabled the creation of plant-based meats closely resembling traditional meat, appealing to a wider audience

What is the main restraint affecting the adoption of Plant Based Meat?

Cost and price competitiveness pose a challenge, as production costs may result in higher retail prices, limiting adoption among price-sensitive consumers

What are the key opportunities in the Plant Based Meat market?

There is significant potential for product innovation and diversification, including the development of new flavors and formats to cater to various consumer preferences

Table of Contents

Chapter 1. Executive Summary

Chapter 2. Scope Of The Study

2.1. Market Definition

2.2. Scope Of The Study

2.2.1. Objectives of Report

2.2.2. Limitations

2.3. Market Structure

Chapter 3. Evolve BI Methodology

Chapter 4. Market Insights and Trends

4.1. Supply/ Value Chain Analysis

4.1.1. Raw Sales channels Providers

4.1.2. Manufacturing Process

4.1.3. Distributors/Retailers

4.1.4. End-Use Industry

4.2. Porter’s Five Forces Analysis

4.2.1. Threat Of New Entrants

4.2.2. Bargaining Power Of Buyers

4.2.3. Bargaining Power Of Suppliers

4.2.4. Threat Of Substitutes

4.2.5. Industry Rivalry

4.3. Impact Of COVID-19 on the Plant Based Meat Market

4.3.1. Impact on Market Size

4.3.2. End-Use Industry Trend, Preferences, and Budget Impact

4.3.3. Regulatory Framework/Government Policies

4.3.4. Key Players' Strategy to Tackle Negative Impact

4.3.5. Opportunity Window

4.4. Technology Overview

12.28. Macro factor

4.6. Micro Factor

4.7. Demand Supply Gap Analysis of the Plant Based Meat Market

4.8. Import Analysis of the Plant Based Meat Market

4.9. Export Analysis of the Plant Based Meat Market

Chapter 5. Market Dynamics

5.1. Introduction

5.2. DROC Analysis

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.2.4. Challenges

5.3. Patent Analysis

5.4. Industry Roadmap

5.5. Parent/Peer Market Analysis

Chapter 6. Global Plant Based Meat Market, By Type

6.1. Introduction

6.2. Chicken

6.3. Pork

6.4. Beef

6.5. Fish

6.6. Others

Chapter 7. Global Plant Based Meat Market, By Sales channel

7.1. Introduction

7.2. Store based

7.3. Non-Store-Based.

Chapter 8. Global Plant Based Meat Market, By Region

8.1. Introduction

8.2. North America

8.2.1. Introduction

8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.2.3. Market Size and Forecast, By Country, 2023-2033

8.2.4. Market Size and Forecast, By Type , 2023-2033

8.2.5. Market Size and Forecast, By Sales channel, 2023-2033

8.2.6. US

8.2.6.1. Introduction

8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.2.6.3. Market Size and Forecast, By Type , 2023-2033

8.2.6.4. Market Size and Forecast, By Sales channel, 2023-2033

8.2.7. Canada

8.2.7.1. Introduction

8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.2.7.4. Market Size and Forecast, By Type , 2023-2033

8.2.7.5. Market Size and Forecast, By Sales channel, 2023-2033

8.3. Europe

8.3.1. Introduction

8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.3.3. Market Size and Forecast, By Country, 2023-2033

8.3.4. Market Size and Forecast, By Type , 2023-2033

8.3.5. Market Size and Forecast, By Sales channel, 2023-2033

8.3.6. Germany

8.3.6.1. Introduction

8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.3.6.3. Market Size and Forecast, By Type , 2023-2033

8.3.6.4. Market Size and Forecast, By Sales channel, 2023-2033

8.3.7. France

8.3.7.1. Introduction

8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.3.7.3. Market Size and Forecast, By Type , 2023-2033

8.3.7.4. Market Size and Forecast, By Sales channel, 2023-2033

8.3.8. UK

8.3.8.1. Introduction

8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.3.8.3. Market Size and Forecast, By Type , 2023-2033

8.3.8.4. Market Size and Forecast, By Sales channel, 2023-2033

8.3.9. Italy

8.3.9.1. Introduction

8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.3.9.3. Market Size and Forecast, By Type , 2023-2033

8.3.9.4. Market Size and Forecast, By Sales channel, 2023-2033

8.3.11. Rest Of Europe

8.3.11.1. Introduction

8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.3.11.3. Market Size and Forecast, By Type , 2023-2033

8.3.11.4. Market Size and Forecast, By Sales channel, 2023-2033

8.4. Asia-Pacific

8.4.1. Introduction

8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.4.3. Market Size and Forecast, By Country, 2023-2033

8.4.4. Market Size and Forecast, By Type , 2023-2033

8.12.28. Market Size and Forecast, By Sales channel, 2023-2033

8.4.6. China

8.4.6.1. Introduction

8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.4.6.3. Market Size and Forecast, By Type , 2023-2033

8.4.6.4. Market Size and Forecast, By Sales channel, 2023-2033

8.4.7. India

8.4.7.1. Introduction

8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.4.7.3. Market Size and Forecast, By Type , 2023-2033

8.4.7.4. Market Size and Forecast, By Sales channel, 2023-2033

8.4.8. Japan

8.4.8.1. Introduction

8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.4.8.3. Market Size and Forecast, By Type , 2023-2033

8.4.8.4. Market Size and Forecast, By Sales channel, 2023-2033

8.4.9. South Korea

8.4.9.1. Introduction

8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.4.9.3. Market Size and Forecast, By Type , 2023-2033

8.4.9.4. Market Size and Forecast, By Sales channel, 2023-2033

8.4.10. Rest Of Asia-Pacific

8.4.10.1. Introduction

8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.4.10.3. Market Size and Forecast, By Type , 2023-2033

8.4.10.4. Market Size and Forecast, By Sales channel, 2023-2033

8.5. Rest Of The World (RoW)

8.5.1. Introduction

8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.5.3. Market Size and Forecast, By Type , 2023-2033

8.5.4. Market Size and Forecast, By Sales channel, 2023-2033

Chapter 9. Company Landscape

9.1. Introduction

9.2. Vendor Share Analysis

9.3. Key Development Analysis

9.4. Competitor Dashboard

Chapter 10. Company Profiles

10.1. Beyond Meat

10.1.1. Business Overview

10.1.2. Government & Defense Analysis

10.1.2.1. Government & Defense – Existing/Funding

10.1.3. Type Portfolio

10.1.4. Recent Development and Strategies Adopted

10.1.5. SWOT Analysis

10.2. Impossible Foods Inc

10.2.1. Business Overview

10.2.2. Government & Defense Analysis

10.2.2.1. Government & Defense – Existing/Funding

10.2.3. Type Portfolio

10.2.4. Recent Development and Strategies Adopted

10.2.5. SWOT Analysis

10.3. Maple Leaf Foods (Field Roast & Maple Leaf)

10.3.1. Business Overview

10.3.2. Government & Defense Analysis

10.3.2.1. Government & Defense – Existing/Funding

10.3.3. Type Portfolio

10.3.4. Recent Development and Strategies Adopted

10.3.5. SWOT Analysis

10.4. Vegetarian Butcher

10.4.1. Business Overview

10.4.2. Government & Defense Analysis

10.4.2.1. Government & Defense – Existing/Funding

10.4.3. Type Portfolio

10.4.4. Recent Development and Strategies Adopted

10.12.28. SWOT Analysis

10.5. Conagra, Inc.

10.5.1. Business Overview

10.5.2. Government & Defense Analysis

10.5.2.1. Government & Defense – Existing/Funding

10.5.3. Type Portfolio

10.5.4. Recent Development and Strategies Adopted

10.5.5. SWOT Analysis

10.6. Kellogg NA Co.

10.6.1. Business Overview

10.6.2. Government & Defense Analysis

10.6.2.1. Government & Defense – Existing/Funding

10.6.3. Type Portfolio

10.6.4. Recent Development and Strategies Adopted

10.6.5. SWOT Analysis

10.7. Quorn

10.7.1. Business Overview

10.7.2. Government & Defense Analysis

10.7.2.1. Government & Defense – Existing/Funding

10.7.3. Type Portfolio

10.7.4. Recent Development and Strategies Adopted

10.7.5. SWOT Analysis

10.8 Amy’s Kitchen, Inc.

10.8.1. Business Overview

10.8.2. Government & Defense Analysis

10.8.2.1. Government & Defense – Existing/Funding

10.8.3. Type Portfolio

10.8.4. Recent Development and Strategies Adopted

10.8.5. SWOT Analysis

10.9 Tofurky

10.9.1. Business Overview

10.9.2. Government & Defense Analysis

10.9.2.1. Government & Defense – Existing/Funding

10.9.3. Type Portfolio

10.9.4. Recent Development and Strategies Adopted

10.9.5. SWOT Analysis

10.10. JBS

10.10.1. Business Overview

10.10.2. Government & Defense Analysis

10.10.2.1. Government & Defense – Existing/Funding

10.10.3. Type Portfolio

10.10.4. Recent Development and Strategies Adopted

10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology