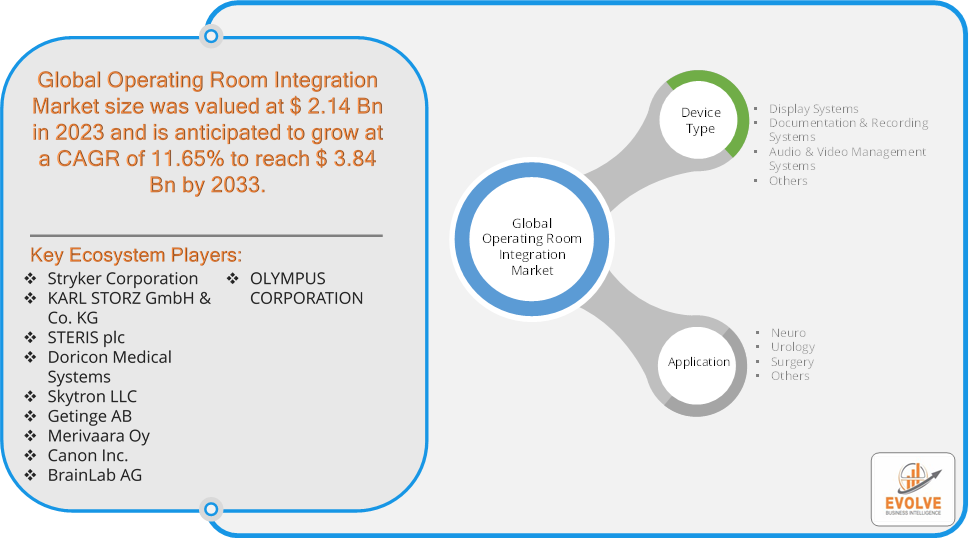

Operating Room Integration Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Operating Room Integration Market Research Report: Information By Device Type (Display Systems, Documentation & Recording Systems, Audio & Video Management Systems, Others,), By Application (Neuro, Urology, Surgery, Others,), and by Region — Forecast till 2033

Page: 165

Operating Room Integration Market Overview

The Operating Room Integration Market Size is expected to reach USD 3.84 Billion by 2033. The Operating Room Integration industry size accounted for USD 2.14 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 11.65% from 2023 to 2033. The Operating Room Integration Market focuses on the integration of advanced technologies and systems within surgical environments to enhance efficiency, safety, and outcomes. It includes the incorporation of equipment such as surgical displays, camera systems, and data management solutions into a cohesive network. These systems streamline communication between devices, improve workflow management, and facilitate real-time data sharing among medical professionals. The market is driven by the increasing complexity of surgeries, the need for improved patient safety, and the growing emphasis on minimally invasive procedures.

Global Operating Room Integration Market Synopsis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the Operating Room Integration market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers adopting various strategies to stabilize the company.

Operating Room Integration Market Dynamics

The major factors that have impacted the growth of Operating Room Integration are as follows:

Drivers:

Ø Advancements in Medical Technology

Rapid advancements in medical technology, including imaging systems, robotic surgery, and patient monitoring devices, are fueling the demand for integrated solutions. ORI systems ensure seamless connectivity and interoperability between these advanced technologies, enhancing their effectiveness and reliability in the operating room.

Restraint:

- Data Security and Privacy Concerns

The integration of various systems and the exchange of sensitive patient data raise concerns about data security and privacy. Ensuring that ORI systems comply with regulatory standards such as HIPAA (Health Insurance Portability and Accountability Act) and other data protection regulations is critical. Any security breaches or data vulnerabilities could undermine the effectiveness of ORI systems and expose institutions to legal and financial risks.

Opportunity:

⮚ Expansion of Healthcare Facilities

The increasing number of hospitals and surgical centers, particularly in emerging markets, presents an opportunity for ORI system providers. As healthcare infrastructure expands and modernizes globally, there is growing demand for integrated solutions that improve operational efficiency and patient care in newly established and upgraded surgical facilities.

Operating Room Integration Segment Overview

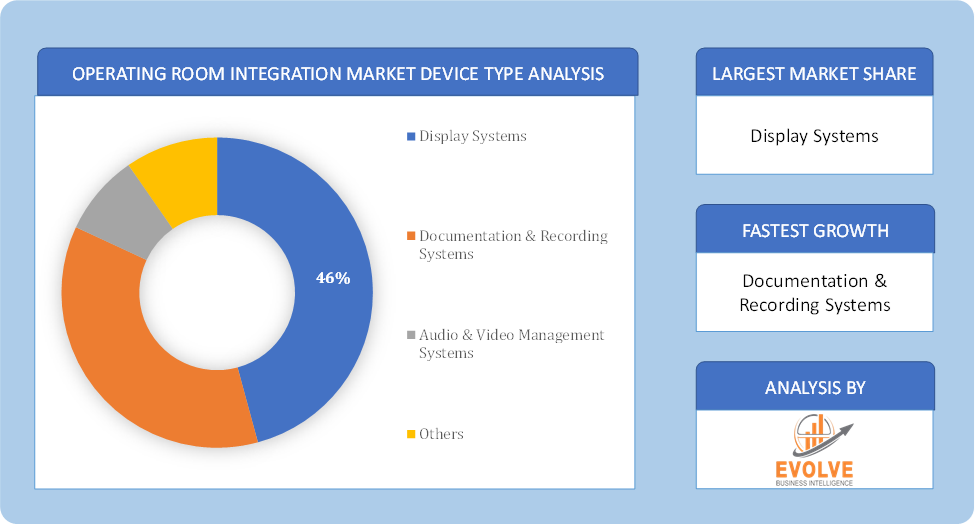

Based on Device Type, the market is segmented based on Display Systems, Documentation & Recording Systems, Audio & Video Management Systems, Others. the Audio & Video Management Systems segment generally dominates, as these systems are crucial for real-time communication, coordination, and the effective management of multimedia content during surgical procedures.

By Application

Based on Applications, the market has been divided into the Neuro, Urology, Surgery, Others. the Surgery application segment typically dominates, driven by the broad range of surgical procedures and the need for comprehensive integration solutions to enhance efficiency and outcomes in diverse surgical environments.

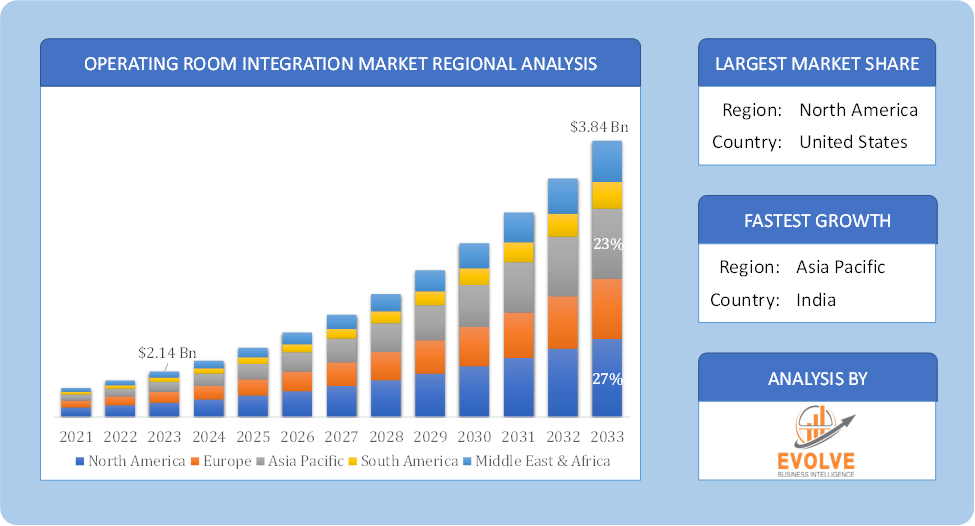

Global Operating Room Integration Market Regional Analysis

Based on region, the global Operating Room Integration market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Operating Room Integration market followed by the Asia-Pacific and Europe regions.

Operating Room Integration North America Market

Operating Room Integration North America Market

North America holds a dominant position in the Operating Room Integration Market. The global market is expected to be dominated by North America. As of January 2021, the National Center for Chronic Disease Prevention and Health Promotion reported that 4 out of 10 adults in the US had two or more chronic diseases, and that 6 out of 10 adults in the US had one or more chronic diseases. The total cost of these conditions to the US healthcare system is estimated to be around USD 3.8 trillion.

Operating Room Integration Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Operating Room Integration industry. From 2023 to 2032, the operating room integration systems market in Asia-Pacific is anticipated to expand rapidly. The market is being driven by an increasing number of minimally invasive procedures, a growing number of patient populations with chronic illnesses that require surgical interventions, an increase in the demand for advanced medical devices in hospitals, and a rapidly growing healthcare infrastructure.

Competitive Landscape

The global Operating Room Integration market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as Device Typelaunches, and strategic alliances.

Prominent Players:

- Stryker Corporation

- KARL STORZ GmbH & Co. KG

- STERIS plc

- Doricon Medical Systems

- Skytron LLC

- Getinge AB

- Merivaara Oy

- Canon Inc.

- BrainLab AG

- OLYMPUS CORPORATION.

Key Development

In September 2022, Stryker Corporation enhanced its Operating Room Integration offerings by unveiling the Stryker iSuite, an advanced integrated OR solution designed to improve surgical efficiency and visualization through cutting-edge technology and seamless connectivity.

Scope of the Report

Global Operating Room Integration Market, by Device Type

- Display Systems

- Documentation & Recording Systems

- Audio & Video Management Systems

- Others

Global Operating Room Integration Market, by Application

- Neuro

- Urology

- Surgery

- Others

Global Operating Room Integration Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 3.84 Billion |

| CAGR (2023-2033) | 11.65% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Device Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Stryker Corporation, KARL STORZ GmbH & Co. KG, STERIS plc, Doricon Medical Systems, Skytron LLC, Getinge AB, Merivaara Oy, Canon Inc., BrainLab AG, OLYMPUS CORPORATION. |

| Key Market Opportunities | · Rising technological advancements |

| Key Market Drivers | · Rising demand for minimally invasive and highly advanced systems to diagnose and treat various diseases· · Growing investments by key players in the OR integration systems |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Operating Room Integration market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Operating Room Integration market historical market size for the year 2021, and forecast from 2023 to 2033

- Operating Room Integration market share analysis at each Device Type level

- Competitor analysis with detailed insight into its Device Type segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including Device Type launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Operating Room Integration market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, Device Type offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Operating Room Integration market is 2021- 2033

What is the growth rate of the global Operating Room Integration market?

The global Operating Room Integration market is growing at a CAGR of 11.65% over the next 10 years

Which region has the highest growth rate in the market of Operating Room Integration?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Operating Room Integration market?

North America holds the largest share in 2022

Who are the key players in the global Operating Room Integration market?

Stryker Corporation, KARL STORZ GmbH & Co. KG, STERIS plc, Doricon Medical Systems, Skytron LLC, Getinge AB, Merivaara Oy, Canon Inc., BrainLab AG, and OLYMPUS CORPORATION. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw Applications Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Operating Room Integration Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Operating Room Integration Market 4.8. Import Analysis of the Operating Room Integration Market 4.9. Export Analysis of the Operating Room Integration Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Operating Room Integration Market, By Device Type 6.1. Introduction 6.2. Display Systems 6.3. Documentation & Recording Systems 6.4. Audio & Video Management Systems 6.5. Others Chapter 7. Global Operating Room Integration Market, By Application 7.1. Introduction 7.2. Neuro 7.3. Urology 7.4. Surgery 7.5. Others Chapter 8. Global Operating Room Integration Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Device Type, 2023-2033 8.2.5. Market Size and Forecast, By Application, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Device Type, 2023-2033 8.2.6.4. Market Size and Forecast, By Application, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Device Type, 2023-2033 8.2.7.5. Market Size and Forecast, By Application, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Device Type, 2023-2033 8.3.5. Market Size and Forecast, By Application, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Device Type, 2023-2033 8.3.6.4. Market Size and Forecast, By Application, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Device Type, 2023-2033 8.3.7.4. Market Size and Forecast, By Application, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Device Type, 2023-2033 8.3.8.4. Market Size and Forecast, By Application, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Device Type, 2023-2033 8.3.9.4. Market Size and Forecast, By Application, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Device Type, 2023-2033 8.3.11.4. Market Size and Forecast, By Application, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Device Type, 2023-2033 8.12.28. Market Size and Forecast, By Application, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Device Type, 2023-2033 8.4.6.4. Market Size and Forecast, By Application, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Device Type, 2023-2033 8.4.7.4. Market Size and Forecast, By Application, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Device Type, 2023-2033 8.4.8.4. Market Size and Forecast, By Application, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Device Type, 2023-2033 8.4.9.4. Market Size and Forecast, By Application, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Device Type, 2023-2033 8.4.10.4. Market Size and Forecast, By Application, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Device Type, 2023-2033 8.5.4. Market Size and Forecast, By Application, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Stryker Corporation 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Device TypePortfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. KARL STORZ GmbH & Co. KG 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Device TypePortfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. STERIS plc 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Device TypePortfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Doricon Medical Systems 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Device TypePortfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Skytron LLC 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Device TypePortfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Getinge AB 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Device TypePortfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Merivaara Oy 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Device TypePortfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Canon Inc. 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Device TypePortfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 BrainLab AG 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Device TypePortfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. OLYMPUS CORPORATION. 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Device TypePortfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology